What Is a BSBDA Account?

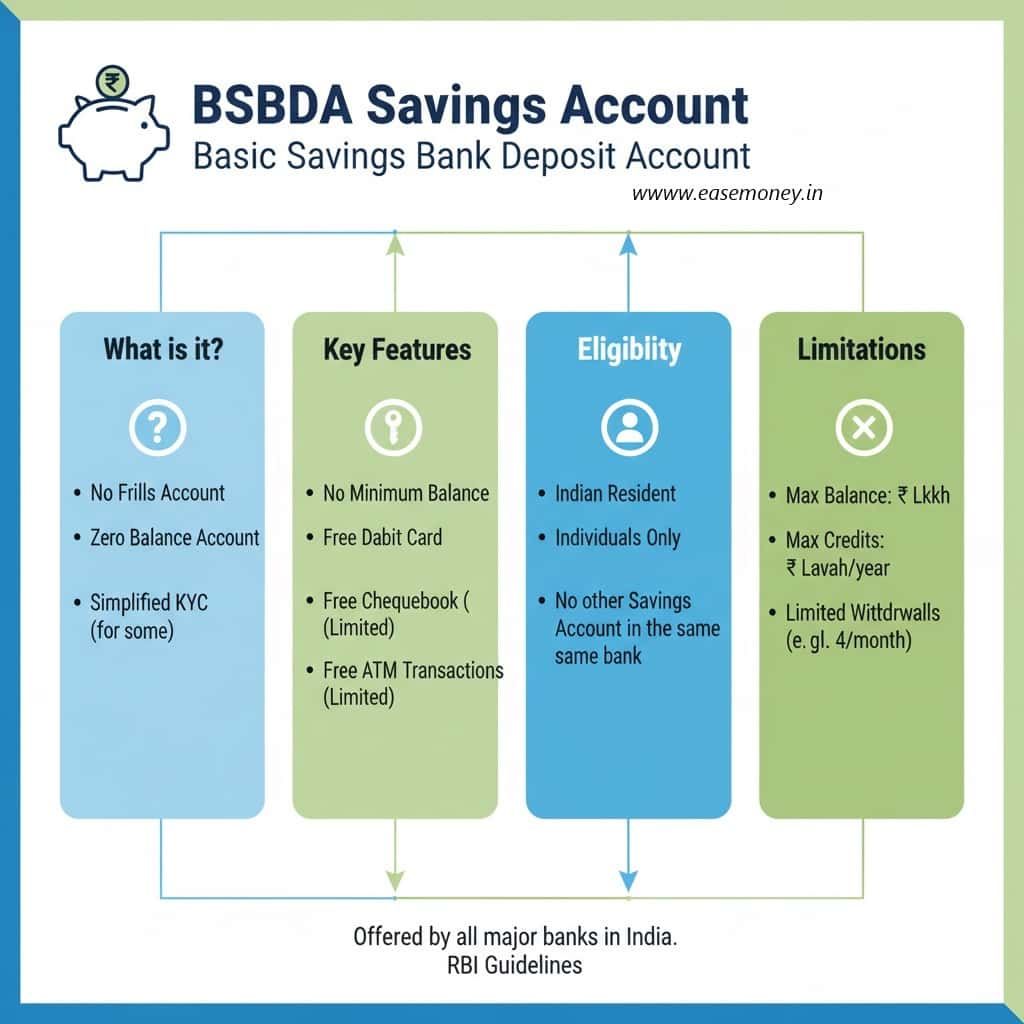

BSBDA is a type of savings account that banks offer. It is mandated by the RBI to provide to every Indian citizen as part of the effort to promote financial inclusion. Every low-earning person, student, minor, and Indian can benefit from that.

Where private banks and other premium banks are launching AMB on maintain monthly basis, the main feature that makes BSBDA unique is that it does not require you to maintain any minimum balance.

In most regular savings accounts, banks require you to maintain ₹2,000, ₹5,000, or even ₹10,000 as a minimum balance — and failure to do so often results in penalties.

With a BSBDA, that stress disappears. However, it has a few limitations as well.

Full Form of BSBDA

BSBDA stands for –

- B – Basic

- S – Savings

- B – Bank

- D – Deposit

- A – Account

This type of account was formerly known as a “No-Frills Account” before the RBI revised the guidelines in 2012 and renamed it BSBDA.

