Understanding the Axis RTGS Form

Compared to other India private sector banks, Axis Bank stands out for its modernised and multifunctional RTGS form.

Unlike most other banks, which issue separate slips or forms for NEFT and RTGS, Axis Bank uses a single integrated request form that allows you to perform RTGS, NEFT, or IMPS transactions — all from one sheet.

Most individuals and companies still choose a branch visit for RTGS.

You will need a single application paper to make any higher limit transaction you want via the Axis Bank Branch. You can tick IMPS for instant transfer mode for up to ₹5 lakh, or you can tick NEFT for cash-based transfer upto Rs. 50,000 or your transfers of amounts below 2 lakh.

For high-value transfers above ₹2 lakh, you should select the RTGS option.

RTGS vs. NEFT vs. IMPS via Axis Bank Branch – Comparison Table

| Feature | RTGS | NEFT | IMPS |

|---|---|---|---|

| Transfer Type | Real-time | Batch-based | Instant |

| Minimum Amount | At least 2 lakh | No minimum | ₹1 |

| Maximum Amount | No limit | No limit | ₹5,00,000 |

| Settlement Speed | Immediate (30-minute window) | Within 30 min–4 hrs | Instant |

| Best For | High-value transfers in Lakh & Crores | Regular transfers | Small, urgent transfers |

| Mode | Online / Branch | Online / Branch | Online / Branch |

How to Get the Axis Bank RTGS Form

The standard and easy option Axis offers to get the RTGS Physical Application form is your RTGS-Enabled Branch, or any nearby one. Just visit when you want to make a transfer, go to the counter, ask for an application form, and you can request a bilingual form. If you are looking for digital options such as PDF and editable formats, here is the list –

1. Official Axis Bank RTGS Form (English Version)

| File | Download link |

|---|---|

| Axis Bank RTGS format PDF | RTGS/NEFT/IMPS Request Form – English (Official PDF) |

Or you can download directly from the site, follow the steps –

- Visit the Axis Bank official site, go to the footer and select other links.

- Tap on download forms, select the accounts tab.

- Scroll down or use the search button to find the latest RTGS PDF.

2. RTGS/NEFT Form (Hindi Version only Original)

You can get the PDF here – PDF Hindi Axis RTGS (Official PDF)

3. Axis Editable PDF Form (Digital Fillable Version)

If you want to fill in your details digitally before printing: Editable Axis Bank RTGS Form – Maxutils PDF

This editable version allows you to:

- Open in any browser or PDF reader.

- Type your details.

- Save as a new PDF with your information.

- Print and submit it at your nearest branch.

- If the digital filling is not working on your phone, you may need a PC to edit the PDF.

Let’s learn how you can fill out the Editable PDF Form:

- You have to open the PDF only in a browser; you can use Chrome, Safari, or any other you like.

- Now, just tap any section where you fill up the details, name or amount, or signature.

- Save your filled form (

Save As→ new file name). - Print it on A4 paper.

- Most branches do not accept a Fillable PDF printout due to physical signature reasons. You can confirm with your branch first.

Tip: Using the editable PDF reduces handwriting errors and ensures neat, legible submissions.

4. Old-Style RTGS/NEFT Form (without IMPS)

Some Axis Bank branches, especially semi-urban or older branches, still provide this traditional version.

You can view and download it here: 🔗 Old Axis Bank RTGS Form (Original PDF)

This form looks similar to government bank such as BOB or SBI RTGS slips, and can still be used for RTGS and NEFT transfers.

