Saraswat Bank is not the type of bank that shows big ads everywhere. You will not see film stars, big banners, or loud online promotion from this bank. Still, in many Tier-1 and Tier-2 cities, people trust Saraswat Bank a lot. This trust is not new. It was built slowly over many years, from 1918. For people putting money in a fixed deposit in 2026, this kind of old trust is more important than brand name or advertising.

If we talk about FD interest, Saraswat Bank keeps it very simple –

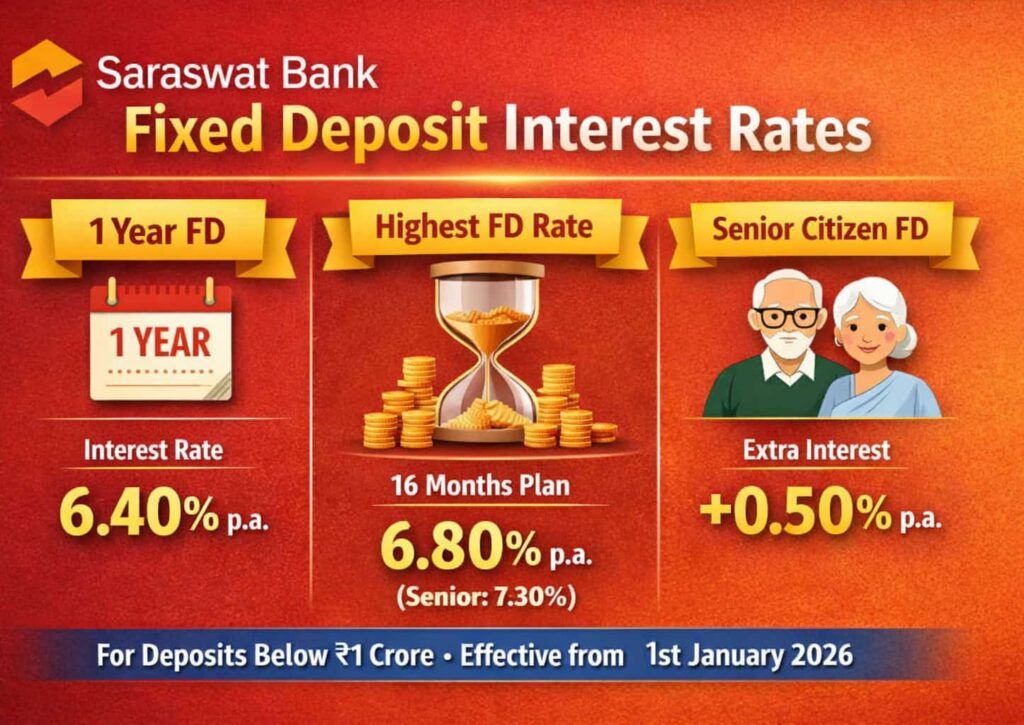

- For general people, the FD rate starts from 3.25% and goes up to 6.80% per year.

- For senior citizens, the bank gives little extra benefit. Their FD interest starts from 3.75% and can go up to 7.30% per year.

- As per their official website, these rates are valid from 1 January 2026.

Saraswat Bank also gives many FD time options. You can make an FD for just 7 days or even for 10 years. Because of this, people can plan an FD according to their needs. Some people want short-term safety, some want long-term saving. The bank allows both without any confusion.

From 2026, Saraswat Bank has changed its FD structure. But like always, the bank has not made it complicated. Many banks confuse people with too many FD names and conditions. Saraswat Bank keeps it straight and practical.

Interest rates are not a show-off type. No fake high numbers. But the rules are clear. Interest slabs are stable. FD schemes are easy to understand. You know what return you will get and when you will get it.

For families who depend on FD interest for safety, not for thrill or excitement, this simple approach really matters. This is why many households still feel comfortable keeping their savings with Saraswat Bank.

As per the Moneycontrol report, till 31 March 2025, Saraswat Cooperative Bank’s total business was ₹91,814 crore. Out of this, ₹55,481 crore was deposited, and ₹36,333 crore was given as loans and advances. In simple words, the bank has a strong deposit base and controlled lending, which gives confidence to regular FD customers.

Saraswat Bank Fixed Deposit Structure (Resident Indians)

For Indian residents, Saraswat Bank does not run many different FD schemes. The bank keeps only one main fixed deposit product. Everything is linked to that single FD.

You just choose how you want to receive the interest. The rest of the structure remains the same. Because of this, people do not get confused between multiple FD names or rules. One FD, a simple system, and easy to manage for regular savers.

Think of it as one FD with multiple ways to receive interest, not multiple FDs.

A resident Indian FD structure is divided into:

- Regular Fixed Deposit

- Monthly Interest Fixed Deposit

- Quarterly Interest Fixed Deposit

- Cumulative Fixed Deposit (Kalpataru)

- Madhukar Tax Saving Fixed Deposit (special-purpose, 5-year lock-in)

Recurring Deposit is not an FD and is treated separately.

