2:30 PM, 12 November 2025 – Every time you pay at the grocery store, transfer rent, or scan a QR for groceries, that small action quietly counts in a digital network that never sleeps. The system counts every single payment, even for 1 Rs.

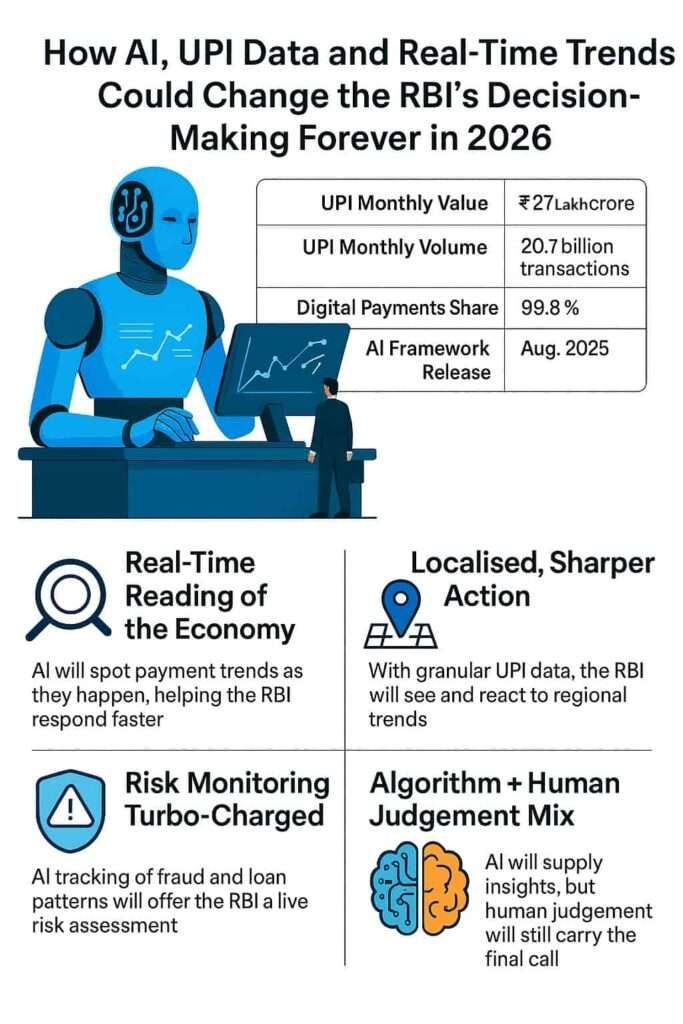

In October 2025, India touched a new milestone: As per NPCI reports and data, 20.7 billion UPI transactions worth ₹27.28 lakh crore.

In the same period, 99.8% of all transactions in India were digital, as per the RBI’s half-yearly payments report.

This flood of live financial data is now reshaping how the Reserve Bank of India (RBI) sees and steers the economy. And in 2026, the transformation will go a step further — powered by Artificial Intelligence (AI) and Machine Learning (ML).

RBI’s Big AI Shift

For the last 100 years, the RBI worked with delayed data, mostly quarterly surveys, slow inflation updates, and scattered bank reports. That old rhythm is ending. or we can say reshaping.

The central bank is now building AI-driven systems that can track and interpret digital payments, credit patterns, and risk signals in real time.

Here’s what’s already happening inside the RBI:

| AI Initiative | Purpose | Description |

|---|---|---|

| Digital Payments Intelligence Platform (DPIP) | Fraud Detection | An AI system to flag suspicious digital transactions instantly and reduce payment fraud. |

| MuleHunter.ai | Cybercrime Tracking | Detects “mule accounts” used for laundering or scams. |

| AI for Supervision | Risk Monitoring | RBI has engaged McKinsey and Accenture to deploy AI models for predicting stress in banks and NBFCs. |

| AI in Monetary Policy | Data Insights | Models are being tested to read spending and inflation patterns more accurately. |

The FREE-AI Framework — RBI’s Rulebook for 2026

In August 2025, RBI released the Framework for Responsible and Ethical Enablement of AI (FREE-AI) — a 200+ page report that sets the code for how banks and fintechs can safely use AI.

It introduces 7 guiding “Sutras” and 6 strategic pillars, balancing innovation with trust.

| Guiding Principles | Strategic Pillars |

|---|---|

| Trust is the foundation | Infrastructure (AI sandboxes, shared data systems) |

| People first | Capacity (training, upskilling) |

| Innovation over restraint | Policy (board-approved AI policies) |

| Fairness and equity | Governance (accountability, explainability) |

| Accountability | Protection (consumer safeguards) |

| Understandable by design | Assurance (AI audits and validation) |

| Safety and sustainability | — |

The framework insists that AI systems used by any financial institution must be:

- Transparent: People must understand how AI decisions are made.

- Accountable: Boards and regulators must own outcomes.

- Auditable: Independent reviews and bias testing are mandatory.

What Changes in 2026

The RBI’s new AI and data systems could make India’s financial management faster, safer, and more responsive.

- Faster economic reading: AI will track shifts in UPI and RuPay card payments daily, and it can spot dips in consumption or liquidity before traditional data arrives.

- More local insights: RBI could identify region-specific trends. A slowdown in eastern India or a credit surge in western states can trigger targeted bank guidance.

- Stronger fraud and risk detection: AI will analyse patterns from millions of transactions to detect next risks, such as loan-app scams or unusual fund transfers. such as most Fraud nowadays starts from UPI.

- Data-driven transparency: With the FREE-AI framework, every algorithm influencing monetary or regulatory decisions must be explainable, not just a black box.

- Human + AI teamwork: AI handles the speed and scale; RBI economists add context. these Both, machine logic and human sense will define India’s 2026 policy style.

The Data Powering India’s Digital Economy

| Indicator | Latest Figure (as of Oct–Nov 2025) | Source or Significance |

|---|---|---|

| UPI Monthly Value | ₹27.28 lakh crore | NPCI data – real-time consumer spending flow |

| UPI Monthly Volume | 20.7 billion transactions | Shows the pulse of day-to-day digital activity |

| Digital Payments Share | 99.8 % (H1 2025) | RBI Payments Report – India is almost fully digital |

| RBI Repo Rate | 5.50 % | PIB – sets the tone for lending & EMIs |

| AI Framework Release | Aug 2025 (7 “Sutras” & 26 guidelines) | RBI’s blueprint for safe & transparent AI use |

| Illegal Loan Apps Flagged | 3,500+ (2023–24) | RBI report – shows growing need for AI monitoring |

Challenges Ahead

The RBI calls its approach “optimistic vigilance,” but AI promises smarter governance; it also comes with challenges, such as great power comes with great responsibility such as high setup costs, data quality gaps, a shortage of skilled experts, and the risk of overreliance on algorithms.

A festive spending surge could be mistaken for long-term growth, or an AI model could misjudge risk because of incomplete data. That’s why the RBI’s emphasis is clear: AI should assist, not decide. It collects or repeats data, but needs experts who suggest.

Easemoney Insight

2026 won’t just mark another tech milestone — it’ll redefine how India’s economy is read and reacted to.

AI and UPI data will give the RBI a real-time pulse of the nation’s financial health — from a ₹40 breakfast payment to a ₹20-crore corporate transfer via RTGS.

Unlike before, when policy reacted to lagging signals, the RBI could now predict stress before it spreads — making India’s monetary system faster, fairer, and far more resilient.

RBI Archive –