Let’s start with a quick fact: E-invoicing in India is mandatory for many businesses, but it is not exactly a “bulk upload” process. Eligible businesses must report B2B invoices to the government’s Invoice Registration Portal (IRP), where each invoice is validated individually and issued an Invoice Reference Number (IRN) and QR code.

Physical invoice copy requirements also differ for goods and services under the GST rules

Invoices are not new. Invoices first appeared as early as 5,000 years ago in ancient Mesopotamia on clay tablets for trade. They existed long before UPI, GST, or digital banking. Yet in 2026, most freelancers, small businesses, newbies, and even startups still struggle with generating a simple invoice. Sometimes, it causes wrong taxes, missing details, delayed payments, and unprofessional formats. The problem is not lack of tools; it’s using the wrong ones.

What Is an Invoice and Why Is It Required Even for Small Businesses

An invoice is a formal commercial document issued by a seller to a buyer that records a transaction. It lists goods or services supplied, shows taxes applied, and states the amount payable. In simple words, it is proof that money is owed and why.

According to Wikipedia, an invoice acts as both a request for payment and a legal record of a sale transaction. It is commonly used for accounting, taxation, and dispute resolution purposes.

Real-life examples you see every day –

- Freelancer example: A quick story of a graphic designer in Jaipur, who finishes a logo project for a startup and charges ₹25,000 for that. When the designer asks for payment from that company, the client replies, “Please share the invoice PDF” Until that invoice is sent, the payment does not move. even though the work is already delivered. This is a pure modern and day-to-day example where physical paper is not required.

- GST example: A service provider collects GST but does not issue a proper tax invoice. Later, when GST returns are filed, the numbers do not match. The client’s input credit gets stuck, and the service provider receives follow-up calls and emails.

- Last example, Small shop owner: A computer repair shop fixes your laptops for nearby offices. The offices ask for a proper invoice so they can show the expense in their records. Without an invoice showing the date, amount, and tax, the payment gets delayed or questioned.

In modern times, even small businesses and freelancers need invoices because:

- Payments are digital and traceable

- Clients need records for their accounting

- Tax systems like GST depend on invoices

- Banks and auditors ask for documentation

Without proper invoices, even if you have a small business, you may face delayed payments, rejected expenses, and tax mismatches.

Invoicing Under GST: What Actually Applies on the Ground

India’s GST law makes invoicing compulsory for taxable supplies. However, many small businesses don’t realise the flexibility available.

As per GST rules issued by the Central Board of Indirect Taxes and Customs (CBIC):

- Supply of goods usually requires three copies of the invoice

- Supply of services requires two copies

- If an IRN is generated, physical movement verification becomes digital

- Small retailers can issue one consolidated invoice for multiple small sales

- Businesses below certain turnover limits are exempt from mentioning HSN codes

(Source: CBIC and GST Rules – Government of India)

This is important because it means not everyone needs complex ERP software. Many businesses only need clean, correct invoices.

In India, the GST law requires invoices must required for taxable supplies, but even outside GST, invoices help you stay organised and credible.

When GST Is Not Required (Based on Annual Turnover)

GST registration is not needed if a business’s yearly income stays below the set limits. In this case, GST cannot be added to the bill.

- For selling goods: up to ₹40 lakh in normal states and ₹20 lakh in special states

- For providing services: up to ₹20 lakh in normal states and ₹10 lakh in special states

Quick example: If your business makes ₹12 lakh in revenue in a year. Since this is below ₹20 lakh, GST is not required. The designer issues a simple Bill of Supply instead of a GST invoice.

What Are the Options to Generate an Invoice Today?

In the current AI-driven world, people still use surprisingly old methods. Let’s be practical.

Common invoice creation options people use

- Word or Excel – most people use them nowadays.

