Most people call it Post Office FD, but its official name is National Savings Time Deposit Account, also known as TD. In simple terms, it works like a normal fixed deposit. You invest money in the post office for a fixed period, and after maturity, you get your amount back with interest.

This scheme is run by India Post and comes under the Government of India’s small savings schemes, which is why people across small towns and villages trust it as a very safe option for their money.

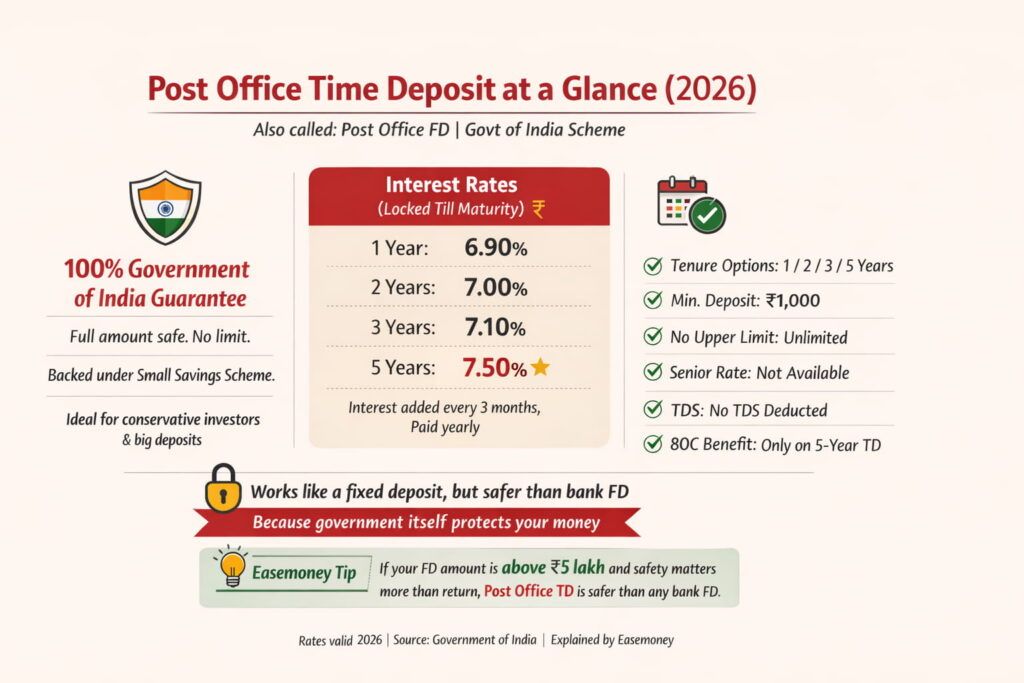

- As of 2026, Post Office TD interest rates start from 6.90% and go up to 7.50% per year, depending on the tenure from 1 year to 5 years.

Interest is added every three months, but it is paid once in a year. Also, in Post Office Time Deposit, there is no extra interest for senior citizens. The interest rate is the same for all people.

Unlike bank fixed deposits, Post Office TD comes with a direct government guarantee. This means your full money is safe, no matter how big the deposit amount is. The 5-year Time Deposit gives the highest interest and also comes with a Section 80C tax benefit, which is why many people prefer this option.

As per figures till February 2018, around ₹97,390 crore was already lying in Post Office Time Deposits. This number itself shows how much people trust the post office with their savings.

The data was given by the Reserve Bank of India and shared through CEIC Data.

Even in 2025–26, interest rates of Post Office TD have not changed much for many quarters. This clearly tells one thing — people are still putting money here regularly, because safety matters more than high return.

Updated Dates (Important for Readers)

- As per the latest update from the Government of India dated 31 December 2025, Post Office Time Deposit (TD) interest rates have not changed for the January to March 2026 quarter.

- These rates are valid from 1 January 2026 to 31 March 2026 and are reviewed by the government every three months.

