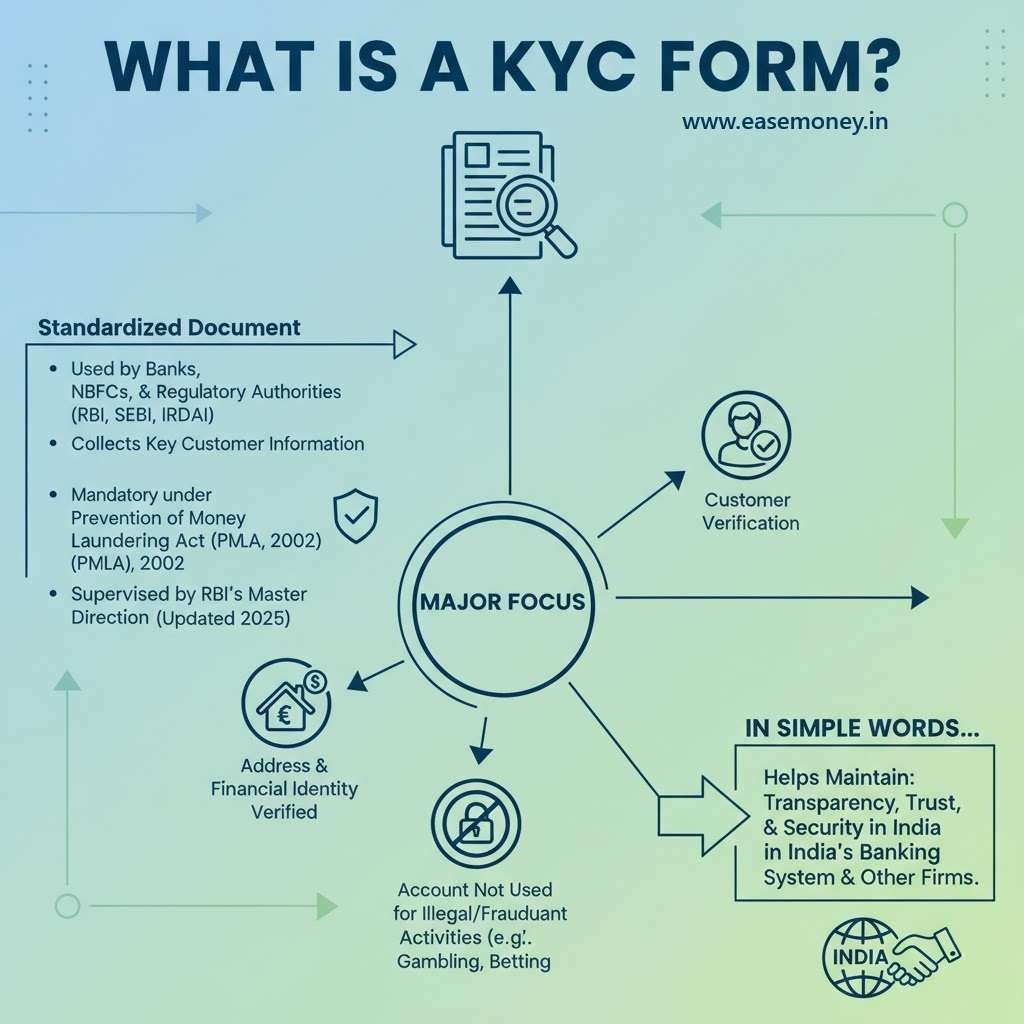

What is a KYC Form?

A KYC form is a standardised document used by your banks, NBFCs regulatory authorities (like the RBI, SEBI, and IRDAI in India), it required to collect key information of all types of customers, including you. It is must must-required policy under the Prevention of Money Laundering Act (PMLA), 2002, and is supervised by the RBI’s Master Direction on KYC, 2016 (updated 2026).

The major focus of those Forms is to confirm that –

- The customer is who they claim to be.

- Their address and financial identity are verified.

- The account is not being used for any illegal or fraudulent such as gambling or betting.

In simple words, it helps maintain transparency, trust, and security in India’s banking system and other firms.

Re-KYC Process by bank forms

If your bank informs you of Re-KYC, you can do it via online or branch banking facility.

In a branch, you have to use the KYC form for updating or reconfirming your existing KYC details that are already on record with your bank or financial institution. If you changed your address, mobile number, or identity, you have to fill out the latest information with a valid scanned document.

