If life has taught us anything, it’s that emergencies never come with an invitation. You mostly observed that a sudden hospital bill, a car breakdown middle of the road, or even a once-in-a-lifetime business deal, all of these come when you least expect them. However, it counts as an opportunity, and when they do, the first question is always the same: Where do I get the money, fast?

At that time, Most people like you rush toward personal loans or swipe their credit cards. Yes, it’s quick, but they also sting with high interest rates, or sometimes it ends your journey with a debt trap. That’s when many regular investors usually overlook a surprisingly practical option such as Loan Against Mutual Funds (LAMF).

Instead of redeeming or withdrawing your years of total invested funds, you can use this as collateral, borrow against them, and still let all your money stay invested in your portfolio. It works like a short-term liquidity without killing its long-term potential in your portfolio.

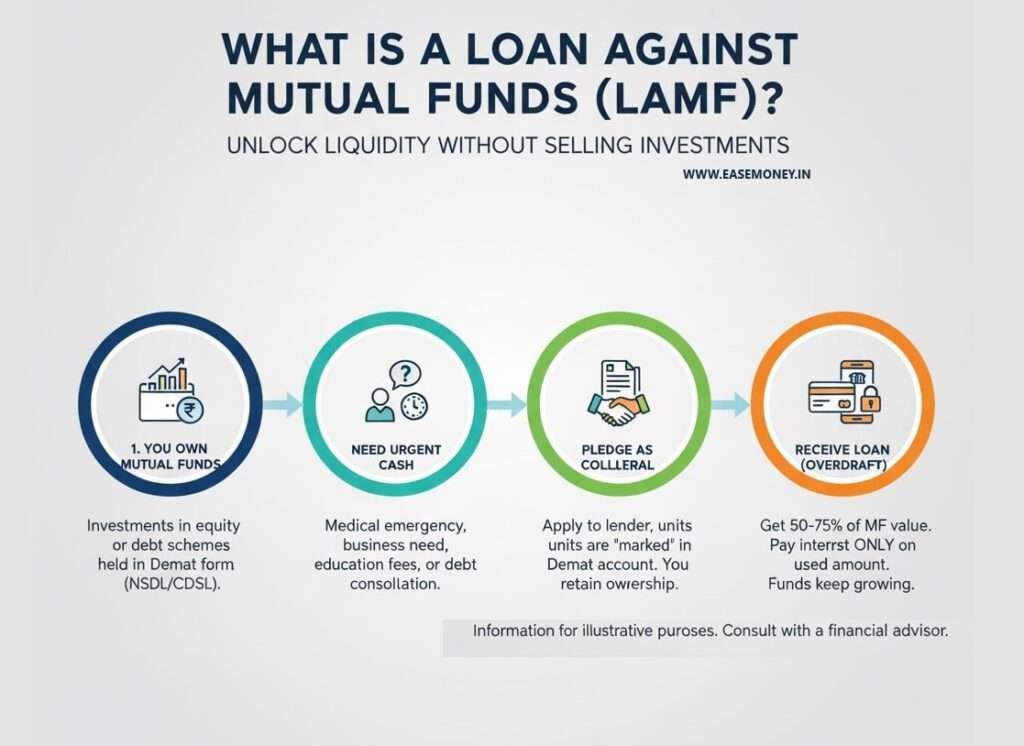

What does LAMF actually mean?

Just imagine, you have a portfolio of mutual funds with a total worth of around Rs. 10 lakh. You don’t want to redeem them because that would disturb your financial plan, or for any other reason. But you do need cash in an emergency, so the action required, you walk up to a lender or bank and say, “I have got this portfolio, can I borrow against it?”

Then your lender marks the total units booked in the system (NSDL or CDSL). You remain the owner, but the lender now has rights over them if you default. The amount that you can borrow is now called the Loan-to-Value (LTV) ratio. It usually goes from 50-75% for equity funds of your investment’s current value. Also, it works around 80-90% if you have debt funds.