Domestic FD Deposit Interest Rates (For deposits below ₹1 crore, Applicable from 1 January 2026)

These rates apply to all regular, monthly, quarterly, Tax savings, NRO, and cumulative FDs. Rates will be the same unless the bank has put any special conditions for a particular time period. For an FD amount more than ₹1 crore, interest rates are different, and the bank decides them separately based on the deposit amount and duration. Here is the table for you –

| FD Time Period | General Public (% p.a.) | Senior Citizen (% p.a.) | Simple Suggestion |

|---|---|---|---|

| 7 – 14 days | 3.25% | 3.75% | Only for parking money short time |

| 15 – 30 days | 3.25% | 3.75% | Not useful for return, only safety |

| 31 – 60 days | 3.50% | 4.00% | Slightly better than savings |

| 61 – 89 days | 4.00% | 4.50% | OK for temporary holding |

| 90 days | 4.75% | 5.25% | Decent short-term option |

| 91 – 179 days | 4.75% | 5.25% | Same as 90 days, no extra benefit |

| 180 days | 5.75% | 6.25% | Good balance of time and return |

| 181 – 240 days | 5.75% | 6.25% | Useful if you don’t want a 1-year lock |

| 241 days – less than 1 year | 6.00% | 6.50% | Better than short FDs |

| 1 year | 6.40% | 6.90% | Most popular FD period |

| 1Y 1D – 1Y 10D | 6.40% | 6.90% | Same return, flexible days |

| 1Y 11D – less than 16 months | 6.40% | 6.90% | No extra gain, only a timing change |

| 16 months | 6.80% | 7.30% | Highest return slab |

| 16M 1D – 16M 10D | 6.80% | 7.30% | Best choice if money is not needed |

| 16M 11D – 2 years | 6.80% | 7.30% | Good for long safety |

| Above 2 – 3 years | 6.50% | 7.00% | Return slightly lower |

| Above 3 – 4 years | 6.60% | 7.10% | Stable long-term option |

| Above 4 – 5 years | 6.60% | 7.10% | For people avoiding market risk |

| 5 Year | 7.00% | Tax savings scheme. | |

| Above 5 – 10 years | 6.60% | 7.10% | Long lock, steady income |

Ground reality: In small towns, 16-month FD is the most talked-about option. The reason is clear, it gives the highest interest without locking money for too long. People feel comfortable with this period.

Long-term FDs are available, but most families don’t like blocking their money for more than 3 years. Unless income is fully stable and regular, people prefer to keep some flexibility. Safety is important, but access to money is equally important for everyday family needs.

Senior citizen benefit:

- Senior citizens get 0.50% extra interest on all type FD, unless you are an NRE or NRO and different scheme.

- As per the rate chart, Senior citizens will get 0.50% extra interest on FD for any tenure. no matter 7 days or 10 years.

- Just submit age proof and a valid ID document

- No extra process, the benefit is applied easily

1. Saraswat Term Deposit – Regular FD

This is the most basic FD option of Saraswat Bank. It is mainly used for short-term money parking, where safety is more important than return.

Main details:

- You can start with a minimum amount to open an FD of ₹1,000

- There is no max limit. (but different interest rates depending on the deposit amount)

- Interest is calculated in simple interest

- Interest is paid only at maturity

- FD period is from 7 days to 364 days

- This FD stays short-term, but if needed, the deposit relationship can continue long-term through other options.

Extra facilities available for you:

- Loan against FD is available, up to 90% of the principal plus accrued interest

- Loan is given at the bank’s discretion

- Instant liquidity option available through overdraft or premature withdrawal (as per bank rules)

- Nomination facility is available for family members

- Term deposits are insured under DICGC, as per the Government of India norms

Real usage on the ground: This FD is commonly used by shop owners and small business people to park extra sales money for a few months. The 364-day limit keeps it strictly short-term, while loan and overdraft options give flexibility if money is suddenly required.

2. Saraswat Fixed Deposit – Monthly Interest Deposit

This FD is made for regular monthly income, not for growing money fast. People choose it when they need fixed cash every month.

How it works:

- Interest is paid every month.

- FD period starts from 12 months and goes up to 120 months

- The main deposit amount stays safe and untouched till the FD ends

Who usually uses this FD:

- Retired teachers and govt staff

- Families depending mainly on a pension

- People running monthly household expenses from interest income

Ground reality: Your interest is credited every month to your bank account. For example, if you put ₹25 lakh, the bank sends interest monthly like regular income or salary, while the main amount stays safe till maturity. Many retired people use this money for household bills, medicines, and daily expenses.

3. Saraswat FD Scheme – Quarterly Interest Deposit

This FD option stays between the monthly and cumulative types. It gives income, but not every month.

