To serve this large number of 20 cr users efficiently and securely, PNB assigns each customer a unique identifier known as the Customer ID.

Your PNB Customer ID is a unique identification number assigned to you when you open an account.

What Does a Customer ID Look Like in Punjab Bank?

It could be 7 to 9 digits long, and in some cases, it may start with letters (called an alphanumeric ID).

It may be numeric (e.g., 56214789) or alphanumeric (e.g., AGY002525) depending on your region or branch setup.

It acts like your digital identity in the bank’s internal system.

When did PNB ask for your CIF?

Your PNB CIF Number is used in various essential banking functions and services. Here are a few examples:

- SMS Banking Registration

- Accessing your PDF e-statements

- Internet Banking login

- PNB One mobile app registration

- Lodging complaints

- KYC updates and more

Knowing your customer ID or CIF is very important; it saves your time, visits to a bank branch, and helps you to access all your offline and online banking services easily.

To retrieve it, let’s start with one of the easiest methods offered by PNB Bank –

How to Retrieve PNB Customer ID Using Only a Mobile Number

If your mobile number is linked to your bank account, PNB offers multiple OTP-based retrieval options.

1. PNB One App: Without Login

Yes, in 2025, this is still one of the fastest ways to retrieve your ID directly from your smartphone. All you need is the internet and a registered mobile number. Here are the steps to follow –

- First, you need to install the PNB One App. If you already have it, make sure it is the latest version.

- Open the app dashboard and accept the Terms of the app and tap on Next.

- Tap “Proceed to Login”.

- Select “Trouble Signing In?”, then choose the “Check Your User ID” option.

- Enter your full 16-digit Account Number.

- Now, select your DOB or enter your 10-digit PAN Card number and tap on the verify button.

- You will receive an OTP on your registered mobile number.

- Enter the OTP, and your Customer ID will be displayed on the screen.

Tip: Your User ID is your customer ID in PNB Keep a record of it in your private notebook for future use.

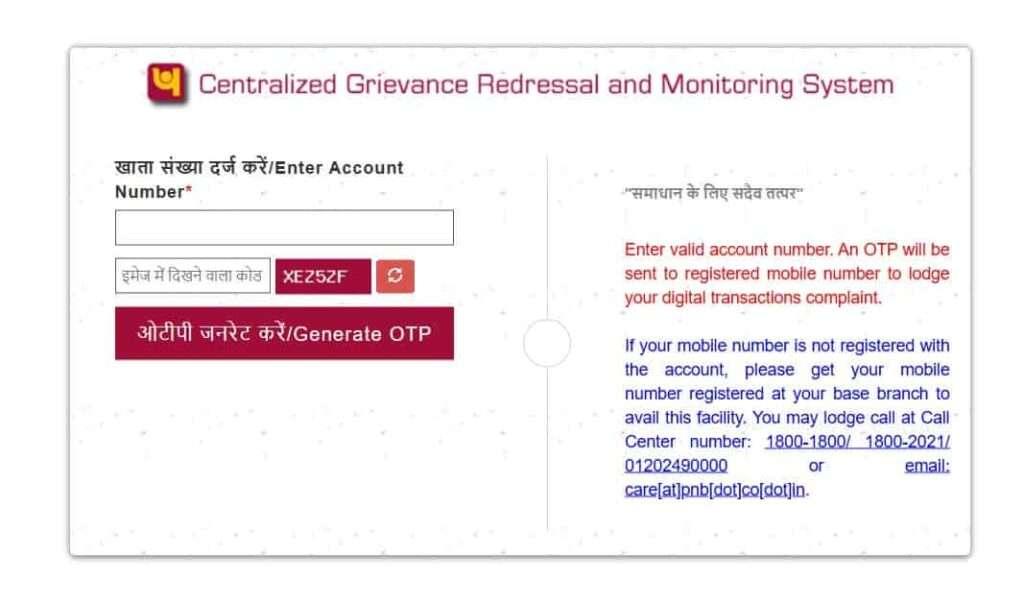

2. Complaint Portal Method

If you only have your account number on hand, you can still recover your PNB CIF no. Follow these steps:

- Visit the PNB Complaint Portal: PNB Complaint Portal.

- Enter your account number and the captcha shown on the screen.

- You’ll receive an OTP on your registered mobile number.

- Select any complaint option, such as “Failed Transaction”.

- Enter the OTP and tap Submit.

After submission, your customer ID, along with your account holder’s name and other details, will be displayed. You can print it too.

Which Digital Methods Help You Find Customer ID Without Logging In?

There are user-friendly, no-login methods for retrieving your CIF online.

