Do you already use a loan or a credit card?

Yes! I already use credit Card OR Loan

See offers I’m likely to pre-qualify for

No credit / low CIBIL

Start building my credit score

Based on your profile, you can instantly explore tools and offers to manage and grow your credit.

Why Building Credit Matters

- You may have PAN card, bank account and even income… but banks still reject loan or credit card. Reason: your report shows No History (NH) 🧾

- This means you are not a risky person — you are an unknown person to the bank. Without any past repayment record, they simply cannot trust you yet.

- Myth: “My savings account activity builds credit score.”

Reality: Salary, balance, deposits or transactions do not create a credit score. - Myth: “Add-on card or family member card will start my score.”

Reality: Score goes to the main holder. Your report still stays NH ❌ - Myth: “Pay-later / instant loan apps will help.”

Reality: Most require an existing score or reject after KYC ❌ - Real Truth: In reality, safe and reliable starting options are only 1–2. You can choose one and begin your credit journey today.

- Banks trust only a repayment history in your own name. That’s why beginners start with an Rs. 2000 to 5000 FD-backed credit card.

- Use it and pay on time — within 1–2 months your first credit score appears 🙂

Tap Continue to start your credit history with an FD-backed credit card, or choose the ZET membership option (₹500 in 3 EMIs).

Start Your First Credit line with These Options

₹2,000–₹5,000 FD only

₹500 mini loan → 3 EMIs → Build 750+ Credit Score with no deposit

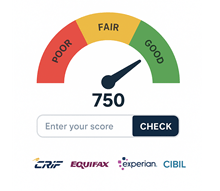

In India, a person can check their credit score free of cost once every year from each of the four credit bureaus. For more frequent checks, many financial platforms also provide updates without needing to contact the bureau directly.

Easemoney also provides a free credit report through Experian or Equifax if the profile is eligible. The process only asks for a mobile number and basic details for verification. This check is a soft enquiry, so it does not affect the credit score and is safe to use.

How to Use the Easemoney Credit Score Checker Tool

Step 1 — Choose your situation

- Tap Yes if you already use any credit card or loan.

- Tap No if you are new to credit or your score is low / not generated.

(A) Credit History Holder: If you tap YES (Already using credit)

- Step 1 — What you will get:

- Your credit score/report (if available)

- Credit cards you are likely to get approved for

- Personal loan lenders matching your profile

- Credit card EMI calculator before applying

- Step 2 — Safe eligibility check: The system performs a soft enquiry. Your CIBIL score does not reduce.

- Step 3 — Mobile verification: Enter your mobile number and verify with OTP (no PAN/Aadhaar on this page).

- Step 4 — Apply (optional): You choose any offer only if you want. Nothing is submitted automatically.

This helps you apply confidently instead of trying multiple banks and facing rejection.

(B) No Credit History Holder: If you tap NO (New OR Low CIBIL)

- Step 1 — What you will get:

- Important Information (What are the possible options to make a credit history)

- Steps to start your first credit record

- FD-backed starter credit card option (small ₹2k–₹5k deposit)

- 500 Rs Loan Small credit-builder plan (EMI-based history creation)

- Step 2 — Credit beginner guidance: The system identifies your report as NH (No History) and shows starter options.

- Step 3 — Mobile verification: Enter your mobile number and verify with OTP.

- Step 4 — Start credit history: Install the Secured Card ZET SBM Bank App, and usually, the first credit score appears within 1–2 months.

Important – Checking eligibility here is safe. A hard enquiry happens only when you finally apply to a bank, not when you check inside this tool. It simply helps you choose the right place first and avoid unnecessary rejection.

Understanding: What is a Credit Score?

See, a credit score is simply a three-digit number between 300 and 900. It basically shows how you have handled loans and credit cards till now. Whenever you apply for a loan or a credit card, the bank first checks this to understand whether you will repay on time or maybe delay.

In India, companies like Experian and Equifax also give scores, but honestly, most banks mainly look at the CIBIL score during approval. That one matters the most.

Important Update (From April 2026 as per TOI): Now banks and NBFCs send your loan and credit card payment report almost every week — around the 7th, 14th, 21st, 28th and at the end. So if you pay EMI, the score can improve faster now. But if even one EMI is missed, it can drop quickly also.

In simple words – if your score is good, the bank feels comfortable giving money. If the score is low, the bank becomes careful — they may reduce the limit, delay approval, or even reject the application sometimes.

