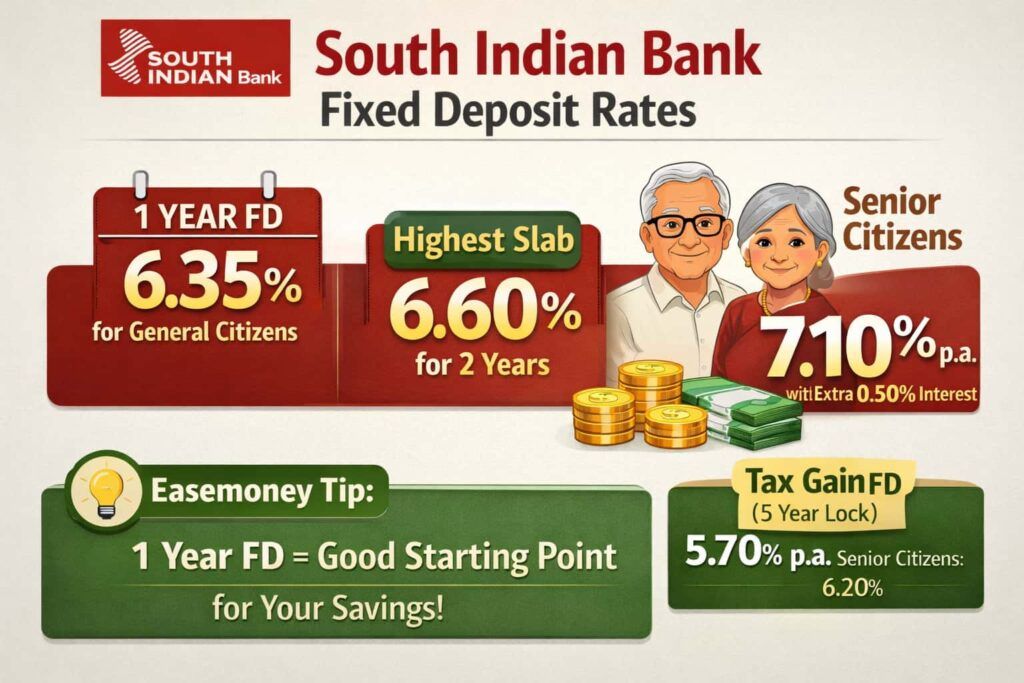

In 2026, South Indian Bank offers fixed deposit interest rates from 2.90% to 6.60% per year for general customers. Senior citizens get an extra 0.50% interest, so the highest FD rate goes up to 7.10% per year.

These interest rates are changed and active from January 14, 2026, and apply to domestic retail fixed deposits below ₹3 crore.

South Indian Bank is not a flashy new-age bank. It is a relationship-based private bank (1929) that has grown slowly and steadily through branch-level trust. The same thinking is clearly visible in how the bank designs its Fixed Deposit (FD) schemes.

Instead of pushing one so-called “highest interest FD”, South Indian Bank offers different FD options for different needs. Some FDs are meant for regular income, some for compounding, some for liquidity, tax saving, bulk fund parking, or steady retirement cash flow.

Unlike banks that focus only on short-term special FDs, South Indian Bank spreads its value across practical tenures, especially around 1 year, 2 years, and structured options like Green Deposits. This makes the FD offering more stable and suitable for people who prefer clarity over marketing hype.

New FD Interest Rates – Callable FDs (Below ₹3 Crore)

This works for NRO, Regular citizen, and senior citizens.

| FD Period | General (%) | Senior Citizen (%) | Easemoney View |

|---|---|---|---|

| 7 days – 30 days | 2.90 | 3.40 | Only for emergency parking |

| 31 – 90 days | 3.50 | 4.00 | Still very low return |

| 91 – 99 days | 4.50 | 5.00 | First decent rate jump |

| 100 – 180 days | 4.80 | 5.30 | Okay, but not best |

| 181 – 270 days | 5.50 | 6.00 | Short-term planning range |

| 271 days – < 1 year | 5.90 | 6.40 | Better than a savings account |

| 1 year | 6.35 | 6.85 | Good starting FD |

| >1 year – <2 years | 5.95 | 6.45 | Rate drops, avoid if possible |

| 2 years | 6.60 | 7.10 | One of the best slabs |

| >2 – <5 years | 6.20 | 6.70 | Stable, not aggressive |

| 5 years – <66 months | 5.70 | 6.20 | Mainly for tax-saving |

| 66 months (Green Deposit) | 6.00 | 6.50 | ESG focus + decent return |

| >66 months – 10 years | 5.70 | 6.20 | Safety first, low growth |

| Tax Gain FD (5 years) | 5.70 | 6.20 | Tax benefit, not high yield |

Quick Points –

- These rates are for retail FDs below ₹3 crore

- Senior citizens get an extra 0.50%, only for resident accounts, and it works for any tenure you choose.

