If you want to send money to someone from your Central Bank of India account, and the amount is bigger than Rs. 2 lakh. You will need the RTGS form if you choose the branch banking. It’s a simple form used to transfer large amounts directly to another bank account in real time across all RTGS-enabled banks under the RBI’s secure payment system.

Central Bank offers a few different RTGS formats — some need a cheque, others don’t. You don’t need to be confused with forms; let me explain all forms of CBI for RTGS. You can directly download it from here as well –

Step-by-Step: How to Download the Central Bank of India RTGS Form

As per the CBI data, there are three officially recognised formats for the RTGS/NEFT form. All forms work for the same purpose, but differ slightly based on branch requirements and how the payment is made (via account debit or cheque).

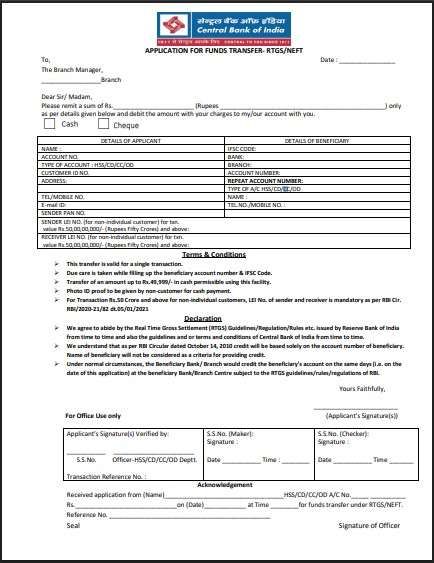

1. Official Cheque-Based RTGS/NEFT Form (CBI 2021 Format, Official in 2025-2026)

This is the standard form, officially provided by listed on the Central Bank of India’s portal, it available in hindi or English separately. This form has a cash option, but it works only for NEFT and smaller payments than Rs. 50,000.

It includes options for:

- RTGS or NEFT transfer

- Payment via cheque or cash

- Space for attaching a self-cheque if chosen

Use this form if your branch instructs you to provide a self-cheque for RTGS transactions.

| File name | Direct Download Link: |

|---|---|

| CBI RTGS Form Original PDF | RTGS_NEFT_Application_Format_rtgs.pdf (Official CBI) |

What RBI Says About Self-Cheque for RTGS

According to RBI guidelines, if RTGS is initiated through a cheque, it must be a self-cheque drawn on the remitter’s own account.

Write “SELF RTGS” on the cheque leaf, sign it, and attach it to the RTGS form.

- Banks are not allowed to issue RTGS via another person’s cheque.

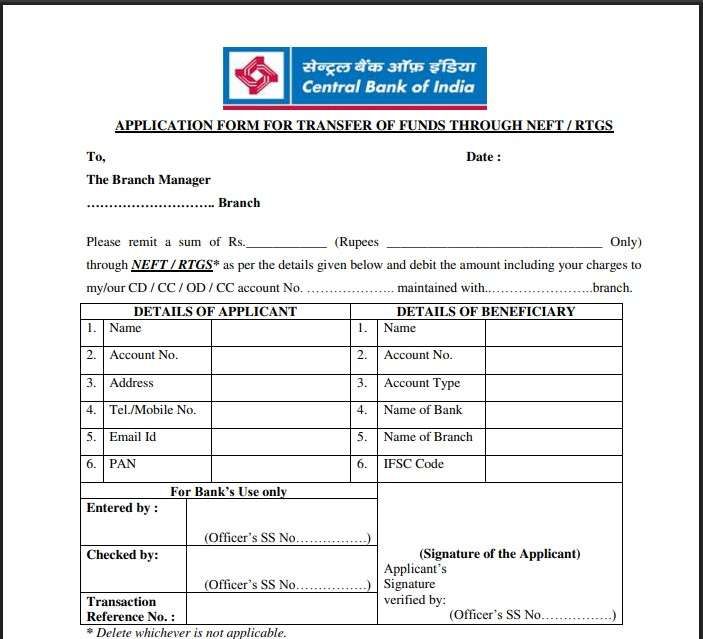

2. Account-Debit RTGS/NEFT Form (No Cheque Required)

This is the account-based RTGS form used in many branches today.

