Closing a bank account is not always a straightforward process. In India, the majority of banks require a visit to a branch to disconnect the account services; however, this is due to KYC reasons.

Recently, in 2025, Axis Bank has tried and introduced a new direct bank account closure option inside the (open by Axis app name) Axis Mobile App, which lets you close certain savings accounts completely online.

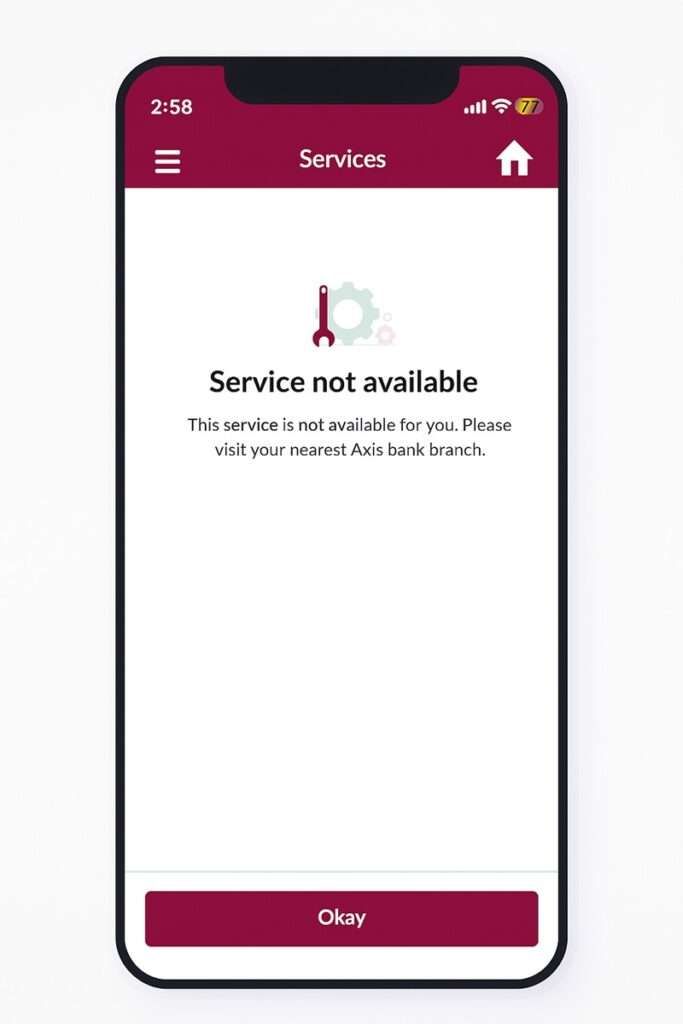

But here’s the catch: this feature does not work for everyone. Many customers still see the frustrating message:

“This service is not available for you. Please visit your nearest Axis Bank branch.”

So, what’s the real way to close your Axis Bank account in 2026? let’s find out, including what the charges and timings are –

1. Close account online using the Axis Mobile App

Axis Bank made headlines by allowing digital account closure through its mobile app. If it works for your account type, such as BSBDA or your eligibility, the process is direct. Here are the steps –

- Update or Download Axis Mobile App – First of all, open your Play Store or App Store and check its latest version. If not, simply update it.

- Login – You have to log in using your mpin or fingerprint. If you have never used it, register using your ATM card or Branch token.

