The Future of HDFC Deposit Slips

HDFC Bank has now gradually shifted from physical paperwork to digital records, yet deposit slips still play a key role in bridging this change. You can deposit your cash directly, with three options:

- Digital,

- Doorstep banking,

- visiting a branch.

You can either use the normal paper deposit slip available at the branch or create a digital e-slip online through Net Banking.

Both are widely accepted branches of HDFC. However, the paper slip carries strict requirements about signatures and declarations, the online method little bit simpler.

Where to Get the Deposit Slip

- Offline paper slip: It is available at all small and big branches of HDFC. usually placed near the customer service desk or counter. You can pick a blank slip and fill it by hand. You will need to use a black or blue ink pen.

- Editable PDF download: You can download the PDF file from the official HDFC website under the forms centre. You have to edit the PDF using any PDF editor, such as Adobe or Sejda, and take a printout and submit it to the nearest branch or doorstep banking.

- Doorstep Banking: Especially for old age people above 70, Minors, illiterate, people with disability and selected customers, you can choose a cash deposit via doorstep banking. Here, you can book a visit, and the CIT agents collect your cash deposit from you, a minimum- ₹ 5,000, and a maximum of ₹ 25,000. No slip required.

- Digital e-slip: You do not need to fill out any paper slips for cash deposit or cheque; this works via request ID. You can get a digital slip via HDFC NetBanking.

How to fill an HDFC Paper Deposit Slip for cash and cheque

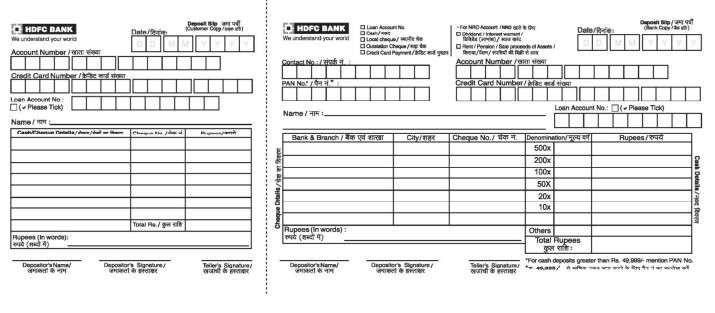

Deposit Slip – Structure and Copies

The paper slip usually comes in two different parts: Customer Copy and Bank Copy. These are joined together and usually filled at the same time. and required to fill same information twice.

- Customer Copy: This part is returned to you after the deposit is made. It carries the bank’s stamp as an acknowledgement and serves as proof of your transaction.

- Bank Copy: This section is retained by the bank and kept as a permanent record of your deposit.

Both copies have the same front side fields, and both require your signature.

