Ujjivan Small Finance Bank is giving good FD interest in 2026. Normal people can get interest up to 7.45% per year, and senior citizens are getting a little extra benefit, up to 7.95% per year, for some selected time periods. Mostly, higher interest is available if an FD is done for 2 years. For 12 months FD, the bank is giving around 7.25%, and for 24 months FD, the interest is on the higher side.

The bank has changed its FD interest rates from 05th August 2025, and these rates are still valid in 2026. These interest rates are only for FD amounts below ₹3 crore.

As of 31st December 2025, the bank’s total deposits reached around ₹42,223 crore. This shows that the bank has seen good growth in both its deposit money and loan businesses. More people are trusting the bank and keeping their savings here. Ujjivan Small Finance Bank also comes under RBI rules, and fixed deposits are safe up to ₹5 lakh under DICGC insurance. Overall, the bank has a decent profile and is considered safe for FD investors.

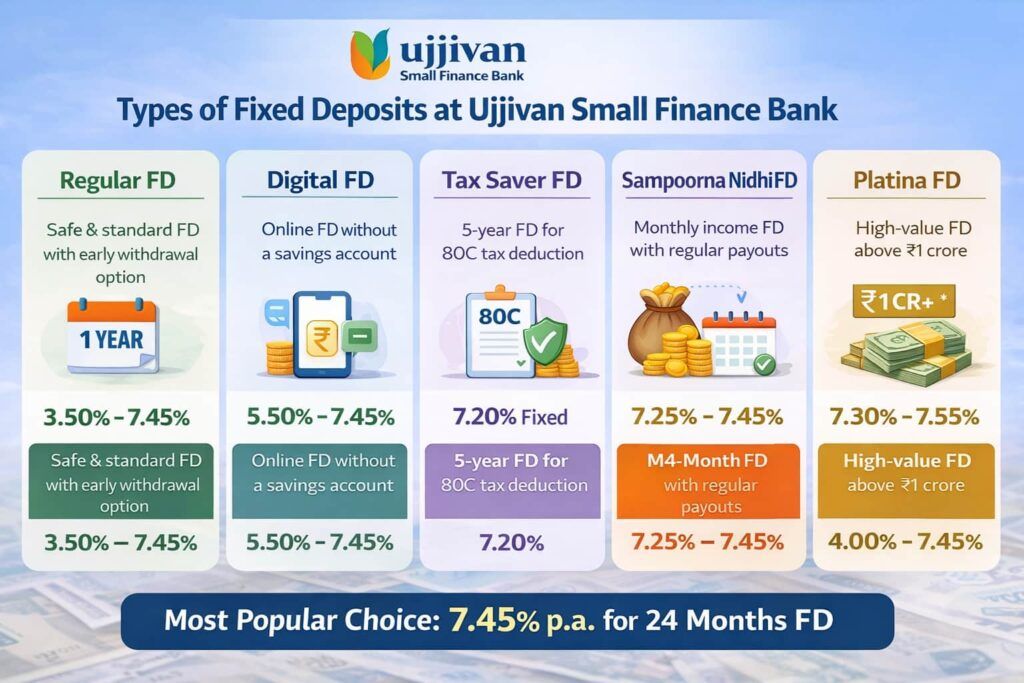

Ujjivan Small Finance Bank does not follow the idea of one FD for everyone. The bank has different FD options based on who the customer is. There are separate FD plans for resident Indians, senior citizens, people who want a monthly income, digital customers, and NRI customers.

This makes FD selection easier for people in small cities and towns, where the main concern is:

- safety of money

- clear rules

- fixed monthly income

- no hidden conditions

How Ujjivan Bank Structures Its FD Products and Rates

Ujjivan Small Finance Bank does not divide fixed deposits only by amount. The bank mainly separates FD options based on customer type, so customers can easily understand which FD is right for them.

Simple way to understand it:

For Resident Indians

- Regular Fixed Deposit

- Digital Fixed Deposit

- Tax Saver Fixed Deposit

- Sampoorna Nidhi (Monthly Income FD)

For NRIs / Returning NRIs

- NRE Fixed Deposit

- NRO Fixed Deposit

- RFC(D) Fixed Deposit (Foreign Currency FD)

Important thing to note: FD interest rates are not the same for all these FD types. Because of this, each FD option is explained separately, so people can clearly know which FD gives what return.

This method helps branch staff explain easily and avoids confusion for first-time FD investors, especially in small cities and towns.

