Are unplanned bank charges silently draining your Bank of Baroda balance? One charge that often surprises BOB customers is the DCARDFEE—a fee that can show up as ₹177, ₹236, or even ₹354 in your bank statement.

Many users complain on the Moneycontrol forum about why these amounts are being debited from their accounts without any clear explanation.

Let’s find out why it charged and how to avoid it.

What is the DCardfee?

The DCARDFEE is known as a Debit Card Annual Fee. As per its name, it is a charge levied by the Bank of Baroda (BOB) for the maintenance and usage of your debit card per year.

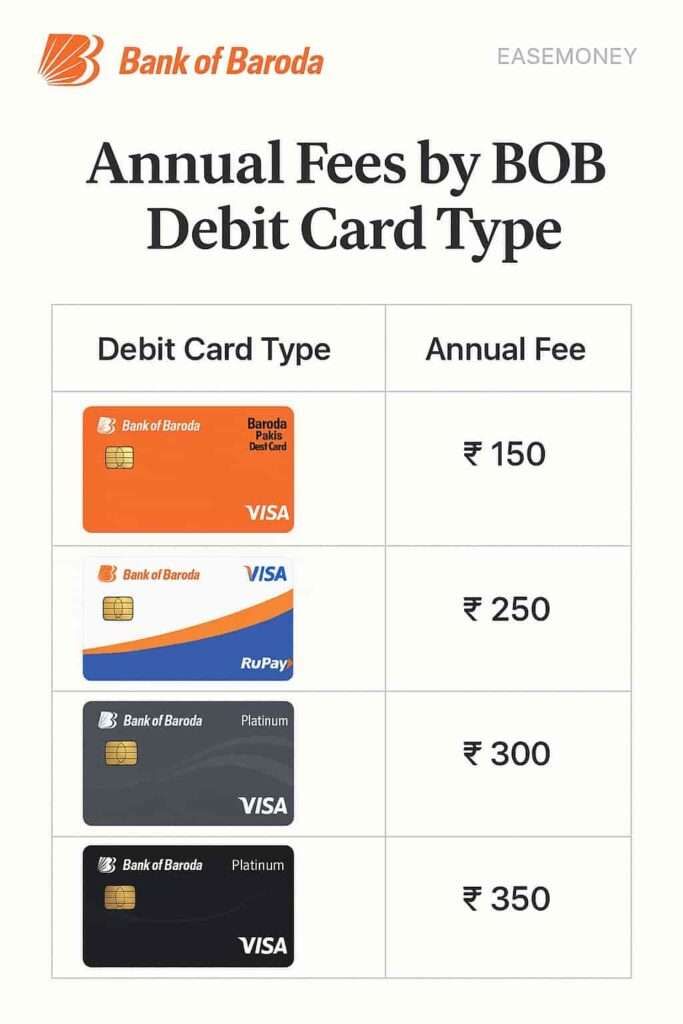

This charge helps cover the bank’s costs for managing your card and bank account. The debit card fee amount varies depending on the type of debit card you own.

What are the factors that affect?

- Bank Internal Policy: Bob and other bank change their fee structure periodically and update their charges and policies over time. So, it is important to check the latest fee details on their website or by contacting customer care.

- Account Type and Card Types: The Different types of bank accounts you hold can influence the annual debit card charges, and Classic, Platinum, or Gold debit cards also affect charges. Premium cards usually have higher annual charges.

- Other Factors: Additional factors are card usage patterns, promotional offers, fee waivers or discounts for specific account holders. can affect fees, you may have higher or lower charges as on the factors. Always contact the bank to get an update.

Most BOB debit Cards offer no annual fee for the first year, then a DCARDFEE is applied in the second year onward. For example, the Bank of Baroda BPCL Debit Card.

Let’s check the annual Fees by Bob’s Debit Card Type –

1. Basic Cards

- RuPay, Visa, MasterCard Classic

- First Year: Free

- Next Year: ₹200/year

2. Premium Cards

- RuPay, Visa, MasterCard Platinum

- First Year: Free

- Following Years: ₹300/year

3. High-End Cards

- RuPay Select

- First Year: Free

- Subsequent Years: ₹500 to ₹1000

4. Business debit Card

- Baroda VISA Vyapaar Business Card

- First Year: Free

- After 1 Year: ₹250/year

5. Government-Sponsored Scheme Cards

- RuPay PMJDY (Bhamashah/Samagra), KCC, Mudra

- Charges: No fees for government-sponsored cards

When Is the Dcardfee Deducted? Timing Explained

The DCARDFEE is typically deducted annually on the card’s issue date or application date. Let me give you an example. One of my clients applied for a BOB Debit card using the BOB App.

The Bank told him to first pay the annual fee, and then the card would be delivered to your address within 7 days. So, The Date he applied is the same as next year, and the Dcardfee charges on his debit card.

How to Check Your BOB DCARDFEE

Now that you know what it is, let’s see how you can check it:

- Check Your Bank Statement: This is the most straightforward way. Go to your email and find the latest bank statement. Open the Statement PDF and check the full details of the transactions.

- BOB World App: You can download the BOB World App. Log in using your mPIN, go to your bank account, and select transaction history to view recent deposits, charges, and more.

- Contact Customer Care: Simply contact the Bank of Baroda customer care number at 1800 5700 or 1800 5000. Ask for the amount of the debit card charged to your account.

- Visit a Branch: Request a statement (Physical statement may be charged Rs. 100) or inquire about Debit card charges directly to the branch personnel.

Avoid Unwanted DCARDFEE Deductions in Bank of Baroda Account

- Go with BOB Virtual Card: The Bob Virtual Card comes with the benefit of no annual fee, eliminating the need to worry about debit card annual charges. Simply download the BOB App and apply for a virtual card.

- Check for Promotional Offers: The Bank offers Lifetime free debit cards during special campaigns and festival offers. Check the bank’s official websites and get benefits.

- Maintain a Premium Account: High-level or salary accounts often waive this fee as part of their benefits and set a limit on spending. If you achieve the spending limit, the bank will waive off the annual debit card charges.

- Exemptions and Waivers: Some banks might waive the fee for certain types of savings accounts or customers meeting exact standards. It’s always a good idea to check with your bank about any potential exemptions or waivers.

Other BOB Debit Card-Related Charges

Apart from the annual charges, you might encounter other charges related to your debit card. Here is a list –

- ATM Withdrawal charges: Charges like BSBD WDL Txn Chg are applied to Bob’s bank account. It happens when you exceed the Free withdrawal limit.

- International transaction fees: These usually happen when you use your card outside of India.

- Lost or stolen card charges: If you lose your debit card accidentally, you can apply for a replacement card.

- Overdraft fees: These are charged when you spend more than the available account balance.

BOB Account Holders Questions –

Does BOB DCARDFEE include GST Charges?

Yes, DCARDFEE comes with GST charges. The bank charges a fee for using a debit card. The government applied an 18% GST on annual debit card charges.

Can I waive the Bank of Baroda DCARDFEE?

In some cases, banks offer waivers for the DCARDFEE. This could depend on your bank account type, like a BSBD account, or specific promotions. It’s best to check with your bank for details.

I was charged an incorrect DCARDFEE. What should I do?

If you believe you’ve been charged incorrectly, simply contact your bank’s customer care number directly. Provide them with your bank details and the transaction information. They will provide you with instructions to follow.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.