RTGS Timings for Axis Bank (Branch-Based vs Online)

As per the RBI and Axis Bank data, the RTGS works 24/7 only if you choose online, but branch-based RTGS have limitations in timings; you may have to select a time to visit and do your RTGS within a few hours. In the branch, lunch hours, cut-off timing delay the payment sometimes. Experts say – Visit your branch ideally between 9:30 AM and 11:00 AM to get your RTGS processed the same day — especially on Saturdays.

| Mode | Availability | Remarks |

|---|---|---|

| Online (Mobile/Internet Banking) | 24×7×365 | Real-time settlement |

| Branch RTGS | Typically 9:30 AM to 3:30 PM (Mon–Fri, working Saturdays) | Subject to branch cut-off |

| Cut-off Time | End of banking hours (~3:30 PM) | Transactions after this process next business day |

| Working saturdays | 1st, 3rd, and 5th is only working saturday | 2nd and 4th, RTGS closed via the branch |

| Special Note | If you submit your RTGS application between 11:30 and 1:00 AM, there is a cut-off phase, and you may find your payment will settle after 2:00 or 2:30. | Don’t worry, it settles the same day |

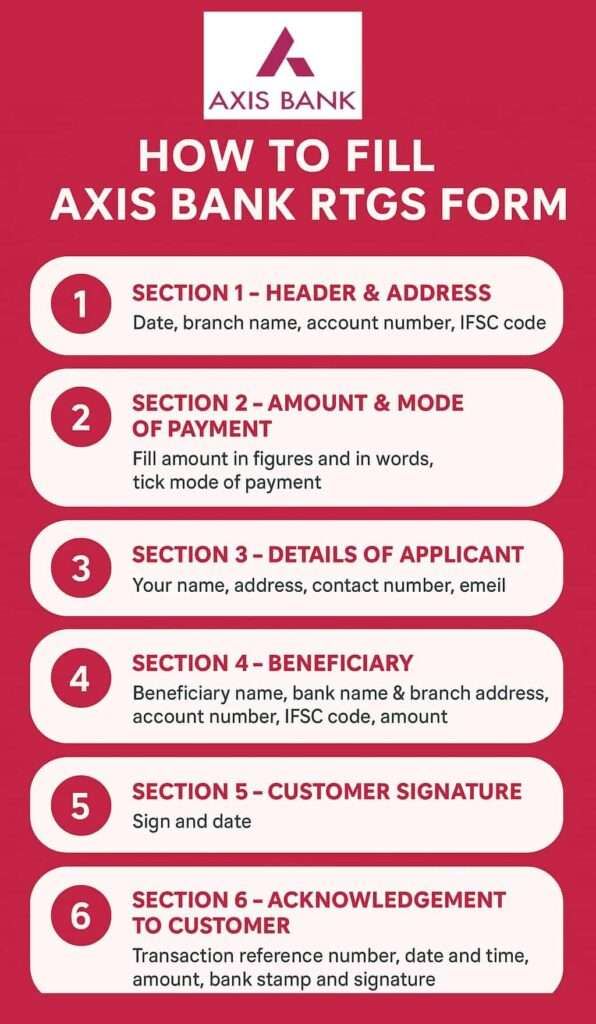

Part-by-Part Guide to Filling the Axis Form for RTGS Transfer

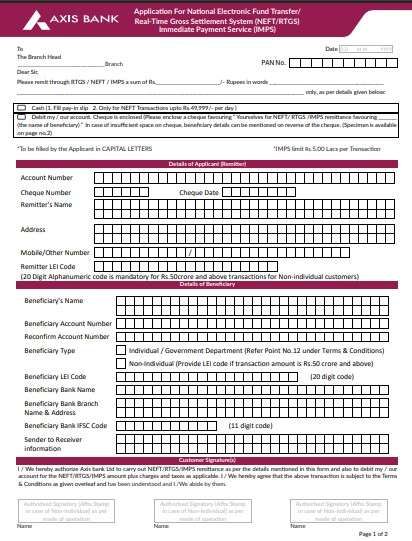

You can fill out the form depending on the form you choose. If older form, start with a bank copy, then write for customer copy. For this latest RTGS form, you have to start from top to bottom, you have to use Boxes for each character, and use capital words only.