How it works:

- Interest is paid every 3 months

- FD period is 12 months to 120 months

- Returns are slightly better than the monthly FD

Who uses this: Families who want a regular income, but don’t need money every month. They are okay with getting interest once every three months.

4. Kalpataru Saraswat Fixed Deposit – Cumulative Deposit

This is the highest return FD option for resident Indians in Saraswat Bank. It is mainly used by people who don’t need a regular income and want the full amount at the end.

How it works:

- Interest is added back every quarter

- No payout in between

- The full amount comes only at maturity

- FD period allowed is 12 months to 36 months

- Interest rates are the same as normal FD, only the payout style is different

Important clarity: There is no separate rate chart for cumulative FD. Same interest rate, only your interest is reinvested instead of paid out.

Real-life example: If you put ₹5 lakh for 16 months at 6.80%, you will get around ₹5.47 lakh when the FD finishes. Many families use this FD for future work, like children’s education, marriage planning, or any big expenses later. Since no monthly money is needed, they let the interest add up till the end.

5. Tax Saving Fixed Deposit (80C)

This FD is only for tax savings. It is not meant for flexibility or regular use. Once money is put in, it stays locked.

Basic rules:

- Your amount will have a lock-in period of 5 years, compulsory

- Minimum deposit starts from ₹5,000

- The maximum allowed is ₹1.5 lakh in one financial year

- Interest is paid quarterly

- The rate of interest is the 7%.

- No premature withdrawal allowed

- Loan or overdraft is not given on this FD

Tax part (very important):

- Tax benefit is available only under Section 80C

- Deduction is on the principal amount only

- Interest earned is fully taxable

- If FD is in the joint name, only the first holder gets the 80C benefit

Who should go for this FD:

- People who still have 80C limit left

- If you want zero risk

- People who are sure they don’t need money for 5 years

This FD is mostly used just to save tax, nothing else.

6. Bulk FD Deposit

If you want to put more than ₹1 crore in an FD, Saraswat Bank gives different interest rates. These rates were changed recently in February 2026, and they are not the same as normal FD rates.

This FD rate is for the general public and NRO accounts. These rates start from 2 February 2026 and will be used by the bank from this date onwards.

| FD Period | ₹1 Cr – < ₹2 Cr | ₹2 Cr – < ₹5 Cr | ₹5 Cr – < ₹10 Cr | ₹10 Cr & Above |

|---|---|---|---|---|

| 7 – 14 days | 3.25% | 4.50% | 4.50% | 4.50% |

| 15 – 30 days | 3.25% | 4.75% | 4.75% | 4.75% |

| 31 – 60 days | 3.50% | 5.50% | 5.50% | 5.50% |

| 61 – 89 days | 4.00% | 5.50% | 5.50% | 5.50% |

| 90 days | 4.00% | 5.75% | 5.75% | 5.75% |

| 91 – 179 days | 4.75% | 5.75% | 5.75% | 5.75% |

| 180 – 240 days | 5.75% | 6.00% | 6.00% | 6.00% |

| 241 days – < 1 year | 6.00% | 6.00% | 6.00% | 6.00% |

| 1 year to 2 years | 6.40% | 6.40% | 6.40% | 6.40% |

| Above 2 – 3 years | 6.40% | 6.40% | 6.40% | 6.40% |

| Above 3 – 10 years | 6.30% | 6.30% | 6.30% | 6.30% |

Simple ground understanding

- For ₹2 crore and above, short-term FD rates are much better

- From 1 year onward, rates become the same across all slabs

- No fancy products, just straight pricing based on the amount

FAQs

Does Saraswat Bank offer NRI Fixed Deposit options?

Yes. Saraswat Bank offers NRE, NRO, RFC, and FCNR deposits. but there is different rate of interest. FCNR is available in USD. NRE interest is tax-free in India; NRO interest is taxable.

How can I invest in Saraswat Bank Fixed Deposit?

You can open FD using GOMO NxT mobile app, by visiting a nearby Saraswat Bank branch, or by checking the official website for latest rates and rules.

Which app is used to open Saraswat Bank FD online?

Saraswat Bank uses GOMO NxT app for digital services. Through this app, customers can open FD, check maturity amount, download receipts, and manage renewals easily.

Which form is required to open an FD for existing customers?

Existing resident and NRI customers must fill out the Term Deposit Account Opening Form. Download here:

Term Deposit Account Opening FormWhat is the minimum amount to open a Saraswat Bank FD?

Minimum FD amount is ₹1,000 for regular deposits. Tax Saving FD minimum is ₹5,000. The maximum for tax saver is ₹1.5 lakh per financial year, as per Section 80C.

Does Saraswat Bank provide FD calculator?

Yes. Saraswat Bank FD calculator is available on the official website. It helps estimate maturity value using amount, tenure, interest rate, and payout option before investing.

Read – Co-operative Bank FD Interest Rates

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.