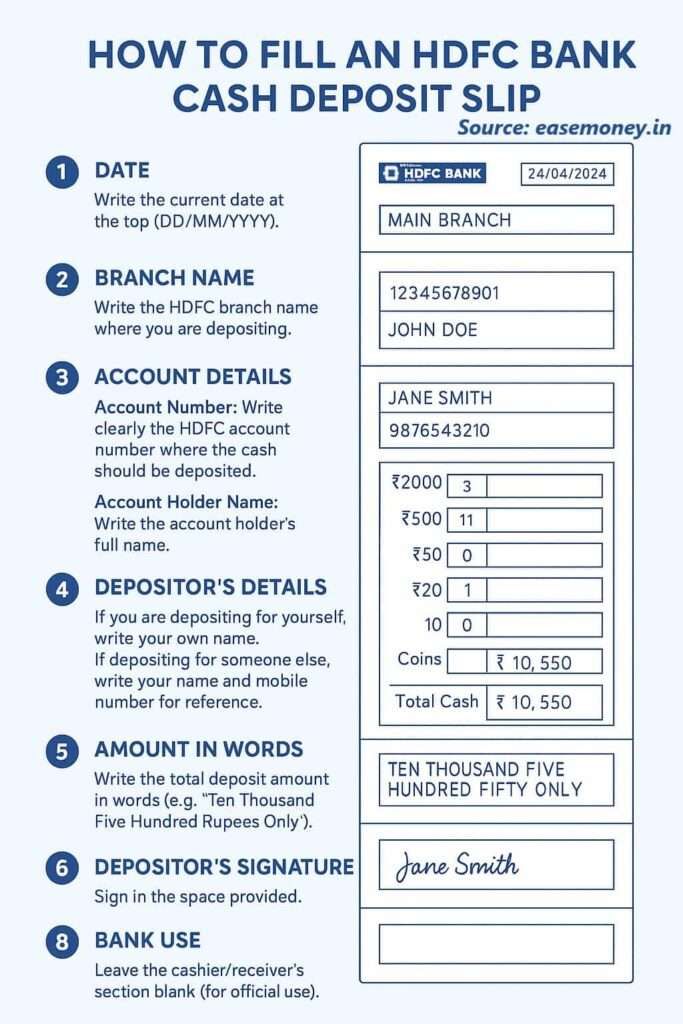

1 Step – Front Side of HDFC Deposit Slip – What to Fill

On the front side of both copies, you have to write with your pen –

- As always, first write today’s date at the top.

- In the 14-digit box, put down your account number where funds are being deposited.

- Account holder’s name as per bank records. Check the passbook or debit card.

- You have to enter your contact number on the bank copy side.

- If you are depositing above Rs. 49,999, then your PAN number must be mentioned in the slip. Without this, the deposit will not be accepted.

- Type of deposit – tick either cash or cheque. On the bank copy side, there is a denomination table and a cheque details box.

– If you are filling in for a cash deposit

The cash section has a table for denominations.

- You have to count each note and write it down. ( such as ₹2000, ₹500, ₹200, ₹100, ₹50, ₹20, Or coins).

- Mention coins separately if included.

- Add the total and write it again in words at the bottom.

Example:

- 5 × ₹500 = ₹2,500

- 10 × ₹100 = ₹1,000

- Total = ₹3,500, then write “Three Thousand Five Hundred Only.”

– If you are filling in for a cheque deposit via a slip

The cheque section is used when depositing one or more cheques.

- First, enter your cheque-issuing bank name and branch.

- Put down the city and the 6-digit cheque number.

- Write the amount mentioned on the cheque.

- If you are depositing multiple cheques, list each separately.

- Add the total and write the figure in words.

After filling in these details:

- Sign on the Customer Copy in the bottom depositor sign.

- Sign again on the Bank Copy at the end.

This makes two signatures on the front side.

2 Step – Back Side slip

The back side of the slip has additional requirements:

- For cash deposits:

- Mention the purpose of the deposit, such as “savings,” “gift,” “grocery shopping,” “loan repayment,” or any other reason.

- Write the relationship with the account holder. If you are depositing into your own account, simply write “Self”.

- Enter your mobile number.

- Write your name clearly in the space.

- For cheque deposits:

- Normally, the back side is not required to be filled by customers.

- If the staff requests, you may need to confirm details like the contact number or the declaration.

Finally, the depositor must sign once more on the back.

This makes a total of three signatures:

- On the front of the customer copy.

- On the front of the bank copy.

- On the back of the slip, under the declaration.

Submitting the Slip at the Branch

After completing both front and back sides:

- Now, go to the cash counter for deposits or the cheque desk/drop box for cheque deposits.

- Hand over the filled slip along with the money or cheque.

- The teller will count the money or collect the cheque, and confirm the declaration.

- The Customer Copy is stamped and given to you for any future notification.

Note: Cash is credited immediately, while cheques are credited after clearing. A cheque usually takes 24 hours if same city, but sometimes, it takes upto 6 working days for confirmation of credit.