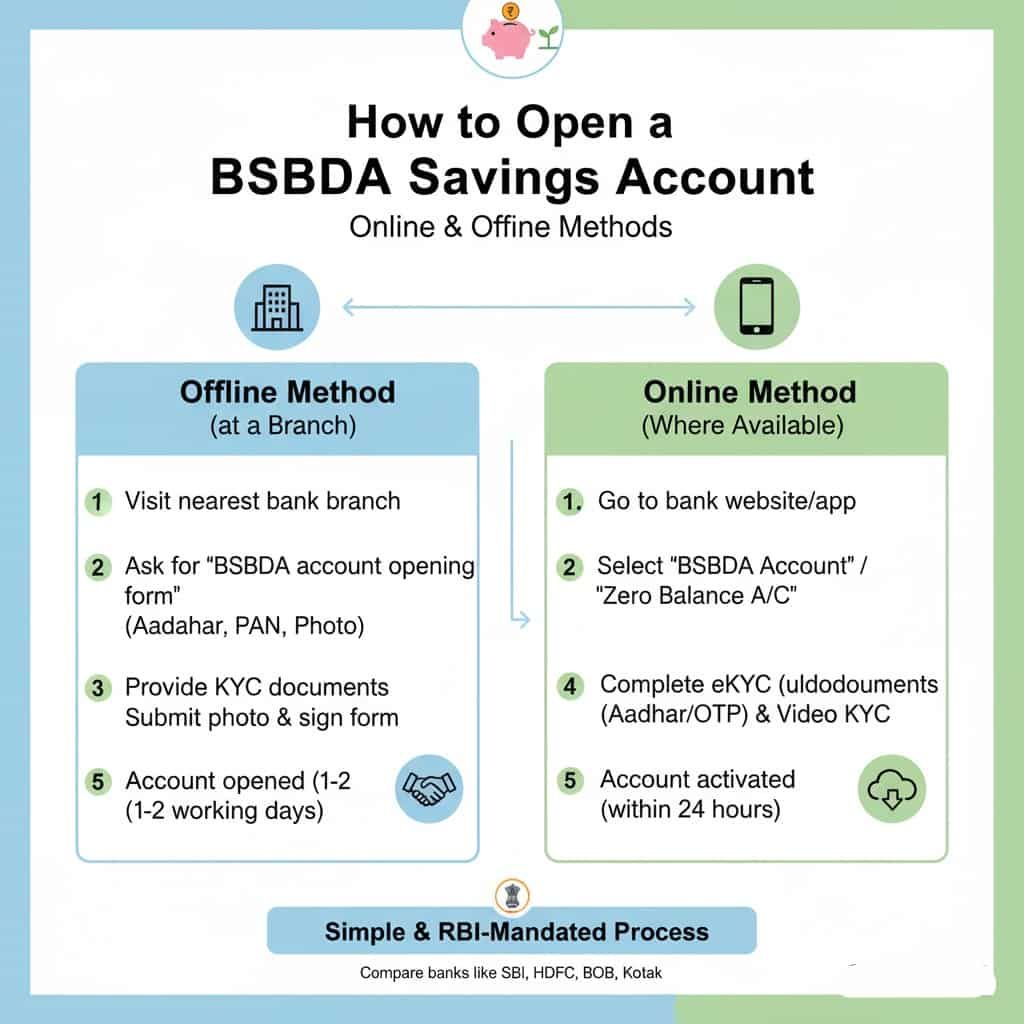

How to Open a BSBDA Account Online or Offline

Opening a BSBDA is simple — banks are required by the RBI to offer this facility. First, find compare few bank services such as SBI, BOB, HDFC, or Kotak. Check benefits, here are the steps after selecting –

Offline Method (at a Branch)

- Visit your nearest bank branch.

- Ask for the “BSBDA account opening form.”

- As per RBI, I need a Zero balance account.

- Provide basic KYC documents (Aadhaar, PAN, your photo, etc.).

- Submit a photograph and sign the form.

- Once verified, your account will be opened — usually within 1-2 working days.

Online Method (Where Available)

Some banks like SBI, HDFC, and Bank of Baroda allow BSBDA accounts to be opened online.

