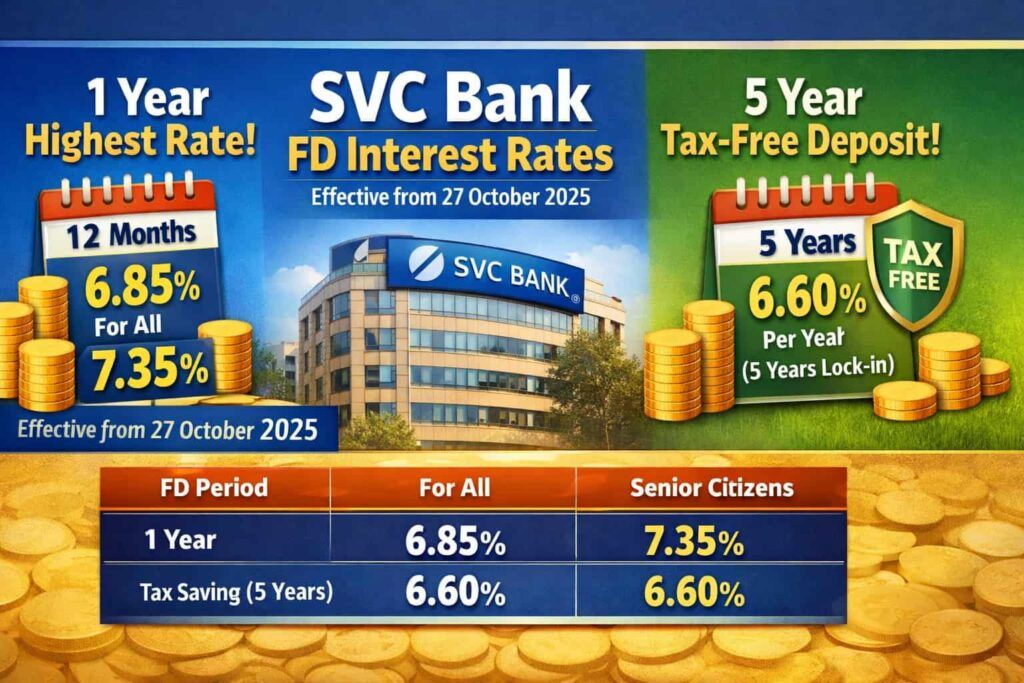

As per the latest official update, SVC Bank FD interest rates are applicable from 27 October 2025, and the same rates are being followed in branches even in early 2026. So whatever rates you see now are not old or expired ones.

- Shamrao Vithal Co-operative Bank offers FD interest rates between 3.25% to 6.85% per year for normal customers.

- For senior citizens, the rates are slightly better, starting from 3.75% and going up to 7.35% per year on domestic fixed deposits.

- Right now, the highest FD interest is given for the 12 months to below 16 months tenure.

This is the period where SVC Bank is paying the best return, especially useful for people looking for a one-year type of investment.

One good thing about SVC Bank is that they keep the FD structure very simple. No confusing scheme names. No unnecessary marketing drama. Just three FD options for regular customers, and separate, clear options for NRI deposits. Anyone can understand it easily.

This simplicity actually matters in 2026. Because a fixed deposit is not about excitement or high risk. FD is for people who want peace of mind. You put money, you know how much interest you will get, and you don’t worry daily.

SVC Bank, earlier known as SVC Co-operative Bank Ltd., is not a new bank. It was established in 1906 and is a scheduled multi-state urban co-operative bank in India. That long history gives confidence to FD customers who care more about trust, clarity, and fixed income, not fancy promises.

As per Acuite Credit Rating Agency, till 31 March 2025, people have kept around ₹16,410 crore in term deposits with the bank. This clearly shows that many customers trust the bank with their savings.

SVC Bank FD Interest Rates charts

Effective from 27 October 2025, this FD interest rate chart of Shamrao Vithal Co-operative Bank is valid for all branches. Rates are per year, and the FD can be closed before maturity if needed.

The same chart applies to Domestic, NRO and NRE deposits and works for all three FD types — Short Term, Long Term and Tax Saving (80C). Only tenure and tax benefit change, not the rate.

