What Statement Options Does KVB Offer: Digital vs. Physical?

KVB offers two types of statements for savings and current account holders:

| Type | Description | Charges |

|---|---|---|

| E-Statement | Delivered as a PDF to your email (monthly, weekly, daily) | Free for monthly, ₹200/month for daily |

| Printed Statement | Physical copy collected from the branch | ₹100–₹200 depending on pages |

Best Choice: Monthly email statements are password-based, free, faster, and easier to store.

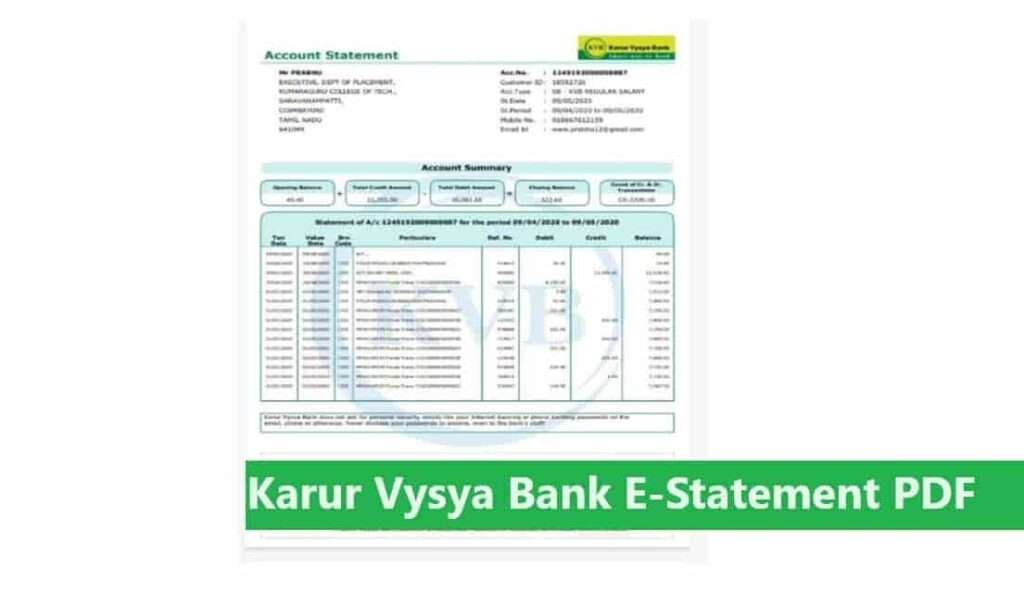

Decoding the Karur Vysya Bank Digital statement

Karur Vysya Bank Digital statements include all your banking information, like deposits, withdrawals, transfers, and any applicable charges during the period.

These e-statements are sent as password-protected PDF files to your registered email ID, ofcourse, to ensure both security and convenience.

Why Use Digital E-Statements Instead of Printed Copies?

Digital statements are:

- Instant: No need to visit a branch

- Secure: Password-protected PDF

- Eco-Friendly: Paperless banking

- Accessible: Open anytime via phone or computer

Let’s check it out –

What is the password for the KVB Bank statement PDF?

To unlock your e-statement PDF, the Karur Vysya Bank (KVB) use your customer ID as your password format to make it simple to use and ensure safety as well.

It’s usually:

- 8 or 10-digit number

- mentioned on your passbook and chequebook

Example: If your CIF is 881293113 That’s your password; no special characters, symbols, or spaces are required. However, you can view your statement in both Internet banking and mobile banking without a password.

Which Ways Can Help You Find Your KVB Customer ID?

It happens a lot; usually, most account holders forget or don’t know their customer ID. Don’t worry if this happens to you. Here’s how to find it easily –

- Missed Bank Banking: Good news, The KVB offers the direct Know Your Customer ID Facility via missed call alert. All you have to do is dial 08882101234 from your registered mobile number, and you will receive your Customer ID via SMS.

- Check your bank documents: Usually, your customer ID is printed first page of your KVB passbook. Also, check your welcome kit, old statements, chequebook, and bank documents.

- KVB D-Lite App: Simply open your KVB Bank Mobile banking. Log in with the 6 digits of your MPIN, navigate to the account overview, and view your customer ID.

- Visit your Home Branch: Drop by your KVB branch and ask a bank representative for help. Also, carry your documents to verify your account.

For more details, read this – KVB Customer ID Find Steps

Where to Find and Download Your KVB Bank Statement PDF?

- Go to your inbox and find the received email from KVB Bank.

- Scroll down to the end of the email to find your attached PDF File.

- Tap on the Save button to download it to your device.

- Now, when you try to open the PDF, a prompt will ask you for a password.

- Please enter your customer ID exactly as it is.

- If you enter the password correctly, the PDF will unlock, and you can view your bank statement.

What to Do If You’re Not Receiving KVB Statements?

If your statement hasn’t arrived:

- First, look at your Spam, Trash, and Promotional folders.

- Update your email under App Settings

- Request a copy via Net Banking or a branch

- Re-register via the DLite App. Here are the steps –

- Download the KVB – DLite & Mobile Banking app from the Google Play Store or Apple App Store.

- Log in using your 6-digit MPIN.

- Go to Services and tap on E-Statement Registration.

- Update your email ID and enter the OTP received on your registered mobile number.

Once the service is successfully started, your generated statement will be sent to your email ID each month.

Smart Fixes for KVB PDF Statement Problems

| Hidden Issue | Real Cause | Uncommon But Effective Fix |

|---|---|---|

| PDF opens blank screen | Battery saver blocks background apps | Turn off Battery Saver / Data Saver, reopen the PDF |

| File name scrambled or shows .bin format | The Email app corrupts file extension | Download via browser (Gmail.com) instead of email app |

| PDF not showing in inbox | Inbox filters or tabs hiding it | Search “KVB e-statement” in your email search bar manually |

| Password still not working | Autofill adds invisible space | Type password manually – don’t use copy-paste or keyboard suggestion |

| Attachment missing on mobile | Light inbox version opened | Open mail on desktop view or enable ‘Load all content’ in Gmail settings |

If none of these steps work, you can call the latest and working KVB customer care number 1860 258 1916 (India) or +91 44 – 66217600 (international) for help.

FAQs You Need

Can I change my KVB e-statement password?

No, the password is system-generated for security reasons. You must use the customer ID as instructed in the email.

What should I do if my KVB e-statement email is missing?

Check your spam/junk folder. If it’s still missing, update your email ID in the KVB Mobile App or contact customer support.

Can I request my KVB e-statement for previous months?

Yes, log in to KVB Net Banking or the Mobile App to download past statements or request them from your branch.

Can I get a mini statement via WhatsApp from KVB?

Yes! Send a WhatsApp message with “Hi” to 9176994444 from your registered mobile number to get your mini statement instantly.

Can I get my KVB statement without Customer ID or NetBanking?

Yes. Use the KVB DLite App with debit-card authentication and OTP to generate MPIN, then download the statement directly.

Why doesn’t my statement show UPI sender names?

KVB hides detailed payer information for privacy. View full details inside your UPI app or use UTR tracking in NetBanking.

Can I download only salary transactions from KVB?

Yes. In DLite, choose Account → Statement → Filters → Credit Only. If employer tags exist, salary transactions appear clearly.

Why is my PDF opening blank on mobile?

Battery saver or low memory blocks for PDF rendering. Close background apps, disable battery saver, or reopen the file in a better PDF viewer.

Does KVB use the same PDF password for savings and current accounts?

Yes. KVB uses the same Customer ID–based password for both savings and current accounts. The account type doesn’t change the PDF password unless the bank officially updates security policy.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.