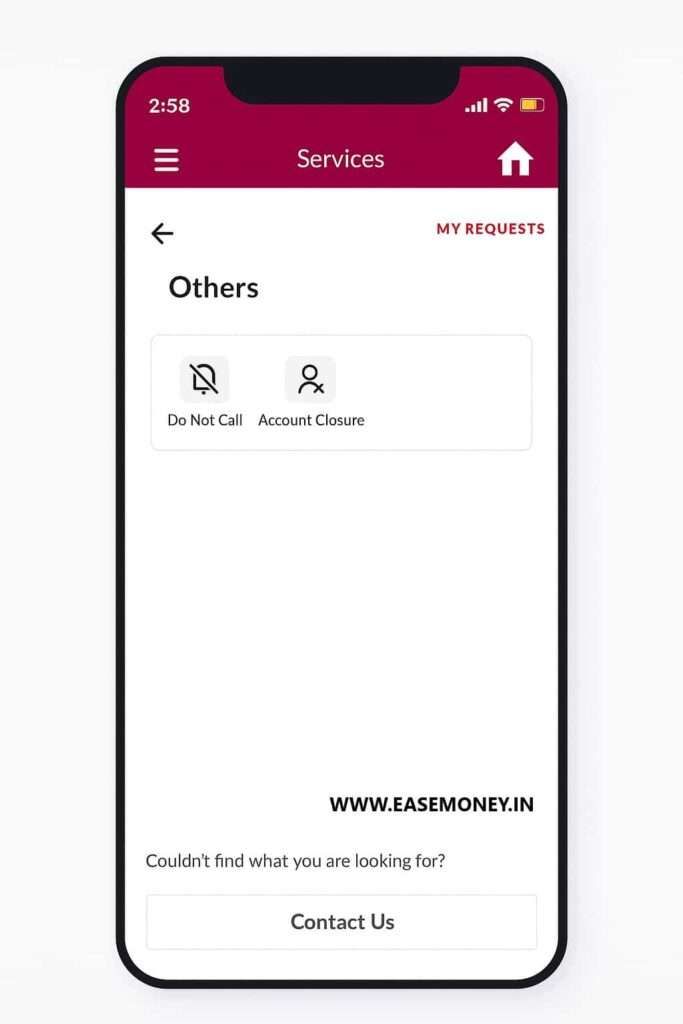

- Services section – On the dashboard, tap on the Menu button on the left side and open services.

- Account Closure option – You can use the search button to find it, or just tap on the More Services button available at the end.

- Account selection – Here, if you have multiple accounts, you have to select the account number that you want to close.

- Choose Reason for Closure – From the list provided below.

- Read Terms – App will notify you that unused cheques and debit cards will be blocked, it also tells you your DD will be issued by your home branch and take a few days to process. Tap on agree and next.

- Choose How to Receive Balance: even if your account balance is zero, you still need to select one.

- Instant Transfer – Only to another Axis account.

- Demand Draft – Free delivery to your registered address only (takes ~6 working days).

- Verify Identity – The last process, you have to end your KYC with the bank via digital proof. Your OTP works like that.

- You can choose the linked mobile number OTP.

- Aadhaar + OTP.

- Choose any one and enter the OTP.

- Get Confirmation – You will get a reference ID and receive an SMS on your phone.

- Track – You can also track your request in the Services section, tap on “My requests” available at the top.

Note: You may get a call from a relationship manager or customer care for any pending issues.

Why Does the App Say “This Service Is Not Available for You”?

As of 2025, Axis Bank is continually adding features in the app, such as In-App Mobile OTP, FD locked and much more, including this new option, account closure, but it is limited.

Many users face this error, and here’s why:

- Account Type Restriction – Not supported for salary accounts, joint accounts, NRI accounts, or older accounts.

- Recent Transaction Block – If you made any transaction or service request in the last 24 hours, closure won’t be allowed.

- Gradual Rollout – Axis is enabling this feature in phases; some accounts are still not eligible.

- Testing phase – According to the Axis Bank customer care agent, the feature is in the testing phase. It may be completely launched soon for all types of accounts.

In those cases, the alternative is only for you – you must use the offline method.