- Joint FD is allowed if one holder is a senior citizen

- All FDs listed above are callable, which means premature withdrawal is allowed

Easemoney Insight

South Indian Bank does not give higher rewards just because you lock your money for many years. In this bank, long lock-in does not mean high return.

The real value comes in specific tenures, not at the extreme long end.

- Around 1 year → clean entry FD, good starting point

- Exactly 2 years → best mix of interest rate and lock-in

- 66 months Green Deposit → suitable for investors who prefer ESG-linked options with decent return

Locking money for 5 to 10 years does not increase yield here. These longer tenures are mainly for capital safety and discipline, not for maximising interest.

Key Features (Simple View)

This FD setup is meant for people who want clear rules, stable return, and bank-branch support, not for those running behind short-term high-rate offers.

SIB Fixed Deposit Features Explained

| Feature | What It Means in Real Life |

|---|---|

| Minimum Deposit | ₹100 if you open an FD at a branch, ₹1,000 if you do it online |

| Maximum Deposit | Retail FDs allowed below ₹3 crore |

| Minimum Tenure | FD can start from just 7 days |

| Maximum Tenure | You can keep FD up to 10 years |

| Interest Rate (General) | From 2.90% to 7.10% per year, based on tenure |

| Interest Rate (Senior Citizen) | Extra benefit, effective return can go close to 7.60% in select tenures |

| Loan Against FD | Up to 90% loan available for most FD schemes |

| Safety | Bank deposits insured by DICGC up to ₹5 lakh |

| Tax Saver FD | 5-year lock-in if you want a tax benefit |

| Premature Withdrawal | Allowed, but A 0.50% penalty is charged for deposits below ₹15 lakh, and 1.00% penalty applies for deposits of ₹15 lakh and above. |

Retail FD Types Explained: What Is Different in Each FD

South Indian Bank offers different Fixed Deposit options to match different needs. Some FDs are for easy withdrawal, some are for tax saving, and some give extra benefits to senior citizens.

In total, there are around 9 to 11 FD schemes for regular Indian residents and citizens. This does not include NRO, NRE, NRI, or FCNR deposit schemes. The FD setup is mainly for people who want clear options based on how and when they plan

1. Regular Fixed Deposit

This is the normal FD most people open first. If you walk into a branch and say, “Open an FD for me”, this is usually what they offer.

How this FD works

- You can keep the FD for 7 days to 10 years

- Interest is simple interest, nothing complicated

- Interest is usually paid quarterly

- If you want a monthly income, that option is also there, but the rate comes a little lower; confirm with customer care or branch staff.

- You can break the FD before maturity, but a penalty will be deducted

- Loan against FD is available if you need money in between

- An auto-renewal option is available, so FD continues if you forget the maturity date

Who should go for this FD

- Salaried people who want safe parking

- Families needing a monthly cash flow

- Anyone who doesn’t want risk and tension

Easemoney Tip (Real Talk)

Don’t make the mistake of locking money for 5 or 10 years without checking rates. In South Indian Bank, many times a 1-year or 2-year FD gives a better return. Always compare before saying yes at the counter.

2. SIB QuickFD (Digital FD)

SIB QuickFD is a fully digital FD, mainly made for new customers who don’t have an account with South Indian Bank. You don’t need to open a savings account. Everything happens online.

How QuickFD works (simple way)

- Minimum deposit: ₹1,000

- Savings account: Not required

- Funding: You can pay using UPI from any bank

- KYC: Done through VKYC, no branch visit

Reality Check (Important)

QuickFD is about ease and speed, not about higher interest.

The interest rates are the same as regular FD. No extra benefit just because it is digital.

Real-Life Example

Suppose you already have money in PhonePe or Google Pay and just want to park ₹10,000 safely for a few months without opening a new bank account. QuickFD works well there. Few clicks, UPI payment, and FD done.