1 Section – Header & Address

| Information | What to Fill |

|---|---|

| To Date (DD/MM/YYYY) | Same date as when you requested at the branch |

| The Branch Head, ______ Branch | Write the Axis Bank branch name where you are submitting the form (for example, put down – “Andheri East Branch, the same location”) |

| Mode of Transfer | Tick RTGS (for any amount above ₹2 lakh). This process focuses on Real-Time Gross Settlement only. |

| PAN No. | RBI usually ask for PAN for a certain limit, you can enter it. |

2 Section — Amount & Mode of Payment

| Field | Filling – |

|---|---|

| Amount in figures | Simply what amount you want to transfer, for example – ₹2,75,000/- |

| Amount in words | “Rupees Two Lakh Seventy-Five Thousand Only” |

| Mode of Payment | Tick one: – Cash: This option does not work for you. – Debit my/our account: if you want Axis Bank to deduct from your account, most branches accept it, but still may ask for a self-cheque. However, self cheque not mandatory if you tick this. – Cheque enclosed: if you are giving a cheque, tick it simply. |

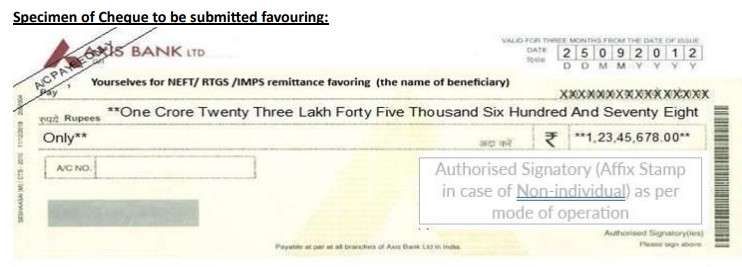

You have to write a self-cheque. Here details of what to fill in –

- Firstly, Pay section, enter “Yourself for RTGS remittance favouring beneficiary name“.

- You have to change the beneficiary to the name where you are sending the amount. Such as RAM KUMAR.

- Enter Amount – same as you fill in the form, both words and digits.

- Now, sign the leaf, or if non-individual, affix the company stamp.

- On the back of the cheque, put down the –

- Beneficiary’s Name

- Account Number

- IFSC Code

- Your Signature

3 Section – Details of Applicant (in simple, your details)

| Field | What to Fill |

|---|---|

| Remitter’s Name | Your full name or your company name |

| Address | Your complete address, check your passbook or self-cheque |

| Mobile / Other Number | Your mobile number, account linked only. |

| Account Number | Your Axis Bank account number (from which funds will be sent) |

| Cheque Number / Date | If you are giving a cheque, write its 6-digit number and date |

4 Section — Beneficiary Where you money will go (individual or company)

| Must required Field | Details |

|---|---|

| Beneficiary’s Name | The person or company receiving the money |

| Beneficiary Account Number | Enter their account number |

| Reconfirm Account Number | Repeat the same account number carefully |

| Beneficiary Type | Tick one: Individual / Government Department / Non-Individual |

| Beneficiary LEI Code | Leave blank unless required for high-value corporate transfer ( more than ₹50 crore) |

| Beneficiary Bank Name | The bank where your beneficiary has an account, for example, “HDFC Bank Ltd. “HDFC Bank Ltd.” |

| Beneficiary Bank Branch Name & Address | another example ~ “Fort Branch, Mumbai” |

| Beneficiary Bank IFSC Code | “HDFC0000123” – Beneficiary IFSC must be 11-digit code |

| Sender to Receiver Information | You can put a basic note if you want. Don’t leave blank, put anything. |

Expert’s Tips – Beneficiary information must be correct. You can ask for a cancelled cheque or business account details; it’s better to re-check after writing.

5 Section – Customer Signature

| Table | How to sign |

|---|---|

| Customer Signature(s) | You can use blue or Black Ink. |

| You have to sign once in the first box. (Just like you do on a cheque leaf) | |

| For joint account holders, each holder needs to sign in the given boxes. | |

| For company accounts, use an authorised signatory and affix the company stamp. |

6 — Acknowledgement to Customer (Customer Copy)

This part is filled in by the bank staff after you submit the form.

After filling in what to do Next + charges –

Once you have filled up your Axis Bank Request form, you are halfway there. just follow –

- Recheck details – just re-verify the account number and basic details of the beneficiary, and confirm your details match with the self-cheque or not.