Here, the amount is directly debited from your Central Bank of India account — no physical self-cheque is needed.

| File name | Direct Download Link: |

|---|---|

| Central Bank of India RTGS form | RTGS/NEFT Account Debit Form (No Cheque) |

You simply fill in your account number, beneficiary details, and sign the declaration section. This version is simpler and commonly used for quick or digitally processed RTGS transfers via a branch.

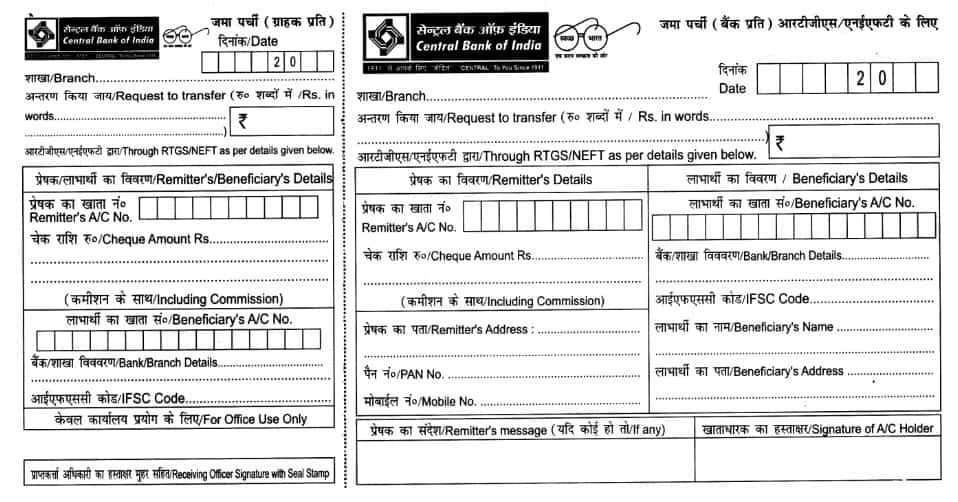

3. Old RTGS/NEFT Form (Dual Copy Format)

The old version comes with two parts – customer copy and bank copy, you need to fill both sides. It was primarily used before the CBS (Core Banking System) was fully integrated across branches. Some locations still maintain this layout for internal record-keeping.

All three forms are officially recognised by the bank; however, the first two (cheque-based and account-based) are the active and preferred versions used in 2026.

| File name | Direct Download Link: |

|---|---|

| CBI OLD RTGS PDF FILE | Old RTGS Form (Customer + Bank Copy) |

Alternate Download Steps (If Direct Links Don’t Work)

You can always download the latest available form from the official website:

- Go to https://centralbank.bank.in/en

- Type “RTGS” in the search box and hit Enter.

- Open the RTGS page from the search results.

- Scroll to the “Download NEFT/RTGS Application Forms” section

- Just tap on the download the current and bank-accepted PDF form.

Forms Available in Multiple Languages

The central bank also provides up to 10 regional languages for customers who want a local language option.

To get a form in your selected language:

- Visit your nearest Central Bank branch. (must be RTGS-enabled)

- Ask the counter staff: Please provide me with an RTGS/NEFT form in the local language or a bilingual form. such as Tamil/English.

Common languages available include:

Hindi, Marathi, Gujarati, Bengali, Tamil, Telugu, Kannada, Punjabi, Malayalam, and Urdu, but it depends on the location of your bank branch.

Fill out the Central Bank of India RTGS/NEFT Application Form

Let’s check how you can fill out an RTGS form; it is quite simple if we divide the parts and understand each also, use capital letters and use boxes for writing –

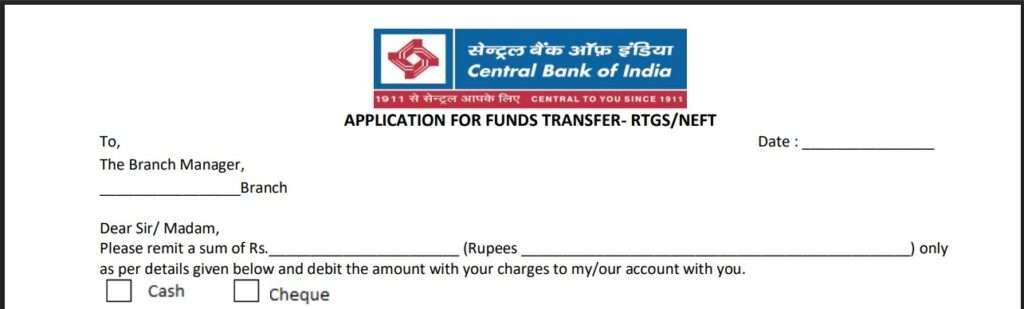

- Header section – First, enter the date and branch name. If it is different from your home branch, use the branch name where you are making this RTGS. example – Andheri Branch.

