The My Wings Credit Card from Axis Bank is still running in 2026. It is a travel-type lifestyle card, mainly made for Indian people. This card was quite popular around 2019, and till now, the basic idea of the card is almost the same.

Unlike big premium travel cards that mostly talk about foreign trips, My Wings is fully India-focused. This card is useful for people who travel inside India, like by flight, train, or bus. Axis Bank has changed rules for many cards over the years, but this card is still for normal domestic travellers, not for luxury or international travel users.

Earlier, this card had many travel, hotel, flight, and Ezeego offers. But one important thing many people don’t know is that all these offers were valid only till April 20, 2019, except IRCTC cashback. Even today, many users get confused, so it is better to always check the latest terms before applying. The better Idea, you can visit a branch or call customer care to specifically apply for that card, or you can check eligibility at easemoney.

At present, the card mainly gives airport lounge access and IRCTC cashback. You also get benefits on bus tickets, railway bookings, and domestic flight tickets. These benefits are simple and useful for people who book travel tickets online regularly.

The card also mentions hotel and holiday vouchers, but again, everything is India-based. There are no big international hotels or foreign holiday benefits. Overall, this card is more about easy local travel savings, not about luxury or global travel.

What Network Axis Bank My Wings Card use?

The My Wings Credit Card from Axis Bank is not issued on RuPay. In most cases, this card comes on the Mastercard network. Some people think it is Visa, but generally, Axis Bank issues My Wings on Mastercard.

Because it is not a RuPay card, you cannot link this card with UPI. So, if UPI on credit card is important for you, My Wings will not help there.

However, if you already hold the My Wings Credit Card, Axis Bank usually offers a pre-approved additional RuPay credit card. These can be cards like IndianOil RuPay or MyZone RuPay.

One good thing is that MyZone RuPay is often offered as LTF (Lifetime Free). You can select it if available, and in most cases, no extra documents are required. The approval is generally quick because it is pre-approved.

So, My Wings itself is not RuPay, but Axis Bank gives an easy option to get a RuPay card separately for UPI use.

What are the Axis Bank My Wings Credit Card Benefits and Features –

One of the biggest highlights of this card is its welcome benefit.

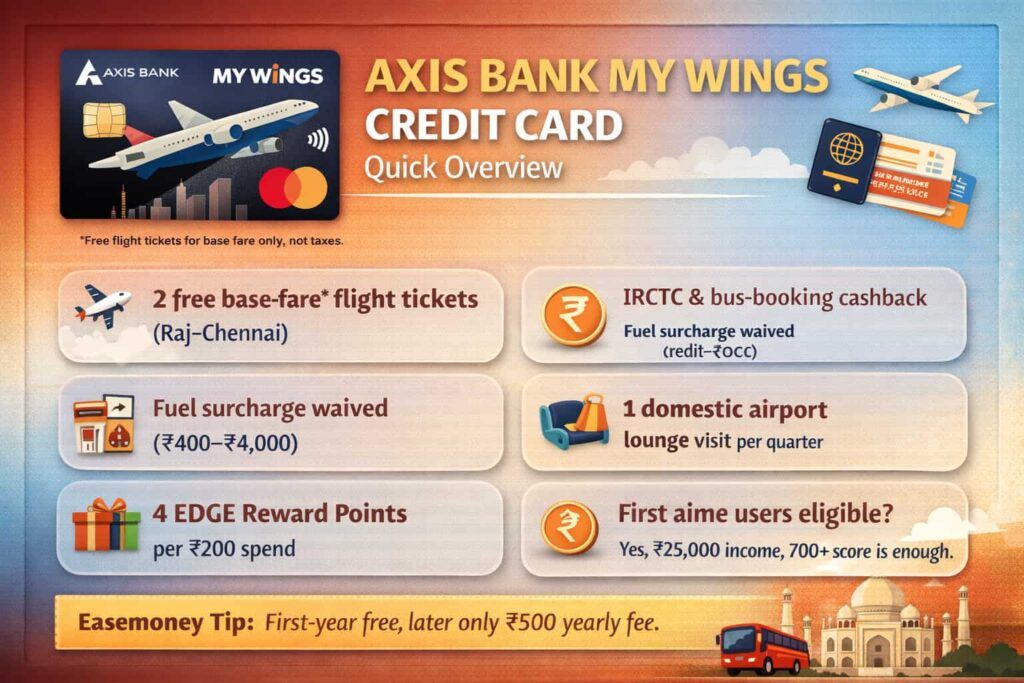

1. Welcome Benefits: Complimentary Flights

With this card, you get 2 complimentary flight tickets, but only the base fare is free. The redemption process is manual but simple if you follow the steps properly.

