The SBM ZET Credit Card, earlier called the Magnet Credit Card, is a secured credit card linked with a fixed deposit. It is issued by SBM Bank India and managed through the ZET platform.

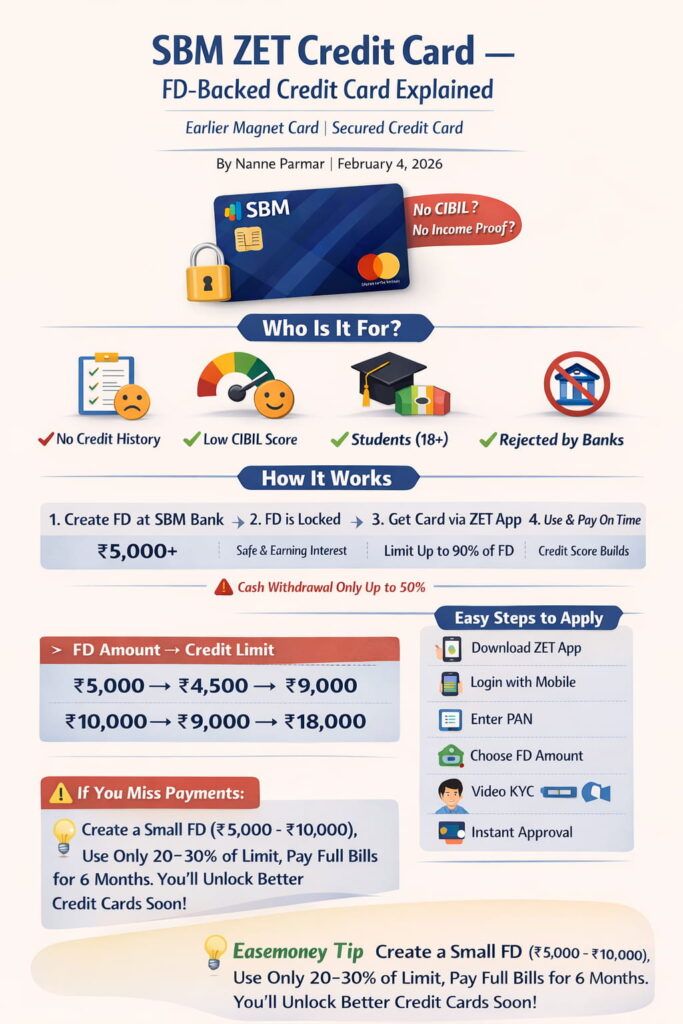

This card is mainly for people who do not have any credit history or whose CIBIL score is very low. It is positioned for a specific gap in the Indian credit market. It helps first-time users start their credit journey and also helps others fix their credit score slowly by regular use and on-time payment.

This card is not approved using salary slips or income documents. The bank gives this card only after you create a fixed deposit with SBM Bank. Since your own FD is kept as security, the bank does not depend on your credit score for approval. Because of this, the chances of getting the card are very high, even

- If you never used credit before

- Your CIBIL score is low,

- You are a student (18+) and have never had any records

- Other banks have already rejected your credit card applications.

FD Amount, Credit Limit, and Cash Limit (Clear Bank Rules)

| Item | What It Means at the Branch Level | Simple Tip |

|---|---|---|

| Minimum FD | You must open an FD of ₹5,000 to get the card. In some limited offers, it can start from ₹2,000. | Start with a small FD if you only want to build credit. |

| Credit Limit | The card limit is up to 90% of your FD value. | Higher FD means a higher card limit. |

| Cash Withdrawal Limit | You can withdraw cash up to 50% of your credit limit. | Avoid cash withdrawal; charges are high. |

| FD Interest | The FD earns interest, up to around 7% per year. | FD interest continues even when the card is active. |

| FD Insurance | FD is insured up to ₹5 lakh under DICGC rules. | Your FD is protected even if the bank fails. |

How the FD-Backed Credit Card Works (Simple, Real Life-based, Steps)

- You open a fixed deposit with SBM Bank using the ZET app.

- Example: You create an FD of ₹20,000 for 12 months.

- This FD is lien-marked by the bank. Means the ₹20,000 is blocked and cannot be withdrawn until the card is closed.

- The bank issues a credit card against this FD. Your card limit is usually close to the FD amount, like ₹18,000–₹20,000. Usually, 90% of your Deposit value.

- You use the card like any normal credit card. You can use it online or offline for groceries, phone recharge, online shopping, or fuel.

- At the end of the month, you get a bill.