FD Options for Resident Indians

Ujjivan Small Finance Bank has a large number of FD customers who are Resident Indians. In fact, this group makes up the biggest share of the bank’s FD deposits. These FD options are mainly useful for:

- salaried people

- small shopkeepers

- farmers and self-employed people

- senior citizens

- families looking for a safe and steady income

These FD plans are made to suit daily needs and simple saving goals. Now, let’s understand each FD option one by one, in an easy way.

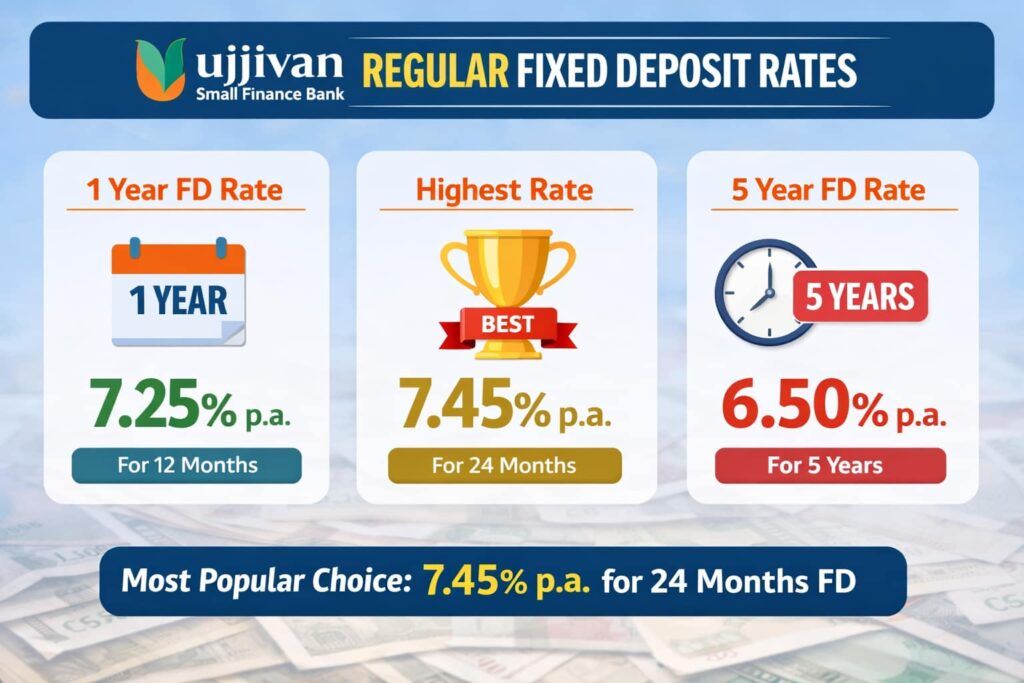

1. Ujjivan Small Finance Bank Regular Fixed Deposit Rates

Ujjivan Small Finance Bank’s Regular Fixed Deposit is the most common FD used by customers. This FD is suitable for people who want their money to stay safe, earn a fixed return, and still have the option to withdraw early if needed.

This FD is mainly chosen by salaried people, small business owners, families, and senior citizens who do not want risk.

Key Things You Should Know

- Minimum deposit: ₹1,000

- FD period: From 7 days to 10 years

- Interest payment: Monthly, Quarterly, or At Maturity

- Premature & partial withdrawal: Allowed

Regular FD Interest Rates (Resident Indians)

Deposit below ₹3 crore | Effective from 05 August 2025

| FD Tenure | Interest Rate |

|---|---|

| 7 – 29 days | 3.50% |

| 30 – 89 days | 4.15% |

| 90 – 179 days | 4.65% |

| 180 days | 6.00% |

| 6 months – less than 12 months | 5.50% |

| 12 – less than 24 months | 7.25% (Good option) |

| 24 months | 7.45% (Best option) |

| 24 months 1 day – 990 days | 7.25% |

| 991 days – 60 months | 7.20% |

| 60 months 1 day – 120 months | 6.50% |

Ground Reality (What People Actually Do)

Most customers prefer 2 years FD, because:

- The interest rate is the highest

- Money is not locked for very long

- Easy to plan future expenses

Senior Citizen Fixed Deposit at Ujjivan Bank

Ujjivan Small Finance Bank offers special FD benefits for senior citizens aged 60 years and above. Compared to normal customers, senior citizens get a higher interest rate on the same FD period.

FD interest rates for senior citizens range from 4.00% to 7.95% per year, depending on how long the money is kept. The highest interest is usually given on a 24-month FD.

Senior citizens also get an extra 0.50% interest over the regular FD rates, which makes this FD a good option for a safe and steady income.

