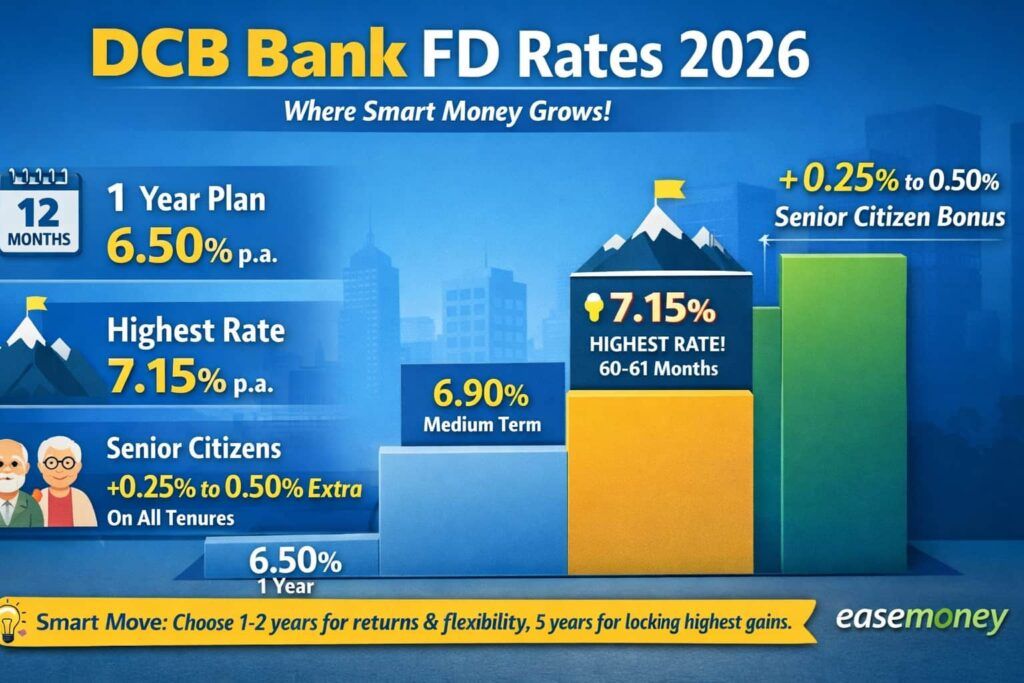

DCB Bank is slowly becoming a good FD bank for 2026. It is not doing big ads, but its FD rates are actually strong compared to other mid-size banks. The bank has recently updated its FD rates and is ready for 2026. As per Resident Indian Fixed Deposit Interest Rates (from 16 January 2026) –

- For normal customers, FD rates start from 3.75% and go up to 7.15% per year on deposits below ₹3 crore.

Senior citizens above 60 years get an extra interest of 0.25% to 0.50%, depending on how long the FD is kept, and the rate can go up to 7.65% per year for some tenures.

DCB Bank is a mid-size private bank under RBI rules. People in metro cities and Tier-2 semi-urban areas usually prefer it because they want simple FD options. Things like clear rules, fixed income, digital FD option, Online documents, and no confusing terms matter a lot to them.

All DCB Bank fixed deposits are also covered under DICGC insurance up to ₹5 lakh per person, which gives basic safety to small and medium investors. let’s check the latest updated table –

DCB Bank FD Interest Rates Chart 2026 (Less than ₹3 Crore)

These FD rates are for domestic retail deposits in early 2026. The interest period starts from 7 days and goes up to 10 years. The rate you get changes based on how long you keep the FD.

| FD Tenure | Interest Rate for regular customers only. | Easemoney Tip |

|---|---|---|

| 7 – 45 days | 3.75% | Parking money only |

| 46 – 90 days | 4.50% | Short idle funds |

| 91 days – < 6 months | 4.75% | Emergency buffer |

| 6 – < 10 months | 6.00% | Better than savings |

| 10 – < 12 months | 6.50% | 1-year planning |

| 12 – < 15 months | 6.90% | Medium term |

| 15 – < 16 months | 7.00% (Better than most mid-tier commercial banks) | Rate jump starts |

| 16 – < 27 months | 6.90% | Balanced option |

| 27 – < 28 months | 7.00% | Rate window |

| 28 – < 37 months | 7.00% | Stable returns |

| 37 – 38 months | 7.10% (This looks cool) | Slightly higher |

| > 38 – < 60 months | 7.00% | Long stability |

| 60 – 61 months | 7.15% (Highest) (Also, locked as a Tax saving) | Lock only if sure |

| > 61 – 120 months | 7.00% | Long lock-in |

Ground reality – Most people don’t like to lock their money for more than 5 years. In real life, 15 to 28 months FD is more popular because the interest is decent, the money is not stuck for too long, and it becomes easier to handle daily and family expenses.

