Sending a large amount of money for any category, such as business payment, property purchase, or investment, the safest and fastest option in India is RTGS (Real-Time Gross Settlement). It is offered by SBI Bank.

However, if you are planning to do this transaction at an SBI branch, you will need a physical RTGS form, a self-cheque, and you must visit the right type of branch.

This form is mandatory at the branch and required to confirm that the bank can debit funds from your account and transfer them to the beneficiary.

Best Time for RTGS via SBI Branch

Even though RTGS is available 24/7 for account holders via Online banking, doing it at the branch, timing is the most important for you. It is a key to ensuring your transfer goes through without delay.

Branch Working Hours:

- Monday – Friday: 7:00 AM – 6:00 PM (RTGS working hours, but the branch opens at 10:AM)

- On regular Saturday: Timing is different – 7:00 AM – 2:00 PM

- Sunday/Public Holidays: Your Branches closed (use RTGS via YONO or SBI online)

- Other Branch Off – SBI branches are closed on the 2nd and 4th Saturdays of every month.

- RBI Downtime: Most banks such including SBI, say RTGS is temporarily unavailable daily between (Typical window) 11:50 PM – 12:30 AM due to RBI settlement. Plan your transactions outside this window. You can confirm with the branch if any issue.

Tip – For you, the Best Time to go is after 10:00 AM And Before 1:00 PM or 1:30 PM

This timeframe can work better for you, because it confirms your transaction is complete on the same day after submitting your application form. It also avoids lunch-hour delays and staff availability for processing your request and branch seal or stamping.

How to Get the Latest SBI RTGS Application Form

SBI time-to-time updates its branch banking forms, including the RTGS form, to match RBI guidelines. Like most of the indian banks, SBI also issue a single physical form for both transaction options – RTGS or NEFT. Here are three easy ways to get the latest version:

1. Collect It from Your SBI Branch

- The simplest option is that you have to visit your nearest RTGS-enabled SBI branch.

- From the Help Counter, request for the “RTGS/NEFT Requisition Form”.

- The form is provided free of cost and is usually bilingual (English and Hindi).

2. Download the Form from SBI’s Website

Follow these steps:

| Step | Action |

|---|---|

| 1 | Simply, visit the official portal – sbi.bank.in (2025, a new RBI update changed the URL for all banks in india) |

| 2 | Use the search box and type “RTGS Annexure” or “Remittance Form” |

| 3 | Click on the result “RTGS/NEFT Requisition Form” |

| 4 | Tap Download to save the bilingual PDF |

| 5 | This is the official editable version — you can fill it out on your computer software, such as Adobe PDF Editor, before printing to save time at the branch. |

| 6 | Not all branches accept printed paper; make sure it is accepted. |

You can download it from here –

| File Name | Latest Link |

|---|---|

| SBI RTGS or NEFT Application | Form Download link through SBI |

3. From SBI FAQs or Help Section

You can also find the Request form from the RTGS/NEFT FAQ section on SBI’s website. Simply, check FAQ number 12 for the downloadable link.

How to Do RTGS From an SBI Branch and Fill the Form Correctly

The SBI RTGS form has two parts:

- Right Side (Branch Copy): Submit to the bank.

- Left Side (Customer Copy): Returned to you with a UTR number and branch seal, and signature of the branch staff as proof of transfer.

You need to fill both sides; however, ignore the “bank use only” section.