- Works, but high chance of calculation mistakes

- Formatting breaks easily

- Not scalable

- Accounting software

- Powerful, but heavy

- Requires setup, login, and learning

- Overkill for many users

- Paid SaaS invoice tools

- Clean design

- Often locked behind subscriptions

- Login and data storage required

- Free online invoice generators

- No setup

- Fast

- Best for freelancers, SMEs, and service businesses

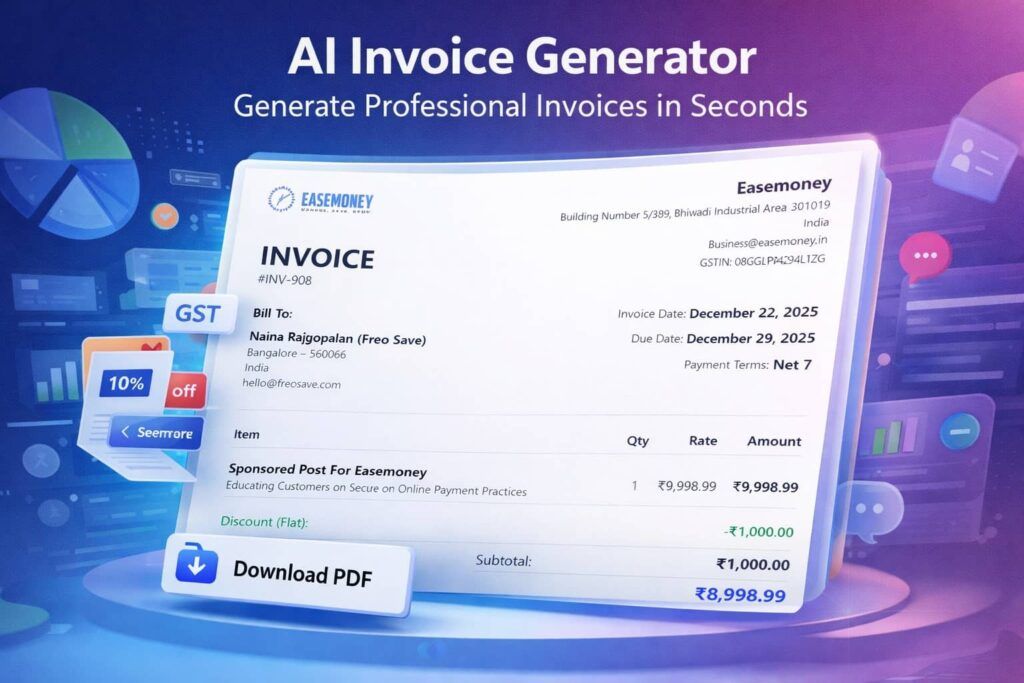

With remote work, global clients, and faster payments, the fourth option is becoming the most practical. This is where Easemoney positions itself — simple, practical, privacy-first. Our invoice generators give one of the best PDF designs in an invoice, simple and modern. It works on mobile and desktop.

How Easemoney Invoice Generator Works in Real Life

Easemoney’s invoice generator is built as a finance utility, not as software you need to learn.

The workflow is simple:

- Open the tool

- Enter details

- See a live preview

- Download a premium PDF

No account creation. No saving your data online.

Tip For you: If a tool asks for sign-up just to create one invoice, it’s not respecting your time. Most importantly, this is free, but it has a save button, so you can add details and tap on save, and it will save in your browser. Later, after 2 days, you can start editing it. Bookmark it.

How to Use Easemoney Invoice Generator and Create a Professional PDF

Here’s a simple process people actually follow:

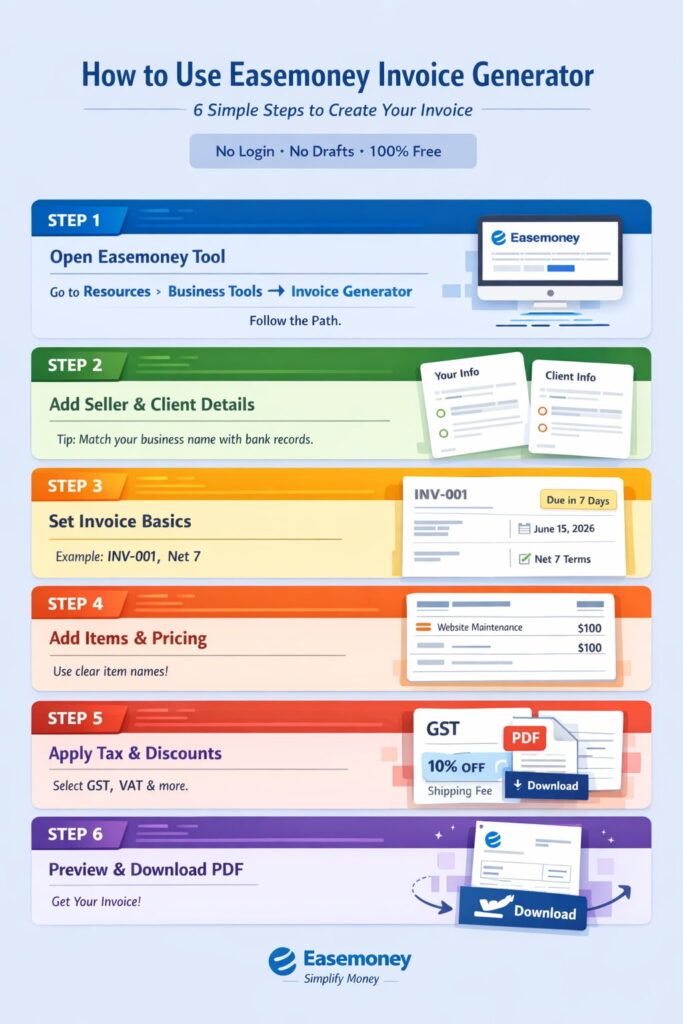

Step 1 — Open the Tool

Go to Easemoney → Resources → Business Tools → Invoice Generator

(Use this path every time, so you don’t waste time searching.)

