Unlike other government and private banks, IDFC now allow users to close accounts without visiting a branch; however, it is a limited service. In January 2025, as per the RBI rules, banks started closing dormant accounts. If you are planning to deactivate your IDFC savings account for any reason.

Closing a bank account should be simple, but in real life, banks add conditions and checks before they actually let you shut it down. By knowing what to prepare first, which method is faster, and why some accounts don’t qualify for online closure at all.

It’s important to make sure you don’t run into problems. Let’s start step by step to close your account –

1: Check Before You Close

Before you ask the bank to close your account, check for these common roadblocks that may occur when you generate a request:

- Negative Balance – If your account has gone below zero balance because of charges or penalties for not maintaining AMB, then you cannot close your account online as well until you pay the minimum charges.

- Loans and Credit Cards – If your savings account has any active loan EMI or a credit card bill, your closure request will be blocked until you shift payments to another bank.

- Auto-Pay and ECS Mandates – Any automatic debit, such as SIP, insurance premiums, or your monthly utility bill, if set as an auto-pay. You must have cancelled or changed to another account to generate a closure request.

- Minimal KYC Accounts – usually very normal. If you opened your account online and never finished the Video KYC, your account is treated as a limited-use account, valid for just one year, with caps on balance and transactions. You can still close it, but the refund of your opening deposit usually goes back to the source account.

2: Choose How You Want to Close

IDFC FIRST Bank offers two main ways to close an account:

- Through customer care (online closure link)

- By visiting a branch with a closure form

It usually depends on your account condition. If your account is clear, no EMI, no auto-pay or negative balance, you can simply request online. But if you have loan dues or have a salary-linked account, you will have to visit the branch.

Method 1: Closing Online Through IDFC Customer Care

This method is the fastest, but it only works if your account is eligible.

- Call Customer Care or your Relationship manager –

- You have to make a call at 1800 10888, the customer helpline number of IDFC, or you can use the IDFC mobile app to find the contact number of a relationship manager in the My Profile section.

- Share your reason for closing (low balance usage, high charges, no branch near me, etc.).

- The executive (male or female) may try to retain you with offers, but closure is your choice.

- Receive Closure Link via SMS –

- Once the request is accepted, you will get an SMS within 10 minutes with:

- A secure closure link (valid for 8-24 hours only).

- A Service Request (SR) number (9–11 digits) for tracking.

- Open the link, it is pre-filled with your Customer ID and Account Number.

- Once the request is accepted, you will get an SMS within 10 minutes with:

- Fill Online Closure Form –

- You have to verify your details (Customer ID, Account No.).

- Select the closure reason from the drop-down list.

- Enter beneficiary account details, for transfer any interest or remaining benefit (required even if your balance is ₹0):

- Enter the account number twice for confirmation.

- Enter the IFSC code.

- The account must be your own account in another bank (such as HDFC, SBI, ICICI, or more).

- Rs. 1 Verification Credit –

- IDFC will first send ₹1 test credit to your beneficiary account.

- If successful, your closure proceeds (if any balance) are transferred.

- Transfer usually happens in 30 minutes to 3 hours via NEFT.

- Final Submission

- Tick the terms & conditions checkbox.

- Tap the Submit form.

- Tap on generate OTP, you will get a 6-digit OTP on your linked mobile number to complete the process.

- Closure Timeline –

- Once submitted, your account is usually closed within 48 hours.

- You will receive a confirmation SMS/email after closure.

This is the best option if you want speed and don’t have anything linked to your account.

Method 2: Home Branch with the account closure form

If your customer care helpline says to you: Your account isn’t eligible, you will need to go the branch route. This usually happens due to your account type, being active in ECS or having linked loans. Sometimes, a few vKYC accounts do not accept direct closure.

1. Download the IDFC Closure Form PDF

- You have to visit the IDFC bank website and scroll down to the footer, tap on the form centre.

- Now, select account services and find “Account Closure Request PDF”

- Tap on Read to get it and print it out, or you can download directly from here –

| File | Link |

|---|---|

| PDF English File | Download (real source) |

Alternatively, you can collect this form directly from your home branch counter. You can ask with bank staff.

