Started in 1906, Cosmos Bank is an old and trusted urban co-operative bank. Many people in Maharashtra and nearby areas know this bank very well. Salaried families, small traders, senior citizens, and co-operative societies trust Cosmos Bank for their savings and Deposits. Recently, Cosmos Co-operative Bank has changed its Domestic Term Deposit (FD) interest rates. These new FD rates are active from 02 February 2026.

Cosmos Bank’s FD structure is not as high as Small Finance Banks, but it is safe and stable. Interest rates are clear, and there is no confusion. At the same time, the FD returns are a little higher than most PSU banks. For people who want a regular income, safety of money, and support from a bank branch, the Cosmos Bank FD is still useful in 2026.

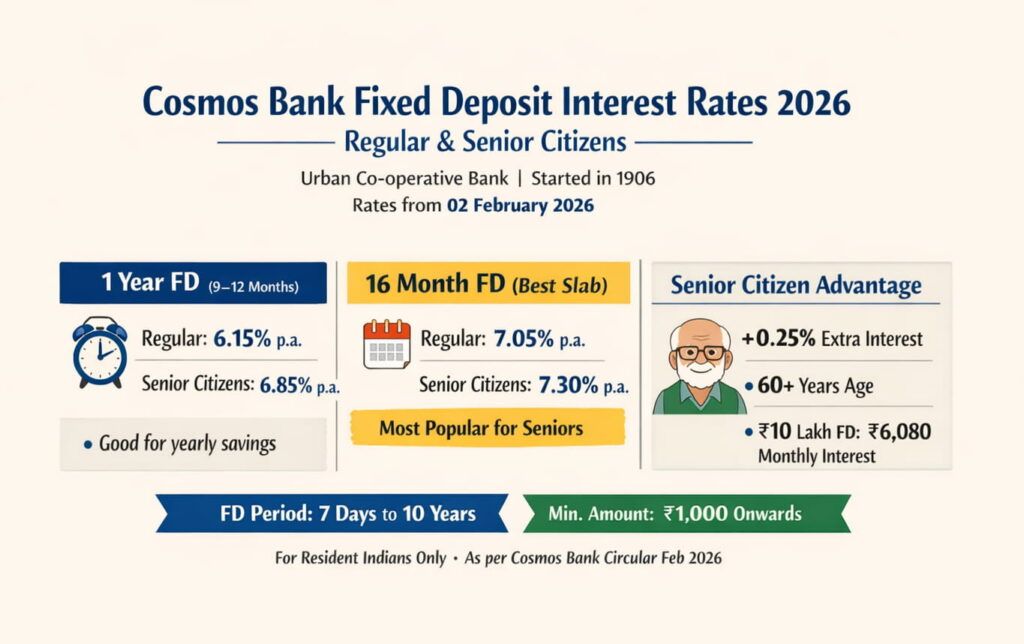

- Normal resident customers: Cosmos Bank FD interest starts from 2.00% per year for very short time periods and goes up to 7.05% per year on selected mid-term deposits.

- Senior citizens (60 years and above): Senior citizens get an extra benefit. FD interest starts from 2.00% per year and goes up to 7.30% per year, which is the highest FD rate currently offered by Cosmos Bank.

The best FD return in Cosmos Bank is available on the 16-month tenure, especially for senior citizens. This option is made for people who want better interest but do not want to lock their money for many years.

Cosmos Co-operative Bank offers FD tenures starting from 7 days up to 10 years. Because of this, customers can easily plan deposits for short-term needs, yearly savings, or long-term safety. Covered by indiancooperative.com, As per the FY25 report published in August 2025, the bank’s total deposits are over ₹22,907 crore, showing strong trust among depositors.

All the FD interest rates given below are applicable only for Resident Indians, unless clearly mentioned otherwise.

Read – Top 10 Co-operative Bank FD Interest Rates

New Cosmos Bank FD Interest Rates Chart 2026

The bank would like to inform all depositors and account holders that these FD interest rates are applicable for General customers, Institutional deposits, Co-operative Credit Societies, NRO accounts, UCBs, and Resident Senior Citizens, including NRE Term Deposits.