So, your portfolio is ₹10 lakh, you may be able to borrow anywhere between ₹5 and ₹7.5 lakh only at equity funds. It usually depends on whether your funds are equity-heavy (riskier, hence lower LTV) or debt-based (safer, higher LTV).

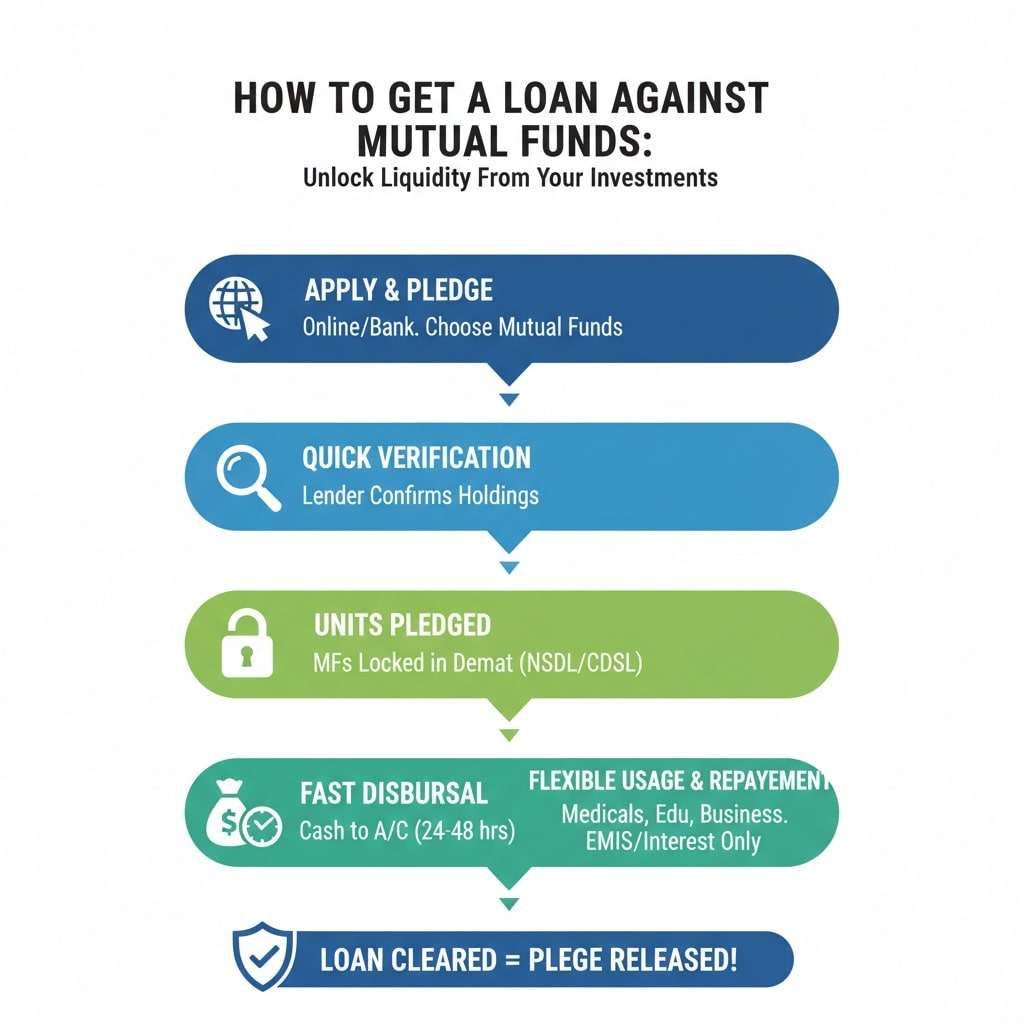

Step-by-Step Process of Taking a Loan Against Mutual Funds

The process is more straightforward than most loans.

- Start the process – You can apply online in just a few clicks or walk into your bank where your existing savings account.

- Pick your funds – Choose which mutual funds you want to pledge.

- Lender checks and locks them – The bank/fintech does a quick check and marks those units as pledged in your demat account. You still own them, don’t worry.

- Money in your account – Within 24–48 hours (sometimes even faster with digital apps), the loan amount hits your bank account.

