Indian banks provide a combined application form for account holders like you, which can be used for both payment options, such as NEFT (National Electronic Funds Transfer) and RTGS (Real-Time Gross Settlement) transactions.

This form is only essential for branch-based money transfers, especially if you want to transfer funds using a cash amount, a cheque, or directly from your account.

For any online NEFT/IMPS/RTGS, you can directly pay using the Indian Bank Netbanking portal, no form required.

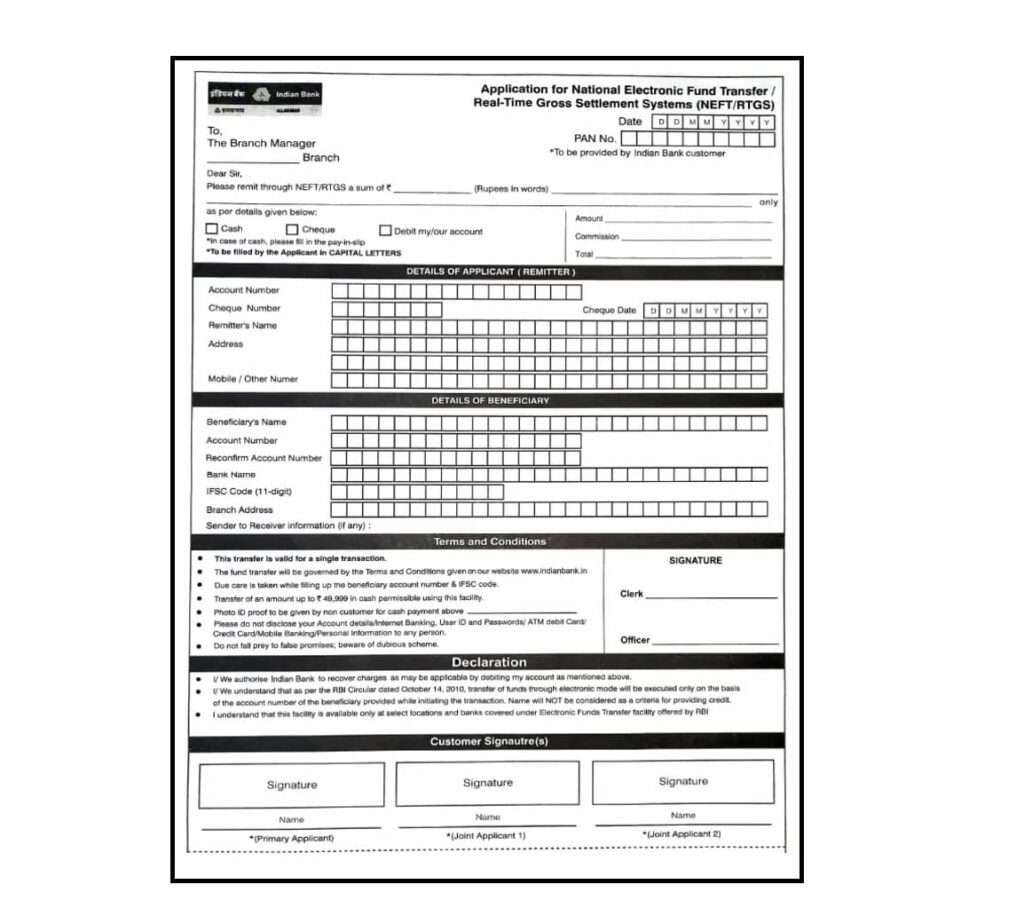

The form is simple and clearly divided into Applicant (Remitter) details and Beneficiary details. Also, available in hindi, Tamil, and other languages. Once filled, it needs to be submitted at the Indian Bank branch counter.

If you had an Allahabad Bank account, it also works for that merged account.

Minimum & Maximum Amount Rules

- NEFT: No minimum or maximum limit (can transfer even ₹1).