FD Options for Resident Indians (Real Users)

Resident Indians are the main FD customers of DCB Bank. These FDs are mostly used by:

- salaried people

- small shop owners and traders

- self-employed professionals

- senior citizens

- families who plan monthly expenses carefully

For them, FD is not investment drama. It is about safe money and steady interest.

How DCB Bank Plans Its FD Options

DCB Bank does not look at FD only by how many months or years. The bank mainly separates FD based on who the customer is and how easily they may need their money back. That’s why the structure feels simple but practical.

For Resident Indians

- DCB Zippi Online Fixed Deposit – Online Option for opening an FD.

- Regular Fixed Deposit – normal FD for most people

- Senior & Super Senior FD – extra interest for age 60+

- Tax Saver FD – for people saving tax under 80C

- Non-Callable High-Value FD – higher amount, no early break

For NRIs

- NRE Fixed Deposit

- NRO Fixed Deposit

- NRI Tax Savings Deposit Scheme

- FCNR (B) Foreign Currency FD

- RFC Deposit (for returning NRIs)

Rates and rules are not the same for every FD, so each option needs to be checked properly. This is especially important if someone is doing FD for the first time.

1. DCB Zippi Online Fixed Deposit

In 2026, DCB Zippi Online FD is fully active and works as a digital-only FD option. It is made for people who want to open an FD without opening a DCB savings or current account. This is work on basic regular FD but offer digital process without the need to visit a branch. Also, senior citizen benefits and premature withdrawals.

How DCB Zippi Works

Zippi works as a standalone online FD.

- No DCB account needed – you can use your existing bank account

- Funding & payout – money is sent from your current bank via UPI or Net Banking

- On maturity, principal + interest comes back to the same bank account

- Deposit limit – You can add ₹10,000 and go max ₹50 lakh per transaction

- Tenure works here – From 30 days to 5 years

- Interest Rates – check above the default chart. Sometimes, they offer a special tenure at high interest for a limited time.

Fully Digital Process (Apply steps)

Everything is paperless and online.

- Apply through the DCB Zippi website or just download the Zippi+ mobile app.

- Enter basic details like PAN and Aadhaar

- Video KYC is compulsory for new users

- Keep a physical PAN card and blank paper for signature

- Aadhaar OTP is used for verification

- Choose the FD period and interest payout (monthly, quarterly, or cumulative)

- After payment, a digital FD receipt (e-TDR) is sent instantly to your email

Managing Your Zippi FD

- Use the Zippi+ App to check or manage FD

- No new login ID needed — You just need PAN + OTP.

- Auto-renewal option available after maturity

- Loan/OD facility up to 80% of the FD amount, without breaking the FD

2. Regular Fixed Deposit at DCB Bank

This is the most-used FD product at DCB Bank in 2026. People mostly use it to park money safely, earn a fixed return, and still keep an option open in case they need cash later.

It works well for people who don’t want risk, don’t want confusion, and don’t want their money fully locked for a long time.

Core Rules (As Used in Real Life)

- Minimum amount: ₹10,000

- Tenure range: From 7 days to 10 years

- Interest payout choice: Monthly, quarterly, or cumulative

- Early closure: Allowed, but a penalty is applied

- Rate of Interest: Please check the rate chart given above for amounts below 3 crore. If you are planning to deposit more than ₹3 crore, the interest rate is different and you should check that section separately.

Single FD amount rate chart: Above ₹1 crore and below ₹3 crore

| Tenure | Interest Rate (% p.a.) Last Updated – 24th January, 2026 |

|---|---|

| 12 to 13 months | 7.15% |

| 13 months 1 day to below 18 months | 7.00% |

| 18 to 19 months | 7.25% |

| 19 months 1 day to below 24 months | 7.00% |

| 24 to 60 months | 7.40% (Highest) |

I put this table here because many people don’t notice the non-callable FD option. If you are okay locking money and you don’t need early withdrawal, the 24–60 month slab clearly gives the best return. Shorter tenures are fine, but they make sense only when liquidity matters more than interest.

Rates change based on tenure, not on marketing offers. Short-term FDs give a lower return, longer tenures give a higher interest.

3. Senior & Super Senior Citizen Fixed Deposit

This FD is basically the same as a regular FD, but the bank gives higher interest if the depositor is a senior citizen. Rules, flexibility, and usage remain the same — only the interest rate is extra.