- Example: You spent ₹3,500 in one month for basic expenses such as clothes.

- You pay the bill before the due date. If you pay the full amount on time, no interest is charged.

- Your fixed deposit remains safe. The ₹20,000 FD is not touched and keeps earning interest till maturity.

- The benefit is here: your credit score is building without too much effort. Plus, once your credit score reached at 750, you can go for any unsecured cards, such as Axis Bank Flipkart Credit card or HDFC MoneyBack credit card.

Important to understand For You:

- Your FD money is not used for spending

- It is only kept as security for the bank

If a customer does not pay credit card bills for a long time, the bank has the right to recover the unpaid amount from the fixed deposit. That is the reason approval is easy even for people with no credit history or a low CIBIL score.

Top Key Features and Benefits

1. Lifetime Free Card Structure

- Joining fee: ₹0

- Annual fee: ₹0

- Renewal fee: ₹0

There is no yearly charge just to keep this card active. Once issued, you can use it without worrying about renewal fees.

2. No Income Proof Required

- Approval depends on the FD amount, not on the salary or any income documents.

- PAN and Aadhaar are enough for the application

- Useful for people whose credit card applications were rejected earlier

- Suitable for first-time credit card users and low CIBIL score holders

The bank is comfortable because your FD is already kept as security.

3. Interest-Free Credit Period (45 Days)

- Standard interest-free period: up to 45 days

- Extra 3 days grace period for settlement

- Total effective window: up to 48 days, depending on billing date

Important conditions to remember:

- Last month’s bill must be paid in full

- The grace period is only for payment processing, not for extra spending time

- Cash withdrawals do not get an interest-free period

If full payment is not made, interest starts from the transaction date.

4. UPI Payments Using Credit Card

- This card runs on the RuPay network

- Can be linked with:

- Google Pay

- PhonePe

- Paytm

- UPI payments are added to the credit card bill

- Interest-free period applies only if the full bill is paid on time

This allows daily use like groceries, milk, vegetables, and local shop payments, which most FD-backed cards do not support.

5. FD Earns Interest While You Use Credit And Safety

- Fixed Deposit keeps earning interest (up to 7% per year), and SBM is RBI registered Bank, so you can relax.

- FD amount is not reduced or broken; however, you can pre-close it via email ID, but there are charges.

- Only kept blocked as security

This helps customers feel comfortable because their money is still growing while they use the credit card.

Rewards & Discounts: What Is Real and What Is Just Promotion

How the ZET Coins System Actually Works –

- This card does not give direct cashback

- Rewards come in the form of ZET Coins

- Coins are credited only when there is an active offer or campaign

Real redemption value of ZET Coins:

| Redemption Type | Actual Value |

|---|---|

| Gift vouchers | ₹0.25 per coin |

| Cash credit | ₹0.20 per coin |

This means 100 coins do not mean ₹100. Many users misunderstand this part.

What You Should Expect From Rewards (Reality Check)

- Rewards are not fixed

- They depend on:

- Ongoing offers

- Merchant tie-ups

- Time-limited campaigns

- Some months you may get rewards, some months you may not

Rewards should be treated as extra savings, not as regular income or guaranteed cashback.

Where Offers Commonly Appear (Examples, Not Permanent)

Offers usually come and go in these categories:

- Online shopping platforms like Amazon, Flipkart, Myntra

- Food and dining services such as Zomato, Swiggy, and Domino’s

- Travel and entertainment, including PVR, MakeMyTrip, and Cleartrip

- Grocery and quick delivery apps like BigBasket, Zepto, JioMart

- Digital subscriptions like SonyLiv, Prime, and Swiggy One Lite

How to Apply for the SBM ZET Credit Card (Real Talk)

- First, tap on the “Apply Now” button given above.

- It will take you to the ZET website or straight to the Play Store. Just download the app from there.

- Open the ZET app after downloading.

- Everything happens inside this same app. You don’t need any other app or branch visit.

- Log in using your mobile number – You will get an OTP. Try to use the mobile number that is already linked with Aadhaar, as it makes things smooth.

- Enter your PAN details

- No salary slip, no income proof. Only PAN is checked.

- Choose your FD amount as you like – This is the money you want to keep as a fixed deposit. The card limit will be based on this amount only.

- Create the FD online – Money goes into the FD directly. No forms, no signatures, nothing offline.

- Do the Video KYC – This step is very simple.