| FD Timings | General Rate (% p.a.) | Senior Citizen Above 60 (% p.a.) | Easemoney Practical Tip |

|---|---|---|---|

| 7 – 14 days | 2.00% | 2.00% | Parking money only |

| 15 – 30 days | 3.00% | 3.00% | Very short holding |

| 31 – 45 days | 3.50% | 3.50% | Avoid if possible |

| 46 – 60 days | 3.75% | 3.75% | Emergency buffer |

| 61 – 90 days | 4.25% | 4.25% | Short idle funds |

| 91 – 119 days | 5.50% | 6.00% | Seniors start gaining |

| 120 days | 6.00% | 6.25% | Rate jump point |

| 121 – 181 days | 5.50% | 6.00% | Medium parking |

| 182 days – < 9 months | 6.00% | 6.50% | Better than savings |

| 9 – < 12 months | 6.15% | 6.85% | Year planning |

| 12 – < 16 months | 6.85% | 7.05% | Good balance |

| 16 months* | 7.05% (Highest) | 7.30% | Best senior slab |

| >16 – 24 months | 6.85% | 7.05% | Stable |

| >24 – 36 months | 6.65% | 7.10% | Seniors benefit |

| >36 months – 10 yrs | 6.75% | 7.15% | Long-term holders |

Important For You: The 16-month FD interest rate is available only for a monthly or Quarterly interest payout. This rate is not applicable for cumulative FD option. If you choose cumulative FD, where interest is added to the deposit and paid at maturity, the 16-month special rate will not apply.

How Cosmos Bank Designs Its FD Slabs (Simple Thinking)

Cosmos Bank does not run behind very high FD rates just to attract people. Instead, the bank keeps the FD slabs practical and easy to use.

The main focus is on:

- Mid-term FD periods like 9 to 24 months

- Regular income needs of senior citizens

- Customers who want a monthly or quarterly interest

- Co-operative societies and bulk deposit holders

This FD structure is made for real Indian families who want stability, not for people who keep chasing only high rates.

Best FD Tenure Choice – What People Actually Do

If we look at branch-level experience and customer behaviour:

- Most working families prefer an FD period between 9 and 16 months

- Most senior citizens prefer 12 to 24 months

- Very few people are comfortable locking money for 10 years

Real-life reason: In Indian households, expenses can come anytime — medical bills, children’s education, marriage functions, or emergency needs. Because of this, flexibility of money is more important than earning 0.20% extra interest.

Senior Citizen FD – Where Extra Interest Really Helps

Cosmos Bank gives 0.25% to 0.50% extra interest to resident senior citizens aged 60 years and above.

This extra return is actually useful for:

- Monthly interest income

- Pension support

- Planning medical and daily expenses

Simple example: If a senior citizen keeps ₹10 lakh FD at 7.30% for 16 months, the monthly interest comes to around ₹6,080 before tax. For many retired people, this amount helps in daily life. It is not just an interest number on paper, but a real monthly income they can use.

Cosmos Bank FD Products for Resident Indians (Explained)

Cosmos Bank offers five FD-type deposit options for Resident Indians. These are not just marketing names. Each deposit option is made for a different real-life need of customers.

1. Regular Domestic Term Deposit (Core FD)

This is the main FD scheme of Cosmos Co-operative Bank and is used by most customers. It is open for individuals (single or joint account), minors through guardian, organizations, and co-operative societies. If you are above 60, you will get an extra 0.25% interest under this scheme.

Key features (easy to understand):

- Minimum deposit starts from ₹1,000 (in multiples of ₹100)

- FD tenure available from 7 days to 10 years

- Interest payout options: Monthly, Quarterly, or Cumulative

- Premature withdrawal allowed (penalty will apply)

- Auto-renewal facility available

- Loan or overdraft facility available against your FD

This FD is mostly used by salaried people, shop owners, and families who want safe savings with flexible options.

How to Apply – If you are planning to open this FD, you can download the Term Deposit Account Opening Form directly from the Cosmos Bank website, fill it out at home, and submit it at the branch. This makes the process easier and saves time.

2. Cosmo Tax Saver Deposit Scheme (Section 80C)

This FD is mainly made for saving income tax. It is not for flexibility. If your main purpose is tax saving, then this FD is useful. Otherwise, it may not suit everyone.

Interest rates offered:

| Category | Interest Rate |

|---|---|

| General | 6.75% |

| Senior Citizen | 7.15% |

Things you must clearly understand before investing:

- This FD has a lock-in of 5 years (60 months)

- Once you deposit money, it will stay locked for the full 5 years

- The deposit amount is eligible for tax benefits under Section 80C

- Only the principal amount gets a tax deduction

- Interest earned is taxable as per your income slab

- Premature withdrawal is not allowed, even in an emergency

So, practically, once you put money in this FD, you should be ready to forget it for 5 years.

Simple real-life example: Suppose you invest ₹1.5 lakh in this Tax Saver FD. You can claim this amount under Section 80C and reduce your taxable income. But the interest you earn every year will be taxed, and you cannot break the FD before 5 years, even if you urgently need money.

