Union Bank issues the KYC form; the name of the form is the data updation form under KYC compliance. It is a bilingual form in nature. You will use this form for your savings, individual or corporate account KYC. As per the RBI, it’s a mandatory process. Union Bank offers both online and offline options for ReKYC.

The Union Bank of India KYC Form is used to:

- Submit or update your personal information, such as name, address, contact details, and PAN.

- Reconfirm your information sometimes during Re-KYC, even if you have already given the same info when opening the account.

- Update details in case of a change in address, ID proof, income, or occupation.

When Is the KYC Form Required?

You’ll be asked to submit or update your KYC form in these common cases:

| Situation | Why It’s Needed |

|---|---|

| Change in address | To verify your new residence with proof. |

| If changing in mobile number/email ID | For communication and OTP verification. |

| Change in occupation or income | To comply with RBI’s income declaration requirements. |

| Expired or new ID proof | When your old ID is invalid or replaced. |

| Periodic Re-KYC | Required every few years, depending on the account, RBI sets the risk category. |

If there’s no change in your existing KYC details, you can do KYC online through the Union Bank KYC portal by simply ticking “There is no change in my current address.”

Documents Required with Union Bank KYC Form

You need to attach self-attested Xerox scanned copies of additional documents after filling out the form. Here is the list of documents you may need.

| Document Type | Examples (Any one from each type) |

|---|---|

| Proof of your Identity (POI) | You can go with Aadhaar Card, Passport, Voter ID, PAN Card, Driving Licence (if aadhaar card not available, choose Voter ID) |

| Proof of Address (POA) | Aadhaar, Passport, Voter ID, OR any Utility Bill (2 months old only – electricity, gas, postpaid mobile, water) |

| Additional Proof (if applicable) | Rent Agreement / Lease Agreement for tenants |

| For Students | Aadhaar + College ID + Form 60 (if PAN not available) |

| Minor accounts | Your parents or guardians’ POI and POA scanned documents |

| Photograph | One recent passport-size photo just for the form only |

How to Get the Union Bank KYC Form

This is the easiest part. Union Bank offers multiple options to get your Form easily. You can get it at home using a computer or a mobile, or you can collect it while available at the home branch.

| Method | Description | Link / Steps |

|---|---|---|

| From the Official Website (Download Forms Section) | Firstly, Visit Union Bank’s official site using a mobile or pc, scroll down to “Customer Corner,” in the footer section, tap on “Download Forms,” and select “KYC Data Application Format.” | |

| Union Bank Direct Download Button (Printable PDF) | If not found, you can click the direct link for the KYC form and print the bilingual English-Hindi form. It is accepted in all branches. | 👉🏻 Direct link PDF: Download KYC Data Application Format (Bilingual PDF) |

| Editable Word Format (Hindi or English) | Go to the KYC information page at Union Bank KYC Portal and download separate MS-Word editable forms in Hindi or English. You can use MS Word to edit before printing. | KYC Word Format – English / Hindi |

| Collect from the Branch | The Best option is your nearest or home Union Bank branch. Ask for the “KYC Data Application Form (Annexure-III).” Staff will provide a physical copy free of cost. | Available at all branches in physical and multiple languages |