How the Score is Made

The score is prepared by credit bureaus using past financial behaviour, such as:

- Paying credit card bills on time or late

- Past loans (personal, car, home, consumer loan, BNPL)

- EMI payment history

- Total outstanding debt

- Number of loan enquiries

All this information is collected into a report and converted into a single number.

Why is a Credit Score Important?

A credit score is like a financial report card. This single number, it represents your creditworthiness and tells banks how safely they can lend money and whether repayments are likely to come on time.

What the Score Range Means

| Score Range | Meaning | What Usually Happens |

|---|---|---|

| 750 – 900 (Very Good) | Very reliable borrower | Loan and credit card approvals become easy, interest rate lower, higher limits |

| 700 – 749 (Good) | Safe profile | Most banks approve without much difficulty |

| 650 – 699 (Average) | Some risk | Loan possible but interest higher, extra documents or guarantor may be asked |

| Below 650 (Low) | High risk | Unsecured loan difficult; better start with FD-backed secured card and build history |

Why Banks Care About This Number

- Loan Approval – A higher score increases the chances of getting a home loan, car loan, or personal loan quickly

- Lower Interest Rate – Good borrowers are charged less interest, which saves a lot of money over the years

- Higher Credit Limit – Credit cards and overdraft limits are usually bigger

- Pre-Approved Offers – Banks start giving ready offers instead of repeatedly asking for documents

- Better Negotiation – A strong score gives power to request lower processing fees or better terms

In some cases, even landlords, finance companies, or partnership businesses informally check credit behaviour to judge payment discipline.

Simple Truth – A score above 750 is generally treated as the comfortable zone. Below that, the bank becomes cautious. No credit history at all (NH/NA) also causes difficulty because the bank cannot judge repayment behaviour.

How to Check a Credit Report For Free?

Here is the step-by-step process to follow and check your Credit Score (CIBIL, Experian, CRIF HighMark, and Equifax) for free –

- Tap on the Check Credit Score & Eligible Offers.

- Enter Your Full Name, Email ID, and Mobile Number – Provide basic details to proceed.

- Verify with a 4-digit OTP – A secure code will be sent to your mobile for verification.

- Enter Additional Details (if required) – First-time users may need to provide PAN Card details and source of income.

- Get Your Credit Score Instantly – View your credit report (CIBIL, Experian, Equifax, and CRIF) along with personalised offers.

- Explore Pre-Approved Offers – Check out exclusive credit card, loan, and financial product options tailored for you.

Note: For first-time users, we may ask for additional details like your PAN Card and source of income to ensure accurate reporting. Don’t worry, your information is safe! EaseMoney is a trusted Zet Partner app, which top investors like Cred, Unacademy, Haptik, Razorpay, Meesho, Groww, DoorDash, PineLabs, and Sequoia back.

Top Credit Score Bureaus in India

In India, there are four credit bureaus, officially called Credit Information Companies and approved by the RBI. All of them keep a record of your loans, credit cards and repayment behaviour, and from that they calculate your credit score.

Most people only know CIBIL because bank staff usually mention that name at the loan desk. But actually, a lender can check any of the four bureaus. Which one is checked depends on the lender — a bank, a finance company or an online loan app may each use a different report. So sometimes a person says their CIBIL is good, but the loan is still rejected. Reason is simple: the lender may not have checked CIBIL, they checked another bureau where the history was weak or limited.

1) TransUnion CIBIL

This is the oldest and most commonly checked report in the country. Most traditional banks treat it as the main reference while giving loans.

Where it is usually checked: Home loans, car loans, and personal loans in major banks.

2) Experian India

More connected with online and digital lending. Many fast-approval loan platforms prefer this report because updates are quicker.

Where it is usually checked: Fintech lenders, app-based loans, instant credit approvals.

3) CRIF High Mark

Very strong in small borrowers and rural lending segments. Many microfinance and small-ticket finance companies rely on this data.

Where it is usually checked: Two-wheeler loans, small consumer loans, rural and microfinance customers.

4) Equifax India

Commonly used when financial data from multiple sources or business activity is involved.

Where it is usually checked: Business loans, SME finance, and some NBFC lending checks.

Important Things to Understand

- The score can be slightly different in each bureau because each uses its own calculation method, and lenders update data on different dates.

- By rule, every person can get one free credit report per year from each bureau.

- Checking your own score is a soft enquiry, so it does not reduce your credit score.

