Jammu and Kashmir Bank started its credit card business many years back. In 1999–2000, the bank made an agreement with American Express and launched an AMEX co-branded credit card. This American Express card is not active now. After that, J&K Bank continued with Visa and MasterCard credit cards, which it has been offering for a long time.

The new change happened in 2025. In 2025, J&K Bank took a fresh step and entered the RuPay credit card segment. As reported by Greater Kashmir, the bank partnered with Pine Labs to introduce a RuPay Credit Card linked with UPI, and work was going on to launch it faster for customers.

So, Visa and MasterCard were already there for many years, but the RuPay credit card is the latest addition in 2025.

All Active Credit Cards in 2026

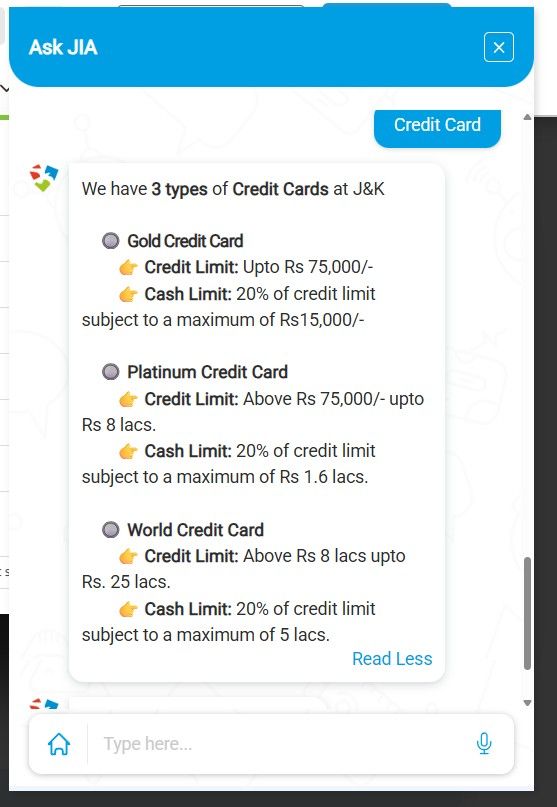

At present, Easemoney verified these details directly through Jammu and Kashmir Bank’s official chatbot in 2026. As of now, Jammu and Kashmir Bank offers only three active credit card types:

- Gold

- Platinum

- World

There are no separate cards beyond these three. All other cards like “Government Employee cards”, “RuPay cards”, or cards shown with welcome offers are only variants of these same three categories, not different credit cards.

Basic features (same for all cards)

All J&K Bank credit cards come with these common facilities:

- You will get a 20 to 50-day interest-free period on card spending

- Revolving credit option if the minimum amount is paid on time

- Easy credit facility with reasonable interest rates

- Cash withdrawal is allowed up to 40% of the total credit limit

- Loyalty points/reward programme for usage

- 24×7 customer support available

- EMI facility on card purchases and outstanding balance

In simple words, features are mostly the same, only the card level changes between Gold, Platinum, and World. J&K Bank continues to offer different credit cards for different income groups, starting from basic cards for regular users to premium cards meant for high-income customers with global usage.

1. JK Gold Empowerment Credit Card

The Gold Empowerment Credit Card is J&K Bank’s most basic unsecured credit card. This card is mainly meant for first-time users and customers with a low risk profile.

Main features

- Credit limit: Up to ₹75,000

- Cash withdrawal: Up to 20% of the limit (maximum ₹15,000)

- Annual Fee Waiver: if a minimum purchase amount of ₹75,000 is made in a year.

- Revolving credit facility available

- 20–50 days interest-free period on spending

- EMI option on eligible purchases

- 24×7 customer support

Who should go for the Gold card?

- People using credit card for the first time

- Low to medium income customers

- Users who want to build a CIBIL score

- Small spend users (around ₹5,000–₹15,000 per month)

Real-life insight: If you already have a J&K Bank savings account, the chances of approval for the Gold card are higher compared to new customers.