- RTGS: Minimum transfer amount is ₹2,00,000 (₹2 lakh). There is no upper limit for account holders.

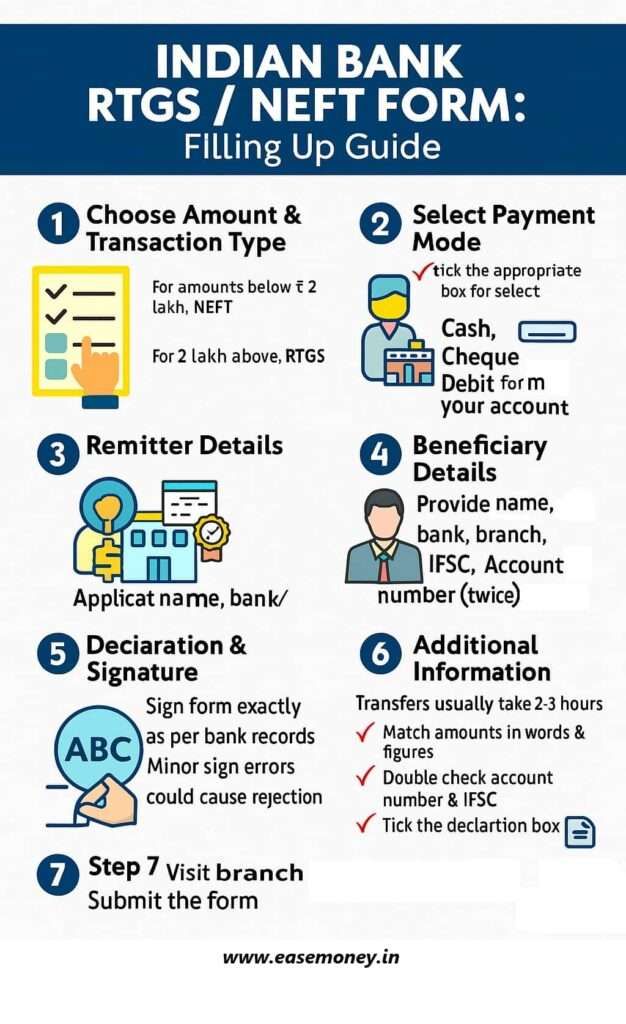

Step-by-Step: How to Fill the Form

The filling process goes from top to bottom. You have to write with a Blue/black Ink pen in four sections.

The PDF of the RTGS Form example for you

1. Header Section

- You have to start with the header, first, write the date, and PAN Card number.

- On the left side, enter your branch name.

- Under “Please remit through NEFT/RTGS”, you have to put the amount in (Figures + Words) clearly.

- You have to tick the correct box – cash, debit my account, or cheque.

2. Applicant (Remitter) Section

- Write down your Account Number, Full Name, and Mobile in CAPITAL LETTERS in Boxes.

- If using a cheque, provide the Cheque Number & Date.

- Enter your passbook-registered address.

3. Beneficiary Section

- This section belongs to where your money will be credited.

- Here, put down your Beneficiary’s Name, Account Number (twice for confirmation), Bank Name, Branch, and correct IFSC Code.

- Optional: Add a message in “Sender to Receiver Information.”

4. Signature & Declaration

- Signature must exactly match bank records; otherwise, the form will be rejected.

- Sign clearly in the Customer Signature section; if a joint account, multiple signatures are required.

Tip for you – The bottom section is your customer acknowledgement slip, which the branch counter gives you as proof of transaction with a bank stamp.

How much time does it take for a Transfer via an Indian Bank Branch

As per RBI policy, RTGS is to be settled in a just 30-minute cycle. Due to branch overload, you may feel delayed, as the location of your home branch, and it may take up to 3 hours during working hours.

- NEFT (Branch): Usually, credited within 2–3 hours during working hours.

- RTGS Form accepting timing: Usually, you can visit the best time from 10:30 to 1:30 AM before lunch. 10:00 AM – 2:00 PM (1st, 3rd, 5th Saturdays).

