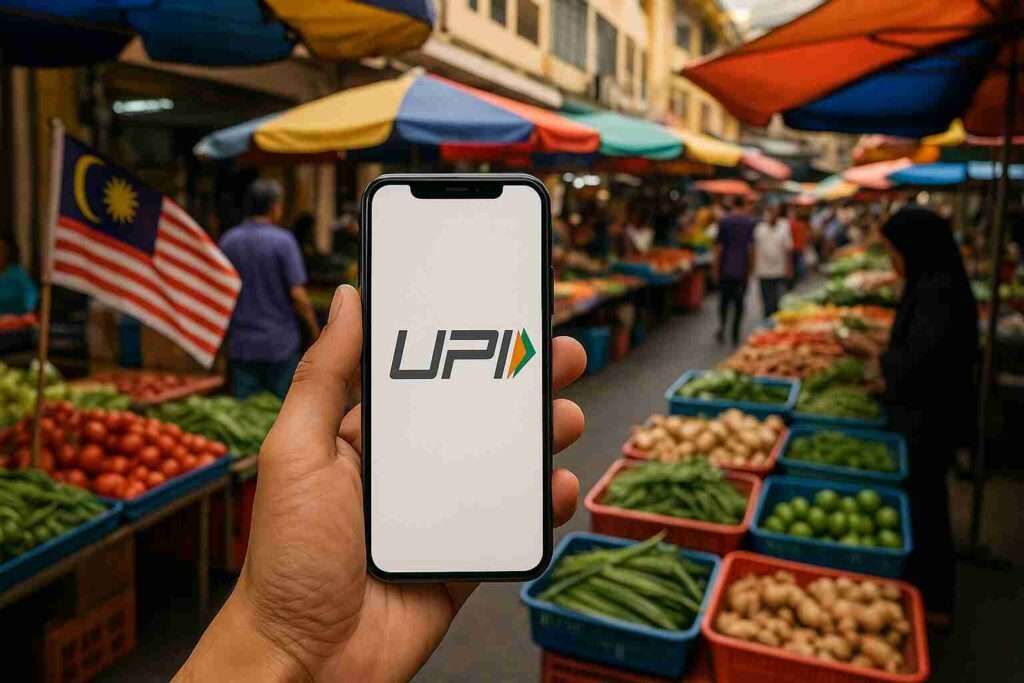

1:30 PM IST – Indian travellers visiting Malaysia will soon be able to pay just like they do at home — using UPI. A recent press release of Curlec says, Razorpay Curlec, a leading Malaysian payment company, has partnered with NPCI International to enable UPI payments directly at Malaysian shops, restaurants, and local businesses.

This allows Indians to pay in Malaysia using familiar apps such as PhonePe, Paytm, Google Pay, BHIM, and others. Payments reach Malaysian merchants instantly in Ringgit (RM) through Razorpay Curlec’s system.

Unlike earlier trips where indian travellers had to carry extra cash, ATM withdrawals with charges, or rely on debit or credit cards with high fees, this update makes spending in Malaysia simple, quick, and low-cost.

What’s New?

- Pay Malaysian merchants using your regular UPI app

- No new apps, no cards, no OTP issues

- Merchants receive money instantly in RM (Malaysian currency)

- Runs through Razorpay Curlec — no extra setup for businesses

In short: You scan with UPI → Malaysia gets the money instantly.

What Is Curlec?

Curlec is a Malaysian digital payments company that helps businesses accept money online. It became part of Razorpay India in 2022. Think of it as Razorpay’s Malaysian arm for the country, providing checkout tools, QR payments, subscriptions, and now UPI acceptance for merchants.

Why It Matters for Indian Travellers

In 2024, Malaysia continues to be one of the most popular travel place for million of Indians. In 2024:

| Travel Metric | Number |

|---|---|

| Indian visitors | 1 million |

| Money spent | RM 6.11 billion |

| Growth YoY | 71.7% |

Until now, Indian travellers commonly used:

- Cash

- Forex cards

- International debit/credit cards

- ATM withdrawals with added charges

UPI removes this hassle. It brings the comfort of scan-and-pay abroad, without worrying about conversion fees or card issues. However, please note that the bank will likely apply a foreign exchange conversion fee, which can range from 3% to 5%. This fee is the bank’s markup on the exchange rate

Why It Helps Malaysian Merchants

For local businesses, this tie-up means:

- Access to a large Indian tourist market

- Payments are settled directly in Ringgit

- No extra hardware or international card network fees

- Faster checkout and reduced payment friction

Curlec handles settlement on the backend, so merchants simply receive their money like any other local payment.

Important Clarification: This Is Merchant-Based UPI, Not Full UPI

This launch does not bring the full UPI cycle to Malaysia. It only allows payments to Malaysian merchants — Indian travellers cannot do peer-to-peer transfers, wallet-to-bank transfers, or local Malaysian UPI-style features.

India’s goal with global UPI is not to replace foreign payment systems but to offer fast, secure, low-cost cross-border payments that make travel and business easier and create a Win-Win situation for everyone. India wants UPI will dominate at the global level.

The Bigger Picture

UPI processed nearly 20 billion monthly transactions in September 2025.

With Malaysia now added, UPI’s global presence continues to grow alongside Singapore, the UAE, Bhutan, Nepal, Mauritius, and more.

What’s Next?

Expect UPI acceptance across popular tourist spots — malls, cafes, hotels, and local stores such as IOI City Mall, Malaysia McDonald’s, and more popular brands — making Malaysia one of the easiest countries for Indians to spend digitally.

UPI Global Archive – With Bahrain onboard, UPI now connects 9 countries — but how global can it really get?