Understanding Yes Credit Cards And Their Digital Approach

As part of its digital-first approach, Yes Bank offers e-statements for better convenience and faster services.

According to the infographic data from Finshots, Yes Bank holds 2% of the total credit card market share in India. The bank had distributed over 13 lakh cards till the end of 2022 due to its digital banking services.

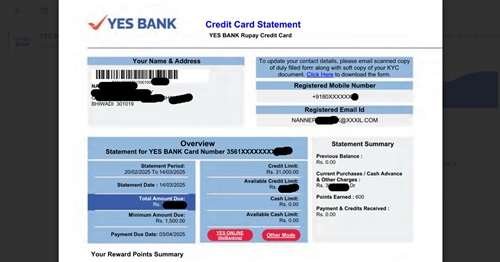

An e-statement is a digital version of your credit card statement sent to your registered email address. It collects all your credit card and personal data, such as customer ID, card number, your address, and bank details.

Also, an e-statement is not just a list of transactions—it serves as a bill due notification and provides your payment due date, minimum due amount, and total balance.

Also, as per the RBI guidelines, Banks must provide an e-statement monthly for convenience and records for users.

Steps to Open Your Yes Bank Credit Card Statement

Once you receive your e-statement from Yes Bank, follow these simple steps to unlock it easily:

Step 1: Receiving the Statement

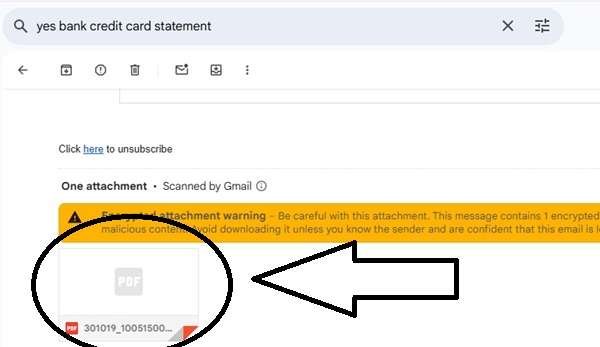

- Locate the Email: Please open your Inbox app and search for a message from Yes Bank in your inbox. If it is not found, please check your spam folder.

- Find the PDF File: open the email and scroll down to the end of it. where you found the PDF e-statement file,

- Download PDF: Tap on the save button to download it, but firstly, ensure you have enough storage in your email and phone. Also, check for a stable internet connection.

Step 2: Opening the PDF

- Find the File: Typically saved in your “Downloads” folder.

- Use a PDF Reader: Open with Adobe Acrobat Reader, Google Chrome, or any built-in PDF viewer.

Step 3: Enter The Password

To unlock your Yes Bank Credit card e-statement, the bank uses a format as the first four letters of your Name on the Card (in CAPITAL letters) followed by your Date of Birth (in DDMM format).

Let me give you a good example –

| Customer Name | Date of Birth | Password |

|---|---|---|

| T R E Eesan | 01-Aug-1984 | TREE0108 |

| Timesh Mishra | 12-March-1982 | TIME1203 |

Type the password exactly as per the format. Also, double-check for no mistakes in typos, date of birth, and symbols.

The password is showing incorrectly after entering the PDF

In case you are unable to open your e-statement PDF file, here are a few Troubleshooting tips for you to follow –

- Ensure Proper Letter Case – The password must be in UPPERCase letters in the first four letters of your name. Please check your credit card while entering the password.

- Enter the Correct Date Format – as always, double-check your DOB in your bank passbook.

If your problem is still not solved, you can reach out to the Yes Bank support team:

- YES First & YES Premia: 1800 103 6000

- YES Prosperity: 1800 103 1212

- International Customers: +91 22 5079 5101

- Email: yestouchcc@yesbank.in

- SMS Support: You can send “HELP” space your “Customer ID” to +91 95522 20020

Popular FAQs

How do I find my Yes Bank credit card customer ID?

Simply check your received Yes Bank credit card welcome kit. The credit card attached paper also has your Customer ID. Alternatively, log in to the Iris mobile app, the Cust ID mentioned in the header of the app homepage.

How can I download my Yes Bank e-statement instantly?

Use the IRIS by YES BANK app: log in, go to the credit card section, select past statements, download it and open your e-statement PDF without a password.

Can I switch back to a physical credit card statement?

Yes, but banks encourage e-statements for security and convenience. You can request a physical copy via customer support, but it may incur minimal charges.

Can I get my Yes Bank credit card statement via WhatsApp?

Yes, you have to save this Yes Bank WhatsApp banking number – 91-82912-01200 in your contact list and send “Hi”, select credit card services, and ask for the statement month-wise.

Is the YES Bank credit card e-statement accepted for reimbursements or disputes?

Yes. It’s a system-generated document accepted for reimbursements, chargebacks, and audits. Branch teams recommend keeping at least 12 months saved for smooth dispute resolution.

Does switching to WhatsApp banking stop email statements?

No. WhatsApp banking only provides access convenience. Monthly statements continue via email unless you specifically deregister. Many users confuse access mode with delivery preference.

Is it safe to remove the password from a YES Bank credit card statement?

Only temporarily. Card security teams advise removing passwords strictly for submission, then deleting the unlocked copy to avoid misuse if devices or cloud folders are shared.

Do initials or spaces in my credit card name affect the PDF password?

Yes. If your card shows initials or extra spaces, only the first four visible letters matter. Branch staff suggest ignoring dots and focusing strictly on card-printed characters.

Why does the YES Bank credit card statement password fail even when the format looks correct?

In branch cases, most failures happen due to the wrong name order. Customers enter Aadhaar or email name, but the card uses the exact embossed name, including spacing and sequence.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.