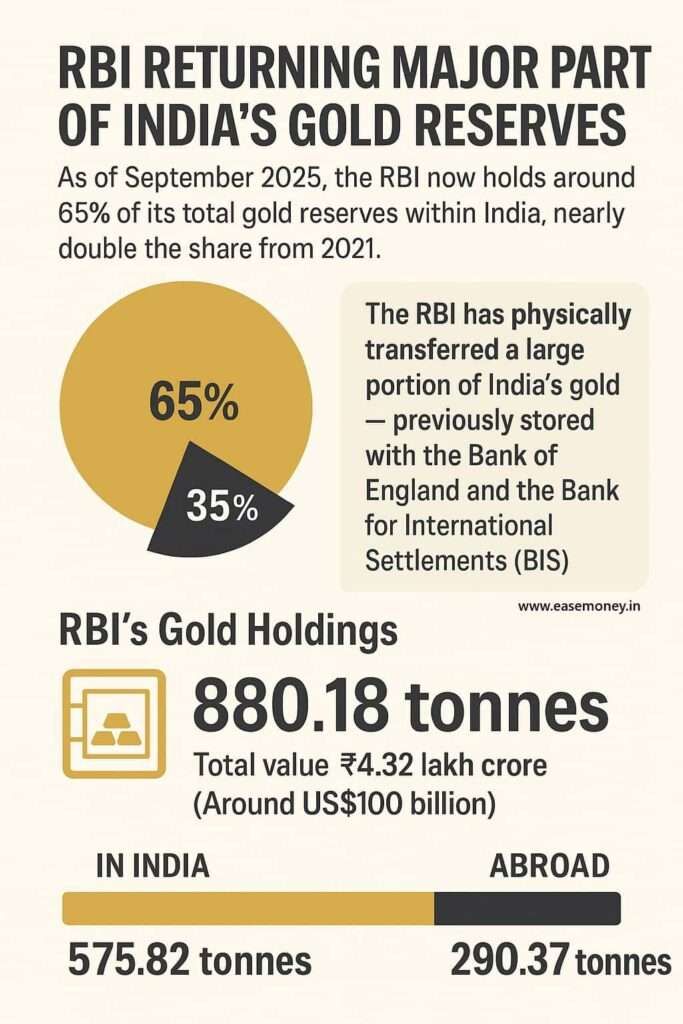

New Delhi, October 29, 2025 – The Reserve Bank of India (RBI) has brought a major part of India’s gold reserves back to the country. It is a pure strong shift for india in national assets. As of September 2025, the RBI now holds around 65% of its total gold reserves within India, nearly double the share from 2021.

This move, in simple words, the RBI has physically transferred a large portion of India’s gold — previously stored with the Bank of England and the Bank for International Settlements (BIS) Now, it is into secure domestic vaults of the country, giving the central bank greater control over its bullion.

According to the RBI’s Half-Yearly Report on Foreign Exchange Reserves (October 2025), the central bank’s total gold holdings stood at 880.18 tonnes. The total value of those tonnes is ₹4.32 lakh crore (Around US$100 billion). Of this, 575.82 tonnes are now held in India, while 290.37 tonnes remain still in abroad, mostly in Europe.

RBI’s Gold Reserve Trend (2021–2025)

| Year | Total Gold (Tonnes) | Gold Held in India (Tonnes) | Share Held Domestically | Estimated Value (₹ Lakh Crore) |

|---|---|---|---|---|

| 2021 | 743.8 | ~245 | 33% | 2.2 |

| 2022 | 785.8 | ~300 | 38% | 2.8 |

| 2023 | 794.6 | 380 | 47% | 3.1 |

| 2024 | 822.1 | 460 | 56% | 3.7 |

| 2025 | 880.2 | 575.8 | 65% | 4.32 |

Sources: RBI Half-Yearly Reports, World Gold Council (Oct 2025)

Why RBI Is Bringing More Gold Home

- Better Control and Security – Storing gold domestically gives the RBI full physical access and now has no dependence on foreign custodians.

- Global Geopolitical Risks – After the freezing of Russian assets in 2022, many central banks, including the RBI, started keeping more of their reserves at home, in their own vaults. It helps to avoid potential sanctions or restrictions of any kind.

- Rising Gold Prices – The value of RBI’s gold holdings rose by around 57% over the last 18 months, mainly due to higher international gold prices.

- Diversification from Dollar Assets – If you don’t know, Gold is being used as a hedge against the U.S. dollar’s volatility. it is following the global trend of reserve diversification.

How India Compares Globally

| Country | Share of Gold Held Domestically | Trend Since 2020 |

|---|---|---|

| India | 65% (↑ from 33%) | Increased repatriation from UK/BIS |

| Germany | 75% | Partial return of gold from the US |

| China | 100% | All gold held domestically |

| Turkey | 95% | Shifted from BIS to domestic storage |

| Russia | 100% | Full domestic storage post-sanctions |

Source: World Gold Council, IMF Data

Gold’s Rising Share in India’s Forex Reserves

| Parameter | Mar 2021 | Mar 2023 | Sep 2025 |

|---|---|---|---|

| Total FX Reserves (US$ bn) | 580 | 578 | 665 |

| Value of Gold (US$ bn) | 36 | 45 | 100 |

| Gold Share of FX Reserves | 6.2% | 7.8% | 13.9% |

Gold now accounts for nearly 14% of India’s total foreign exchange reserves, its highest share in more than a decade.

What It Means for India

- India’s move to bring back reserves shows RBI wants financial independence and safe money.

- By keeping more gold in India, the central bank ensures faster access, better plans, better strategies, more security over states, and greater transparency.

- The RBI has not made any major new purchases recently — the increase in value mainly reflects the global rally in gold prices, which are now above US$2,600 per ounce.

- The trend shows that central banks, including India’s, continue to view gold as a trusted and liquid asset during times of global uncertainty.

The RBI’s decision to hold nearly two-thirds of India’s gold reserves domestically is a clear signal of growing confidence in local storage, reserve management, and national financial security.

India’s gold is, quite literally, coming home.

More RBI Updates –