- One important thing to note — for 5-year TDs opened after 9 November 2023, premature closure rules are stricter.

- For comparison, the current Post Office Savings Account interest rate is around 4% per year.

Post Office Time Deposit Interest Rate Chart – Updated 2026

Below are the official Post Office TD rates for resident individuals. Once you book a TD, this rate stays locked till maturity.

| TD Tenure | Interest Rate (per year) | Interest Added | What It Means for You |

|---|---|---|---|

| 1 Year TD | 6.90% | Quarterly | Better than a savings account, good for short-term parking |

| 2 Year TD | 7.00% | Quarterly | Slightly higher return if you can wait longer |

| 3 Year TD | 7.10% | Quarterly | Balanced option for safety + decent interest |

| 5 Year TD | 7.50% (Highest) | Quarterly | Highest return + tax benefit under 80C |

Easemoney Insight – Once you open a Post Office TD, your interest rate is fixed. Even if the government increases or reduces rates later, your booked rate will not change.

Comparison with Other Post Office Schemes

If you are looking for more return or have a specific purpose, you can also look at these post office schemes:

- Senior Citizen Savings Scheme – 8.2% (Very popular with retired people. Safe scheme and good for regular income.)

- Sukanya Samriddhi Account – 8.2% (Meant for girl child. Mostly used for future education or marriage planning.)

- National Savings Certificate – 7.7% (Suitable for people who want safe savings with tax benefits.)

- Kisan Vikas Patra – 7.5% (Simple scheme where money becomes double in around 115 months.)

- Monthly Income Scheme – 7.4% (Good option for those who want fixed money every month.)

Each scheme has its own use. Post Office TD is good for safety, but for higher return or monthly income, these schemes can be a better fit.

What are the Deposit Rules

One big difference between Post Office TD and bank FD is in big deposits. In banks, if you put a very large amount (like ₹2–3 crore), it is called a bulk deposit, and the interest rate can be different. But in the Post Office TD, there is no such system.

- Whether you deposit ₹10,000 or ₹10 crore,

- Interest rate and rules remain the same.

There is no concept of bulk TD in the post office.

| Rule | Details |

|---|---|

| Minimum deposit | ₹1,000 |

| Further deposits | Multiples of ₹100. It means you can deposit money in steps of ₹100. For example: ₹1,100, ₹1,200, ₹1,300, ₹1,400 — and so on. |

| Maximum deposit | No upper limit (Subjective) |

| Number of accounts | Unlimited |

| Interest payout | Annual |

| Modes | Cash, but a limited amount as per Income Tax / Cheque / Transfer |

Other Important Things You Should Know

- Account limit: There is no upper ceiling on how much total money you can keep across TD accounts.

- Transfer facility: You can easily transfer your TD from one post office to another anywhere in India using the India Post transfer form.

- Tax on interest: Interest earned is fully taxable.

- Post office does not cut TDS, but you must show this interest in your income tax return under “Income from Other Sources.”

Types of Post Office Time Deposit Accounts

Post Office TD offers different account-holding options for individuals and families. You can open multiple TD accounts in any allowed combination.

Account Holding Options

- Single Account

- Opened and operated by one adult

- A minor aged 10 years or above can open and operate the account independently

- Joint Account (Up to 3 Adults)

- Joint-A: All account holders must sign for withdrawals or closure

- Joint-B: Any one holder can operate the account alone

- Guardian Account

- Opened by a guardian for a minor below 18 years or a person of unsound mind

- Operated by the guardian until the minor attains adulthood

- Fresh KYC required when the minor turns 18

Key Rules

- Single accounts can be converted into joint accounts and vice versa

- There is no limit on the number of TD accounts a person can hold

- Accounts can be held in different formats at the same time

- Trusts, HUFs, institutions, and NRIs are not eligible

If you are investing with family, the Joint-B option is more useful because any one holder can operate the account in case of emergency. You can use Form 10 to add or change a nominee in your TD.