It is required because under the RBI’s 2026 guidelines, every customer must periodically update their KYC details based on risk level:

| Risk Category | Re-KYC Frequency |

|---|---|

| Low Risk | Every 10 years |

| Medium Risk | Every 8 years |

| High Risk | Every 2 years |

Note: Low-risk customers can now continue using accounts up to one year after the due date if their Re-KYC is pending, and they will get three reminders before any restriction is applied.

What Information Is Required in a KYC Form?

In almost every KYC form, digital or physical paper, this information is mandatory. Below are the key details you will be asked to fill:

| Section | Information Needed |

|---|---|

| Personal Details | Full name, gender, date of birth, father’s/spouse’s name |

| Contact Information | Mobile number, email ID |

| Identity Proof | PAN number, Aadhaar number (or other OVD) |

| Address Details | Permanent and current address (with proof) |

| Occupation | Type of employment and source of income |

| Financial Profile | Income range or category |

| Aadhaar | Your bank also provide aadhaar seeding form for KYC |

| Declaration | Signature, thumb impression, date, and confirmation of authenticity |

Most forms also include a section for a photograph and official verification by a bank officer or relationship manager.

Who Needs to Submit a KYC Form?

Every bank or financial customer in India must complete KYC, including:

- Savings or current account holders

- Fixed deposit customers

- Credit card applicants

- Loan account holder such as -home, personal, business, car and other

- Mutual fund and insurance investors

- New users of digital wallets, NBFCs, and fintech apps

Even existing customers need to re-submit KYC (Re-KYC) periodically or change any vital existing information.

Types of KYC Forms

It usually depends on how you do your KYC. Here list of KYC forms in the banking –

- Physical KYC – if your bank suggests visiting a branch, you have to go through the physical KYC form. It is a traditional method, visit the branch, fill out the KYC form, attach your recent photograph, add your documents (Aadhaar, Passport, or Driving license) and your Tax document (Form 60 or PAN) and your regular signature is required.

- PDF KYC form – Nowadays, most banks offer a direct PDF file on their official website form centre. Simply go there, you can download, print it out, and fill out the information. You can mail it to the address of the home branch, or you can drop it in the box of your branch.

- MS Word KYC Form – Most banks, such as Union Bank, offer an editable MS Word KYC form. You can download it, fill it out using MS Office, and submit it at a branch or upload it directly to the website.

- e-KYC (Electronic KYC) – This method works on Aadhaar-based OTP. When you do online KYC, the system shows the pre-filled KYC for; you have to confirm with OTP, and your KYC is done. you may have to upload additional documents, if you changed any existing details.

Officially Valid Documents (OVDs) for KYC

The RBI defines as Officially Valid Documents (OVDs) that can be used for KYC verification:

| Document Type | Accepted Proofs |

|---|---|

| Proof of Identity (POI Govt-approved) | Your Aadhaar, E-Aadhaar, PAN, Passport, Voter ID, NREGA Job Card (with state official stamp), Driving Licence |

| Proof of Address (POA Document type) | Aadhaar, Passport, Voter ID, Utility Bill for example – (water bill, LPG, or electrcitiy bill last 2 months only) |

| Additional Proof (if needed) | Rent Agreement for tenant, your College ID or school application (students), |

| Photograph | any recent passport-size color photo |

| Income Proof (if asked) | Your Salary slip / Form 16 (for high-risk accounts only) |

Step-by-Step: How to Fill Any Bank KYC Form

- Firt simply go to your home branch or website and Get the form (printable PDF or physical branch copy).

- Write in BLOCK letters using black/blue ink only.

- Fill basic your details and bank details:

- Name, Account No., Customer ID (CIF), DOB, Gender, Marital Status, you can use your Bank passbook or bank statement.

- Enter address: Permanent + current (tick “same as permanent” if unchanged). you have to provide latest address with document proof, utility bills.

- Provide ID details: Type of OVD (Aadhaar/PAN etc.) + number.

- Occupation & Income: You have to give your job information, source of income, salary, and your family annual income.

- Contact info: Your latest active Mobile No. + Email ID (must match Aadhaar for e-KYC and digital statements for email).

- Signature & date: Sign exactly as per bank records.

- Attach scanned copies of OVDs, POA, and additional forms.

- Submit at your home branch or via the bank’s e-KYC portal (if available).