- Use it your way – Pay that hospital bill, cover college fees, manage business cash flow, or clear expensive credit card dues. No questions asked.

- Repay at your pace – Some lenders let you go with EMIs, others allow you to just pay the interest monthly and settle the principal later.

- Get your funds back – Once you repay, the pledge is removed and your mutual funds are back under your full control.

Addon Tip for you: In some cases, lenders also offer an overdraft facility linked to your mutual funds. This means you can withdraw only the amount you need (instead of the full loan sanctioned), and pay interest only on what you actually use.

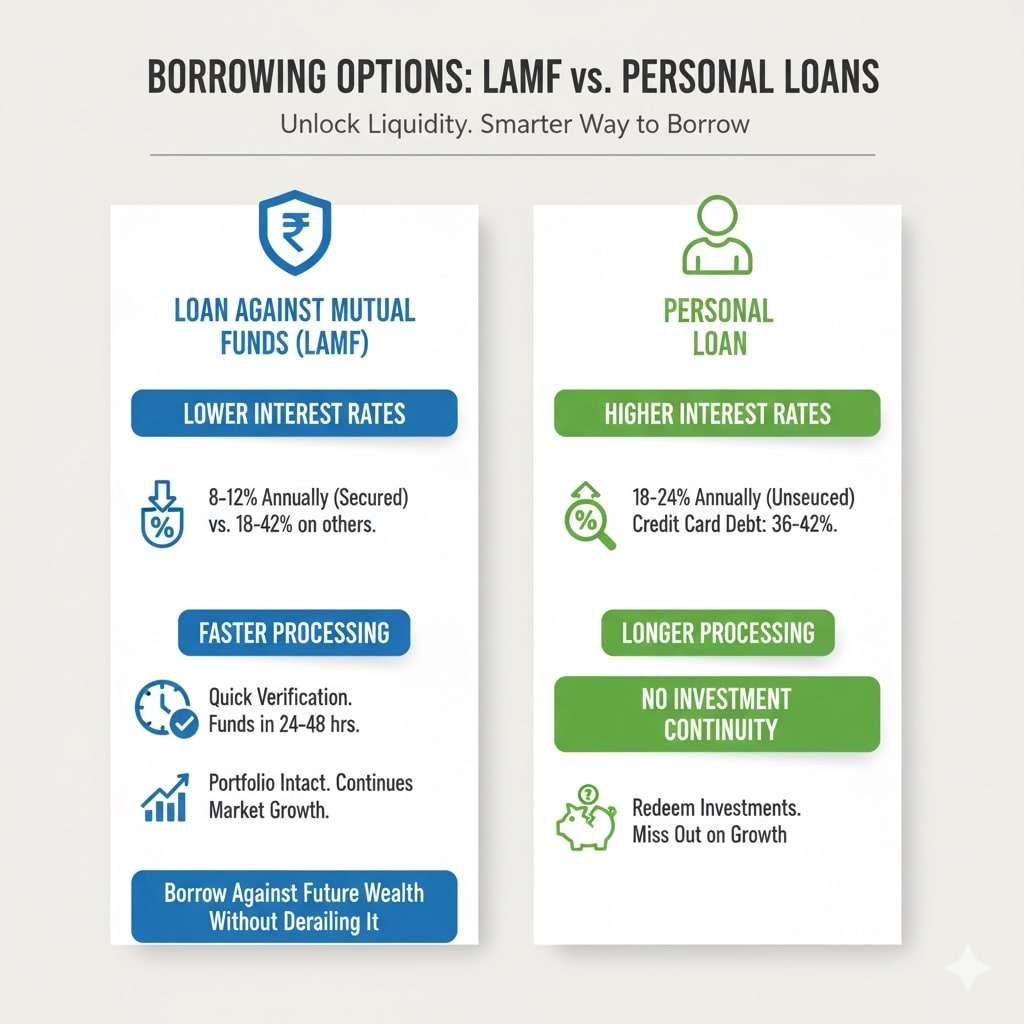

Comparing Borrowing Options: LAMF and Personal Loans

Three reasons stand out.

