Utkarsh Small Finance Bank has designed its fixed deposit products in a very practical and ground-level way. Instead of pushing all customers into one common FD category, the bank clearly separates small savers, high-value depositors, digital users, and bulk investors.

This makes things easier because people don’t keep the same amount of money in real life. Some start small with ₹5,000, some invest ₹20–₹50 lakh, and a few even go above ₹3 crore. Utkarsh keeps these groups separate, so rate confusion does not happen.

The bank revised its FD interest rates from 01 December 2025. After this change –

- General customers get interest starting from 4.00% per year, going up to 7.50% per year on FD amounts below ₹1 crore.

- For senior citizens, the most attractive rate is 8.00% per year on the 2 to 3-year tenure, which is currently the best option for higher returns.

A Utkarsh Small Finance Bank Fixed Deposit (FD) is a safe option where you invest one-time money and get a fixed return after a chosen period. The bank is fully RBI-regulated, and deposits are insured up to ₹5 lakh under DICGC, which gives extra safety to regular investors and families.

What Makes Utkarsh FDs Easy For You (Different Types of FD Products)

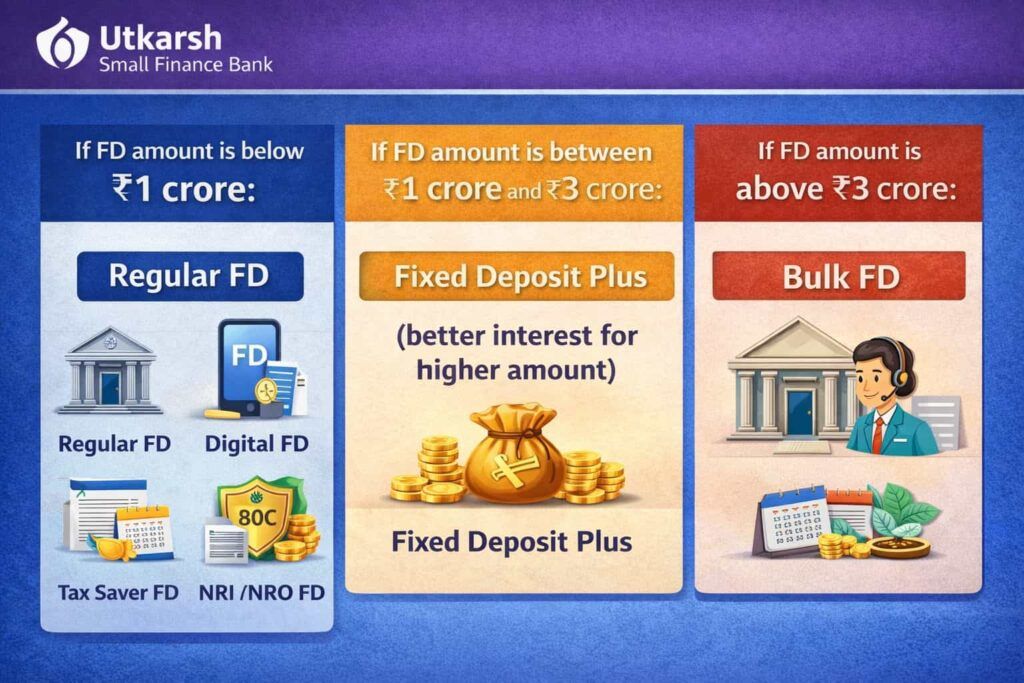

Utkarsh Bank has kept its fixed deposit system very simple. The bank does not mix all customers into one FD type. Instead, FD options are separated based on how much money you invest.

This makes it easy for people from small cities and towns to choose the right FD without confusion.

Simple way to understand Utkarsh FD options:

- If the FD amount is below ₹1 crore:

- Regular FD

- Digital FD

- Tax Saver FD

- NRI / NRO FD

- If the FD amount is between ₹1 crore and ₹3 crore: Fixed Deposit Plus (better interest for higher amount)

- If the FD amount is above ₹3 crore: Treated as Bulk FD, handled directly at the branch

Because of this clear system, bank staff explain faster, and customers also feel comfortable while investing. Let’s talk about different types of FDs –

1. Utkarsh Bank Regular Fixed Deposit: The Main FD Most People Use

This is the main fixed deposit option of Utkarsh Small Finance Bank. Most people use this FD to save money safely or to get a fixed income without tension. It is simple, easy to understand, and suitable for customers from small cities and towns. It offer 4% interest rate to 7.50% at the highest for general people.