Important note (source-based)

As per Paisabazaar, J&K Bank also shows Empowerment Card variants with different limits:

- Blue: Up to ₹25,000

- Silver: Up to ₹50,000

- Gold: Up to ₹1 lakh

However, these limits are not clearly verified on J&K Bank’s official website, so they should be treated as indicative only, not final.

2. J&K Bank Platinum Credit Card

The Platinum Credit Card is one of the most commonly issued cards by Jammu and Kashmir Bank in 2026. There are different versions, but the card level is the same – Platinum only. It is mastercard network card.

1. Standard Platinum Card

This card is for working professionals and regular salaried users. mostly private jobs and higher income.

Main points:

- Credit limit: It goes ₹75,000 to ₹4 lakh

- Cash withdrawal: 20% of limit (maximum ₹80,000)

- Welcome offers: Around ₹4,000 from premium brands

- Annual fee waiver: If you spend ₹75,000 in a year

- Global concierge service (MasterCard) for emergency help, like a lost card or emergency cash

2. Govt Employees Platinum (Variant)

This is not a separate card, just a Platinum card with better benefits for govt staff.

Main points:

- Credit limit: Up to ₹8 lakh

- Cash withdrawal: 40% of limit (maximum ₹1.6 lakh)

- Lifetime free card (no annual charges)

- Airport lounge access

- Same MasterCard global concierge services

- Welcome bonus: Offers worth ₹4,000

Important clarity (very simple)

Govt Employee card is NOT a new card type. It is a Platinum card only, but with a higher limit and lower charges.

Small comparison

- Standard Platinum: Good for private jobs & regular salaried users

- Govt Platinum: Best for govt employees due to high limit + no fees

Who should choose Platinum?

- Salaried professionals

- Govt employees

- People with a stable monthly income

- Online shoppers and digital spenders

- Users who want the annual fee waiver option

Simple tip: If your income is steady and you spend regularly, Platinum is better than Gold. Govt employees should always ask for the Govt Platinum variant, notthe normal one.

3. JK Bank World Credit Card

World Credit Card is the highest-level credit card of Jammu and Kashmir Bank. It support VISA And MasterCard only, not RuPay. This card is not for everyone. Bank gives it only to selected customers in 2026. most HNI level card from J&K Bank.

Main features

- Credit limit: You can get ₹4 lakh to ₹25 lakh, depending on your income and bank record

- Cash withdrawal: It allows 20% cash, but a maximum ₹5 lakh only

- Welcome offer: Around ₹10,000 value on premium brands

- Airport lounge access: Available in India and some international airports

- Golf benefit: Mastercard World Golf program, games and lessons at selected golf courses in India

- Concierge help: 24×7 help for emergency cash, lost card, stolen card

- International usage: The card works outside India also

- Reward points: 1 point for every ₹100 spent

- Fuel benefit: Fuel surcharge waiver at petrol pumps (as per monthly limit)

Who should take the World card?

- People with high salary income

- Business owners

- Frequent flyers and travellers

- Users with a premium lifestyle spending

Reality check (very important):

- World card approval is fully relationship based.

- Customers who already have strong banking history with J&K Bank get first preference.

- New customers usually don’t get this card easily.

Easemoney tip: High income alone is not enough. If your salary account, FD, or loan is already running with J&K Bank, then approval chances improve.

What about RuPay Credit Cards?

Yes, J&K Bank does give RuPay credit cards, but one thing is important to understand.

RuPay is only a card network, not a separate credit card type. Just like Visa or Mastercard, RuPay works on the network level only.

RuPay Credit Card (How it actually works )

- RuPay cards are mostly issued as Platinum-level cards

- These cards can be linked with UPI, which is the main advantage

- Card works on UPI-QR, POS machines, online shopping, and ATMs

- Zero joining fee in most cases

- Zero annual fee for first year

- From second year, annual fee waived if yearly spend is above ₹75,000

- Easy EMI facility available on spends

- 1% fuel surcharge waiver at all fuel pumps in India (waiver capped for transactions up to ₹5,000 per month)

- Can be easily linked with any UPI app

- Reward points on card spending

- Forex charges around 3.5% for international use

Branch-level tip: If you want UPI + credit card in one, ask for RuPay Platinum. If you don’t care about UPI, Visa or Mastercard Platinum also works fine.