- Transaction Request – in remit of sum section, put down your amount in figures such as Rs. 5,00,000. And enter the same amount in words. Example – Five lakh only.

- Tick the option – As per RBI, you cannot use cash for RTGS transfer, so simply tick on cheque and ready a self-cheque. You have to fill in the cheque number in the form as well.

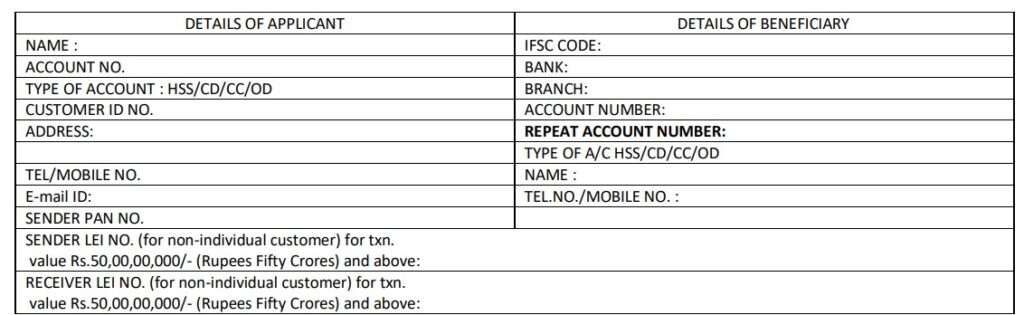

1. DETAILS OF APPLICANT (Your details)

| Field | What to Fill |

|---|---|

| NAME | Your full name as per bank records |

| ACCOUNT NO. | Your account number in Central Bank of India |

| TYPE OF ACCOUNT (HSS/CD/CC/OD) | Select your account type — usually “SB” (Savings) or “CA” (Current). In form, “HSS” stands for Savings, “CD” for Current Deposit. |

| CUSTOMER ID NO. | Your bank-provided Customer ID |

| ADDRESS | Your registered address |

| TEL/MOBILE NO. | Your mobile number linked with bank |

| E-mail ID | Your valid email ID |

| SENDER PAN NO. | Your PAN number (mandatory for large transfers) |

| SENDER LEI NO. | Only if you are a company or entity doing transactions ≥ ₹50 crore |