- Takes around 30–60 seconds

- You only need to show your PAN card on camera

- Mostly no questions, just show PAN and done

- The card gets approved –

- In many cases, the virtual credit card comes within 30 minutes. You can start using it online and on UPI the same day.

- The physical card comes later –

- The plastic card reaches your address in 5 to 6 days, sometimes earlier.

- Bill payment and control – You pay your credit card bill using UPI inside the ZET app.

- You can see spending, limit, and due date in the same app.

One real thing to know: If something fails because of a network issue or an app problem, don’t panic. Your money is not stuck. The amount is usually refunded within 24 hours.

Before applying, just keep this ready:

- PAN card

- Aadhaar-linked mobile number

- Stable internet

That’s all. Process is simple, fast, and made for normal users, not tech experts.

What are the Charges – Read This Slowly

Interest and Charges

| Type | What You Actually Pay |

|---|---|

| Annual Fee | nil |

| Online or swipe spends | 3.5% per month (around 42% in a year) after the free period |

| Cash withdrawal interest | 3.5% per month, counted from the same day |

| ATM cash withdrawal fee | 3.5% or ₹300, whichever is higher |

| Foreign currency usage | 2.49% markup |

| Late payment charge | ₹299 |

| GST | 18% on all charges and interest |

Simple truth: If you don’t pay bills on time, this card becomes very costly very fast. Bank is not joking here.

Minimum Amount Due (MAD) – This Confuses Many People

| What Is Included | How It Is Counted |

|---|---|

| Outstanding amount | 5% or ₹100, whichever is higher |

| Interest part | 100% added |

| All fees | 100% added |

| Over-limit amount | 100% added |

| EMI amount (if any) | 100% added |

If you pay only MAD:

- The card will not get blocked, okay

- But interest keeps running every month

- Credit score improvement becomes slow or stuck

Advice: MAD is only for emergencies. Normal habit should be pay full bill.

Billing Cycle and Statement (No Usage Also Counts)

| Item | How It Works |

|---|---|

| Statement | Generated every month (You can check the document to find your exact date) |

| Due date | Around 15 days after the statement |

| Extra grace | 3 days only |

| Where to check | Email + ZET app |

Important thing people miss: Even if you don’t spend a single rupee, the bank still creates a statement. Always open the app and check once.

How Credit Score Reporting Works and the Real Situation

- Inside the ZET app, you usually see the Experian credit score

- Other apps may show CIBIL, Equifax, or CRIF scores

- Seeing different numbers in different apps is normal, not an error, However, you can check the CIBIL official website as well for better tracking.

Each bureau calculates scores in its own way, so small ups and downs across apps are expected.

What Actually Improves Your Credit Score (Ground Reality)

- Use only below 30% of your card limit – Example: If your limit is ₹20,000, try not to cross ₹6,000–₹7,000.

- Pay the full bill amount every month – Partial payment helps the bank, not your score.

- Never miss the due date – One late payment can spoil months of good work.

- Use the card regularly, not once in six months – Small spends every month work better than one big spend.

One Honest Thing to Understand

There is no fixed or guaranteed score jump. Some people see improvement in 2–3 months, some take 6 months or more. It depends only on how disciplined you are and how long you stay regular.

FAQs

Is the SBM ZET Credit Card lifetime free?

Yes. As of 2026, the SBM ZET Credit Card has a zero joining fee, a zero annual fee, and a zero renewal fee, so you pay nothing just to keep it active.

What is the credit limit of the SBM ZET Credit Card?

The credit limit depends on your FD amount. Usually, the bank gives up to 90% of the FD value. Example: ₹20,000 FD gives around ₹18,000 limit.

What is the main use of the SBM ZET Credit Card?

This card is mainly used to build or repair a credit score. It helps people with no credit history or low CIBIL get access to safe, controlled credit.

Is the SBM ZET Credit Card safe or risky?

Yes, it is safe. Your FD is insured up to ₹5 lakh under DICGC rules. Card transactions follow RBI banking rules and are issued by SBM Bank India.

Does the SBM ZET Credit Card give cashback?

It does not give fixed cashback. Rewards come as ZET Coins, whose value depends on active offers. These rewards should be treated as bonus savings, not guaranteed returns.

Does the SBM ZET Credit Card give Flipkart cashback or a discount?

Sometimes, yes. During active campaigns, users may get up to 2.5% off on Flipkart, but offers change often and are not permanent or fixed.

Can villagers or small-town users use this card easily?

Yes. The card works with UPI, RuPay network, and simple app controls. No salary proof needed, making it suitable for village, small-town, and first-time users.