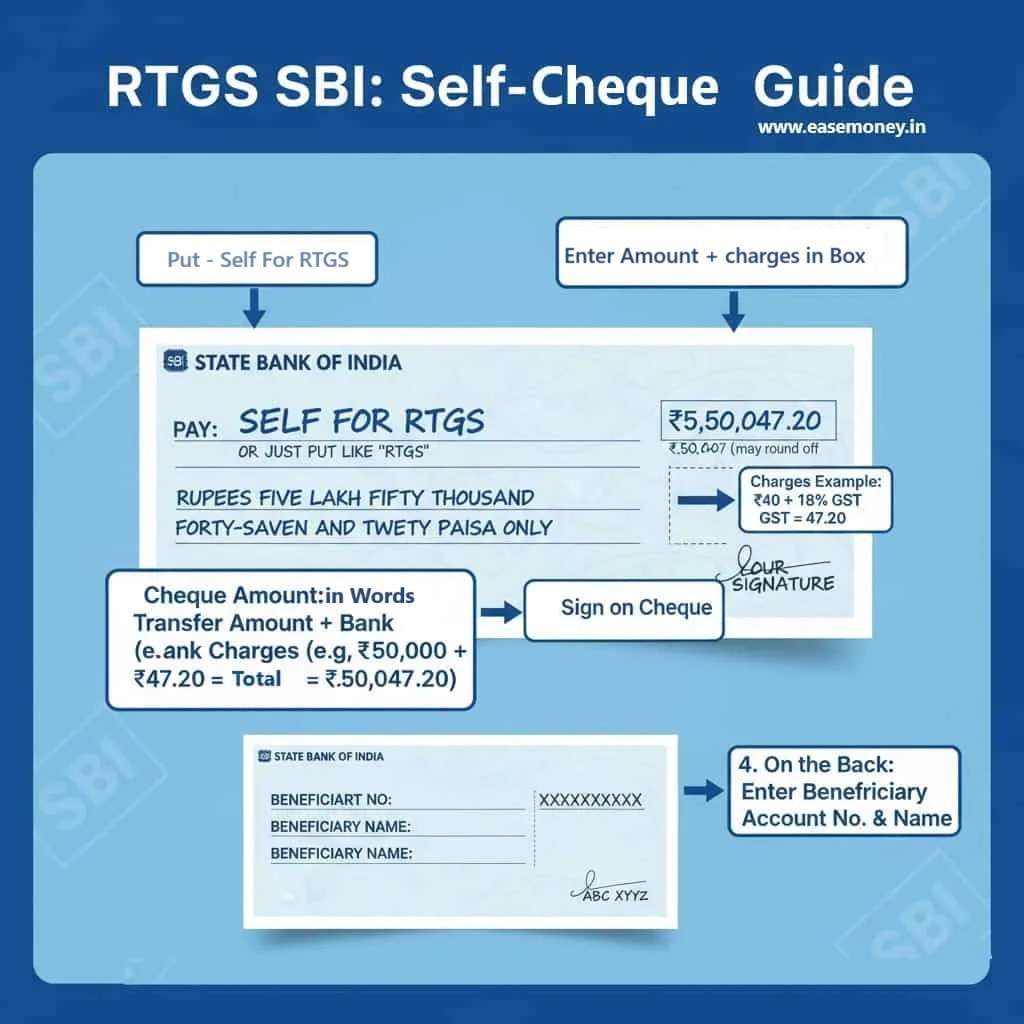

Step 1: Write a Self-Cheque for the Total Amount

- RTGS at the branch requires a self-cheque.

- You have to put down the cheque amount as Transfer Amount + Bank regular Charges, such as GST.

- Example: Your amount for transfer is ₹5,50,000, but charges on that ₹40 + GST (18%), then add this ₹47.20 or just put 48 Rs.

- Total Cheque = ₹5,50,047.20 (your branch may round off to ₹5,50,047).

- In the payee column → write “SELF for RTGS” or just put “Yourself”

- You have to sign on cheque and on the back side, enter the beneficiary account number and Name.

2 Step – Fill Amount in Form

- Starts with Basic – Date, Branch, and Tick RTGS (for any payment above 2 lakh)

- After the basic, you have to put down the amount after the (₹) symbol – Amount in figures, such as ₹5,50,000.

- Amount in words, you can write in Capital: Rupees Five Lakh Fifty Thousand Only

3 Step – Enter Account & Cheque Details

- After the amount section, the Tick Cheque option.

- Neither cash nor Account transfer options are allowed in RTGS by default.

- You will need a cheque for that.

- Enter cheque number & date. (the self-cheque issued)

4 Step: Beneficiary Information

- Name of Beneficiary (exact as per bank records).

- Bank name & branch address → For correct information, ask your beneficiary for a cancelled cheque or the photo front page of the passbook.

- IFSC Code in the boxes (must be correct).

- Now, write down the Account Number (twice) to confirm.

- If your amount is above 50 Crore, you also need to provide the LEI Number; if the amount is below, simply ignore it.

5 Step: Enter Charges & Total in Form

- Fill Remittance Charges (₹47.20 in example), usually you have to put the charges; you can ask from branch for the latest charges.

- Write Total Amount = ₹5,50,000 + ₹47.20 = ₹5,50,047.20.

- After the charges are added, write the words in capital.