Also, remember: Credit bureaus give scores to individuals. Credit rating agencies (like those rating companies or government bonds) are a completely different system. You can check your score using the tool above. Easemoney’s checker currently provides reports through its partner platform and fetches data mainly from Experian and Equifax.

How Your Credit Score Works Now (New Fast-Update System — 2026)

From 1 April 2026, India’s credit reporting system is moving to a fast-update model. Earlier, your credit report used to update after many weeks. Now it updates almost continuously. RBI pushed this change, so lenders see your current behaviour, not your 2-month-old behaviour.

Simple meaning: Your credit score is no longer a slow report card. It is now more like a live attendance register.

What Actually Changed

Banks and NBFCs now send your repayment data to credit bureaus five times every month instead of once. Reference dates (fixed) –

- 7th

- 14th

- 21st

- 28th

- Last day of the month

Between these dates, lenders send small updates — like EMI paid, new loan opened, or missed payment. Then next month they submit a full record again. And credit bureaus have very little time to process it — usually within about 2 days. So your score can change in the same week.

Old System vs New System

| Feature | Old System (Before) | New System (2026 onwards) |

|---|---|---|

| Update speed | 30–45 days delay | Around 7 days cycle |

| EMI paid | Improvement is visible after months | Visible within days |

| Missed EMI | Sometimes delayed reporting | Shows very quickly |

| Loan approval | Based on old data | Based on current behaviour |

| Multiple loan applications | Could slip unnoticed | Quickly visible to lenders |

What This Means For You (Real Talk)

Good news first

- If you clear a credit card bill → score can improve within a week

- Close a personal loan → banks may immediately see lower risk

- You may qualify for lower interest faster

But the risky side

- Even 1 missed EMI → quickly reported

- Applying many loan apps in one week → lenders can see all enquiries

- No more “I will pay next month, and it won’t show”

Earlier, you had a buffer. Now you don’t.

Extra 2026 Rules (Important)

- No foreclosure charges on new floating-rate loans (after Jan 1, 2026)

- Dormant loan/credit accounts inactive for 2+ years may get closed automatically

- Lenders must give a clear rejection reason if the loan is declined

Practical Advice (Very Important Now)

Do these 4 things:

- Turn on auto-debit / NACH / ECS for EMIs

- Pay credit card before due date (not minimum due)

- Avoid applying to 4–5 loan apps together

- Check your credit report regularly

Because now even a one-day delay can affect the score much faster than before.

What are the Credit Score Factors That Affect (India)

In India, your score is prepared from records held by four bureaus — TransUnion CIBIL, Experian, Equifax and CRIF High Mark. Each uses its own formula, but in practice, they all look at the same behaviour patterns. Below is what actually moves your score up or down.

| Factor | Weight (approx) | What lenders understand from it |

|---|---|---|

| Payment history | 30–35% | Are you reliable or careless |

| Credit utilisation | 25–30% | Are you financially stretched |

| Credit mix | 10–25% | Can you handle different debt types |

| Credit history length | 10–15% | Are you experienced borrower |

| Recent enquiries | 10–20% | Are you urgently looking for money |

1) Payment History — the real backbone

Banks don’t panic if you earn less. They panic if you miss a payment. One missed EMI or credit card due can reduce roughly 50–100 points. And under the new fast-update system, it appears very quickly.

Practical truth: You don’t build a good score by taking loans. You build it by closing them properly.

2) Credit Utilisation Ratio (CUR)

This is the silent score killer. Example: Card limit ₹1,00,000 and You spend ₹85,000.

You may pay on time, but the bureau sees: this person depends heavily on credit.

Safe zone: below 30% usage

Danger zone: above 50% usage

Many rejections in India actually happen due to utilisation, not late payment.

3) Credit Mix

Lenders’ trust balance.

| Type | Example |

|---|---|

| Secured | home loan, car loan, gold loan |

| Unsecured | credit card, personal loan |

Only personal loans → risky profile. Card + one secured loan → stable profile. The system is basically checking: do you manage debt or live on debt?

4) Length of Credit History

Your oldest account matters more than your newest. A person with:

- 1 card running since 2018

- often looks safer than someone who opened 3 cards this year.

Many people close old card thinking useless — but that card was actually holding their score.

5) Recent Credit Enquiries

Every loan or card application leaves a footprint. Each enquiry may drop 5–10 points temporarily. But the real problem is clustering. If you apply: 5 apps in one week – system assumes → financial emergency. It starts loan approval probability falls sharply.

