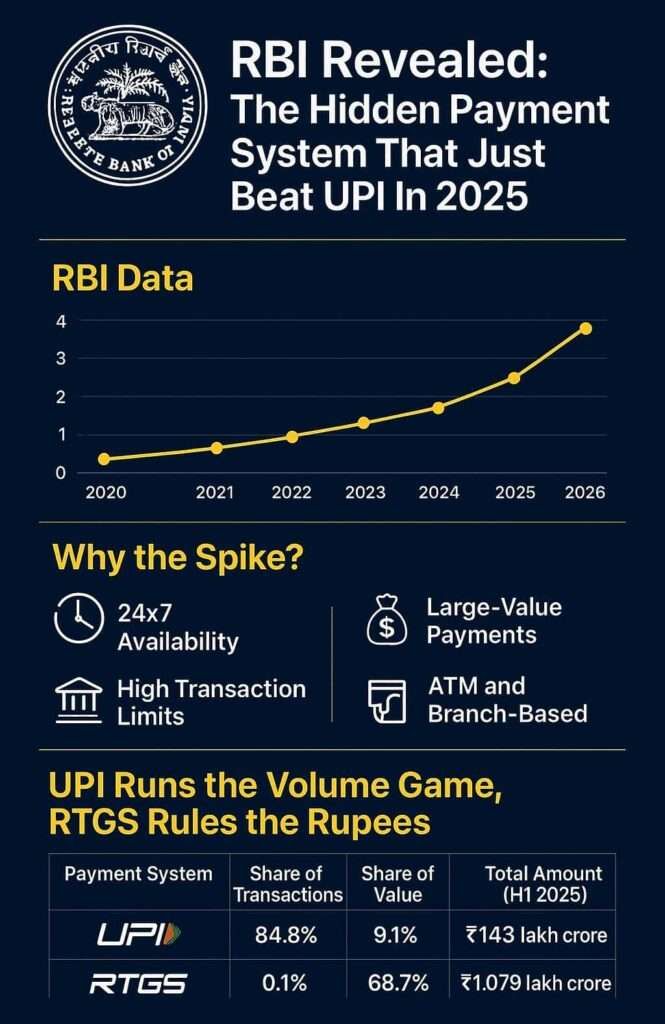

October 29, 2025: For years, the UPI has been the biggest face of digital payments in india – it is a trendy, quick, free, and universal payment system everyone uses. But in 2025, it’s the less flashy Real-Time Gross Settlement (RTGS) that has quietly taken the top spot when it comes to money moved.

As per the new data of the RBI half-yearly payments report (H1) 2025, RTGS processed a record ₹1,079 lakh crore between January and June 2025. It is seven times the value of all UPI transactions. During the same period. In contrast, UPI handled 10,637 crore transactions worth ₹143.3 lakh crore, UPI dominating in volume but not in value.

UPI Runs the Volume Game, RTGS Rules the Rupees

UPI remains India’s most used payment channel by far. From tea-stall payments to e-commerce checkouts, UPI has become the default mode for everyday transfers.

But on the other hand, RTGS is used for large-value transfers typically between banks, corporates, individuals, and institutions. It is capped at a minimum limit of ₹2 lakh while transferring. It handled barely 0.1 per cent of total digital transactions by count, yet contributed an astounding 68.7 per cent of total transaction value.

| Payment System | Share of Volume | Share of Value | Total Amount (H1 2025) |

|---|---|---|---|

| UPI | 84.8 % | 9.1 % | ₹143 lakh crore |

| RTGS | 0.1 % | 68.7 % | ₹1,079 lakh crore |

Source: RBI Payments Report 2025

Why RTGS Has Spiked So Dramatically

The RTGS boom isn’t a sudden surprise — it’s the outcome of steady digital transformation since 2020:

- 24×7 Access: Ever since RBI made RTGS available round-the-clock in December 2020, banks and corporates began shifting high-value transactions to digital channels.

- Corporate Treasury Digitisation: Large firms now settle vendor, salary, and interbank payments instantly instead of relying on NEFT or cheques.

- Liquidity Management: With volatile markets and tighter cash flow cycles, banks use RTGS for same-day liquidity adjustment. It works in a just 30-minute window; you can settle a payment almost instantly.

- Branch-to-Online Migration: Over 85% of RTGS transfers now happen online via internet or mobile banking, compared to just 40% in 2020. However, most individuals still find the Branch banking for larger payments reliable. They chose RTGS application forms.

- Government and PSU Payments: Ministries and state bodies increasingly rely on RTGS for high-value disbursals and fund settlements.

RTGS Value Growth: 2020–2025

| Year | RTGS Value (₹ lakh crore) | YoY Growth |

|---|---|---|

| 2020 | 1,378 | — |

| 2021 | 1,521 | +10.4 % |

| 2022 | 1,645 | +8.1 % |

| 2023 | 1,780 | +8.2 % |

| 2024 | 1,938 | +8.9 % |

| 2025 (H1) | 1,079 | +11.5 % (half-year) |

Source: RBI & EaseMoney Analysis

The Bottom Line

UPI powers the people, RTGS powers the system.

Together, they’ve made India a rare example of a nation where a chai payment and a ₹10-crore transfer both happen digitally — and instantly.