6 Step: Applicant & Submission

- Enter your Name & Mobile Number.

- Address if applicable.

- Sign the form (signature must match bank records).

7 Step: Left Side (Customer Copy)

- You have to repeat the key details (amount, charges, total).

- This will be returned to you after processing

- The branch staff write down the UTR number + branch seal.

- You can use it to track your progress after submitting.

For example, if you don’t include charges in the cheque

If you write a cheque only for ₹5,50,000, the bank will deduct charges separately, such as if you want to send ₹5,50,000 and also you put the cheque for exactly ₹5,50,000.

Then the bank will deduct the RTGS fee from the same amount.

- Transfer amount entered: ₹5,50,000

- RTGS charges deducted: ₹47.20

- Actual amount credited will be: ₹5,49,952.80

In simple words, the receiver will get ₹47.20 less than you planned.

The regular Charges for RTGS via the SBI Branch

| Mode | Amount Slab | Charges (without GST) | With GST (18%) |

|---|---|---|---|

| Branch | If your amount around ₹ 2,00,000 – ₹5,00,000 | ₹20 | ₹23.60 |

| Branch | Above ₹5,00,000 | ₹40 | ₹47.20 |

| Online (Net Banking / YONO / Mobile Banking) | Any amount | Free | Free |

If you transfer money online (through YONO, Internet Banking, or Mobile Banking), RTGS is completely free.

RTGS Transaction Limits in SBI

| Channel | Minimum Limit | Maximum Limit |

|---|---|---|

| Interbank RTGS (Branch) | 2 Lakh only | ₹25,00,000 |

| YONO / SBI Mobile App | same | ₹25,00,000 |

| Retail Internet Banking | 2 Lakh | ₹25,00,000 |

| Corporate Internet Banking – Vyapaar | ₹2,00,000 | ₹2 Crore |

| Corporate Internet Banking – Vistaar | Capped as the same | ₹500 Crore |

Message: RTGS works as an interbank transfer only (SBI → other banks). It does not work for SBI-to-SBI transfers. This is an important insight before writing the form. You have to use NEFT or IMPS instead for the same bank and a different account.

Real-Life FAQs

Can I use SBI RTGS for buying a property in India?

Yes, you can. RTGS is only for big payments such as property transactions. Just ask for a cancelled cheque from the seller via the branch and add a purpose code.

Can RTGS Be Done From Any SBI Branch?

Not really, you can only perform RTGS transfers from an RTGS-enabled branch. If you are looking in your city, go to the official RBI RTGS branch list, just press Ctrl key + F and enter your city name.

Can I transfer ₹50 lakhs through SBI RTGS?

Yes, but only through certain channels.YONO only allow ₹25 lakh per transaction; you may have to visit your branch. However, it also depends on your account type.

Can RTGS take 24 hours in SBI?

No, RTGS is almost instant. Most transfers are completed within 30 minutes just after requesting, but sometimes, it takes 1 or 2 hours, depending on your submission timings and batched settlement protocols.

Can SBI reject an RTGS request even if my form is filled correctly?

Yes. RTGS may be rejected if the beneficiary name doesn’t match the bank records or IFSC is wrong. Even a single alphabet mismatch can stop processing until correction at the counter.

Is the self-cheque compulsory for SBI RTGS at the branch?

Yes. SBI requires a self-cheque for the full amount, including charges. Cash or debit-only RTGS is not accepted at branches due to audit and RBI compliance rules.

What happens if I forget to include RTGS charges in the cheque amount?

SBI deducts charges from the transfer amount itself. Example: ₹5,00,000 RTGS with ₹47.20 charges means the beneficiary receives ₹4,99,952.80, not the full amount you intended.

Can I cancel an SBI RTGS after submitting the form?

Only if it hasn’t been processed yet. Once UTR is generated, cancellation is impossible. Tip: Confirm beneficiary details twice before handing over the form to the teller.

Why do SBI branches prefer RTGS submissions before 1 PM?

Early submissions avoid settlement delays and lunch-hour backlog. RTGS filed before 1 PM usually clears faster, often within 30–60 minutes, compared to late-afternoon requests.

What is the most common mistake customers make on SBI RTGS forms?

Writing beneficiary account number once instead of twice. SBI asks for double entry to avoid wrong credits. Missing or mismatched entries trigger manual verification and delays.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.