- You can open this FD if you are a resident Indian, a joint account holder, an HUF, a small business owner, or a partnership firm or trust.

Key Details You Should Know

- The minimum FD amount is ₹1,000, which helps people who want to start with small savings.

- There is no fixed maximum limit, but regular FD interest rates are applicable only up to ₹1 crore. Amounts above this are handled separately.

- FD tenure starts from 7 days and goes up to 10 years, but in real life, most customers get better value in the 2 to 3 years range.

- Interest rules are very simple. If FD is below 181 days, interest is calculated as simple interest. If FD is above 181 days, interest is given with quarterly compounding.

- You can choose how you want your interest — monthly, quarterly, or a full amount at maturity. Senior citizens get higher interest rates.

- Premature withdrawal is allowed with a 1% penalty, but no penalty applies if the FD is closed within the first 7 days. The FD process can be done easily through the branch or digital mode.

Current active FD Interest Rate Table (Simple View)

Ground reality: Most customers choose 2 to 3 years, because returns are good and money does not feel stuck for too long.

| FD Tenure | General Customers |

|---|---|

| 7 days – 45 days | 4.00% |

| 46 days – 90 days | 4.50% |

| 91 days – 180 days | 5.00% |

| 181 days – 370 days | 6.00% |

| 371 days – < 2 years (729 days) | 7.25% |

| 2 years – 3 years (730–1095 days) | 7.50% (Popular and highest) |

| Above 3 years – < 4 years | 7.25% |

| 4 years – 5 years | 7.00% |

| Above 5 years – 10 years | 6.75% |

Note:

- These FD rates are for deposits below ₹3 crore, come with a premature withdrawal option, and are applicable from 01 December 2025.

- If you are planning to invest more than ₹1 crore, do not rely only on the above FD rate chart. Instead, check the Fixed Deposit Plus scheme, which offers higher interest rates but does not allow premature withdrawal.

2. Senior Citizen Fixed Deposit

In Utkarsh Small Finance Bank, Senior Citizen FD is not a separate product. It is the same domestic fixed deposit, but customers aged 60 years or above get an extra 0.50% interest automatically.

This small extra interest makes a big difference when the FD amount is high or when interest is taken monthly or quarterly. That is why many senior citizens prefer Utkarsh FD for regular income or long-term safety.

An extra senior citizen benefit is applied only if:

- The senior citizen is the first account holder

- Extra senior citizen interest does NOT apply to NRE or NRO FDs. This rule comes from RBI guidelines, not the bank.

Senior Citizen FD Interest Rates (Latest)

(Domestic FD | Deposit below ₹3 crore | Effective from 01 December 2025)

| FD Tenure | Senior Citizen Interest Rate |

|---|---|

| 7 Days to 45 Days | 4.50% |

| 46 Days to 90 Days | 5.00% |

| 91 Days to 180 Days | 5.50% |

| 181 Days to 370 Days | 6.50% |

| 371 Days to less than 2 Years (729 Days) | 7.75% |

| 2 Years to 3 Years (730–1095 Days) | 8.00% (Good option) |

| Above 3 Years to less than 4 Years | 7.75% |

| 4 Years to 5 Years | 7.50% |

| Above 5 Years to 10 Years | 7.25% |

Tip For You – The best rate for senior citizens is 8.00% on 2 to 3 years FD, which is why this tenure is most popular.

3. Fixed Deposit Plus Scheme – For Amount Above ₹1 Crore

Once your FD amount crosses ₹1 crore, Utkarsh Small Finance Bank moves you to Fixed Deposit Plus. This FD is meant for large surplus money, where you do not need liquidity and can keep funds locked for better returns.