How to redeem complimentary flight tickets –

- First, call the Ezeego1 helpline number – 1800 120 0408

- Tell the customer care executive clearly that you want to use the My Wings flight ticket offer

- You will need to give your 15-digit Axis Bank My Wings primary credit card number as the promo code

- After that, you can book your flight ticket

- You must pay taxes and surcharges yourself

- Payment for taxes is done using the My Wings Credit Card, either through IVR or the online process

An important thing to understand here is that only the base fare is free. Airport taxes, fuel surcharges, and other charges are not included and have to be paid separately.

Before booking, it is a good idea to check the latest terms and conditions, because these offers are usually time-bound and rule-based.

2. Dining Delights

- The My Wings Card from Axis Bank also supports the Dining Delights Program, just like many other Axis Bank credit cards.

- With this program, you can get dining offers at selected restaurants across India. The benefit is mainly useful when you eat out at partner restaurants in big and mid-size cities.

- Do not expect luxury fine-dining benefits everywhere.

- The offers depend on the restaurant tie-ups and current Axis Bank terms. Still, for normal dining and occasional outings, this program can give decent savings, same as other Axis credit cards.

3. Cashback on All India Domestic Flights

- You can get up to 20% cashback on the base fare of domestic flight bookings

- This offer is only valid if you book:

- By calling 1800 120 0408, or

- Through www.ezeego1.com

- To use the offer, you need to:

- Share the first 15 digits of your Axis Bank My Wings primary credit card number with the customer care executive, or

- Enter the same number as a promo code on the website

- You must pay the full ticket amount, including taxes and surcharges

- Payment has to be done using the My Wings Credit Card through IVR or the online process

- The cashback amount is credited to your card within 7 working days

4. Airport Lounge Access

- The My Wings Card gives 1 complimentary airport lounge access per quarter.

- Lounge access is available only at selected domestic airport lounges

- The eligible lounge list and full rules are as per the Mastercard airport lounge access program, the rules updated in 2025.

- Lounge availability depends on the airport and current Mastercard tie-ups

- It is always better to check the latest eligible lounge list and terms before travelling, as lounges and rules can change.

5. Travel & Booking Benefits

Cashback on Travel Bookings

- Cashback available on:

- IRCTC train tickets

- Bus ticket bookings

- Railway ticket bookings

- Useful for users who book travel regularly online

Wednesday Delight Offers

- Special Wednesday-only offers from Axis Bank

- Deals change based on the current Axis Bank tie-ups

6. Fuel Surcharge Waiver

- Fuel surcharge refund on transactions between:

- ₹400 minimum

- ₹4,000 maximum

- Valid at all fuel stations across India

- GST on fuel surcharge is not refundable

- No reward points on fuel spends

- Maximum benefit is up to ₹400 per statement cycle

My Wings Rewards & Cashback Benefits

1. EDGE Reward Points

- You earn 4 EDGE Reward Points for every ₹200 spent

- Points can be redeemed from the EDGE Rewards catalogue

- Catalogue has 500+ reward and voucher options

2. Movie Ticket Cashback

- 25% cashback on movie ticket bookings

- Valid for:

- Online booking

- Box office ticket purchase

Note – Overall, these benefits are good on paper, but many of them are offer-based and rule-based. So before using any benefit, it is always better to check latest terms, caps, and validity.

How the Fees & Charges Works – My Wings Credit Card

1. Main Card Fees

| Fee Type | Charges |

|---|---|

| Joining Fee | ₹1,200 |

| Annual Fee (1st Year) | Nil |

| Annual Fee (2nd Year onwards) | ₹500 |

| Add-on Card (Joining + Annual) | Nil |

2. Usage, Interest & Penalty Charges

| Type | Charges |

|---|---|

| Cash payment fee | ₹175 |

| Cash withdrawal | 2.5% (Min ₹500) |

| Interest (Finance charges) | 3.75% per month |

| Late payment (₹501–₹5,000) | ₹500 |

| Late payment (₹5,001–₹10,000) | ₹750 |

| Late payment (Above ₹10,000) | ₹1,200 |

| Over-limit penalty | 2.5% (Min ₹500) |

| Cheque bounce / auto-debit fail | 2% (Min ₹500) |

3. Travel, Fuel & Other Charges

| Type | Charges |

|---|---|

| Railway ticket surcharge | As per IRCTC |

| Fuel surcharge | 1% (Refunded for ₹400–₹4,000) |

| Foreign currency transaction | 3.5% |

| Dynamic Currency Conversion | 1.5% + tax |

| Rent payment | 1% per transaction |

| Reward redemption fee | Applicable |

| GST | As per government rules |

Simple Talk (Reality Check)

- First year no annual fee, from the second year ₹500 only

- Cash withdrawal is very costly; better avoid

- If you pay late, charges add up fast

- Fuel surcharge refund is useful, but GST is not refunded

- Foreign spending is expensive because of extra charges

- If you pay the full amount on time, most charges won’t hit you

Who Can Apply, Documents, and Details –

The My Wings Credit Card from Axis Bank is mainly for people who travel inside India and want flight and travel cashback. To apply, you just need to meet some basic rules.