How to Apply for J&K Bank Credit Card in 2026

1. Online Apply (Best option if you already have account)

You can apply online, but mostly this is for existing customers only.

How to apply online:

- Go to official website: jkbank.com

- Click on Personal Banking, In menu, select Credit Cards section.

- Select Apply Online

- Choose what you want:

- Normal credit card, or

- Credit card against FD

- It will ask for the Operative Account Number

- This means you must already have a J&K Bank account

- New customers usually cannot apply directly online

- Enter basic personal and financial details

- Verify details using the OTP linked with your account

- Submit the form

After submission, bank official will call you for confirmation and verification.

2. Offline Apply (Branch Visit)

If you don’t have account or want better chances, branch visit works better.

Offline process:

- Visit the nearest or your home J&K Bank branch or call your customer care with documents.

- Ask for a credit card application form

- Fill the form and submit the required documents

- The bank will do the KYC verification and approval process.

Branch apply works better for:

- Government employees

- People applying for a high credit limit

- You will need an ITR and a salary slip at the branch. However, you can apply card to card, just give your other bank credit card statement.

What are the charges for all these J&K Bank Credit Cards?

J&K Bank Credit Card Charges (2026)

At present, the charges for J&K Bank credit cards are structured by card variant. Premium cards offer higher limits and benefits, while basic cards come with lower entry costs.

Annual Fee: ₹200 + GST

Interest: 3.00% monthly

Annual Fee: ₹300 + GST

Interest: 3.00% monthly

Annual Fee: ₹1,000 + GST

Interest: 3.00% monthly

Late Payment Fee: ₹250 + GST

Minimum charge: ₹300

Overlimit Fee: 2.5% (Min ₹400)

(Standard caps apply)

EMI Processing: ₹99 + GST

Check Eligibility Rules & Documents Required

Eligibility & Documents for J&K Bank Credit Card (2026)

To apply for a J&K Bank credit card, you need to meet basic age and income requirements. These conditions vary slightly based on the card type — Gold, Platinum, or World.

Documents Required

- Aadhaar Card

- PAN Card / Form 60

- Voter ID / Passport

- Driving Licence

- Aadhaar Card / Passport

- Utility Bill (≤ 3 months old)

- Ration Card / Property papers

- Last 3 months salary slips

- Form-16 (last 2 years)

- 6 months bank statement

- ITR of last 2 years

- Business / Pension proof

- 6 months bank statement

Question Answers

Who is eligible for a credit card in Jammu & Kashmir Bank?

Any Indian person between 21 to 65 years can apply if income is regular. CIBIL should be okay type, not very bad. If you already have J&K Bank account or you are govt employee, approval usually comes faster.

What are the benefits of J&K Bank credit card?

You get 20–50 days interest free time if bill paid on time. EMI option is there for shopping. Cash withdrawal also allowed within limit.

Rewards are simple, not heavy. Overall card is safe and disciplined, good for users who don’t overspend.What is the credit limit of J&K Bank credit cards?

Limit depends on your income and card type. Empowerment Cards (Blue, Silver, Gold) mostly comes between ₹25,000 to ₹75,000.

Platinum card can go up to ₹8 lakh. World card is for high income people and can go up to ₹25 lakh.What is the interest rate of J&K Bank credit card?

Interest is around 2.25% to 3% per month at present. If you pay full bill before due date, no interest is charged. Interest comes only when you pay minimum amount or delay.

What CIBIL score is required for J&K Bank credit card?

If your CIBIL is above 700, chances are good. Even 650–700 score people can get Gold card or FD card if income and account history is stable.

Very low score people may face rejection.How fast is approval for J&K Bank credit card?

Normally approval takes 7 to 15 working days. Govt employees and salary account holders in J&K Bank usually get faster approval. In some cases, it gets done within 7 days after documents check.