Core Rules of FD Plus (Simple)

- Minimum deposit: Above ₹1 crore

- Maximum deposit: Less than ₹3 crore

- Premature withdrawal: Not allowed

- Interest payout: Monthly, Quarterly, At maturity

- Senior citizens: Get extra interest

If you may need money in between, FD Plus is not suitable.

Fixed Deposit Plus – Interest Rates Chart

(No premature withdrawal | ₹1 crore to below ₹3 crore | active from 01 December 2025)

| FD Tenure | General Customers | Senior Citizens |

|---|---|---|

| 7 days – 45 days | 4.00% | 4.50% |

| 46 days – 90 days | 4.50% | 5.00% |

| 91 days – 180 days | 5.00% | 5.50% |

| 181 days – 370 days | 6.00% | 6.50% |

| 371 days – < 2 years | 7.50% | 8.00% |

| 2 years – 3 years | 7.75% | 8.25% |

| Above 3 years – < 4 years | 7.50% | 8.00% |

| 4 years – 5 years | 7.25% | 7.75% |

| Above 5 years – 10 years | 7.00% | 7.50% |

Simple Summary – FD Plus gives better interest, but the money gets locked. Choose it only if you are sure you won’t need funds before maturity.

4. Digital Fixed Deposit (Quick FD Option)

Utkarsh Small Finance Bank offers Digital Fixed Deposit mainly for new customers who want to open an FD digitally and quickly without full paperwork. This FD works on limited KYC, so some limits are applied.

Digital FD – Simple Conditions

- FD amount: ₹1,000 to ₹90,000 only (Amount is capped at ₹90,000 because of limited KYC)

- Tenure: 7 days to 365 / 366 days

- Number of FDs: Only one Digital FD allowed

- Interest payout: At maturity only

- Interest rates: Same as regular retail FD

- Premature withdrawal: Allowed, but a branch visit is required

Who Should Use Digital FD

- First-time FD customers

- People who want to test the bank digitally

- Small savers who don’t want to visit a branch

Note – Digital FD is not meant for large investments. For higher amounts, a regular FD with full KYC is a better option.

How to Apply for Digital Fixed Deposit (Step-by-Step)

- Visit the official website of Utkarsh Small Finance Bank

- Click on “Book Fixed Deposit” or “Digital FD”

- Enter your mobile number (it must be linked with Aadhaar)

- Verify the mobile number using 6-digit OTP

- Put your PAN card details

- Now, enter your Aadhaar number and complete OTP-based KYC

- Choose FD amount between ₹1,000 to ₹90,000

- Select FD tenure from 7 days up to 365 / 366 days

- Confirm interest payout at maturity (this is the only option)

- Make payment using UPI

- After successful payment, your Digital FD gets booked instantly

- Download the FD Advice, which is also sent to your registered email ID

Important Points to Remember

- Only one Digital FD is allowed per customer

- No savings account with Utkarsh is required

- Premature withdrawal is allowed, but you must visit the branch

- Digital FD is available only for new customers because it works on a limited KYC

5. Tax Saver Fixed Deposit – Only for Saving Tax

Utkarsh Small Finance Bank Tax Saver Fixed Deposit is meant only for Section 80C tax saving. This FD is not for flexibility or income. It is mainly used to save tax at the end of the financial year. The rate of interest you will get –

| FD Tenure | General Customers | Senior Citizens |

|---|---|---|

| 5 Years | 7.00% | 7.50% |

Important Points You Must Know

- Investment amount: ₹1,000 to ₹1.5 lakh

- Lock-in period: 5 years compulsory

- Premature withdrawal: Not allowed

- Loan or overdraft: Not allowed

- Interest payout: Only at maturity

- Interest tax: Interest earned is fully taxable

- Tax benefit: Only the invested amount qualifies for the 80C deduction

- Tax regime: Works only under the old tax regime

If your main goal is to save tax, this FD is useful. If you want liquidity or a regular income, this FD is not suitable.

6. FD Options for NRI Customers

Utkarsh Small Finance Bank offers two FD options for NRI customers, based on where the money comes from.

1. NRE Fixed Deposit (For Overseas Income)

Utkarsh Small Finance Bank NRE Fixed Deposit is for money earned outside India.