What are the Documents & Eligibility

- Required Documents: To open a Post Office TD, Aadhaar and PAN are compulsory. You also need recent photographs.

- Nomination Rules: Nomination is allowed and can be added at the time of opening or updated later.

- Compliance Rule: Aadhaar must be submitted within 6 months, otherwise the account can be frozen or deactivated as per Small Savings rules.

- Who Can Open: Only resident Indian individuals are allowed to open this account.

- Account Types Allowed: You can open a single account or a joint account with up to 3 adults.

- A minor aged 10 years or above can open and operate the account in their own name.

- A guardian can open the account for a minor or for a person of unsound mind.

- Not Allowed: NRIs, foreign nationals, companies, trusts, institutions, and HUFs are not allowed.

- Age Condition: There is no upper age limit for opening the account.

Note: If Aadhaar is not given within 6 months, the account can be stopped or closed as per the post office rules.

How to Apply for a Post Office Time Deposit (TD)

1. Offline Method (Most Common – For New Users)

This method is mainly used by people opening a Post Office TD for the first time. A Post Office savings account is not required.

Steps:

- Go to your nearby post office (the one that handles computer-based accounts).

- Ask the counter staff for a Time Deposit account opening form

- Fill in basic details like name and address

- Submit Aadhaar, PAN, and photographs

- Deposit a minimum amount of ₹1,000

- Choose the deposit period — 1, 2, 3, or 5 years

- Collect your Time Deposit passbook

This is the only option for first-time users who do not already have a post office account.

2. Online Method (For Existing Users Only)

This option is available only if you already have a Post Office savings account with internet or mobile banking activated.

Requirements:

- Active Post Office Savings Account

- Internet or mobile banking access

Steps:

- Log in to India Post e-Banking and enter your User ID.

- Go to General Services

- Select Open Time Deposit Account

- Enter the deposit amount and tenure

- Confirm using OTP or transaction password

No need for any KYC, but basic verification.

Post Office TD vs Bank FD – Safety in Simple Words

The real difference between a Post Office TD and a Bank FD is who guarantees your money. In a Post Office TD, the government itself stands behind your deposit, so the full amount is safe. They called this Sovereign Guarantee. In a bank FD, safety comes through insurance, which is limited and minimum amount safety protocol.

| Point | Post Office TD | Bank FD |

|---|---|---|

| Who protects your money | Government of India | Deposit insurance (DICGC) |

| Safety type | Full government guarantee | Insurance cover |

| Maximum protection | No limit (full amount safe) | ₹5 lakh per bank |

| Risk level | Almost zero | Depends on the bank |

- Simple tip: If your amount is above ₹5 lakh and you want less tension, Post Office TD is the safer choice.

- Easemoney Reality: This is why large investors, trusts (via individuals), and conservative families prefer Post Office TD over bank FDs for capital parking.

How Premature Closure Rules Work (Read This First)

- First thing to remember — you cannot close any TD before 6 months, no matter what.

- If it is a 1, 2, or 3-year TD and you break it between 6 and 12 months, you will get only savings account interest.

- If you close it after one year, the post office will give TD interest, but 2% will be cut.

- For a 5-year TD, the rules are very strict. You cannot close it for 4 years.

- If you close a 5-year TD after 4 years but before maturity, interest is again paid at the savings account rate, and any extra interest already paid is taken back.

Warning: If you feel you may need money in between, do not go for a 5-year TD.

Extension & Renewal Rules

- A 1-year TD can be extended within 6 months after maturity.

- A 2-year TD can be extended within 12 months.

- A 3-year or 5-year TD can be extended within 18 months.

- You can extend a TD only two times.

- The interest rate will be whatever rate is running on the day your TD matures.

- You can even give the extension request before maturity, no need to wait.

Tax Treatment

| Aspect | Rule |

|---|---|

| Interest income | Fully taxable |

| TDS | Not deducted |

| 80C benefit | Only 5-year TD |

| Tax head | Income from Other Sources |

Tip – The Post Office does not deduct TDS, but the tax liability remains.