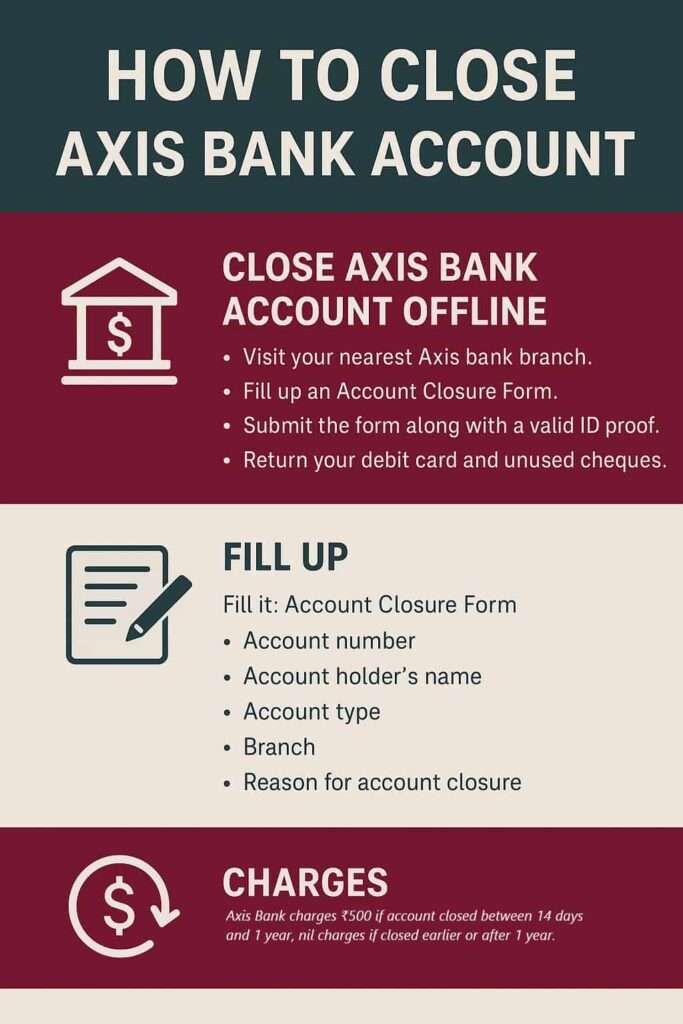

2. Close account offline using the branch form (or courier)

If the app does not work, the offline method is still the most reliable. You will need to fill out and submit the Savings & Current Account Closure Form (CASA form). In case you want closure without visiting your home branch or you are not available in your city, you can choose a courier option as well. follow these steps –

What are the documents Required First

- Filled & signed closure form (A4 printed)

- Scanned Copy of Aadhaar/PAN (self-attested), Also, your signature back side of the scanned paper.

- Debit card cut into 4 pieces (not mandatory)

- Unused cheque leaves (optional)

- Passbook (if available)

- Cancelled cheque (mandatory if amount > ₹25,000 via NEFT/RTGS)

How to Download Axis Bank Closure Form (PDF)

- Simply, open the official Axis Bank site using Chrome or Bing and scroll down to the footer quickly.

- In the Other Links section, click on download forms. It is your Axis Bank form centre.

- You can use the search button to find the “Savings & Current Account Closure Form” PDF version.

- By default, it is available only in English.

- Tap on the Download and save it as a PDF, or just print it out.

| Quick | Link |

|---|---|

| Direct link | Original English PDF |

Note: You can ask for a printed copy at the branch help desk. The branch also provides multiple language options; you can select Hindi or Tamil.