Basic Eligibility (Simple)

| Criteria | Details |

|---|---|

| Age (Primary card) | 18 to 70 years |

| Add-on card age | Around 15–18 years |

| Nationality | Resident Indians and NRIs |

| Credit Score | Around 700–750+ for easy approval |

Simple talk: If your credit score is decent and your payments are clean, approval chances are better.

Income Requirement (Easy View)

| Type | Income Needed |

|---|---|

| Salaried person | ₹20,000–₹25,000 monthly |

| Self-employed | Around ₹3.6 lakh yearly (ITR needed) |

| Existing Axis customer | From ₹25,000 monthly |

| New Axis customer | Up to ₹50,000 monthly in some cases |

Reality check: Existing Axis Bank customers usually get easier approval than new users.

Documents Needed (Normal)

Identity & Address Proof

- PAN Card (For VideoKYC)

- Aadhaar / Passport / Voter ID

Income Proof

- Salaried: Last 3 months’ salary slip or Form 16

- Self-employed: Latest ITR and last 2 years’ financials

No fancy documents. Just basic papers that most people already have.

How to Apply Using Easemoney.in (Easy Steps)

- Tap on apply now or easemoney eligibility checker. As per your credit history, the tool will find.

- Enter basic details like name, mobile number, and email

- Select your job type (Salaried or Self-employed)

- Enter your monthly or yearly income

- Verify with OTP

- You will see the cards you are eligible for

- Select Axis Bank My Wings Credit Card

- You will be redirected to Axis Bank’s official site

- Complete KYC, VideoKYC, show your PAN in camera, and Mobile OTP.

- Done.

If your income is stable and your credit score is okay, My Wings Card is not hard to get. Existing Axis Bank users usually have better chances and faster approval.

Let’s Compare: Is Axis My Wings Still Good in 2026?

In 2026, the My Wings Credit Card from Axis Bank is seen as a budget travel card. It is useful, but when you compare it with top travel cards in India, it clearly stays one level below.

Big travel cards give higher rewards, more lounge access, and better point usage. My Wings is more for basic domestic travel, not premium travel.

Comparison: My Wings vs Popular Travel Cards

| Feature | Axis My Wings | Axis Atlas | HDFC Regalia Gold |

|---|---|---|---|

| Annual Fee | ₹500 (from 2nd year) | ₹5,000 | ₹2,500 |

| Best For | Casual domestic travel, bus & train users | Frequent flyers, luxury hotels | High spenders, family travel |

| Welcome Benefit | 2 free base fare flight tickets | 2,500–5,000 bonus miles | ₹2,500 voucher + memberships |

| Reward Rate | 4 points per ₹200 (low value) | High value on travel spends | Good value via SmartBuy |

| Lounge Access | 1 per quarter (domestic) | Many domestic + international | Domestic + international |

| Forex Charges | 3.5% | 3.5% | 2% (better for abroad) |

Simple meaning:

- My Wings = low cost, limited benefits

- Atlas & Regalia = expensive but more powerful

Which Card Should You Choose?

Choose Axis My Wings if:

- You want a low-fee card

- You mainly want 2 free domestic flight tickets (base fare)

- You often book IRCTC trains or buses

- You are okay with basic rewards, not premium perks

Go with Axis Atlas if:

- You travel very frequently

- You want maximum value from flights & hotels

- You understand reward points and airline transfers

- You don’t mind paying a high annual fee

Choose HDFC Regalia Gold if:

- You want balanced travel + lifestyle benefits

- You travel with family

- You want lower foreign exchange charges for foreign trips

Try SBI Card Elite if: (BONUS)

- You spend large amounts regularly

- You like milestone rewards

- You want Club Vistara benefits and movie tickets, along with travel perks

My Wings is not the best travel card in 2026, but it is still a cheap and simple option for normal Indian travellers who don’t want premium cards.

New FAQs

Which type of credit card is best in Axis Bank?

There is no single best Axis Bank card. For 2026, My Wings suits low-cost domestic travel, Atlas fits frequent flyers, and Regalia Gold works better for family lifestyle spending.

What is the Axis Bank My Wings Credit Card best for?

My Wings is best for people taking 3–6 domestic trips yearly, using IRCTC or buses, and wanting simple flight cashback without paying high annual fees.

What rewards do you get on Axis Bank My Wings Credit Card?

You earn 4 EDGE Reward Points per ₹200 spent. Reward value is low but usable for vouchers. Best use is travel cashback, not long-term reward accumulation.

Does Ambani use a credit card?

There is no public proof that Mukesh Ambani uses any credit card. Ultra-high net-worth individuals mostly use private banking and corporate arrangements, not regular consumer credit cards.

Should first-time users apply for Axis Bank My Wings Card?

Yes, first-time users with ₹25,000 monthly income and 700+ credit score can start with My Wings. Fees are low and approval chances are decent.