- Lower interest rates – because the loan is secured against your investments, lenders don’t charge the sky-high rates you see with personal loans. You may find that Rates may range between 8–12% annually, compared to 18–24% on personal loans or 36–42% on credit card debt.

- Faster processing – the assets are already yours, so lenders just need to secure them, not run endless eligibility checks.

- Your money keeps working – unlike redemption, where your investment journey is cut short, here your portfolio stays intact and continues to participate in market growth.

In short, you borrow against your future wealth without derailing it.

What are the Risks and Considerations Factors?

Absolutely. No loan comes without strings; the biggest risk is market volatility. If the market dips and your pledged funds lose value, the lender may raise a margin call asking you to either pledge more units or repay part of the loan. Ignore this, and they have the right to sell your units.

Another point to note is that you’ll never get 100% of your portfolio’s value. Lenders keep a buffer by offering only 50-75%. And yes, even though the rates are lower than credit cards, interest still adds up if you hold the loan too long.

Let’s make it real with an example

- Say you have got ₹16 lakh worth of mutual funds. The lender agrees on an LTV of 50%.

- That means you’re eligible for up to ₹8 lakh. During the tenure, suppose the NAV of your funds climbs.

- Perfect when you repay, your investments come back, hopefully at a higher value. But if the NAV drops? The lender could ask you to add more collateral or clear part of the balance.

- That’s why it’s wise to monitor your portfolio even while it’s pledged.