| RECEIVER LEI NO. | Only if applicable for ₹50 crore+ transaction |

2. DETAILS OF BENEFICIARY (Receiver’s details)

| Field | What to Fill |

|---|---|

| IFSC CODE | Beneficiary bank’s IFSC code (e.g., SBIN0001234) |

| BANK | Name of the bank (e.g., State Bank of India) |

| BRANCH | Branch name (e.g., Churchgate Branch, Mumbai) |

| ACCOUNT NUMBER | Beneficiary’s account number |

| REPEAT ACCOUNT NUMBER | Write it again carefully to avoid mistakes |

| TYPE OF A/C (HSS/CD/CC/OD) | Choose account type – Savings or Current |

| NAME | Beneficiary’s full name |

| TEL.NO./MOBILE NO. | Beneficiary’s contact number (if known) |

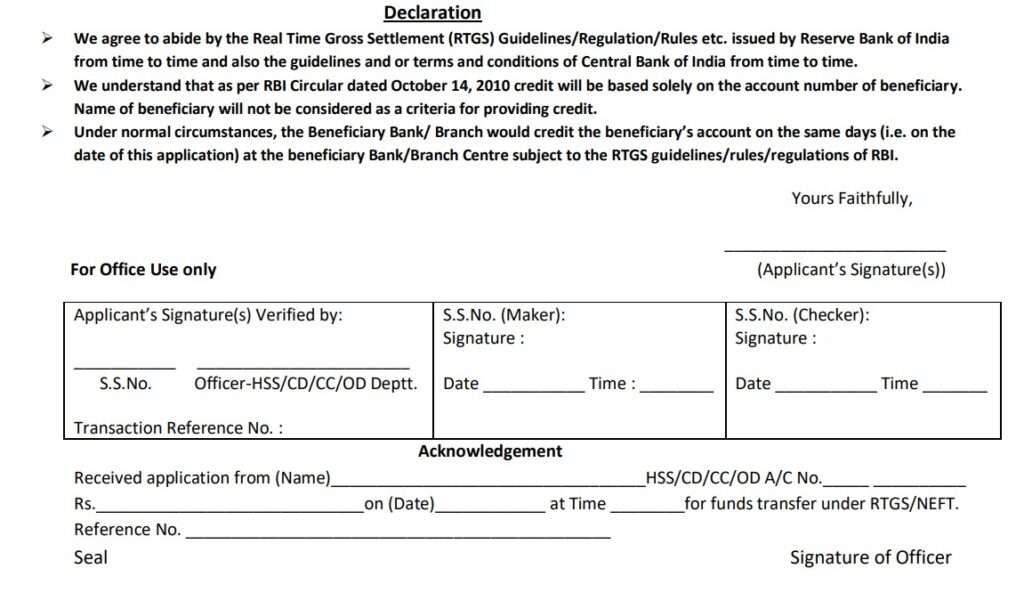

3. Declaration (Bottom Section)

You don’t need to write anything here — just sign after the “Yours Faithfully” line in the box: Sign exactly as per your bank account signature or your self-cheque you do.

4. For Office Use Only

Leave everything in this section blank — bank staff will:

- Verify your signature

- Assign reference number, date, time, and officer codes

5. Acknowledgement Slip (Bottom Part)

- Simply, repeat basic information here; it is your confirmation slip. The bank officer will sign here, enter the reference number, the bank seal, and give back to you the section. You can use it to track your payment if you find a delay.

RTGS Transaction Charges

As per the RBI’s latest directive, all banks must follow capped charges for RTGS transactions.

| Transaction Type | Amount Range | Maximum Charge After Tax |

|---|---|---|

| Inward RTGS | Any amount | Free |

| Outward RTGS | ₹2,00,000 – ₹5,00,000 | ₹29 approx |

| Outward RTGS | Above ₹5,00,000 | ₹59 Approx |

Where to complain about RTGS

The RTGS usually happens within 30 minutes, but if you apply by 3:30 PM, it may settle the next day if there is no holiday in between. If your RTGS transaction is delayed or not credited –

- Contact your home branch first. You can email at rtgscpp@centralbank.co.in for the issue.

- If still unresolved, email a detailed complaint to cgmcepd@rbi.org.in (RBI Consumer Education and Protection Department).

Note – If a transaction fails, the uncredited amount is returned to your account within one hour or before the end of the business day, whichever is earlier.

Additional Q/A for users

Can I use an old Central Bank RTGS form in 2026?

Yes, you can; usually, the form accepts some rural or semi-urban branches, but it’s better to use the updated format for faster processing.

Can I cancel or edit my RTGS form after submission?

No, as per RBI, once you submit and process an RTGS transaction cannot be reversed or edited. So, it needs to double-check and cross verification of details before submitting.

What if my RTGS fails or money is not credited?

Don’t worry, your money is stuck in the system. If funds aren’t credited, the amount is automatically reversed to your account within one business day, as per RBI RTGS regulations.

Which RTGS form should I use in the Central Bank of India?

Use the account-debit RTGS form if your branch allows direct debit. If staff ask for a cheque, switch to the cheque-based form. Both are RBI-approved and valid in 2025.

Do all Central Bank branches accept the same RTGS form?

Mostly yes, but branch practice differs. Urban branches prefer account-debit forms, while rural branches still ask for cheque-based or old dual-copy formats for internal records and audit comfort.

Why does the form ask to repeat the beneficiary account number?

This is a manual error-control step. Writing the account number twice reduces digit mistakes, which is the most common reason for RTGS rejection or delayed reversal at the branch level.

What is the safest time to submit RTGS in Central Bank branches?

Submit before 2:30 PM on working days. After that, branch batching, lunch breaks, or RBI settlement windows may delay credit to the next working day.

How long should I wait before raising a complaint for delayed RTGS?

Wait 2 hours first. If not credited, contact your branch with the acknowledgement slip. Most delays auto-resolve or reverse by end of the same business day.

Should I keep the RTGS acknowledgement slip after payment?

Yes, keep it for at least 6 months. It contains the reference number needed for tracking, written confirmation, audits, property payments, or vendor disputes.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.