DCB Bank clearly keeps age-wise rules. People from 60 years to less than 70 years are counted as Senior Citizens, and people 70 years and above are kept under Super Senior Citizens. Based on how long the FD is kept, the bank gives an extra interest of around 0.25% to 0.50% more than normal FD rates.

This extra return is not just for show. For people who depend on FD interest for monthly expenses, even a small rate increase makes a visible difference in payout and helps manage household costs better.

Senior or Super Senior FD Rates (below ₹3 crore)

This chart is active from 16 January 2026.

| FD Tenure | Senior (60–70) | Super Senior (70+) | Best Use |

|---|---|---|---|

| 7 – 45 days | 4.00% | 4.00% | Short parking |

| 46 – 90 days | 4.75% | 4.75% | Buffer funds |

| 91 days – < 6 months | 5.00% | 5.00% | Emergency |

| 6 – < 10 months | 6.25% | 6.25% | Short income |

| 10 – < 12 months | 6.75% | 6.75% | Yearly plan |

| 12 – < 15 months | 7.15% | 7.15% | Good option |

| 15 – < 16 months | 7.50% | 7.50% | Rate spike |

| 16 – < 27 months | 7.15% | 7.15% | Balanced |

| 27 – < 28 months | 7.25% | 7.25% | Safe |

| 28 – < 37 months | 7.25% | 7.25% | Stable |

| 37 – 38 months | 7.60% | 7.65% | High return |

| > 38 – < 60 months | 7.25% | 7.25% | Income |

| 60 – 61 months | 7.65% | 7.70% (Highest) | Only if sure |

| > 61 – 120 months | 7.25% | 7.25% | Long lock |

Most of the time, seniors get 0.25% extra, but in a few specific tenures, the bank gives 0.50% extra, which is where FD income improves the most.

Real insight: Most senior citizens don’t go very long. Tenures of around 15–28 months are commonly chosen because interest is decent and money is not locked for too long. Longer tenures only make sense if income planning is already sorted.

4. Tax Saver Fixed Deposit (Section 80C)

This FD is mainly for tax saving, not for flexibility. People should choose it only when the main goal is to save tax, not when they may need money in between.

At DCB Bank, the interest rate is slightly better compared to many other tax saver FDs. But rules here are strict and fixed, because these are government-defined rules, not bank-made rules.

Note: Interest earned on FD is taxable. Your bank cuts 10% TDS (or 20% if PAN is not given) when yearly FD interest goes above ₹40,000 for normal individuals and ₹50,000 for senior citizens.

Clear Rules

- Tenure: 5 years (compulsory)

- Investment limit: ₹10,000 to ₹1.5 lakh in one financial year

- Premature withdrawal: Not allowed

- Loan / OD: You will not get this.

- TDS: Applicable

Tax Saver FD Interest Rate

| Tenure | Interest Rate |

|---|---|

| 5 years | Around 7.00% – 7.50% per year (can change slightly) |

Important to Understand

- Only the amount you deposit (principal) gets an 80C tax benefit

- The interest you earn is fully taxable

- You cannot break this FD, even in an emergency

Real-life insight: This FD makes sense only when your 80C limit is still unused, and you want a safe, no-risk tax-saving option. If flexibility matters to you, this FD is not a good fit.

FD Options for NRIs at DCB Bank

DCB Bank keeps NRI FDs clearly separated, so there is less confusion. Which FD you choose mainly depends on where your income comes from and whether you want tax-free interest or easy repatriation.

1. NRE Fixed Deposit – For Overseas Income

This FD is used when your foreign income is sent to India.

Key things to know

- Your Interest is tax-free in India

- Full repatriation allowed (money + interest can go abroad)

- Minimum tenure: 1 year

- No senior citizen extra benefit

- If FD is closed before 1 year, no interest is paid

NRE FD Interest Rates (16th January, 2026)

| Tenure | Interest Rate (% p.a.) |

|---|---|

| 12 – < 15 months | 6.90% |

| 15 – < 16 months | 7.00% |

| 16 – < 27 months | 6.90% |

| 27 – < 28 months | 7.00% |

| 28 – < 37 months | 7.00% |

| 37 – 38 months | 7.10% |

| > 38 – < 60 months | 7.00% |

| 60 – 61 months | 7.15% (Highest) |

Real insight: NRE FD is best when you want a tax-free return and full freedom to take money back abroad.

2. NRO Fixed Deposit – For Income Earned in India

This FD is used for rent, pension, dividends, or property sale money earned in India.