- Closed: Sunday, 2nd, and 4th Saturday.

- Alternative – Online Net/Mobile Banking: Available 24×7 (even on holidays, branch closed timings).

Charges for NEFT/RTGS in Indian Bank

| Type | Amount | Charges* |

|---|---|---|

| NEFT (Branch) | Any value | ₹2.50 – ₹25 + GST |

| RTGS (Branch) | ₹2–5 lakh | ₹25 + GST |

| RTGS (Branch) | Above ₹5 lakh | ₹50 + GST |

| Online (Net/Mobile Banking) | Any amount | Usually Free |

Note: You may find slightly different charges at the branch as per the RBI/Indian Bank.

Where to Download the Form PDF

- From the Indian Bank official website (Downloads section), not active now.

- From reliable portals like TaxHeal or Scribd.

- You can get the form directly at the branch table near the withdrawal and cash counter. You also ask the bank staff.

| Online Link | |

|---|---|

| Original RTGS PDF | Download Link (English) |

What are the Mistakes to avoid for a quick transfer?

| Mistake | What Happens | Solution |

|---|---|---|

| Not writing in CAPITAL LETTERS | The application may be rejected | Don’t miss blocks while entering digits or words / CAPITAL letters (ABC) |

| Wrong IFSC code | Transfer fails or is delayed | Verify with the beneficiary before submitting |

| Incorrect account number | Funds may go to the wrong account | Enter twice carefully, double-check digits |

| Signature mismatch | Form rejected immediately | Sign exactly as per the PAN printed. You can check your PAN Card. |

| Amount mismatch (figures vs words) | Delay or rejection | Ensure both are identical |

| Not ticking the payment mode | The bank won’t know how to process | Tick Cash / Cheque / Debit clearly |

| Leaving the declaration unsigned | Request invalid | Sign where required (all applicants) |

Does the Indian Bank RTGS form PDF accept in all branches?

No, the Indian Bank RTGS form doesn’t work or is not accepted in the printed version; you have to visit the RTGS branch and ask for an original copy of the form.Can I download the Indian Bank RTGS form PDF for free?

Yes, the RTGS/NEFT form PDF is available free of cost on the Indian Bank’s official website. Simply go to Forms Centre, common forms, tap on RTGS/NEFT or can be collected directly at branches.

Is the Indian Bank RTGS form available in Hindi also?

Yes, Indian Bank provides RTGS/NEFT forms in both English and Hindi. Customers can request the preferred language, such as their local language, at the RTGS-selected branch. Also, it may work as a bilingual.

How long does RTGS actually take when done from a branch?

Officially, RTGS settles in 30 minutes, but branch workload matters. Realistically, expect 1–3 hours during working time, especially in busy urban or lunch-hour slots.

Do I really need an RTGS form if I already have internet banking?

Yes, but only at the branch. For cash, cheque, or assisted transfers, the form is compulsory. Online RTGS/NEFT through Indian Bank net banking works 24×7 without any form.

What is the most common reason Indian Bank RTGS forms get rejected?

Signature mismatch tops the list. Branch staff reject instantly if it differs from the records. Tip: Sign exactly like your account opening form, not Aadhaar or casual daily signatures.

Why does the branch insist on writing details in CAPITAL letters?

CAPITAL letters reduce digit and name mismatch during backend processing. Small handwriting errors can delay RTGS by hours. Tip: write slowly inside boxes, especially account numbers and IFSC.

Is downloading the RTGS PDF better than taking it from the branch?

Branch-issued forms are safer. Some printed PDFs are not accepted due to format or clarity issues. For urgent transfers, always pick the original form kept near the cash counter.

Can Allahabad Bank account holders still use this RTGS form?

Yes. After the merger, Allahabad Bank accounts are fully treated as Indian Bank accounts. The same RTGS/NEFT form, IFSC logic, and charge structure applies across all branches.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.