The Complete Checklist for Union Bank KYC Form Fill Up

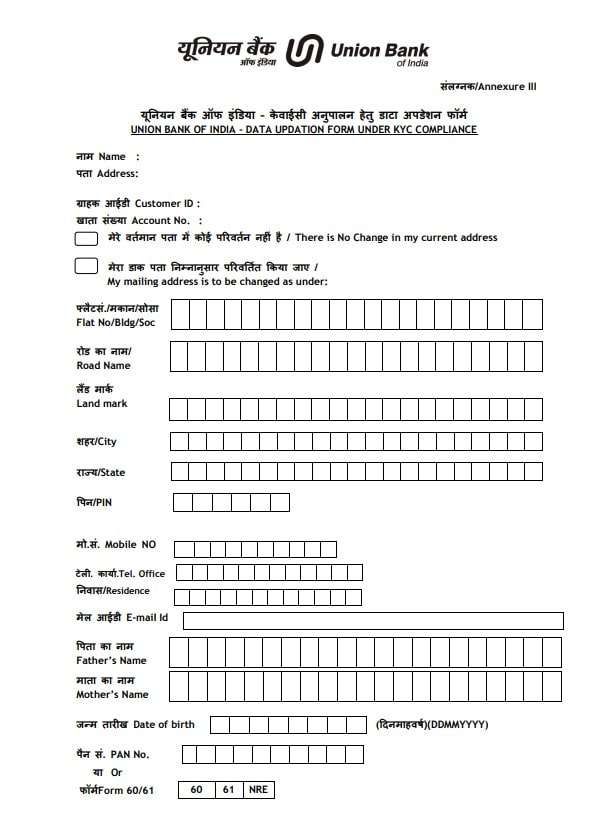

The KYC form is usually in two pages, provided by your union bank branch; you have to start with the header and go to the bottom. Follow these instructions carefully while filling in, use Capital words and avoid overwriting –

1 Step: Basic Information

- Start with the first page header, write your Full Name, Customer ID, and Account Number exactly as printed on your bank passbook or cheque.

- Now, fill in your current address in detail — including Flat No., Building/Society, Road, City, State, and PIN Code, same as provided before.

2 Step: Address Confirmation

- Now, if you changed your address recently, tick and enter your new address in the boxes. You must have new address proof.

- If the same as before, simply tick – “There is no change in my current address” — all details are the same.

3 Step: Your Contact Information,

- Put down your mobile number (if adding new, but must be linked with your aadhaar)

- landline number is optional; you can ignore it.

- Your email ID is optional, but it’s better to enter it (a good idea for monthly digital statements)

Step 4: Family & Personal Details

- Enter your Father’s Name and Mother’s Name.

- Here, fill in your Date of Birth in the format for each box. use YYYY.

- Mention your PAN number, or if PAN is not available, you can tick “Form 60/61” and ask for a form from the counter.

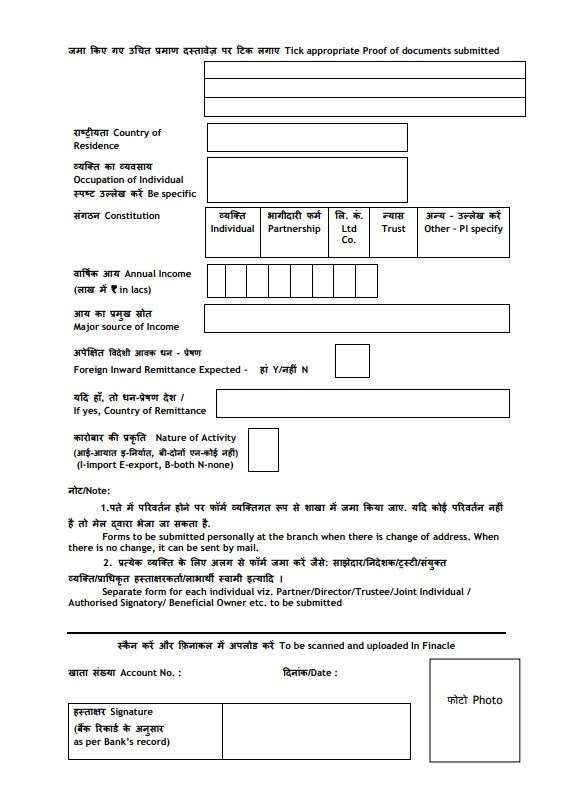

5 Step: Occupation & Income

- On the second page, enter your proof of documents you will provide xerox for OVD, such as Aadhaar or PAN. write 1 for identity and 1 for address.

- Put your country name where you live and select constituion, if regular savings, select individual.

- Mention your profession (Service, Business, Student, Retired, farmer). If not working, you can put “looking for a job or a student”.

- State your annual income range (in ₹ lakhs). such as Rs. 3,50,000 Lakh per year.

- If applicable, write down your source of income (salary, business, pension, agriculture or more)

6 Step: Other Information

- Tick whether you expect foreign remittance (Y/N) and the country if yes. or if no idea, just tick “N”

- Indicate nature of business (I-Import, E-Export, B-Both, N-None).

- Most retail customers can select “N – None.”

7 Step: Signature and Photo

- Add your passport-size photograph in the photo section.