Senior citizens 60 years and above get 0.50% extra interest on FD. It’s the same FD, just a better rate for elders, no extra condition, but an NRI senior citizen is not eligible for benefits.

| FD Period | Normal Customers (%) | Senior Citizens (%) | Simple Desi Note |

|---|---|---|---|

| 7 to 14 Days | 3.25% | 3.75% | Very short parking, only for emergency money |

| 15 to 45 Days | 3.50% | 4.00% | Better than savings, but still short-term |

| 46 to 89 Days | 4.00% | 4.50% | Good for 2–3 months extra cash |

| 90 Days | 4.75% | 5.25% | Small jump in interest after 3 months |

| 91 to 117 Days | 5.00% | 5.50% | Decent option if unsure about long lock-in |

| 118 Days | 5.25% | 5.75% | Special slab, the bank gives a little extra |

| 119 to 179 Days | 5.25% | 5.75% | 4–6 months safe return |

| 180 Days | 6.00% | 6.50% | After 6 months, rates become attractive |

| 181 to 330 Days | 6.15% | 6.65% | Almost 1 year, stable choice |

| 331 to 364 Days | 6.15% | 6.65% | One-year planning without full lock |

| 12 Months | 6.85% (Highest) | 7.35% (Highest) | ⭐ Very popular FD tenure |

| Above 12 to below 14 Months | 6.85% | 7.35% | Same benefit as a 1-year FD |

| 14 to below 16 Months | 6.85% | 7.35% | ⭐ Highest interest slab |

| 16 to 24 Months | 6.75% | 7.25% | Long-term but slightly lower rate |

| Above 24 to 60 Months | 6.60% | 7.10% | For people who want peace, not chasing rates |

| Above 60 to 120 Months | 6.60% | 7.35% | Seniors get long-term benefits |

| Tax Saving FD (5 Years) | 6.60% | 6.60% | Tax benefit, but money locked |

Important FD Tip: If you break an FD before maturity, the bank charges a 1% penalty on the interest rate applicable for the period your money stayed. If your FD rate is 6.85% and you break early, you may get around 5.85% for that period.

SVC Bank Fixed Deposit Structure (Resident Customers)

Shamrao Vithal Co-operative Bank does not make FD complicated. For normal Indian customers, SVC Bank gives only three FD options:

- Short Term Fixed Deposit

- Long Term Fixed Deposit

- Tax Exempt Fixed Deposit (80C)

That’s it. Nothing extra. It included senior citizens’ benefits.

All these FDs give an assured return. Money is safe, and interest is fixed. There is no risk tension like the share market.

The difference is very simple:

- How long do you keep the money

- whether you want tax savings or not

- and how easily you may need money back

The scheme is the same, only the purpose is different.

Extra FD Options (Ask at Branch)

Apart from the main FD types, SVC Bank also gives two extra options inside the same FD. These are not separate schemes. You just need to tell the branch staff.

- Reinvestment Deposit Scheme – This is a cumulative FD. In this option, interest is added every three months and again invested with your main amount. You do not get money monthly. But at maturity, you receive one big amount. Good for people who want growth and no regular income.

- Monthly Income Plan (MIS) – This option is for people who need a monthly income. Interest is paid every month into your account. The rate is a little lower, but the income is regular. Many senior citizens choose this for daily expenses.

1. Short Term Fixed Deposit – SVC Bank

Short Term FD in Shamrao Vithal Co-operative Bank is mainly used to park money safely for a short time. It is useful when you don’t want to keep cash idle in savings account but also don’t want a long lock-in.

Key Details:

- Minimum deposit starts from ₹500

- Tenure is from 15 days to 364 days

- Interest is paid at maturity

- You can read the above chart interest rate, but only for 1 year.

- It is an assured return FD, no risk tension

Digital Benefit:

- You can book this FD from home using Internet Banking.

- If you book online, you also earn reward points, which is a small extra benefit.

Ground Reality: This FD is mostly used by shopkeepers, small traders, and families who get temporary cash and want to keep it safe for some time, without blocking money for a long period.

2. Long-Term FD Plan

Long-term FD in Shamrao Vithal Co-operative Bank is for people who want steady saving for 1 year to 10 years, but still want option of regular income if needed. It suits families who don’t like risk but want a better return than a savings account.

Key Details:

- Minimum deposit: ₹500

- Tenure: 12 months to 120 months

- Assured return, no market tension

Interest Payout Options:

Monthly, Quarterly, Half-yearly, Yearly, or at maturity — the customer can choose as per need.

Other Benefits:

- Cumulative option (interest added back)

- Auto-renewal facility

- Extra interest for senior citizens

- Loan against FD up to 90%

Real Life Example

Atmaram Bhide invested ₹3 lakh in an FD for 14–16 months because interest was good and the lock-in was not too long. At around 6.85%, after 16 months he earned roughly ₹27,000–₹28,000 as interest. Total amount at maturity came close to ₹3.27 lakh. Safe money, fixed return, no tension — exactly Bhide style.