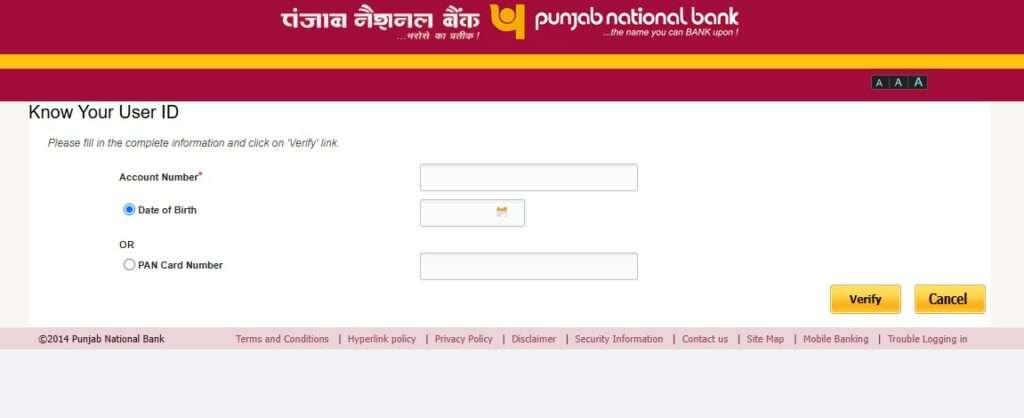

1. PNB Net Banking Site:

Here, you do not need to enter login credentials, and no need to download the PNB One app. Here, you need a web browser and your account number. Let’s check how it works –

- Visit the official website of PNB Bank and tap on the Retail Internet Banking Portal.

- Click on “Know Your User ID”, just below your login section.

- Enter your 16-digit account number, DOB or PAN, and registered mobile number.

- An OTP will be sent to your phone—enter it.

- Your Customer ID (same as User ID) will be shown on the screen.

2. Alternative: PNB WhatsApp Banking

- Save +91-9264092640 and send “Hi”

- In the main menu, contact the staff.

- Ask for User ID help or type “Know CIF”

Where to locate the customer ID directly in Digital Banking

If you already use PNB Internet Banking Portal, follow these methods –

- Go to Account Overview > My Profile

- Your CIF will appear under account details

On the PNB One app:

- Tap Services > Profile Details

- Find Customer ID alongside account info

Who Can Retrieve Customer ID? Eligibility Criteria Explained

According to the PNB security norms, only users meeting the following criteria can access their CIF digitally:

- Must be an active account holder

- The mobile number must be linked to a bank account

- The account should not be dormant or closed

- Details like PAN/DOB should match bank records

If you do not match these criteria but are looking for your customer ID, you can simply contact the bank here –

PNB Customer Care Numbers (Toll-Free 24/7):

- 1800 1800

- 1800 2021

They need to verify you first, but once it’s complete, you can get your CIF no easily.

Email Support:

You can also visit the nearest branch using the PNB Branch Locator. Bank staff will assist you in retrieving your ID.

Tip: Carry a valid ID proof when visiting a branch for verification.

Bonus for you: If you are not comfortable with online methods and are having trouble, you have to use the traditional method and look at each document you have, such as your bank passbook, welcome letter, welcome email (received just after full KYC), Cheque book, Printed Bank statements, and your credit card statement.

Before You Go – Read These Quick Answers

Where is the customer ID in the PNB passbook?

It’s usually printed on the front page as “Customer ID,” “CIF No.,” or similar near the account details section below your name and account number.

Can I get my PNB Customer ID by SMS?

PNB does not currently offer a direct SMS method to retrieve your Customer ID. But you can use the PNB one method to get it directly.

Is my User ID the same as my Customer ID?

Yes, by default, according to the PNB FAQs Portal, your User ID for PNB Internet Banking is the same as your Customer ID.

Can I find my Customer ID in a credit card statement?

Yes, if you are a PNB credit card holder, your CIF number (Customer ID) is listed in the statement.

What does a PNB Customer ID look like (example)?

It’s usually 7 to 9 digits, and sometimes alphanumeric. For example: A12345678, AGY002565, or R23456789.

What exactly is a PNB Customer ID, and how is it different from an account number?

Your Customer ID in Punjab National Bank is your permanent banking identity. It links all accounts and services, while account numbers are product-specific and can change.

What should I do if all online methods fail to show my Customer ID?

You have to visit your nearest PNB branch with Aadhaar or PAN. Branch staff can retrieve your Customer ID instantly after verification. This remains the most reliable offline solution.

Who is eligible to retrieve Customer ID digitally at PNB?

Only active account holders with a linked mobile number and matching PAN or DOB can retrieve CIF online. Dormant or mismatched accounts usually require branch verification.

Where can I see my Customer ID after logging into PNB digital banking?

Once logged in, go to Profile or Account Overview. Your Customer ID is clearly displayed alongside account details in both the PNB One mobile app and the internet banking dashboard.

Can I find my Customer ID without logging into net banking?

Yes. PNB’s net banking portal and PNB One app both offer OTP-based “Know User ID” options, allowing CIF retrieval without entering any existing login credentials.

What is the fastest way to retrieve Customer ID using only my mobile number?

The PNB One app’s “Trouble Signing In → Check User ID” option is fastest. With account number, DOB or PAN, and OTP, your Customer ID appears instantly.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.