- Sign clearly in the box (as per bank records or cheque leaf).

- Date the form before submission.

Other Forms You Might Need (If Bank Requests)

Sometimes, depending on your KYC update type, the bank may ask for a few additional forms. Here are the official links:

| Form | Purpose | Download Link |

|---|---|---|

| FATCA / CRS Declaration Form | Required for accounts involving tax residency declaration or foreign income. | Download FATCA Form (PDF) for union Bank |

| Form 60 | For customers who don’t have PAN (available on page 7 of AOF). | Download Account Opening Form (Form 60 Page 7) |

| Citizen Integrity Pledge | Optional form, if provided by the branch. | Available at the branch only |

Note: You don’t need to submit FATCA or Citizen Integrity Pledge unless your branch specifically requests it or provide additional forms.

Submission Process at the Branch

- Get your all paperwork:

- Filled KYC form

- Your scanned Documents

- One passport photo

- PAN or Form 60 (anyone)

- Visit your home branch (the branch where your account is maintained), you have to go base branch only.

- Submit the documents to the staff; they will verify, scan, and upload them to Finacle, the bank’s central system.

- You will receive an SMS on your linked mobile number once your KYC is successfully updated. if everything correct including your document scanned copy.

How Long Does It Take to update Union Bank KYC?

- Online “No-Change” Re-KYC: Instant or within 24 hours.

- Branch submission with address change: It can take 2–5 working days after document verification. You can visit your branch if it takes longer than a week. You may have to provide additional documents.

- SMS/Email Text: Usually sent once KYC is marked as “verified” in the system.

- Union Bank KYC Portal: You can check the live status using Chrome on your phone.

How to Check KYC Status Online

- Visit the official portal only – Union Bank Re-KYC Portal

- Tap on “Re-KYC for Individual Customers.”

- Enter your Customer ID, PAN, or Account Number. (anyone)

- Verify with your registered mobile number (6-OTP required).

- You will see one of these messages on display:

- “KYC Not Due” — Your KYC is complete.

- “KYC Due” — Your KYC needs to be updated before the last date.

FAQs about KYC Form

Is there any online option for Re-KYC at Union Bank?

Yes, you can do basic KYC online through the Union Bank Re-KYC solution portal using your customer ID and mobile OTP, however, you cannot edit information while KYC.

Can an unemployed person open or update a Union Bank account without income proof?

Yes, unemployed individuals can declare “Unemployed” under occupation and provide valid ID and address proof to complete KYC successfully.

How often does Union Bank ask for KYC re-verification?

KYC re-verification usually happens every two to eight years depending on your risk category and type of account — low, medium, or high risk.

How can I check if my Union Bank KYC is due or updated?

Mostly, Union Bank sends SMS to your registered mobile number for KYC update notification with the last date; however, you can check the “KYC Due” or “KYC Not Due” status at the Union Bank official website.

What KYC documents are accepted for students without income proof?

Students can provide a valid college ID, School Application, or passport as ID proof, plus Form 60 if PAN is unavailable or not yet allotted.

Can I submit the Union Bank KYC form without visiting my home branch?

Mostly no. In 8 out of 10 cases, Union Bank asks you to visit your base branch because physical documents are verified and uploaded in Finacle under the original CIF.

What is the most common mistake customers make in the Union Bank KYC form?

Writing details that don’t match Aadhaar exactly—especially house number and PIN. Even a small mismatch delays approval by 2–3 working days and may trigger document re-submission.

Is Aadhaar mandatory for Union Bank KYC in 2026?

Not compulsory, but highly preferred. Without Aadhaar, verification usually takes longer. Branches often ask one extra POA document, especially for address changes or re-KYC cases.

Why does Union Bank ask about foreign remittance in a normal savings account?

RBI requires banks to assess transaction risk. Even retail customers must tick Yes/No. If unsure, choose “No”—it doesn’t affect your account or services.

How do I know my Union Bank KYC is fully approved, not just submitted?

Only SMS confirmation means approval. If no SMS after 5 working days, visit the branch and ask the staff to check the KYC status in Finacle, not just portal status.

What should students write in the income and occupation columns?

Write “Student” as occupation and select the lowest income bracket. Around 90% student KYC approvals succeed without income proof if ID and address documents are valid.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.