3. Non-Callable Deposit Scheme (Bulk FD – 13 Months)

This FD is mainly for big deposit amounts. It is not for normal retail customers. If you are planning to keep above ₹2 crore, then only this FD makes sense.

Interest rates offered:

- General customers: 7.00% per year

- Senior citizens: 7.20% per year

Important points you should clearly understand:

- This scheme is available only for bulk deposits

- Early withdrawal is not allowed at all

- Once money is deposited, it stays locked for 13 months

- The higher interest rate comes with zero flexibility

So, if you are comfortable keeping a large amount without touching it for 13 months, this FD gives a slightly better return. But if there is even a small chance that you may need money, then this scheme is not suitable.

4. Flexi Fixed Deposit (FFD) – Sweep FD

This FD works together with your savings or current account. It is useful for people who want to earn some FD interest, but still need money anytime without tension.

Sweep options and interest rates:

| Account Type | Sweep Tenure | Interest Rate |

|---|---|---|

| Savings Account | 30 days | 3.00% |

| Current Account | 14 days | 2.00% |

| Co-operative Society Current Account | 45 days | 3.50% |

How it works in real life:

- Extra balance in your account automatically moves into the FD

- When you need money, it automatically comes back to your account

- There is no need to break the full FD

- Only the required amount is taken back

This FD is best for people who have irregular cash flow, like traders, business owners, professionals, and co-operative societies. Your money keeps earning interest, but you still have full access when needed. Your Money works like an FD, but behaves like savings when you need it.

5. Cosmo Care Deposit Scheme – Emergency FD

This FD is made mainly for medical emergency use, not for earning high returns. It works like a financial backup, especially when health insurance is not enough or not available.

Key features you should know:

- Minimum FD amount starts from ₹25,000

- Immediate withdrawal is allowed during hospitalization

- The bank has tie-ups with around 100 hospitals; you can find the full list at official website.

- SMS-based emergency payment facility is available

- FD amount can be used for oneself, family members, and even close friends

- Overdraft (OD) facility is also available against this FD

This scheme is mostly used as a safety net. In case of sudden hospital expense, money can be arranged quickly without running here and there.

Key Investment Features

- RFC Deposits: These deposits are for Resident Foreign Currency (RFC) accounts. Interest rates are usually updated every month and are linked to global benchmarks like SOFR or EURSTR. Rates may change depending on international market movement.

- NRE Term Deposits: These FDs are made only for NRIs. Interest rates go up to 7 to 7.30% per year for deposit periods between 1 year and 18 months.

- Minimum investment: You can start an FD with just ₹1,000, so even small investors can begin easily.

- Safety of money: You are insured up to ₹5 lakh under DICGC, which gives basic protection to depositors.

- Premature withdrawal: If you break the FD before maturity, a 1.00% penalty is usually charged on the interest rate applicable for the period the FD was kept.

- Interest payout options: You can choose how you want interest — monthly, quarterly, semi-annual, or cumulative (paid at maturity).

- Loan against FD: If needed, you can take a loan or overdraft against your FD for around 90% to 95% of the deposit value, without breaking the FD.

In simple words:

These FD options are made to suit different types of customers — NRIs, foreign currency holders, and regular savers — with a focus on safety, flexibility, and easy access to funds.

FAQs

How to use the Cosmos Bank FD calculator?

Open Cosmos Bank FD calculator, enter the deposit amount, tenure, and payout type. It shows interest and maturity instantly. Use it before booking FD to compare monthly versus cumulative returns.

Are Cosmos Bank FD rates fixed or floating?

Cosmos Bank FD rates are fixed. Once you book FD, rate stays same till maturity. Bank may change rates later, but old FDs are not affected.

What is the full name of Cosmos Bank?

Full name is Cosmos Co-operative Bank Limited. It is an urban co-operative bank, started in 1906, mainly trusted in Maharashtra by salaried people, traders, and senior citizens.

What are Cosmos Bank fixed deposit interest rates for senior citizens?

In February 2026, senior citizens get up to 7.30% per year at Cosmos Bank. Best rate is for 16-month FD with monthly or quarterly interest payout.

What is minimum FD amount and maximum tenure in Cosmos Bank?

Minimum FD amount in Cosmos Bank is ₹1,000, in ₹100 multiples. FD period starts from 7 days and goes up to maximum 10 years option.

Is Cosmos Bank FD safe for small savers?

Cosmos Bank FDs are covered under DICGC insurance up to ₹5 lakh per depositor. This gives basic safety for small savers and retired people only.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.