Key points –

- Interest is taxable in India

- TDS is deducted

- Repatriation allowed after tax and documents

NRO FD Interest Rates (16th January, 2026)

| Tenure | Interest Rate (% p.a.) |

|---|---|

| 7 – 45 days | 3.75% |

| 46 – 90 days | 4.50% |

| 91 days – < 6 months | 4.75% |

| 6 – < 12 months | 6.00% – 6.50% |

| 12 – < 24 months | 7.25% |

| 24 months | 7.45% |

Real Story For You: NRO FD is mostly used to park Indian income safely, not for tax saving.

3. FCNR (B) & RFC Deposits – Foreign Currency FDs

These are for NRIs who don’t want exchange rate risk.

What makes them different –

- FD is kept in foreign currency, not INR

- Available in USD, GBP, EUR, AUD, CAD

- Interest is compounded half-yearly

- RFC FD is mainly for returning NRIs (RNOR)

- You will get no interest if closed before 1 year

Example For you (USD FCNR – 2026)

- 1–2 years: ~4.9%

- 2–3 years: ~4.5%

Quick insight: FCNR FD makes sense when you want a stable foreign-currency return and don’t want to worry about rupee ups and downs.

FD Rate Comparison: DCB Bank vs Top Banks

Its FD rate goes up to 7.15% per year for regular people, which is clearly higher than most big banks. Big banks like HDFC Bank and State Bank of India focus more on safety, brand name, and branch network. Because of that, their FD rates usually stay lower, around 6.25% to 6.60%.

On the other side, Small Finance Banks (SFBs) give very high rates, even up to 8.60%, but many people feel slightly uncomfortable locking big money there. DCB Bank sits in the middle space — better rates than big banks, and more comfort than SFBs.

FD Rate Comparison Table (Deposits below ₹3 crore)

| Bank Name | Bank Type | Regular FD Rate (% p.a.) | Senior Citizen Rate (% p.a.) |

|---|---|---|---|

| Unity Small Finance Bank | SFB | 8.60 | 9.10 |

| Suryoday Small Finance Bank | SFB | 8.00 | 8.20 |

| RBL Bank | Private (Mid) | 7.20 | 7.70 |

| DCB Bank | Private (Mid) | 7.15 | 7.65 |

| IndusInd Bank | Private (Mid) | 7.00 | 7.50 |

| ICICI Bank | Private (Large) | 6.60 | 7.10 |

| Axis Bank | Private (Large) | 6.45 | 6.90 |

| State Bank of India | Public (Large) | 6.40 | 7.05 |

Simple Words –

- DCB’s sweet spot: Its top rate 7.15% comes only for a specific tenure (60 to 61 months), not all periods.

- Mid-bank fight: In the mid-size private bank space, DCB competes closely with RBL Bank and IndusInd Bank.

- Why people choose DCB: Many people want better return than SBI/ICICI, but still don’t want to go fully into SFBs — that’s where DCB fits well.

Q/A For You

Does DCB Bank offer a 444-day Fixed Deposit?

No. As of 2026, DCB Bank does not have any officially named 444-day FD scheme. Rates depend on standard tenure slabs, not marketing-number deposits.

Has DCB Bank cut FD interest rates recently?

Yes. DCB revised FD rates earlier after the RBI repo cuts. Compared to 2025 peaks, some tenures dropped 40–65 bps, but select 15–61 month slabs remain competitive.

What is the highest FD interest rate at DCB Bank in 2026?

For regular customers, the maximum is 7.15% at 60–61 months. Senior citizens can earn up to 7.70%, but only on very specific long tenures.

Is DCB Bank FD safe for middle-class investors?

Yes. DCB is RBI-regulated and DICGC-insured up to ₹5 lakh per person. It suits people wanting better returns than SBI, without small-finance-bank risk discomfort.

Can I open a DCB Bank FD fully online?

Yes. Through DCB Zippi Online FD, no savings account is required. PAN, Aadhaar OTP, video KYC, and UPI/net banking are enough. The entire process is paperless.

Does DCB Bank FD allow premature withdrawal?

Yes, except Tax Saver and non-callable FDs. Regular and Zippi FDs allow early closure with penalty, usually 0.5%–1%, depending on tenure and amount.

Is there a DCB Bank FD calculator available?

Yes. DCB provides an online FD calculator on its official website. It shows maturity value based on amount, tenure, payout option, and senior-citizen benefit clearly.

Who should actually choose DCB Bank Fixed Deposit?

Best for salaried people, seniors, and families wanting 7%+ steady income, digital convenience, and medium-term locking. Not ideal if you need ultra-short liquidity or flashy schemes.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.