3. Tax Exempt Fixed Deposit

Tax Saving FD in Shamrao Vithal Co-operative Bank is only for saving tax, not for flexibility. This FD is for people who are sure they won’t need this money for the full 5 years.

Key Rules (Straight):

- Minimum deposit: ₹500

- Maximum deposit: ₹1.5 lakh

- Lock-in period: 5 years compulsory

- Eligible under Section 80C

- Interest rate: 6.60% per year, check the chart for the latest.

Important Tax Points (Very Clear):

- Only the principal amount gets the 80C benefit

- Interest earned is fully taxable

- No premature withdrawal

- No loan or overdraft on this FD

Real Life Story –

A salaried employee invests ₹1.5 lakh in this FD to save tax. He gets a ₹1.5 lakh deduction under 80C, reducing taxable income. After 5 years, the maturity amount comes around ₹2.05–2.10 lakh (approx). Tax saved today, safe return later — but money stays locked for the full 5 years.

4. NRE Term Deposit Interest Rates

- NRE rupee FDs are accepted only for 365 days to 60 months

- These FDs are only for Non-Resident Indians

- Account is rupee-denominated

- Short-term NRE FDs below 1 year are not allowed

- The highest NRE interest right now is 6.85%.

| FD Tenure | Interest Rate | Ground-Level Note |

|---|---|---|

| Up to 1 Year | Withdrawn | Not allowed as per RBI guidance |

| Above 12M to <14M | 6.85% | One of the best slabs right now |

| 14M to <16M | 6.85% | Same high return, popular choice |

| 16M to 24M | 6.75% | Slightly lower, still stable |

| Above 24M to 60M | 6.60% | Long-term peace, steady return |

If you are an NRI and want a good return without locking money for many years, the 12 to 16-month NRE FD makes most sense. Longer tenure gives safety, but interest is slightly lower. Simple choice — decide how long you can wait, the rate is already clear.

5. FCNR (B) Deposit

FCNR FD is popular because:

- No exchange loss (money stays in foreign currency)

- Tax-free in India

- Full repatriation allowed

In simple words, NRIs who earn in dollars prefer FCNR so their money is not affected by rupee ups and downs. Right now, USD FCNR gives up to 5.75% for 1 year, which is the best slab.

FCNR (B) Interest Rate Table chart

| Tenure | USD | GBP | EUR | JPY | AUD |

|---|---|---|---|---|---|

| 1 Year to <2 Years | 5.75% | 0.50% | 0.50% | 0.10% | 0.50% |

| 2 Years to <3 Years | 4.25% | NA | NA | NA | NA |

| 3 Years to <4 Years | 4.00% | NA | NA | NA | NA |

| 4 Years to <5 Years | 3.50% | NA | NA | NA | NA |

| 5 Years | 3.50% | NA | NA | NA | NA |

6. RFC Term Deposit

RFC Interest Rate Table Effective from 1 February 2026 –

| Tenure | USD | GBP | EUR |

|---|---|---|---|

| 1 Year | 5.75% | 0.50% | 0.50% |

| 2 Years | 4.25% | NA | NA |

| 3 Years | 4.00% | NA | NA |

RFC FD is for returning Indians who came back to India but still hold foreign currency. It helps them keep money in USD, GBP or EUR without converting immediately.

Special Point (Very Important): If a person becomes NRI again, RFC account can be converted into NRE or FCNR easily. That flexibility is the biggest advantage.

FAQs

What are the SVC Bank fixed deposit rates for senior citizens?

Senior citizens get 0.50% extra interest on resident FDs. For 12 months, the rate becomes 7.35% p.a. This benefit applies from 7 days to 10 years.

Is the SVC Bank Fixed Deposit trusted or safe?

Yes. Shamrao Vithal Co-operative Bank is RBI-regulated and deposits are insured up to ₹5 lakh under DICGC, giving basic safety to village and small-town families.

Can I break the SVC Bank FD early if money is needed?

Yes, premature withdrawal is allowed. The bank charges 1% penalty on the applicable interest. Example: breaking a 12-month FD at 8 months gives a lower adjusted interest.

How to download SVC Bank fixed deposit account opening form?

You can download the official FD form DEP-14J from the SVC Bank website.

Direct link: Account Opening Form for Fixed DepositWhich FD tenure is most popular in cities for SVC Bank?

In cities, 12 to 16 months FD is most chosen. Reason: good interest, not long lock-in, and money remains available for medical, farming, or family needs.

Read Now – Co-operative Bank FD Interest Rates

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.