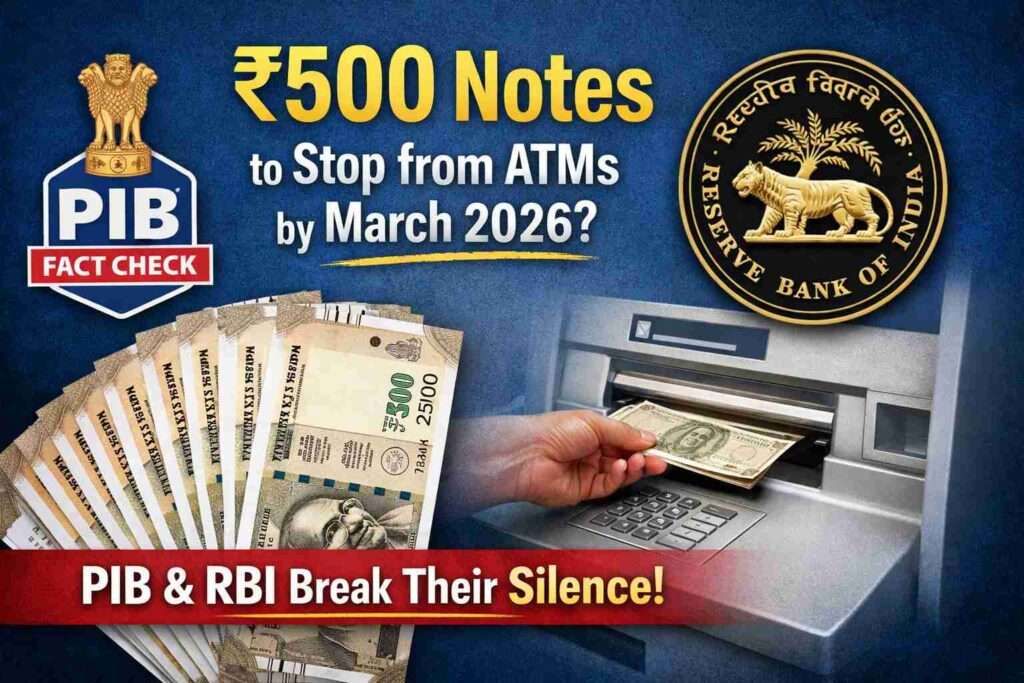

2:50 PM IST NEW DELHI – A viral wave of posts on social media such as Facebook, X (changed Twitter), WhatsApp Groups, and Telegram has sparked confusion about the status of the ₹500 currency note. These posts claim that the Reserve Bank of India will stop dispensing or withdrawing ₹500 notes from ATMs by March 2026. They are adding facts such as a 2000 Rs note already stopped at the ATM, now, this time a 500 Rs bill. A few posts on X and Facebook are saying: discontinue the denomination altogether.

This went viral and even at Google Trends, so the Press Information Bureau (PIB) has stepped in with a clear response: this claim is fake, and no such announcement has been made by RBI or any government authority.

PIB is a nodal agency by the Indian govt for real, fact-checked information by the government. They start PIB Fact checked X page to find and claim fake info, they act as the government’s official communication and fact-checking arm. When it issues a clarification, it reflects the government’s verified position.

Here’s What PIB Fact Check Clarified

In an official fact-check post on social media platform X, PIB clearly tells that several viral posts claiming the RBI plans to stop ₹500 note circulation are untrue. The statement reads:

- The claim that the RBI will stop ₹500 notes from ATMs by March 2026 is fake.

- The RBI has made no such announcement

- ₹500 notes have not been discontinued and remain legal tender.

In simpler words: your ₹500 notes are safe to use, just as they are today. There’s no official RBI circular, notification, or press release saying these notes will be phased out or removed from ATM circulation by any specific date.

Why This Claim Went Viral

The rumour appears to be a classic example of misinformation spread through social platforms:

- A viral video on YouTube and forwarded messages on WhatsApp made a range of claims. Including that banks would stop dispensing ₹500 notes by late 2025 and that ATMs would only release ₹100 and ₹200 notes by March 2026.

- Some posts loosely referenced past policy changes around smaller denomination notes, confusing the public.

- Similar claims were circulating months ago. This type of fake claim is easy to go viral because it is too familiar after the 2016 Indian banknote demonetisation.

- Most people do type of fake claim, sometimes just to get clicks on ads and make money and sometimes they got funding from different countries to make claims.

So while the content spreads fast, the foundation is flimsy and unverified.

Own Research Signals: Why People Get Worried

Through our own monitoring of social platforms and news reports, this misinformation gains traction because:

- Historical Context – India’s 2016 demonetisation, when ₹500 and ₹1,000 notes were suddenly invalidated, still lives in public memory. Any suggestion of big currency changes triggers fear and confusion faster than clarifications.

- ATM Behaviour Misinformation – Rumours about RBI directives on ATM note mixes (like increasing ₹100/₹200 notes) get mixed up with speculation about ₹500 notes, even when no formal policy exists.

- Viral Content Incentives – Sensational claims attract views and shares, even among users who mean well but don’t verify facts.

What the RBI Has Said

To be clear, RBI has not announced any plan to:

- Withdraw ₹500 notes from circulation.

- Stop dispensing ₹500 notes from ATMs by March 2026.

- Make ₹500 notes illegal tender.

As of today, there is no plan, no proposal, and no announcement to stop ₹500 notes from ATMs by March 2026.

Recent Story – ₹2000 Note Update: Still Valid or Exchangeable in November 2025?