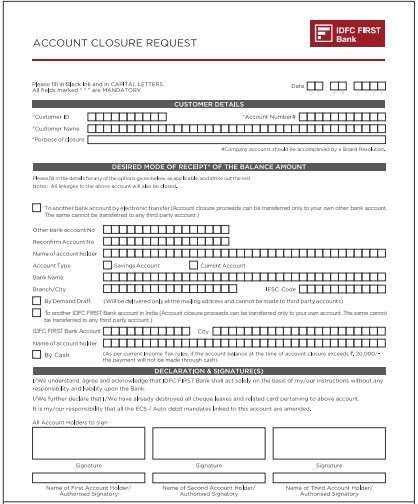

2. How to fill the Form Correctly

- As always, start with the date in the header boxes.

- Write down your customer ID and your account number.

- Also, your account holder’s name as per the passbook or statement.

- Enter your purpose of closure. You can check the list below.

- The mode of receipt, here you can select the way you want your money, such as an electronic transfer. Select it and enter your other bank account details.

- Likewise, you can select by cash (below Rs. 20,000) or Demand Draft.

- Mode of Transfer: You can tick the NEFT/RTGS option as per your need.

- Sign in the same style as bank records.

- The bank also asks for a scanned copy of your PAN or Aadhaar to complete the process.

- All set, submit to your branch with your cancelled cheque or scanned copy of your passbook (beneficiary account).

Note: Once submitted, the bank gives you an acknowledgement paper slip with a reference number. Your account closure via the branch can take upto 7 working days.

Reasons You Can Choose While Closing

Both online and offline forms require you to select a reason. Here are the official options:

- Unhappy with customer service

- Inability to maintain AMB / High charges applied

- Dissatisfied with current products

- Change of residential status

- Specific product/facility no longer required

- Account not in use

- The branch is not located nearby

- Corporate salary account – Change of employer

- Other

Tip For You: If charges/AMB are the issue, you can ask the bank to convert your account to a zero-balance product (if eligible, such as Pratham Savings Account) before final closure.

How to Handle Minus Balance Accounts in IDFC

This is one of the most frustrating issues for customers. What if your account shows a minus balance and you don’t want to pay it? Usually, a bank won’t process your closure until you pay the negative balance.

If you do not pay the amount, you will be counted as a

- Default on your CIBIL score: the negative balance can negatively affect your credit score. A poor CIBIL score can make it difficult to get any type of loans or credit cards.

- Internal Banned: You may select a blocklisted customer.

Most customers do not pay small dues, but from a long-term point of view, it’s risky. A home loan or car loan rejection because of an old unpaid balance is far more painful than clearing a small penalty today.

However, if you believe the charges are unfair, you can raise a dispute with IDFC’s grievance team or escalate to the RBI Ombudsman. Banks sometimes waive charges when customers show a genuine case or real issues.

Real-Life Questions for You

Does IDFC FIRST Bank charge for account closure?

Yes, but only if you closed within six months of opening, with a charge of Rs. 500. Your zero fee banking policies do not apply to free closure requests for the first 6 months, but it is free if closed after 12 months or more.

How do I close my IDFC salary account online?

Salary accounts are eligible only if no active employer link exists. First, inform HR to stop crediting salary. Then call IDFC customer care; if eligible, you will get a closure link. Otherwise, closure must be done at a branch.

Can I close my IDFC account through the mobile app?

Currently, the IDFC FIRST app does not have a direct closure option; however, you can generate an online request.

Why does IDFC FIRST Bank sometimes refuse online account closure?

Online closure fails when accounts have minus balance, linked loans, salary credits, ECS mandates, or incomplete video KYC. In such cases, branch submission becomes mandatory.

How fast is the online account closure process at IDFC?

Once you submit the OTP-verified online form, most accounts close within 48 hours. Balance transfer usually happens within a few hours after ₹1 verification succeeds.

Does IDFC FIRST Bank charge any fee for account closure?

Yes, ₹500 is charged if you close within six months of opening. After twelve months, closure is free. Charges are deducted automatically from the account balance.

What happens if my IDFC account shows a negative balance?

The bank will not process closure until dues are cleared. Unpaid negative balances may affect your CIBIL score and future loan or credit card approvals.

Can salary accounts be closed online at IDFC FIRST Bank?

Only after salary credits stop completely. First inform your employer, then contact customer care. If employer linkage exists, branch closure is compulsory.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.