- Go to the bank’s official website or mobile app.

- Select “Basic Savings Bank Deposit Account” or “Zero Balance Account.”

- Fill out the application form, and upload documents.

- Complete eKYC verification (via Aadhaar/OTP) and Video KYC.

- Account details will be sent to your registered email/mobile.

- The account will be activated within 24 hours.

What If the Bank Asks for a Minimum Balance?

One of the issues many people face and complain that bank branches still say We don’t offer zero-balance accounts” and “You must maintain ₹2,000 or ₹5,000 to open it.

This is not correct for BSBDA accounts, as per the circular of the RBI, your bank must have to provide a minimum facilities free of charge account if you are fully eligible.

If a bank is refusing to open a zero-balance BSBDA or is forcing you to maintain a minimum balance, here’s what you should do:

- Politely demand from the staff that you want to open a “Basic Savings Bank Deposit Account as per RBI rules.”

- Quote the RBI circular (UBD.BPD.Cir.No.5/13.01.000/2012-13 dated August 17, 2012), which clearly states that all banks have to provide a regular BSBDA account.

- Try another branch or bank – some bank staff are unaware or may push regular accounts for targets.

- File a complaint with the bank’s grievance cell or directly with the RBI Banking Ombudsman if they still refuse.

What are the BSBDA Account Limits (2025 Rules)

Let’s talk first about the limits of your account, then the features, for a true story-

BSBDA accounts are designed to provide basic regular banking services, but they also come with certain limits just since they are used for personal financial needs and not for heavy transactions or larger withdrawals.

Here are the most important limits to know:

Free Transaction Limit

- Withdrawal charges – You can only make 4 free withdrawals per month (including ATM, branch, NEFT/RTGS, standing instructions, etc.)

- After the free limit, banks can charge a nominal fee (usually ₹10 to ₹25 per transaction). You find in your bank statement charges code – “BSBD WDL TXN CHG“

What is the common charges list

| Charge Type | Details / Limits |

|---|---|

| Account Opening | Free |

| Minimum Balance | None; no penalty |

| Cash Deposits | Free (high-value deposits may need verification) |

| Cheque Deposits | Free |

| Branch Withdrawals | Free upto 4 |

| Online Transfers (NEFT/IMPS/RTGS) | Limited free per month; nominal fee beyond the limit |

| Debit Card Issuance | Free (usually RuPay) |

| Debit Card Annual Fees | Usually free; charges apply for international use |

| SMS / Transaction Alerts | Free |

| Cheque Book | Only 10 free (extra books ₹25–₹50) |

| Overdraft Facility | Not allowed |

| Dormancy / Inactivity Fees | May apply if the account is inactive for several years |

| Other Hidden Charges | Charges may apply for non-standard services, such as, special remittances or card replacement |

Small BSBDA Account Limits (Simplified KYC Accounts)

If the account is opened with simplified KYC (for people who don’t have full ID/address proof), it’s treated as a BSBDA-Small Account, and the limits are stricter:

- Maximum balance: ₹50,000. If it goes above, you may find your account frozen.

- Maximum annual credits: Upto Rs. 1,00,000 only (Capped by RBI)

- Maximum monthly withdrawals/transfers: ₹10,000

- You can not use it for foreign remittances allowed without completing your full KYC via branch or video KYC.

These limits are designed to keep small accounts secure and prevent misuse.

After Full KYC

- You will get no maximum balance restriction; however, banks may apply transaction limits and limitations on withdrawing money using ATMs.

- UPI, NEFT, IMPS, and RTGS are usually unlimited and free of charge; however, you can confirm with your bank.

Services or Features Available in a BSBDA Account

Here’s what you get free of charge in a typical BSBDA:

- Deposit and withdraw cash

- Receive money via NEFT, IMPS, UPI, or cheque

- Get an ATM-cum-debit card with no annual fees

- Free passbook updates

- Free balance inquiries at ATMs

- You will get the UPI App via Aadhaar, so all your digital payments are easy.

- Online banking and mobile banking services (in most banks)

- You can use it for Aadhaar seeding as well as for APS subsidy, APBS credit, and refunds.

