In 2026, North East Small Finance Bank is giving quite good FD interest rates for people who just want their money to stay safe and earn steady returns. The bank has both Callable and Non-Callable FD options, so it works for normal savers as well as people who have some big surplus money and want a fixed rate locked for full tenure.

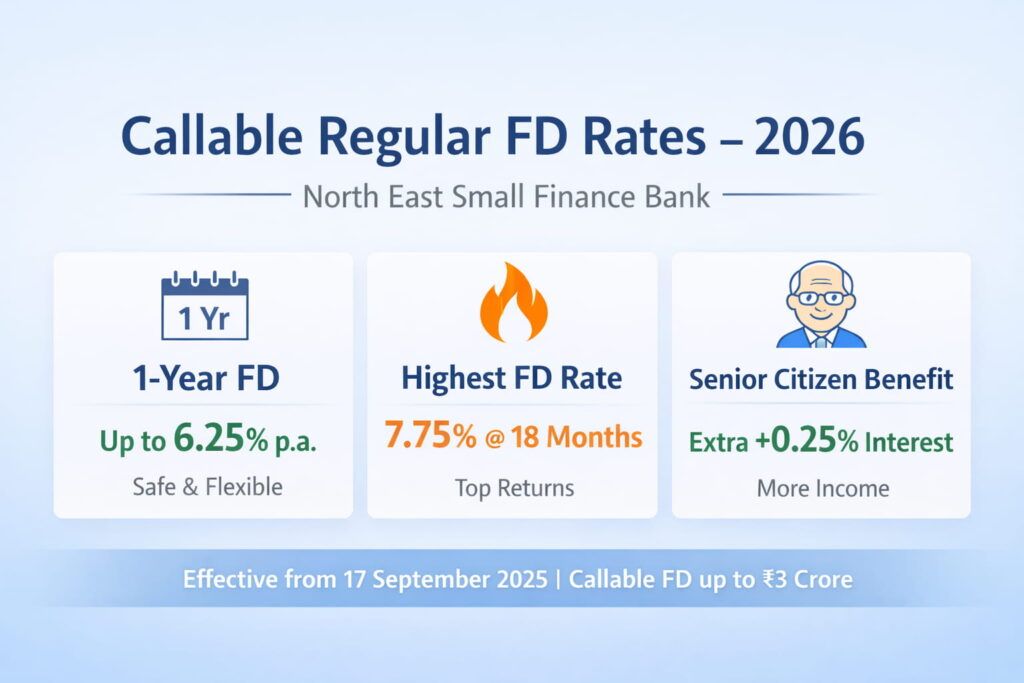

For regular customers, FD interest goes up to 7.75% per year on some special tenures such as 18 months. Senior citizens get 0.25% extra interest, depending on how long the FD is kept. These rates are valid for deposits up to ₹3 crore, and if the amount is higher, the bank usually handles it directly through the branch.

These FD rates are active from 17 September 2025 and are still running in 2026, unless the bank changes them later.

Fixed Deposits are still one of the most trusted savings options in India. Even today, when many market products are available, a lot of people still choose FD because the money stays safe and returns are already known. You can also pick the tenure as per your need. Among small finance banks, North East Small Finance Bank offers decent FD interest rates, mainly for medium and long-term deposits.

How North East Small Finance Bank Structures Its Fixed Deposits

Unlike many banks that just say “FD” and don’t explain much, North East Small Finance Bank clearly splits its fixed deposits into two types:

- Callable Regular Fixed Deposits – for people who may need money in between

- Non-Callable Fixed Deposits – for people who want better interest and can lock money

Because of this clear structure, customers—especially from small towns and tier-2 or 3 cities can easily understand:

- When the money can be taken out

- When the money is fully locked till maturity

- and why some FDs pay higher interest than others

1. NESFB Regular FD – For Regular Customers (Callable FD Up to ₹3 Crore)

Callable Fixed Deposits are the most common type of FD people usually go for. Unlike locked FDs, here you can break the FD before maturity if some urgent need comes up. Yes, the bank will cut a small penalty on interest, but at least your money is not fully stuck.

At North East Small Finance Bank, callable FDs are mostly chosen by regular customers—people who want safety but still want the option to use their money if needed.

Key Features of Callable FD (simple way)

- Minimum deposit: ₹1,000 – you don’t need big money to start

- Tenure: From 7 days to 10 years – short-term or long-term, both work

- Premature withdrawal: Allowed – unlike some FDs, where money is fully locked

- Penalty: Around 1% cut on interest if you break it early

- Best for: Salaried people, families, and senior citizens who want peace of mind

Callable FD Interest Rates – Regular & Senior Citizens

| FD Tenure | Regular | Senior Citizen | Real-life Tip (Which is better?) |

|---|---|---|---|

| 7 – 29 days | 3.50% | 3.75% | Only okay for parking money short-term |

| 30 – 45 days | 4.25% | 4.50% | Still low, use only if money is needed soon |

| 46 days – 3 months | 4.50% | 4.75% | Slightly better, but not for returns |

| 3 months 1 day – 6 months | 5.25% | 5.50% | Fine for short plans, not long saving |

| 6 months 1 day – 12 months | 6.25% | 6.50% | Decent option if unsure about locking money |

| 12 months 1 day – 18 months | 7.25% | 7.25% | Good balance of safety and return |

| 18 months 1 day – 18 months 2 days | 7.75% (Highest) | 7.75% | Best choice, highest interest rate |

| 18 months 3 days – 36 months | 7.50% | 7.50% | Slightly lower than peak, still good |

| 36 months 1 day – 60 months | 7.00% | 7.25% | Senior citizens may prefer this |

| 60 months 1 day – 120 months | 6.50% | 6.75% | Lock only if long-term sure |

Note – Effective from 17 September 2025

Simple takeaway (real talk)

- Best overall FD: 18-month tenure (7.75%)

- Safe middle ground: 12–18 months

- Senior citizens: Monthly payout + 3–5 year FD works well

- Short tenure FDs: Only for temporary parking, not for earning

2. Non-Callable Fixed Deposits – High-Value FD (₹1 Cr to ₹3 Cr)

Non-Callable Fixed Deposits are fully locked FDs. Once you put money here, you can’t take it out before maturity. Unlike a callable FD, there is no option to break it, no partial withdrawal, nothing.