Step 2 — Enter Seller & Buyer Details

Type your business info first and then the client’s details. Always cross-check phone and email.

Tip: If a client wants tax invoices for GST returns, ask their exact GSTIN before billing.

Step 3 — Add Invoice Number & Dates

Invoice number should be sequential (Don’t skip numbers — messy books create audit trouble later).

Pick the invoice and the due date.

Step 4 — Add items and pricing

Clearly describe each item you are billing — avoid general terms like “Work done”. Example: “Sponsored guest posts cost 5000 Rs”.

Step 5 — Apply Tax or Discount

Choose the appropriate tax or customs tax if outside the standard. Add a discount only if agreed before billing.

Step 6 — Preview & Download PDF

You can check the live preview first, then click Download PDF. Save it locally and send it to the client. You can print the invoice. It works well on A4 paper.

How to Make an Invoice for a UK Client for a $200 Deal

Let’s take a real example:

Scenario: You are an Indian freelancer, designing a marketing banner for a UK client for USD 200.

- Business: Your details (name, address, India)

- Client: UK company details

- Currency: USD ($) — paste symbol if needed

- Item: “Marketing banner design – final delivery”

- Amount: 200

- Tax: For export of services, GST might be zero-rated (check GST rules).

- Payment: Add PayPal email or SWIFT/bank details

- Terms: “Payment within 7 days”

Download PDF and send via email or messenger — simple and professional.

Top 10+ Expert Suggestions on Invoicing (Real-World Advice)

- For quick billing, always issue invoices immediately after work completion or before collecting the advance first.

- Use sequential invoice numbers without gaps.

- Mention payment terms clearly on every invoice.

- Keep item descriptions specific, not generic.

- Offer at least two payment options.

- Avoid manual tax calculations wherever possible.

- Maintain PDF backups of all invoices.

- Use consolidated invoices only when legally allowed.

- Do not mix multiple clients in one invoice.

- Review invoice preview before sending — every time.

- When trying to send the first invoice, first create multiple and verify with experts, then send to your client.

Financial experts and small-business advisors repeatedly stress that clear invoicing improves cash flow and reduces disputes.

FAQs

Do I legally need an invoice if my business is very small?

Yes. Even small businesses need invoices to prove income, avoid payment delays, and stay safe during tax checks, audits, or client disputes later.

Is a WhatsApp message or payment screenshot equal to an invoice?

No. Screenshots prove payment happened, not why. An invoice explains the transaction clearly, which banks, clients, and tax authorities actually rely on.

Can invoices really help me get paid faster?

Yes. Clear invoices reduce client back-and-forth. When amount, due date, and payment details are visible, finance teams process payments quicker without follow-up calls.

What happens if I charge GST but don’t issue a proper invoice?

Your problems start later. Client input credit can get blocked, numbers won’t match in returns, and you may receive follow-ups or notices instead of smooth compliance.

Should freelancers issue invoices even if clients trust them?

Trust helps relationships, not records. Invoices protect both sides, especially during tax filing, income verification, or when work scope is questioned months later.

Is using free invoice tools risky for serious businesses?

Only if they are poorly built. A clean, calculation-accurate, privacy-first invoice generator is safer than messy Excel sheets or reused old PDFs.

Why do clients insist on invoice PDFs instead of messages?

Because invoices fit into accounting systems. Finance teams cannot book expenses using chats or emails without a proper invoice structure and reference details.

Do international clients really care about invoice quality?

Yes. Global clients expect clean, professional invoices. Poorly formatted bills create doubt, delay payments, and make Indian freelancers look unorganised.

Is invoicing going to become stricter in the future?

Yes. With digital payments and GST systems tightening, invoices will matter more, not less. Clean invoicing today prevents bigger problems tomorrow.

Can wrong invoice details cause future tax trouble?

Absolutely. Your incorrect dates, missing taxes, or mismatched amounts create issues during returns, audits, and sometimes even block refunds or credits.