Post Office TD vs Bank FD (2026 – Simple Comparison)

| Point | Post Office TD | Bank FD |

|---|---|---|

| Safety | Fully backed by government | Insured up to ₹5 lakh per bank |

| 1-Year Interest | 6.9% | Around 6.25% to 7.0% |

| 5-Year Interest | 7.5% | Around 6.05% to 7.25% |

| Senior Citizen Benefit | No extra interest | Extra 0.50% to 0.75% |

| Tax Benefit | 5-year TD gets 80C benefit | Only specific tax-saver FDs |

| TDS on Interest | Not cut by post office | Cut by bank if limit crossed |

| Tenure Choice | Fixed (1, 2, 3, 5 years) | Very flexible |

| Online Facility | Limited | Easy and fully online |

| Loan on FD | Not available | Available in most banks |

Recommendation:

- Choose Post Office TD if: You have more than ₹5 lakh, want full safety, and do not want TDS to be cut automatically.

- Choose Bank FD if: You are a senior citizen, may need a loan in an emergency, or want full online convenience.

Post Office Time Deposit Calculator

A Post Office TD calculator is used to check how much money you will get at maturity and how much interest you will earn. You only need to enter three things:

- Deposit amount

- Time period (1, 2, 3, or 5 years)

- Interest rate

The calculator works as per the post office rules. Interest is added every 3 months but paid once in a year. Unlike bank FD calculators, there is no safety limit here, because Post Office TD is fully backed by the government.

People mostly use this calculator to:

- Compare 1-year vs 5-year TD

- Check the loss in case of early closure

- Plan Section 80C using the 5-year TD

Real-Life Example (Shyam Ji, Age 55)

- Who is he: Shyam Ji is 55 years old and works in a private job.

- What he wanted: A safe place to keep money. No risk. No tension.

- What he did: He invested ₹5,00,000 in a 5-year Post Office TD at 7.50% interest.

What happened after 5 years (approx.)

- Interest was added every 3 months

- Money was paid once every year

- Final amount: around ₹7.25 to ₹7.30 lakh

- Total interest earned: around ₹2.25 lakh

Why this worked for him

- He did not want ups and downs like the share market

- He did not need money for 4 years

- His full amount was 100% safe

- He also used the 5-year TD for 80C tax saving

For someone like Shyam Ji, Post Office TD gave peace of mind, fixed return, and full safety — something bank FDs cannot fully guarantee for large amounts.

FAQs

What is the interest on ₹1 lakh FD in Post Office?

On ₹1 lakh invested in a 5-year Post Office Time Deposit at 7.5% (Jan–Mar 2026), maturity is around ₹1.45 lakh, earning ~₹45,000 interest before tax.

What is the Post Office Time Deposit for 5 years?

The 5-year Post Office Time Deposit offers 7.5% annual interest, quarterly compounding, Section 80C tax benefit, and full sovereign guarantee, but funds cannot be withdrawn before four years.

Is a Post Office Time Deposit better than a bank FD?

Post Office Time Deposit is safer for large amounts due to sovereign backing, while bank FDs offer better liquidity, senior citizen benefits, and loan flexibility, but only ₹5 lakh insurance coverage.

What are the disadvantages of Post Office Time Deposit?

Key drawbacks include no senior citizen extra interest, strict premature withdrawal rules, limited online access, and lower post-tax returns for 30% tax slab investors compared to market-linked options.

Is money in a Post Office Time Deposit fully safe?

Yes. Unlike bank FDs insured up to ₹5 lakh, Post Office Time Deposits are backed directly by the Government of India, meaning 100% principal and interest protection without any cap.

Who should ideally invest in Post Office Time Deposit?

Post Office Time Deposit suits risk-averse investors, retirees parking large sums, and taxpayers using 5-year TD for 80C, but not investors seeking high liquidity or inflation-beating returns.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.