Because the money is completely locked, North East Small Finance Bank offers higher interest rates on Non-Callable FDs. This is mainly meant for people who already know they won’t need the money in between.

Key Features of Non-Callable FD

- Deposit amount: ₹1 crore to ₹3 crore (not for small savers)

- Premature withdrawal: Not allowed at all

- Partial withdrawal: Also not allowed

- Best for: Surplus money that is just lying idle

- Returns: Higher than normal callable FD

Simple logic: Money fully locked = bank pays better interest.

Non-Callable FD Interest Rates – Regular & Senior Citizens (Updated chart)

| FD Tenure | Regular | Senior Citizen | Real-life Tip |

|---|---|---|---|

| 7 – 29 days | 3.75% | 4.00% | Only for very short parking |

| 30 – 45 days | 4.50% | 4.75% | Still short-term, returns are okay |

| 46 days – 3 months | 4.75% | 5.00% | Better than savings, nothing more |

| 3 months 1 day – 6 months | 5.50% | 5.75% | Decent for temporary surplus |

| 6 months 1 day – 12 months | 6.50% | 6.75% | Safe choice if locking for a year |

| 12 months 1 day – 18 months | 7.50% | 7.50% | Very good return for 1–1.5 years |

| 18 months 1 day – 36 months | 7.75% | 7.75% | Best option, highest interest |

| 36 months 1 day – 60 months | 7.25% | 7.50% | Senior citizens may like this |

| 60 months 1 day – 120 months | 6.75% | 7.00% | Lock only if very sure long-term |

Real-Life Use Case (who actually uses this FD)

Non-Callable FDs are mostly chosen by people like:

- Business owners with excess cash

- People who sold land or property and don’t want to risk

- Families park money temporarily before buying another asset

- Investors who don’t need liquidity and just want fixed returns

In short: If money is extra, not needed anytime soon, and you want maximum FD interest, a Non-Callable FD makes sense. If there’s even 1% chance you may need the money, better stay with a callable FD.

Is North East Small Finance Bank Safe for Fixed Deposits?

Yes, it is safe for normal FD investors. North East Small Finance Bank is a proper RBI-regulated small finance bank. It’s not new or random.

- The bank got its RBI licence in 2015

- Banking operations started in July 2016

- It works under full RBI rules and supervision

- Fixed Deposits are covered by government deposit insurance

So from a basic safety point of view, it ticks all boxes.

FD Insurance – What Is Actually Protected?

All deposits in the bank are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC).

- Up to ₹5 lakh per person, per bank is insured

- This includes FD, savings, current account, and RD

- Insurance covers principal + interest, not just the deposit amount

So if your total deposit is within this limit, the risk is already capped.

Slice Merger – Simple Explanation

- October 2023: Slice announced a merger with the bank; the source is Wintwealth.

- October 2024: Merger completed after RBI approvals

- May 2025: Bank name changed to Slice Small Finance Bank

For FD customers, nothing changes:

- Your existing FD stays valid

- Interest rate stays the same

- Maturity date stays the same

- RBI regulation and deposit insurance stay the same

Real talk: This was a name and ownership change, not a problem for FD holders.

How to open a North East Small Finance Bank FD

Opening an FD is very simple.

- You can call the bank on 1800-121-1905 and ask them what to do

- You can check the nearest branch here: nesfb.com/branch

- Or just walk into the nearest branch and open the FD directly

Take your basic documents, decide the amount, and the FD gets done. If the FD amount is big or it is a non-callable FD, a branch visit works best.

FAQs

How does the 18-month FD beat other tenures in real return?

Example: ₹1 lakh at 7.75% for 18 months gives ~₹11,200 interest, outperforming a 12-month term at 7.25% — best balance of liquidity and yield among standard tenures.

What’s the highest FD rate at North East Small Finance Bank right now?

As of Feb 2026, the maximum 7.75% p.a. is at 18-month tenure on both callable and non-callable FDs — same for regular & senior citizens.

Should I choose callable or non-callable FD?

If cash chance >1%, pick callable for flexibility. If money is idle and sure, non-callable earns 0.25–0.50% extra interest over same tenures.

If I invest ₹10 lakh, how does premature withdrawal work?

In callable FD, early break deducts ~1% from interest. Example: ₹10L for 12 months at 6.25% becomes ~5.25% if broken early — still safer than savings.

How much extra do senior citizens earn on NESFB FD?

Senior citizens get up to +0.25% extra interest. On ₹50 lakh for 3 years, senior rate ~7.50% vs regular ~7.25% — ₹37,500 extra over 3 years.

How does the North East Small Finance Bank FD rates calculator actually help?

The FD rates calculator shows exact maturity amount. Example: ₹1 lakh at 7.75% for 18 months gives ~₹1,11,200, helping tier-3 investors plan safely.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.