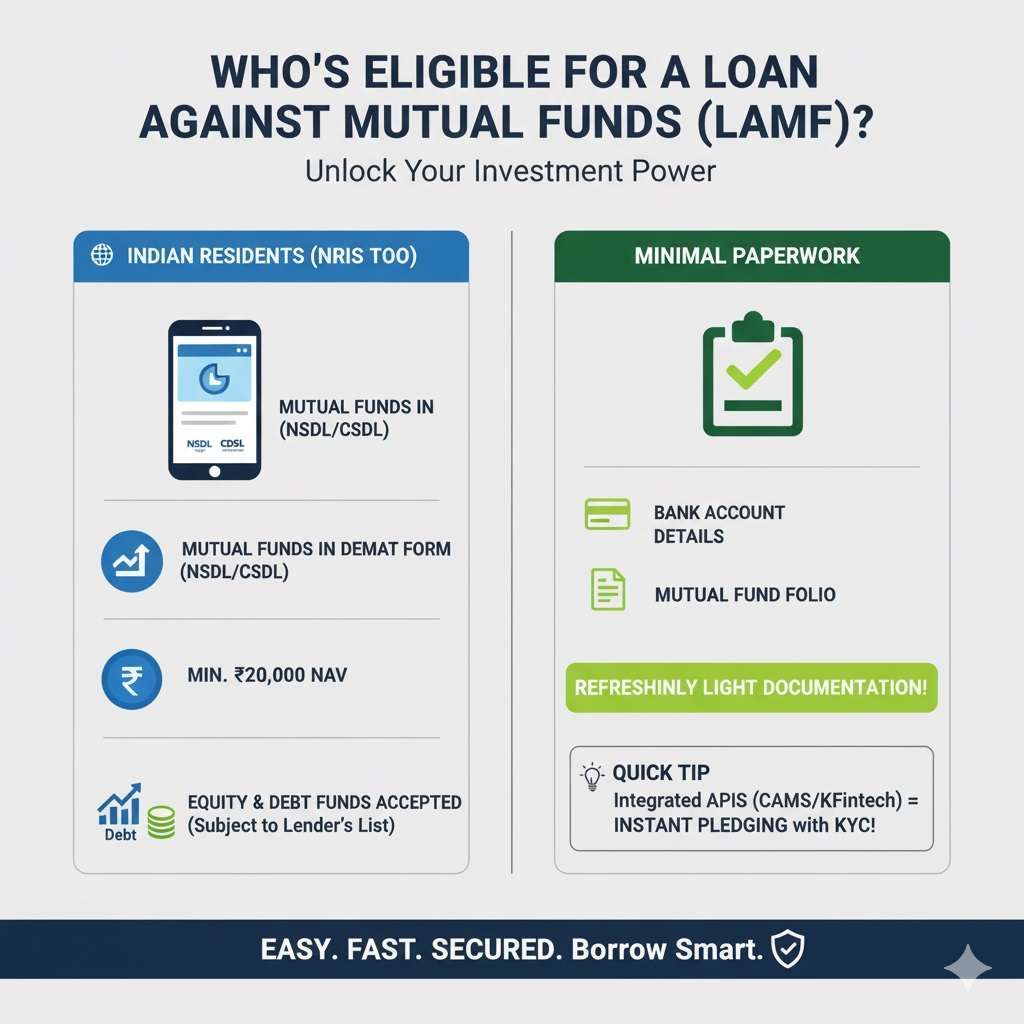

Who’s eligible for LAMF Offers?

If you are an Indian resident (NRIs too, with some lenders), have mutual funds in demat form with NSDL/CDSL, and usually at least ₹20,000 NAV, you’re good to go. Both equity and debt funds are generally accepted, subject to the lender’s list.

Paperwork is minimal: PAN, bank account details, and your mutual fund folio. Compared to the mountain of documents required for other loans, this feels refreshingly light.

Quick Tip: Some lenders have integrated APIs with registrars like CAMS/KFintech, which makes pledging almost instant if your KYC is already done.

When does taking LAMF make sense?

Think short-term needs where liquidating investments would hurt. For instance:

- Paying a sudden medical bill.

- Handling short-term business working capital.

- Covering education expenses.

- Funding travel or personal goals.

- Replacing high-interest credit card dues with something cheaper.

The golden rule? Borrow only what you can comfortably repay.

How does it stack up against other options?

- Loan against FDs: Safer but limited since FDs don’t grow as fast as mutual funds.

- Loan against shares: Similar idea, but riskier because stocks are more volatile.

- Personal loan: Quick but expensive.

- Overdraft facility: Flexible, but usually tied to income and banking relationships.

For investors already holding mutual funds, LAMF often turns out to be the sweet spot, fast, relatively cheap, and convenient.

Tax Angle: Redeem vs Borrow

This is one area many investors miss.

- Redeeming mutual funds may attract capital gains tax (short-term or long-term, depending on your holding period).

- Borrowing against mutual funds does not trigger any tax, since you’re not actually selling units.

Key Benefit: By choosing LAMF, you not only keep your investments growing but also avoid your unnecessary tax outflows.

Is a loan against mutual funds better than a personal loan?

Yes, in most cases, such as when your interest rates are much lower and your money stays invested. Personal loans are faster sometimes, but far more expensive due to their interest, processing fees, and foreclosure charges.

What happens if the mutual fund value falls after I take the loan?

If markets dip, your lender may ask you to pledge more funds or repay part of the loan. That’s called a margin call.

Does taking a loan against mutual funds affect future SIPs or dividends?

No. Your SIPs continue normally, and dividends (if any) still belong to you. Only pledged units are restricted. New investments remain completely free and unaffected by the loan.

Can lenders sell my mutual funds without informing me?

Only if you ignore margin calls. Lenders must notify you first and give you time to add collateral or repay. Sudden selling happens only after repeated non-response or extreme NAV drops.

Is LAMF suitable for long-term borrowing needs?

Not ideal. LAMF works best for short to medium-term cash needs. Holding it too long increases interest cost and market risk, reducing the advantage over personal loans.

Can I partially repay or prepay a LAMF without penalty?

Yes, most lenders allow partial or full prepayment without charges. This flexibility is a big advantage over personal loans, where foreclosure penalties often apply.

What’s the biggest mistake investors make while using LAMF?

Borrowing the maximum eligible amount. Smart users keep a buffer below max LTV to avoid margin calls during market corrections and reduce stress during volatility.

Do all mutual funds qualify for a loan against them?

No. Only lender-approved schemes qualify. Sector funds, small-cap heavy funds, or very volatile schemes are often excluded or offered lower LTV to reduce lender risk.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.