How Digital Paperless Deposit Slips Work in HDFC

It works on reference ID or request number; you have to generate an e-slip. It comes with SMS Instead of carrying a physical slip, you prepare details online and receive a reference ID. It’s like an OTP verification at the branch process. Here are the steps –

How to Generate an e-Slip

- Firstly, visit the official HDFC portal and log in to Netbanking with your customer ID, password, and OTP.

- On the dashboard, select Accounts in the menu, and on the right side, choose Quick links.

- Select an option like Cash Deposit or Cheque Deposit.

- Fill account number, denomination details for cash, or cheque details for cheque deposit.

- Enter your mobile number.

- Tap on the submit button to generate a 9-digit Request ID sent by SMS. This ID is valid for two working days.

Using the e-Slip at the Branch

- Visit your local or any nearest branch with your cash or a cheque. You can use the HDFC branch locator to find the nearest.

- Show the SMS or simply your request ID.

- Hand over the money or cheque.

- The teller put the ID in the system and processed the deposit without requiring to filling out of any paper slip.

Insight for you: When you deposit money into someone else’s HDFC account, you may have to fill up the Money Mule Declaration Form at the branch. Also, the Relationship field must not be left blank in the form.

The limits of deposit slips in HDFC

| Deposit Method | Savings Account Limit | Current Account Limit | Notes |

|---|---|---|---|

| E-Slip (Cardless) | ₹25,000 per transaction, ₹2 lakh/day | ₹1 lakh per transaction, ₹6 lakh/day | Request ID valid for 2 working days |

| Paper Slip (Branch) | Upto ₹50,000 per day | Up to ₹2 lakh per month for free | PAN Card required |

| Card-Based Deposit | ₹1 lakh per transaction | ₹1 lakh per transaction | At cash deposit machines (CDM) |

| Cash Recycler (CDM) | Up to 200 notes per transaction, subject to account limits | Same as savings, subject to limits | The Machine accepts notes only, not coins |

Additionally Asked Questions

Can I get an HDFC Bank deposit slip with the account number prefilled?

Not really, the deposit slips do not have pre-fill details even if you download the PDF directly from HDFC mobile banking or Internet banking; however, you can choose e-slip where the account number is not required to fill for self-deposit.

What types of deposits can we do with an HDFC deposit slip at a branch?

You can pay or deposit your loan, local cheques, outstation cheques, credit card payments, and cash by using your slip at the branch.

Are HDFC paper deposit slips still accepted in 2026?

Yes. Branches still accept paper slips, especially for third-party deposits. Tip from counters: digital e-slips are faster, but paper slips remain valid with signature and PAN if the amount crosses ₹49,999.

What’s new in HDFC digital e-slips in 2025–26?

E-slips now generate a 9-digit Request ID instantly via NetBanking. Idea: it cuts counter time by almost 50%, since tellers don’t re-enter account or denomination details.

Can I deposit cash into someone else’s HDFC account using e-slip?

Partially. Branches may ask for a Money Mule declaration and relationship details. Tip: keep ID proof ready; otherwise, staff may redirect you to a paper slip.

Is doorstep cash deposit still active for senior citizens?

Yes. Doorstep banking supports deposits between ₹5,000–₹25,000. Idea: book a day earlier; slots fill fast in metro and tier-2 cities during pension dates.

What common mistake delays cash deposit credit?

Wrong denomination total or missing signature. Branch staff say 7 out of 10 rejected slips fail due to calculation mismatch. Always re-count notes before submission.

Do cheque deposits still need a physical slip in 2026?

Mostly yes. Cheque drops still rely on slips for tracking. Tip: write mobile number clearly—SMS alerts depend on it once cheque clearing starts.

Which deposit method is fastest at busy HDFC branches?

Cardless e-slip is fastest, followed by Cash Deposit Machines (CDMs). Branch data shows CDMs clear deposits in under 2 minutes if note count stays within limits.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.