Bank & Form List (Fill Up and download PDF)

| Bank Name | Type of Form and names | Use Case | Download / Guide |

|---|---|---|---|

| Punjab National Bank (PNB) | Specimen Proforma for KYC Updation | New KYC / Re-KYC / PAN Link / Address Change | PNB KYC Form Guide |

| State Bank of India (SBI) | Annexure A / B / C | A – No Change B – Change in Details C – Address Change | SBI KYC Form PDF |

| Union Bank of India (UBI) | Data Updation Form under KYC Compliance | New KYC / Re-KYC / Corporate Accounts | Union Bank KYC Form |

| Bank of India (BOI) | Customer information updation | Used for AML/KYC/CFT | BOI Form Download PDF |

| Bank of Baroda (BOB) | 3 Types of Form | Online KYC depend on Aadhaar data — if it doesn’t match with customer data, a KYC Form is needed. | BOB KYC Forms |

| Bank of Maharashtra (BOM) | Single Form – Self-Declaration Form for Periodic Updation of KYC | Video KYC or EKYC failed for the Account, eligible only for physical KYC | BOM PDF |

| UCO Bank | 4 forms depending on account types | SMS KYC option is open | UCO KYC Updation PDF |

| Canara Bank | Single form for updation | You can use email or SMS banking | Canara Bank Annexure I PDF |

Difference Between Physical KYC and Digital KYC

| Feature | Physical KYC | Digital KYC / e-KYC |

|---|---|---|

| Submission Mode | Paper form at branch | Online / App-based |

| Document Type | Photocopies + signature | Digital files / OTP verified |

| Verification | Face-to-face | Aadhaar / Video call |

| Time Taken | 2–5 working days | Instant to 24 hours |

| Preferred For | Branch banking users | Online customers, fintech users |

Both are equally valid under RBI rules, as long as verification standards are met.

Is PAN Card Mandatory for a person with a KYC form?

Yes, your PAN card is mandatory; it is required for all customers, including the unemployed, as per the guidelines of RBI KYC Master Direction and the Income Tax Act, 1961. However, if you are a student, minor, or just don’t have a PAN yet, you can submit Form 60 or Form 61, declaring that you don’t have one. You can collect form 60 at your home branch KYC counter or you can get from your bank website.

When You Upload a Scanned Copy:

- The scanned PAN card must be clear and readable (colour preferred).

- Ensure the signature or printed name is visible.

- Always self-attest the scanned image before uploading (write “True copy – self-attested” and sign twice).

FAQs Related to KYC Forms

Can a joint account holder update KYC separately?

Yes, each account holder must submit individual KYC/Re-KYC forms even for joint accounts, because both account holders hold different PAN and KYC details.

Can the bank freeze an account or stop UPI if KYC is not updated?

Yes, banks may temporarily block your account transactions, including UPI and ATM. You can do any withdrawal or transfer until you submit the KYC form. In this case, most account starts within 24 hours after KYC.

Can I use digital copies of documents instead of a physical Xerox?

Yes, most banks now accept self-attested digital scans or PDFs for online Re-KYC submission. Most banks also offer a KYC portal for all types of KYC stuff, including Union Bank, the Central Bank, or PNB.

Can KYC be updated via a customer service call?

No, banks generally do not allow full KYC updates over calls; you must submit a form, complete video KYC or do netbanking for KYC.

Why do banks ask for Re-KYC even when nothing has changed?

Because RBI mandates periodic verification, not just change-based updates. Even unchanged accounts must reconfirm details to prevent misuse. Most low-risk customers face Re-KYC once every 8–10 years.

What usually happens first when a bank marks KYC as “due”?

Initially, only UPI or digital limits get restricted. Branch cash access usually continues. Full freeze happens only after reminders are ignored—typically 30–90 days, depending on bank policy.

Is it safer to update KYC online or by visiting a branch?

Online is faster, but branch KYC is safer for address or ID changes. Physical verification reduces mismatch risk. Many banks resolve branch KYC in 48–72 working hours.

Why do banks insist on occupation and income details during KYC?

These details decide your risk category, not taxation. Even approximate figures work. Leaving income blank often causes silent rejection, delaying approval without any SMS update.

Can a single mistake really delay KYC approval?

Yes. A wrong PIN code or a missing signature can delay KYC by 3–5 working days. Always match the address and name exactly with Aadhaar or your chosen OVD.

Do homemakers or students face problems during KYC?

No, if filled correctly. Write “Student” or “Homemaker” and mention nominal annual credit like ₹25,000–₹1,00,000. Banks don’t reject low income—incomplete fields cause issues.

What’s the smartest way to avoid repeated KYC requests in future?

Link Aadhaar, PAN, mobile, and CKYC properly once. Accounts with complete digital linkage usually avoid frequent Re-KYC and qualify for OTP-based confirmation instead of physical forms.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.