But if you already have an SIB account, normal FD works just fine.

3. Fast Cash Deposit

This FD is made for very short-term money. When you have some cash lying idle and don’t want to keep it in a savings account, this option works.

How this FD works (plain words)

- Tenure options: 30 days, 46 days, or 91 days only

- Partial withdrawal: Allowed if you need some money in between

- Auto-renewal: Available, FD can roll over automatically

- Loan against FD: Not allowed

Where This FD Is Useful

This FD is helpful when you have a temporary surplus and don’t trust yourself to keep the money untouched. Instead of spending it, you park it in FD for a short time. Think of it like this: Money is not needed today, but also not for long-term lock-in. Fast Cash FD gives discipline, not a high return.

Good choice when you want an FD habit instead of idle cash.

4. Kalpakanidhi Deposit (Cumulative FD)

Kalpakanidhi is South Indian Bank’s compounding FD. In simple words, interest keeps getting added back to the FD, so money grows a little faster over time.

- Interest is compounded quarterly

- Tenure: From 6 months up to 10 years

- No monthly or quarterly payout — money stays locked

- Because of compounding, the effective return is higher

- Loan against FD is available if needed

This FD is for people who don’t need a regular income and are okay with letting money sit and grow.

Simple Example For You – Let’s say you put ₹3,00,000 at 6% for 3 years.

- Normal FD (with payout): You get around ₹3.54 lakh

- Kalpakanidhi FD: You get around ₹3.57 lakh

Same interest rate. No magic. The extra money comes only because interest is compounding, not because the bank is paying more.

When This FD Makes Sense

If you don’t need monthly cash and want better final amount, Kalpakanidhi works better than a regular payout FD.

5. SIB Bank Max Plus – Non-Callable Deposit

This FD is not for everyone. It is meant only for people who have a big surplus of money and are sure they won’t need it before maturity.

features

- Minimum deposit: ₹1,00,00,001 (above 1 crore)

- Maximum deposit: Below ₹3 crore

- Premature withdrawal: Not allowed at all

- Loan against FD: Not available

- Interest rate: Slightly higher than normal callable FDs

Rate snapshot (Retail non-callable, Feb 2026)

| Tenure | Rate |

|---|---|

| 1 year | 6.55% |

| 2 years | 6.80% |

Risk trade-off: Extra yield is typically 20–40 bps over callable FDs. Liquidity risk is absolute.

Once you put money here, it is fully locked till maturity. The only reason to choose this FD is the higher interest. But in return, you give up all liquidity. No breaking FD, no loan, no adjustment.

This works only if the money is truly surplus — not an emergency fund, not business cash, not money you might need. If there is even 1% doubt that you may need the money, don’t choose this FD.

6. South Indian Bank Tax Gain 2006 (80C FD)

This FD is only for tax savings. Nothing else. If your main goal is to reduce taxes, this FD does the job.

Key points –

- Lock-in: Full 5 years (money is fully blocked)

- Maximum investment: ₹1.5 lakh per financial year

- Interest: Earned, but interest is taxable

- Premature withdrawal: Not allowed

- Loan against FD: Not allowed

Once you invest, you cannot touch the money for 5 years. No emergency exit.

Real-Life Example

Ramesh runs a small shop and earns around ₹9 lakh per year. To save tax, he invested ₹1.5 lakh in the Tax Gain FD of South Indian Bank.

Because of this:

- His taxable income reduced

- He saved around ₹36,000 in income tax

That tax saving helped him manage school books for his kids and medical expenses at home. The FD return was secondary — tax saving was the real benefit.

Important –

This FD is not for flexibility or high returns. It works only if:

- You want an 80C tax benefit

- You are okay with a 5-year lock-in

- You don’t need the money urgently

If liquidity matters, avoid this FD.

7. SIB Bank QEnd Fixed Deposit

This FD is for people who like interest coming at the end of every quarter. Not monthly, not yearly — fixed quarterly income.

How it works for you –

- Interest payout: Every quarter end

- Tenure: From 7 days up to 10 years

- Loan against FD: Available

- Senior citizen benefit: Extra interest applicable

You keep the principal intact, and interest comes four times a year.

Where This FD Is Useful

QEnd Deposit works well if you have predictable quarterly expenses — like school fees, insurance premiums, or business-related payments. Instead of withdrawing a lump sum or breaking the FD, the interest itself covers expenses.