Ujjivan Small Finance Bank – Senior Citizen FD Rates

| FD Tenure | Senior Citizen FD Rate (p.a.) Deposit below ₹3 crore |

|---|---|

| 7 days to 29 days | 4.00% |

| 30 days to 89 days | 4.65% |

| 90 days to 179 days | 5.15% |

| 180 days | 6.50% |

| 6 months to less than 12 months | 6.00% |

| 12 months to less than 24 months | 7.75% (Good option) |

| 24 months | 7.95% (Best option) |

| 24 months 1 day to 990 days | 7.75% |

| 991 days to 60 months | 7.70% |

| 60 months 1 day to 120 months | 7.00% |

What Most Senior Citizens Prefer (Ground Reality)

- 24 months FD is most popular because the interest is highest

- 12–24 months FD is chosen when some flexibility is needed

- Monthly interest payout helps manage regular expenses

- No tension of market ups and downs

2. Digital Fixed Deposit – Online FD Without Savings Account

Ujjivan Small Finance Bank Digital Fixed Deposit is for people who want to open an FD fully online, without visiting the bank branch. The biggest benefit is that no savings account is required to open this FD.

This FD is useful for people who:

- Want to open an FD online

- do not want to open a savings account

- prefer a paperless and simple process

Digital FD Conditions (Simple)

- Savings account: Not required

- Minimum FD amount: ₹1,000

- FD period: From 6 months to 10 years

- Interest rates: Same as Regular FD

- Premature withdrawal: Allowed after 6 months, without penalty

- Senior citizen benefit: Available

Who Should Choose Digital FD

Digital FD is a good option for first-time FD customers, young earners, and people who are comfortable using mobile or online banking. It saves time, avoids branch visits, and still gives the same interest as a normal FD.

3. Tax Saver Fixed Deposit (Rates)

Ujjivan Small Finance Bank Tax Saver Fixed Deposit is only meant for saving tax under Section 80C. This FD is not for flexibility or short-term use.

People should choose this FD only when the main goal is tax saving.

Important Rules

- Lock-in period: 5 years (compulsory)

- Investment amount: From ₹1,000 to ₹1.5 lakh in one financial year

- Premature withdrawal: Not allowed

- Loan or overdraft: Not allowed

- Who can invest: Resident Indians and HUF only

Tax Saver FD Interest Rate

| FD Tenure | Interest Rate |

|---|---|

| 5 years | 7.20% |

Important Understanding (Do Not Miss This)

- Only the invested amount qualifies for a tax benefit under Section 80C

- Interest earned is taxable as per your income tax slab

- This FD is good for people who want safe tax savings, not liquidity

4. Sampoorna Nidhi FD – Monthly Income FD

Ujjivan Small Finance Bank Sampoorna Nidhi FD is made for people who want a fixed monthly income and do not want to disturb their main savings amount.

This FD is mostly useful for:

- senior citizens

- families managing monthly household expenses

- people who want income but want to keep their principal safe

Why This FD Is Different

- Interest is credited every month

- Works like a pension-style income, but with FD safety

- A savings account with Ujjivan SFB is mandatory

- Auto-renewal option is available

- Premature closure allowed after 6 months, without penalty

Eligibility for Sampoorna Nidhi FD

- Who can open: Individuals with an existing Ujjivan SFB Savings or Current Account

- Nationality: Resident Indians only

- Minimum deposit: ₹25,000 (in multiples of ₹1,000)

- FD period: 12 to 60 months (only in multiples of 12 months)

- Age limit: No minimum age requirement

Sampoorna Nidhi Interest Rates

| FD Tenure | Interest Rate |

|---|---|

| 12 – < 24 months | 7.25% |

| 24 months | 7.45% |

| 24 months 1 day – 990 days | 7.25% |

| 991 days – 60 months | 7.20% |

| Senior citizen benefit | +0.50% |

Senior citizens get an extra +0.50% interest per year.

Ground Reality (Who Should Choose This FD)

Sampoorna Nidhi FD is best for people who want:

- monthly income without risk

- safe alternative to a pension

- no tension in the stock market or mutual funds

5. Platina FD – High-Value Fixed Deposit Option above 1 Cr.

Ujjivan Small Finance Bank Platina FD is a special fixed deposit meant for people who invest large amounts. This FD is not like a normal retail FD and is mainly used by high-value customers who want better interest with full safety.

This FD is suitable when the investment amount is above ₹1 crore and below ₹3 crore.