- Attach your documents – if you select cheque, take it along with the form, ready with your original ID proof (aadhaar or PAN), if asked.

- Submit at Counter – just give your cheque + application form to the branch officer only, don’t use any drop-box or other method.

- Wait for Processing – The bank official will initiate your RTGS transaction and give you the acknowledgement slip, which is your proof + tracking option.

- Pay Applicable Charges – When you do an RTGS at the branch, a small fee is charged, it automatically deducted from your account. It is a separate fee, not counted in the amount.

- let me give an example – If you transfer ₹6,00,000 through a branch, the total fee will be ₹50 + 18% GST = ₹59. Your account must have an extra amount for the fee.

- How much Take Time – Your transfer settlement timing is just 30 minutes, but it may take 2 to 3 hours if any cut-off timing occurs.

- Complain Axis RTGS issue – You can track your request via Axis Bank Customer Care. The Axis Bank CFC on 022-71315766 and Email ID – cfc@axisbank.com for queries related to NEFT and RTGS transactions.

Here’s what Axis Bank currently applies for branch RTGS transactions –

| Transfer Amount (₹) | Charge (per transaction) | Remarks |

|---|---|---|

| ₹2 lakh – ₹5 lakh | ₹25 + GST | Standard RTGS charge |

| Above ₹5 lakh | ₹50 + GST | High-value RTGS transfer |

| Online RTGS (via Internet / Mobile App) | Free | 24×7, no branch visit needed |

RTGS FAQs

Can I get the Axis Bank RTGS Form in Excel format?

Currently, Axis Bank does not officially provide an Excel (.xlsx) RTGS form. However, you can convert the editable PDF version to Excel using free online PDF-to-Excel converters before printing. it only for practices.

Is the Axis Bank RTGS Form printed on A4-size paper?

Yes, both the official and editable RTGS forms are designed for A4-size printing. It requires an A4 sheet for branch scanners and their internal systems.

Can I submit an Axis Bank RTGS Form at any branch in India?

Yes, you can submit an Axis Bank RTGS form at any Axis Bank branch in India. Here is the RTGS centres PDF List of Axis Bank.

How do I track my RTGS transaction after submitting the Axis Application form?

You can use this 16-digit UTR number available on your Acknowledgement slip – customer copy paper, provided by your branch staff after processing your RTGS at the counter. You can confirm with the same branch or customer care. Alternatively, you can use the Axis Bank mobile app “Transaction History” section to track it.

Why does Axis Bank use one form for RTGS, NEFT, and IMPS?

Axis designed a single integrated form to reduce errors. The branch staff only processes the option you tick. Using one form cuts rejection chances by nearly 30% during peak hours.

Is a self-cheque compulsory for Axis Bank RTGS at the branch?

Mostly yes. Even if “debit my account” is ticked, many branches still ask for a self-cheque as debit authorisation, especially for first-time or high-value RTGS transfers.

What happens if I accidentally tick NEFT instead of RTGS?

The transaction won’t fail, but settlement may be delayed. For amounts above ₹2 lakh, staff usually reconfirms. Always circle RTGS clearly to avoid the wrong processing mode.

Can Axis Bank RTGS be stopped after submission at the branch?

No. Once processed and UTR generated, RTGS cannot be reversed. If you notice an error, inform staff before the acknowledgement slip is issued—that’s the only safe window.

Why does Axis Bank ask to re-enter the beneficiary account number twice?

It’s a manual error-prevention step. Branch data shows that most RTGS failures come from wrong account digits. Writing it twice reduces mis-credit risk significantly.

Can Axis Bank reject RTGS due to insufficient balance for charges?

Yes. If the balance doesn’t cover the amount + ₹25/₹50 + GST, RTGS is rejected. Smart tip: keep ₹100 extra buffer before submitting the form.

Does Axis Bank delay RTGS during lunch hours or late afternoons?

Yes, sometimes. Submissions between 1:00–2:00 PM or after 3:00 PM may queue internally. Best results come from morning submissions before noon.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.