Simple logic: Money stays safe, income comes on time.

8. Flexi & Flexi Smart Deposits

These deposits are linked directly to your Savings or Current Account. The idea is simple: keep money earning FD interest, but still have access when needed.

Functions –

- FD amount stays linked to your account

- When the account balance goes low, FD automatically breaks partially

- Auto sweep-in happens without visiting the branch

- You can withdraw money any number of times

- Interest is recalculated only on the broken portion

- Loan against FD: Not available

Important Reality Check

Flexi FD gives convenience, not a higher return. If sweeps happen often, the actual interest earned comes down because the FD keeps breaking again and again.

This works best for people who:

- Want liquidity

- Keep a decent balance

- Don’t withdraw frequently

If you use the account daily and money moves a lot, a normal FD is better.

9. SIB Bank Green Deposit

Green Deposit is a fixed-tenure FD where your money is used for environment-friendly projects. It works like a normal FD, but with a green purpose attached to it.

Overview –

- Tenure: Fixed at 66 months

- Interest rate: Similar to a normal FD, nothing extra

- Senior citizen benefit: An extra interest is applicable

From the return point of view, there is no big difference compared to other FDs.

Ground-reality –

You don’t choose this FD for higher interest. You choose it because you want your money to support green and sustainable activities.

So think of it like this: Return is decent, but impact is the real reason.

10. SIB Care (Senior Citizen FD)

This FD is meant for retired people who want a fixed monthly income, not just interest.

- Every month, you get a fixed payout

- The payout includes interest + a part of your principal

- Because of this, the FD balance slowly reduces

- You can choose a tenure from 2 to 10 years

- Works like a pension-style FD, not a normal FD

Insights –

- This FD is not for wealth creation

- Capital does not stay intact

- Best suited for monthly expense management

- Useful when FD income is replacing salary or pension

In short:

- Need regular monthly cash → SIB Care works

- Want final lump sum growth → avoid this FD

Table — Retail FD structures (what actually differs)

| Scheme | Interest style | Liquidity | Loan allowed | Who it fits |

|---|---|---|---|---|

| Regular Fixed Deposit | Simple / Monthly / Quarterly | Full (premature allowed) | ✅ Yes | Conservative savers |

| Kalpakanidhi (KND) | Quarterly compounding | Full | ✅ Yes | Yield-focused investors |

| Fast Cash Deposit | Simple / Cumulative | Partial withdrawal | ❌ No | Ultra-short parking |

| Max Plus (Non-Callable) | Simple / Cumulative | ❌ None | ❌ No | High-corpus, lock-in |

| Tax Gain 2006 | Cumulative | ❌ None (5y lock) | ❌ No | 80C taxpayers |

| QEnd | Quarterly payout | Full | ✅ Yes | Predictable income |

| Flexi Deposit | Cumulative (sweep) | Auto partial | ❌ No | SB-linked liquidity |

| Green Deposit | Simple / Cumulative | Full | ✅ Yes | ESG-aligned investors |

| SIB Care | Amortised payout | No premature | ❌ No | Retirees |

| Galaxy | Simple / Reinvestment | Callable / Non | Conditional | Institutions |

| Flexi Smart | Cumulative (CA sweep) | Auto partial | ❌ No | Traders OR businesses |

FAQs

How can I download the South Indian Bank FD application form?

You can download the official South Indian Bank FD application and rate structure PDF directly from the bank website. Link: https://www.southindianbank.bank.in/userfiles/forms/application_form_for_term_deposits.pdf

How to close a South Indian Bank Fixed Deposit before maturity?

Visit the branch with an FD receipt and ID proof, or use net banking if enabled. A 0.50% to 1% penalty applies based on deposit amount, as per rules effective 2026.

Can SIB QuickFD be closed before maturity?

Yes, SIB QuickFD can be closed before maturity through the digital platform. Penalty applies the same as regular FD. Money is credited back to the original bank account used during opening.

Where can I get the South Indian Bank FD form offline?

You can collect the FD form from any South Indian Bank branch for free. Minimum FD starts from ₹100 at the branch. Carry Aadhaar, PAN, and one photo for smooth processing.

Which South Indian Bank FD is best for senior citizens in 2026?

For senior citizens, a 2-year FD at 7.10% gives the best balance of return and lock-in in 2026. Monthly income seekers should compare Regular FD vs SIB Care carefully.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.