Key points:

- For foreign income

- Interest is tax-free in India

- Full repatriation allowed (principal + interest)

- Minimum amount: ₹10,000

- Maximum amount: Less than ₹3 crore

- Tenure: 1 year to 10 years

- Premature closure:

- No penalty

- No interest if FD is closed before 1 year

- Eligible:

- NRIs & PIOs (as per FEMA)

- Seafarers, diplomats, students abroad

Best for NRIs who want tax-free and safe returns.

2. NRO Fixed Deposit (For Income Earned in India)

NRO Fixed Deposit is for income earned in India, like rent, pension, or business income.

Key points (simple):

- For Indian income

- Interest is taxable

- TDS applicable

- Interest can be repatriated after tax

- Minimum amount: ₹10,000

- Maximum amount: Less than ₹3 crore

- Tenure: 7 days to 10 years

- Premature withdrawal:

- Allowed with 1% penalty

- No interest if closed within 7 days

- Eligible:

- NRIs & PIOs

- Seafarers, diplomats, students abroad

Suitable for managing India-based income.

NRE & NRO FD – Interest Rates (Quick View)

(Deposits below ₹3 crore | Effective from 01 December 2025)

| FD Tenure | NRO FD | NRE FD |

|---|---|---|

| 7 – 45 days | 4.00% | – |

| 46 – 90 days | 4.50% | – |

| 91 – 180 days | 5.00% | – |

| 181 – 364 days | 6.00% | – |

| 365 – 370 days | 6.00% | 6.00% |

| 371 days – < 2 years | 7.25% | 7.25% |

| 2 – 3 years | 7.50% | 7.50% |

| Above 3 – < 4 years | 7.25% | 7.25% |

| 4 – 5 years | 7.00% | 7.00% |

| Above 5 – 10 years | 6.75% | 6.75% |

Key Deposit In Utkarsh Bank

As of 31 December 2025 (Q3 FY26), the CNBCTV18 news says – Utkarsh Small Finance Bank had total deposits of about ₹21,087 crore. A large part of this money was kept in Fixed Deposits (FDs), which shows that many customers trust the bank for safe savings.

- Out of the total amount, ₹12,586 crore was kept as Fixed Deposits by normal customers, such as families, salaried people, and senior citizens.

- Apart from this, ₹3,890 crore came from big FD holders, like companies and large investors.

This clearly shows that both small and big customers are keeping their FD money with Utkarsh Bank.

If the fixed deposit amount is ₹3 crore or more, it is treated as a bulk FD. In this case, the interest rate is not shown in the regular rate chart and is decided separately by the bank, based on the deposit amount. Customers can contact the bank or visit the nearest branch to discuss the interest rate and FD details.

FAQs

What exactly is the Utkarsh FD Credit Card?

Launched in 2024, the Wish Credit Card is FD-backed, RuPay-based, lifetime free, offering up to 3% cashback on PhonePe spends with zero income proof requirement.

How much extra does a senior citizen earn in the Utkarsh FD?

Senior citizens earn +0.50% p.a. extra on most tenures. E.g., a 2-year FD at 7.50% becomes 8.00%, meaning ₹80,000 yearly on ₹10 lakh.

Why are there two interest rate charts below ₹3 crore?

Because Utkarsh separates retail FD (below ₹1 crore) and FD Plus (₹1 crore–<₹3 crore). The second chart shows FD Plus higher rates but no premature exit allowed.

What is the best FD tenure in Utkarsh for balanced returns?

Retail 2–3 year FDs are sweet spot. As of Dec 2025, yields near 7.50%-8.00% beat long-term 5–10 year returns, yet keep money flexible for emergencies.

How does premature withdrawal affect interest in Utkarsh FD?

If you break an FD early, interest is recalculated at lower applicable slab and 1% penalty applies. Broken within 7 days? Zero interest paid.

If I deposit ₹1.5 crore, which FD rate applies?

Amounts above ₹1 crore up to <₹3 crore fall under FD Plus rates (higher than retail). For ₹3 crore+, contact the branch for bulk deposit rates.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.