Important for you – Some facilities depend on banks to banks, such as cheque books, SMS alerts, or demand drafts, might not be included by default. such as SBI does not give a cheque book facility for usage. If additional services are charged or require a minimum balance, the account will no longer qualify as a BSBDA.

Who Is Eligible to Open a BSBDA Account?

One of the best parts about a BSBDA is that any Indian resident can open it. There are no restrictions on:

- Age

- Income level

- Occupation

- Location

It works for all. If you are a student, homemaker, housewife, tuition teacher, self-employed person, working from home only, salaried employee, or older citizen, you are eligible.

A few key points to remember:

- You cannot hold more than one BSBDA in the same bank.

- If you already have a regular savings account and want to switch, you will need to close the old account within 30 days of opening a BSBDA.

- You can still open fixed deposits or recurring deposits with the same bank if you want to save or invest.

BSBDA vs Regular Savings Account: What’s the Difference?

| Feature | BSBDA | Regular Savings Account |

|---|---|---|

| Minimum Balance | ₹0 | ₹2,000 – ₹10,000 |

| Free Withdrawals | 4/month | Varies (often 5+ per month) |

| ATM Debit Card Charges | Free | Usually chargeable |

| Cheque Book | Optional / Chargeable | Usually Free |

| Transaction Limit | Basic | Higher |

| Best For | Students, low-income, minimal users | Regular users, salaried, high transactions |

Is BSBDA the Same as a Jan Dhan Account?

No, however, though similar in appearance, BSBDA and Jan Dhan accounts are not identical. A Jan Dhan account is a type of BSBDA introduced under the Pradhan Mantri Jan Dhan Yojana (PMJDY) and comes with government-linked benefits.

- Jan Dhan Account have up to ₹2 lakh Accidental Insurance.

- Overdraft Facility upto Rs. 10,000 after 6 months.

Yes, it is also a financial inclusion, but it provides extra benefits as well.

Additional User Q/A

What documents are required for BSBDA?

You don’t need to provide any additional documents; you just need your address proof (Voter ID, driving license or Aadhaar), 2 passport-size photos, and your PAN card. However Original PAN card is required for both online and offline opening. If you don’t have a PAN Card, submit Form 60 and additional declaration forms.

Can a BSBDA be upgraded to a regular savings account?

Yes, you can easily and simply request a form at the branch for the upgrade to a regular savings account with higher features and limits. The bank may ask for a deposit amount, then withdraw after full KYC for the regular account.

Why do banks hesitate to open a BSBDA despite RBI rules?

Many branches push regular accounts for targets. BSBDA earns them nothing. Tip: clearly say “Basic Savings Bank Deposit Account as per RBI circular”—that phrase usually changes staff behaviour instantly.

Can a bank force me to maintain a minimum balance in a BSBDA?

No. BSBDA legally requires zero minimum balance. If staff insist on ₹2,000–₹5,000, escalate to the branch manager or the grievance cell. RBI rules override internal bank sales policies.

Why do BSBDA accounts have only four free withdrawals monthly?

BSBDA is designed for basic personal use, not heavy transactions. RBI capped free withdrawals to prevent misuse. After four, small charges apply—usually ₹10–₹25 per extra transaction.

What happens if my BSBDA remains inactive for a long time?

Long inactivity can make the account dormant, limiting transactions. Reactivation is simple—one branch visit with ID. No penalty, but unused debit cards may stop working temporarily.

Is a BSBDA debit card truly free for life?

Mostly yes for domestic RuPay cards. Charges may apply only for replacements, international usage, or premium variants. Always confirm card type before accepting upgrades suggested by branch staff.

Can I run UPI and receive subsidies through a BSBDA?

Yes. BSBDA fully supports UPI, DBT subsidies, pensions, and refunds. Aadhaar seeding works normally. Many government payments are actually designed assuming a BSBDA-style account.

Should salaried or working professionals still consider BSBDA?

Yes, if you want a secondary zero-balance account for UPI or bills. Keep the salary account separate. This simple split can save ₹3,000–₹6,000 yearly in minimum balance penalties.

What is the biggest risk with a Small BSBDA (simplified KYC)?

Crossing limits unknowingly. If balance exceeds ₹50,000 or yearly credits cross ₹1 lakh, the account may freeze. Complete full KYC early to avoid sudden transaction blocks.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.