India is preparing for a historic transformation in its banking sector — one that could change how money moves, how credit flows, and how Indian banks stand on the world stage.

By FY 2026-27, as per the Finance ministry press conference, the government plans to merge 12 public sector banks (PSBs) into just 4 mega-banks — each large enough to compete with top global lenders.

Unlike the earlier 2019-20 merger wave, which focused on survival and cleanup, this new plan aims for global competitiveness, not just domestic efficiency.

Upcoming Bank Merger – The Big Plan

According to reports from Economic Times, Moneycontrol, and Finance Ministry insiders, the Nirmala Sitharaman-led Finance Ministry has already started groundwork with the RBI to finalize which PSBs will merge, who will anchor them, and how the new entities will be structured.

| Category | Bank Name | Likely Anchor / Merging Into | Govt Stake (%) | Future Role |

|---|---|---|---|---|

| Large PSU Bank | State Bank of India | – | 57.5% | Remains India’s largest; global presence to expand |

| Large PSU Bank | Punjab National Bank | Will anchor UCO Bank + Punjab & Sind Bank | 73.15% | National expansion, retail + MSME focus |

| Large PSU Bank | Bank of Baroda | May absorb Indian Overseas Bank + Bank of Maharashtra | 63.97% | South-India expansion + trade finance |

| Large PSU Bank | Union Bank of India | Possible anchor for Bank of India + Central Bank of India | 83.49% | Corporate and infra lending powerhouse |

Why It Matters for You

- Global Ambition: To rank among the world’s top 50. The goal is to create 4 Indian banks with a combined balance sheet strong enough to compete.

- Ease of Credit: Fewer, stronger banks simply benefit you; you will get faster loan approvals, lower interest rates, and easy-to-find branches. Also, it provides easy credit, especially for MSMEs and infrastructure projects.

- Better Stability: Large banks can absorb shocks, manage NPA risks, and scale operations faster.

Unlike smaller regional banks that struggle with technology and compliance, these four upcoming indian giants will carry the digital backbone and global scale India needs for modern banking.

The Expected Transformation by FY 2026-27

| Parameter | Current (2025) | After Merger (2026-27 Target) |

|---|---|---|

| No. of PSU Banks | 12 | 4 Mega Banks |

| Total Assets | ₹171 lakh crore | ₹230+ lakh crore (est.) |

| Global Ranking | None in Top 50 | 2–3 banks likely to enter Top 50 |

| Market Share | ~60% | 75%+ of India’s banking market |

| Target Year | — | FY 2026-27 |

What’s Next for India’s Banking Future

If executed as planned, this move could mark the start of India’s Banking 2.0 era —

- where SBI, PNB, BoB, and UBI become India’s “Big Four”,

- where every Indian business — from a small trader in a village to an industrial exporter — gets faster credit through stronger, tech-driven banks,

- and where Indian banks no longer just follow the global financial system — they lead it.

Unlike the past, this is not just another merger.

It’s India’s statement to the world — “We’re building banks the world will recognise.”

EaseMoney View — How We See It

The 2026 PSU Bank Plan could redefine India’s banking strength for decades.

At EaseMoney, we see this as the foundation of India’s global banking rise, not merely a domestic reform.

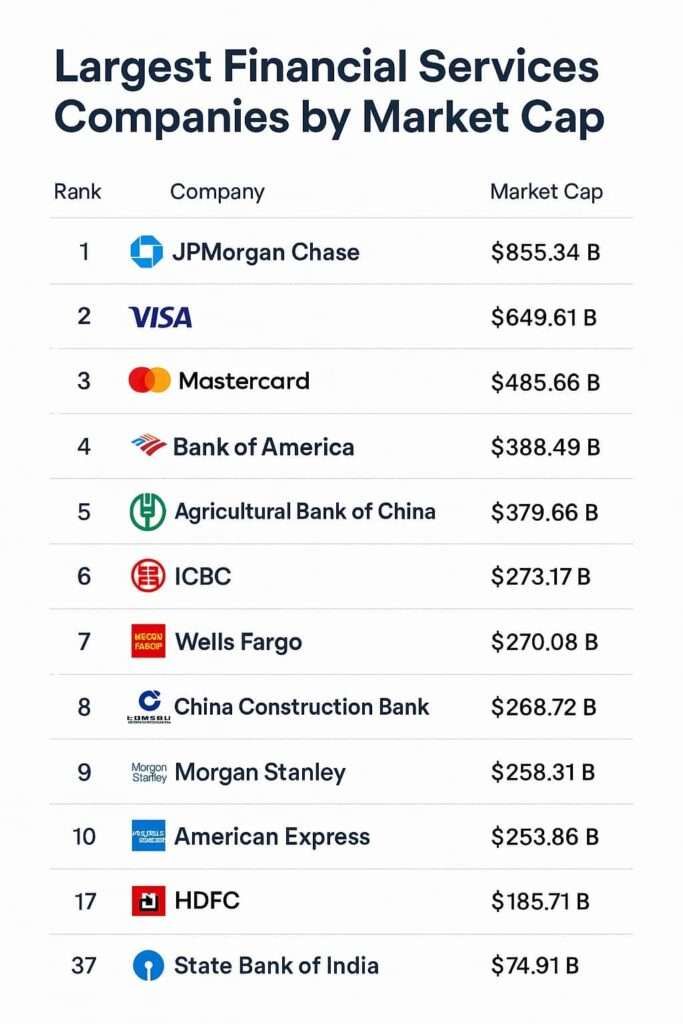

Let’s look at the global picture:

| Global Financial Leader | Market Cap (USD) | Position |

|---|---|---|

| JPMorgan Chase (USA) | $855.34 Billion | #1 |

| Bank of America (USA) | $400+ Billion | #2 |

| Agricultural Bank of China | ~$390 Billion | #3 |

| HDFC Bank (India) | $183.54 Billion | #17 |

| ICICI (India) | USD 107.99 | #34 |

| SBI (India) | USD 100B | #37 |

| Post-Merger PSU Giants (Estimated) | $200–250 Billion (combined) | Potential Top 10 |

Source: https://companiesmarketcap.com/largest-financial-service-companies-by-market-cap/

Unlike private banks that grow independently, this merger gives public banks the combined capital and scale to finally compete with the likes of JP Morgan and Bank of China.

If India executes this right, we’re not far from seeing an Indian bank enter the world’s Top 10 list — a milestone that could happen before 2030.

Final Word

The 2026 Bank Plan isn’t just about merging institutions — it’s about merging ambitions.

It signals India’s readiness to build world-class banks, capable of serving both local trust and global growth.

More – Upcoming SBI Merger 2026: How Indian Govt Plans to Create a $1 Trillion Superbank