News Desk, November 9, 2025 — Every day, millions of Indians buy tiny bits of gold through apps like PhonePe, Paytm, Jar, Google Pay, and Groww.

It feels effortless — open the app, tap Buy Gold, pay ₹10 or ₹100, and watch your “24K gold balance” grow.

But have you ever wondered where that gold actually is? Who stores it? Who checks it? And who really owns it?

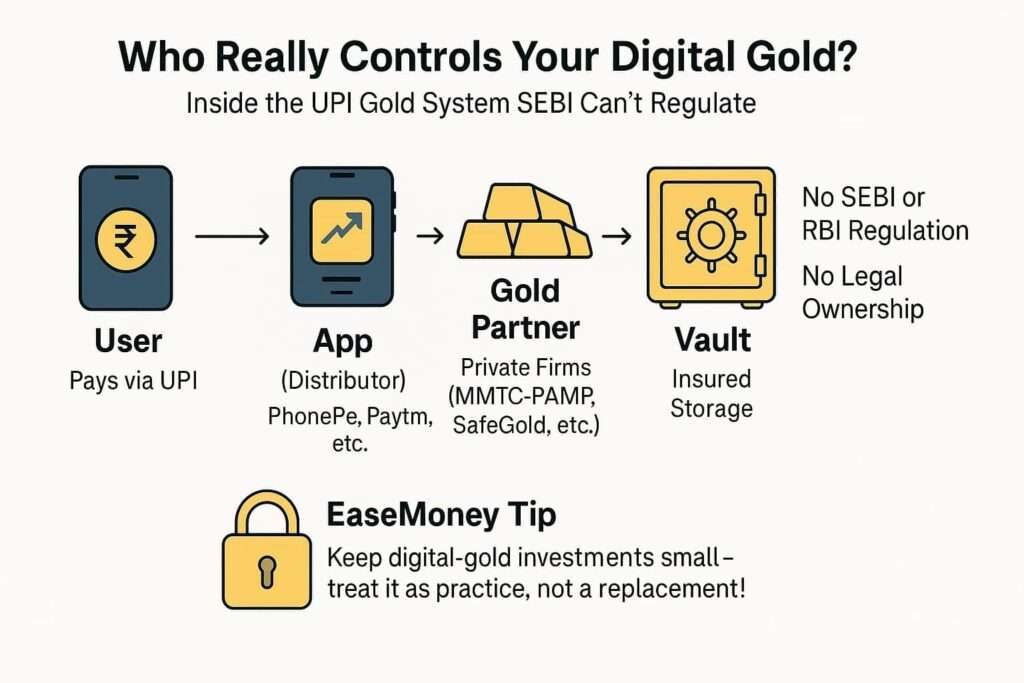

The Hidden Chain Behind Every UPI Gold Purchase

Let’s break down what really happens when you buy “digital gold”:

- You pay through your UPI app.

- The app doesn’t sell the gold — it just acts as a middleman.

- The app forwards your money to a private company — mainly one of three:

- MMTC-PAMP India Pvt. Ltd.

- SafeGold (Digital Gold India Pvt. Ltd.)

- Augmont Goldtech Pvt. Ltd.

- These companies claim they hold the same amount of real physical gold in a private, insured vault.

- You see your “digital grams” on the app screen — but you don’t legally own that gold bar; you just hold a promise that it’s there.

That’s the quiet reality of India’s digital-gold economy — a mix of fintech convenience and private trust.

The Core Players — and What Each Does

| Layer | Who They Are | What They Do | Regulator / Law Behind It |

|---|---|---|---|

| App (PhonePe / Paytm / Google Pay / Groww) | Fintech distributor | Provide you, an interface to buy, store, or sell small gold units | None — only general IT rules |

| Gold Partner (MMTC-PAMP / SafeGold / Augmont) | Private bullion company | Sells and stores physical gold claimed to match your digital units | No SEBI and RBI license: they usually hold a security trustee to safeguard customer interests |

| Vault / Logistics firm | Private vault operator (few examples for you – Brinks, Sequel, and more) | Keeps physical gold and insures it | Insurance + BIS standards only |

| You (Investor) | App user | Hold a claim or balance in digital grams | No legal ownership certificate |

In short, the entire system runs on private promises, not on any government regulation.

The Real Numbers

- India’s digital-gold market in 2025 is around – ₹4,000 – ₹5,000 crore a year, driven mostly by micro-purchases such as 10 rs.

- UPI payments have super-charged this trend — digital-gold transactions rose over 370 % in 16 months, according to The Economic Times.

- Average order value on PhonePe and Paytm? Between ₹250 – ₹500, mostly from younger users under 35.

- Industry trackers say there are now 5 – 6 million active digital-gold buyers across India.

The scale is massive — but the system remains entirely private.

What Keeps It “Safe” (and What Doesn’t)

What Exists:

- Gold is stored in insured vaults managed by the private partner.

- Many partners use third-party auditors to verify gold weight and purity.

- Insurance covers theft or physical loss, but only as per company policy.

What Doesn’t Exist:

- No RBI or SEBI officer audits these vaults.

- No public list of how much gold each company holds.

- No legal protection if a company fails, merges, or delays redemption.

- No investor-protection fund like in mutual funds or banks.

So, while your app might show a shining “24K Gold Balance”, in the eyes of the law it’s simply a private claim, not a regulated asset.

Inside SafeGold: A Closer Look

SafeGold — one of the largest players — is a product of Digital Gold India Private Limited, backed by the World Gold Council and InVent Capital.

- It is not approved or licensed by the RBI or SEBI.

- It holds gold in secure, insured vaults, not in a government depository.

- There is no government-appointed trustee overseeing customer holdings.

- Apps like PhonePe only distribute SafeGold’s product; they don’t own or store the gold.

If SafeGold ever faced operational issues, customers’ recourse would be limited to the company’s own terms, not a government system.

Why SEBI Stepped In

SEBI issued its caution after seeing:

- Fintech apps calling digital gold “safe”, “government-approved”, or “24K certified”.

- Apps offering digital gold as cashback for UPI or wallet use.

- Growing confusion among users who thought “digital = regulated”.

SEBI’s warning wasn’t a ban — it was an education notice.

The message: “You’re buying from private firms, not SEBI-monitored institutions.”

Real-World Lesson (Recent story)

In 2025, hackers stole nearly ₹1.9 crore worth of digital gold from an app under Aditya Birla Capital (source: Economic Times).

Because digital gold isn’t regulated, victims had to depend entirely on the company’s internal process — there was no SEBI or RBI help available.

EaseMoney Insight

Digital gold isn’t evil; no need to fear. It’s actually a great first step for new investors to understand gold-based savings.

You can start with ₹100, watch price movements, and learn discipline.

But — don’t treat it like a bank deposit or government bond.

EaseMoney Tip:

- Keep your digital-gold exposure small (below 10 % of total savings).

- For long-term safety, shift to Gold ETFs, SGBs, or EGRs.

- Treat digital gold as practice investing, not permanent investing.