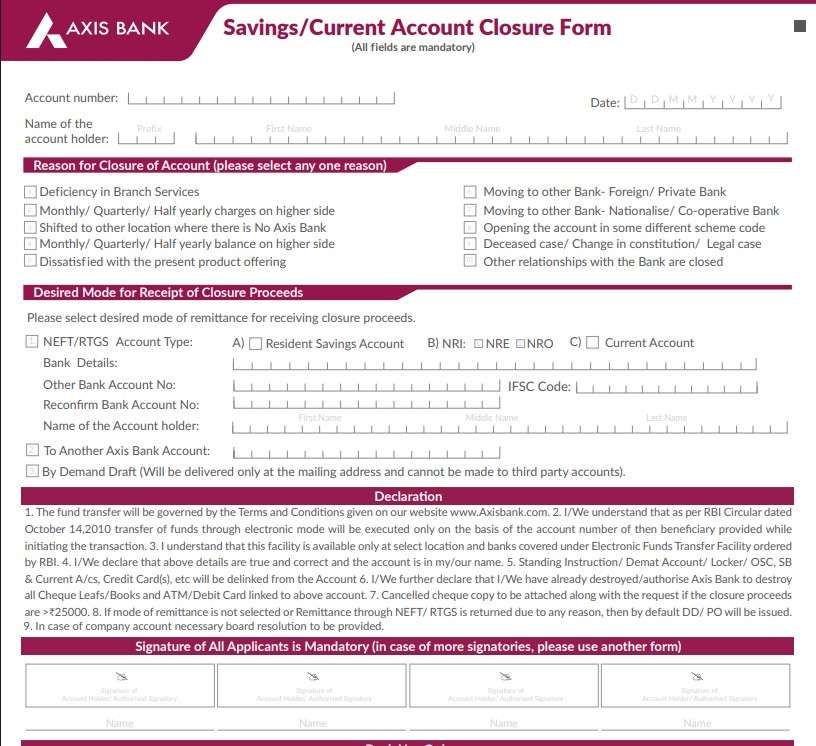

Where to start filling up the printed Account Closure Form of Axis Bank

This form you have to fill out using any regular pen from top to bottom easily. The sections you have to fill out are – Top header, reasons why closing, mode of transfer, declaration, and signature only. After that, you can ignore the bank use and the acknowledgement section, which is handled by your branch team. Let’s start –

- First, write down your account number and the date.

- Enter your full name.

- Simply, choose your real reason why you are closing it or just select “Other relationship with the bank is closed”.

- Select desired Mode of Receiving Balance:

- To another Axis account (mention account & IFSC).

- NEFT/RTGS to another bank (attach cancelled cheque if > ₹25,000).

- Demand Draft (sent to the recorded address).

- Just read the declaration and Sign in the box. For joint accounts, all holders must sign.

- All set, after signing, attach any scanned copy of PAN or aadhaar.

How to Submit the Form

- Option 1: Visit your base Branch – Submit at the home branch, collect the acknowledgement slip.

- Option 2: Courier – If you can’t visit, courier the form + documents to your home branch. Axis will process the request once received.

- You can find the exact address on Google Maps.

When will my account be closed after submitting the form at the Axis Branch?

- Branch/Courier processing – As per data on the official Axis Bank website, the closing period is within 2 working days, but it depends on the branch and account eligibility; it may extend upto 7 working days. You can track your request using the reference ID or the acknowledgement slip.

- Balance remains – Your Cheque/Demand Draft sent within 5-9 working days.

What are the Axis Bank Account Closure Charges?

The 15 February 2025 revised charges notification states that the charges are the same. Rs. 500 + GST for all types of savings accounts in Axis, but it is limited and depends on your closing time –

- Within 14 days of account opening = No fee

- Between 14 days and 1 year = ₹500 closure fee

- After 1 year = No fee whenever you want

How the Fee Is Deducted in Reality

- The fee is directly debited from your balance before closure.

- Example: If you have ₹5,000 in your account and close it within 6 months, Axis will deduct ₹500, and you will receive ₹4,500.

- If your balance is less than ₹500, you must deposit extra money first; otherwise, closure will not be processed.

Additional Customer Request Questions

How to close an Axis Bank Salary Account online?

Salary accounts usually can’t be closed online via the app. You will need to fill out the closure form and submit it at your home branch or via courier. Also, you can request from your company’s HR team.

Can I submit the Axis Bank account closure form at any branch?

Most branches will suggest you go only to your home branch, but Axis accepts closure forms via courier too. Always check with your branch before wasting a visit.

Can I close an Axis Bank account if it has a negative balance?

You can request your branch manager to waive off your negative balance, if you are eligible under any scheme, they can transfer your account type, such as BSBDA or PMJDY.

Why does the Axis Mobile App show “service not available for you”?

This usually means your account type is restricted, you made a recent transaction, or the feature isn’t enabled yet for your profile under Axis Bank’s phased rollout. it simpe means branch visit required for any closing account with KYC.

How many days does Axis Bank take to close an account?

Usually 2–7 working days after submission. Delays happen if balance is low, documents mismatch, or account has linked services like debit cards or ECS mandates.

What happens if my account balance is less than ₹500?

Closure won’t process. You must deposit enough money first so Axis can deduct the ₹500 closure charge, otherwise the request stays pending at branch level.

Will Axis Bank call me before closing the account?

Yes, sometimes. Branch staff or relationship managers may call to confirm intent, clear dues, or check pending services before final approval of account closure.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.