What DOES NOT Affect Your Score (Common Myths)

These things banks check for loan approval, but they do not change your credit score:

- Your salary level

- Bank balance or fixed deposit

- Debit card usage

- Age or education

- Job title

A ₹20,000 salary person with discipline can have a higher score than a ₹1 lakh salary person with missed payments.

Multiple Credit Cards & Loans (How it works in Credit Score)

Keeping more than one credit card is not always bad. In fact, it often helps. Your total credit limit becomes higher, so your usage looks controlled. If you spend ₹40,000 and your limit is ₹50,000, the bank feels you are stretched. But the same ₹40,000 on a ₹1.5 lakh total limit looks comfortable. Same spending, different impression.

The problem is management. Different due dates, and one forgotten payment is enough to drop 60–100 points. Many people damage their score not by overspending, but by missing one small bill. Loans are different. Banks don’t mind loans; they mind pressure. If income is ₹40,000 and EMIs are ₹22,000, they worry about repayment capacity. Also, a 720 score built over many years of clean repayment can look safer to a bank than a fresh 750 with a short history.

Top 10 Practical Steps to Increase Your Credit Score

1. Activate auto-debit immediately

Most score damage is not intentional — it is forgetfulness. One missed due date can undo 6 months of improvement.

2. Keep utilisation under 30%

If the total card limit = ₹2,00,000. Try to keep outstanding below ₹60,000 before the statement date. Not due date — statement date.

3. Pay the credit card in full, not the minimum due

Minimum due only avoids the penalty. It does not protect your score properly, and interest starts compounding.

4. Do not close your oldest credit card

Even if you use it once every 6 months, keep it alive. Put a small recharge yearly and pay it. Old account = strong history.

5. Avoid multiple loan apps together

Spacing matters. Keep at least a 4–6 months gap between major applications. Many fintech rejections happen simply due to enquiry load. if you apply for a loan and end of KYC, it reject, it affect directly your score.

6. Clear small overdue amounts first

₹2,000 overdue hurts almost as much as ₹50,000 overdue in scoring logic. The system sees behaviour, not size.

7. Use a secured credit card if you have no score

Open a card against a ₹10k–₹25k fixed deposit. Within 4–6 months, you create your first proper credit history. This is the cleanest entry into the system.

8. Reduce outstanding before applying loan

If your card shows ₹90k usage and you apply for a loan today → rejection is likely. If you pay and apply next week → result often changes. Timing matters more than people think.

9. Check your report twice a year

Very common issues, such as a closed loan still active, wrong overdue, duplicate account. Then email to fix it. Correcting one error can add 30–80 points.

10. Maintain one stable loan + one active card

This is actually the healthiest profile: one running card and one properly managed loan. Not zero credit, not too much credit.

Hard Enquiry vs Soft Enquiry (FOR CIBIL)

Now this part confuses many people.

1. Hard Enquiry

This happens when you apply for a loan or credit card.

- Score may drop 5–10 points

- Banks can see it

- If you apply to many places at the same time, your approval chances reduce

- Remains in the report for about 24 months

So if you apply for 4–5 cards in one week, the bank understands you urgently need money… and they become careful.

2. Soft Enquiry

This happens when you check your own score or when you get a pre-approved offer.

- No impact on score

- Only you can see it

- Used for eligibility checks

- Safe anytime

So you can check your score whenever you want; nothing will happen to the score.

FAQs

Can I get a credit card with a low CIBIL score?

Yes possible. Around 600–650 score banks reject normal cards, but an FD-based card works. Example ₹5,000 deposit card builds a record. After 90–120 days of regular payment, improvement usually becomes visible.

How fast can my credit score increase?

After 2026 weekly reporting, changes are quicker. Pay full bill on 5th and update may reflect next weekend. Two to three months consistent payments typically improve 30–70 points.

Does checking CIBIL reduce my score?

No. Self-checking is soft enquiry. I checked multiple times within one month and score unchanged. Only real application like loan or credit card causes 5–10 points drop normally.

What is safest way to build credit first time?

Start with secured card or credit builder loan. ₹2,000–₹10,000 FD card enough. Use for recharge or electricity bill and always pay full amount before due date monthly.

Why did my score drop after payment?

Usually due to utilization ratio. Example ₹20,000 limit and ₹18,000 usage equals 90%. System treats risky. After next reporting cycle and lower balance, score normally recovers automatically.