What Makes Platina FD Different

- This is a non-callable FD, which means money cannot be withdrawn before maturity

- Partial withdrawal is not allowed

- FD can be opened for 1 year to 5 years

- Auto-renewal is not available

- Interest can be taken monthly, quarterly, or at maturity

Because of these conditions, Platina FD is meant for money that is not needed urgently.

Who Should Choose Platina FD

Platina FD works best for:

- people with large surplus funds

- investors who do not need early withdrawal

- those looking for higher interest than normal FD

- people who want safe returns without market risk

Platina FD Interest Rates

Last updated 05 August 2025 | Deposit above ₹1 crore and below ₹3 crore

| FD Tenure | Interest Rate (p.a.) |

|---|---|

| 12 months to less than 24 months | 7.35% |

| 24 months | 7.55% (Best option) |

| 24 months 1 day to 990 days | 7.35% |

| 991 days to 60 months | 7.30% |

Important to know:

- These rates are different from regular retail FD rates

- No extra interest is given to senior citizens in the Platina FD

FD Options for NRIs & Returning NRIs

Ujjivan SFB offers three separate FD products depending on NRI status and source of money.

1. NRE Fixed Deposit – For Overseas Income

This FD is for NRIs earning outside India.

Key Rules –

- Interest: Tax-free in India

- Repatriation: Full (principal + interest)

- Minimum tenure: 1 year

- Senior citizen benefit: Not allowed (RBI rule)

NRE FD Interest Rates (Updated in 2026) –

| Tenure | Interest Rate |

|---|---|

| 12 – < 24 months | 7.25% |

| 24 months | 7.45% |

| 24 months 1 day – 990 days | 7.25% |

| 991 days – 60 months | 7.20% |

| 60 months 1 day – 120 months | 6.50% |

2. NRO Fixed Deposit – For Income Earned in India

This FD is used for: rent, pension, dividend, and business income earned in India.

Key Points –

- Interest: Taxable

- TDS applicable

- Repatriation allowed after tax

- Premature & partial withdrawal allowed

NRO FD Interest Rates –

| Tenure | Interest Rate |

|---|---|

| 7 – 29 days | 3.50% |

| 30 – 89 days | 4.15% |

| 90 – 179 days | 4.65% |

| 180 days | 6.00% |

| 12 – < 24 months | 7.25% |

| 24 months | 7.45% |

3. RFC(D) Fixed Deposit – For Returning NRIs

RFC(D) is not NRE or NRO. It is a foreign currency FD for NRIs who have permanently returned to India.

Key Highlights

- Currency: USD only

- Minimum deposit: USD 500

- No exchange rate risk

- Principal & interest fully repatriable

- Can convert to NRE / FCNR(B) if NRI status returns

RFC(D) USD Interest Rates (Latest)

| Tenure | Regular USD | USD ≥ 100,000 |

|---|---|---|

| 1 – < 2 years | 5.30% | 6.00% |

| 2 – < 3 years | 4.50% | 4.50% |

| 3 – < 4 years | 4.25% | 4.25% |

Special 6.00% rate applies Dec 2025 – Feb 2026 only.

FAQs

Is Ujjivan Small Finance Bank safe for fixed deposits?

Yes. Ujjivan SFB is RBI-regulated, with deposits insured up to ₹5 lakh by DICGC. As of FY25, strong retail FD base shows consistent depositor confidence.

What are the current Ujjivan Small Finance Bank FD rates for senior citizens?

Senior citizens earn an additional 0.50% p.a. over regular rates. As of 05 August 2025, the highest effective rate reaches 7.95% on select tenures.

What is the FD interest rate for 1 year in Ujjivan Small Finance Bank?

For resident Indians, the 12-month FD rate is 7.25% p.a. (effective August 2025). Senior citizens receive 7.75% p.a. on the same tenure.

How accurate is the Ujjivan Small Finance Bank FD rates calculator?

The official FD calculator uses real-time rates and compound logic. Tip: Always recheck maturity value on booking date, as rates depend on fund credit timing.

Should NRIs choose NRE, NRO, or RFC fixed deposits in Ujjivan Bank?

Choose based on money source. Overseas income suits NRE (tax-free). Indian income needs NRO. Returning NRIs benefit from RFC(D) avoiding currency conversion risk.

Is monthly income from Sampoorna Nidhi FD better than regular FD?

Yes for cash-flow needs. Sampoorna Nidhi credits interest monthly, ideal for retirees. Example: ₹10 lakh at 7.45% pays ~₹6,200 monthly before tax.

Which Ujjivan FD tenure gives the best risk-return balance?

Data shows the 24-month FD offers the highest rate at 7.45% p.a. It balances return visibility and liquidity better than longer lock-in tenures.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.