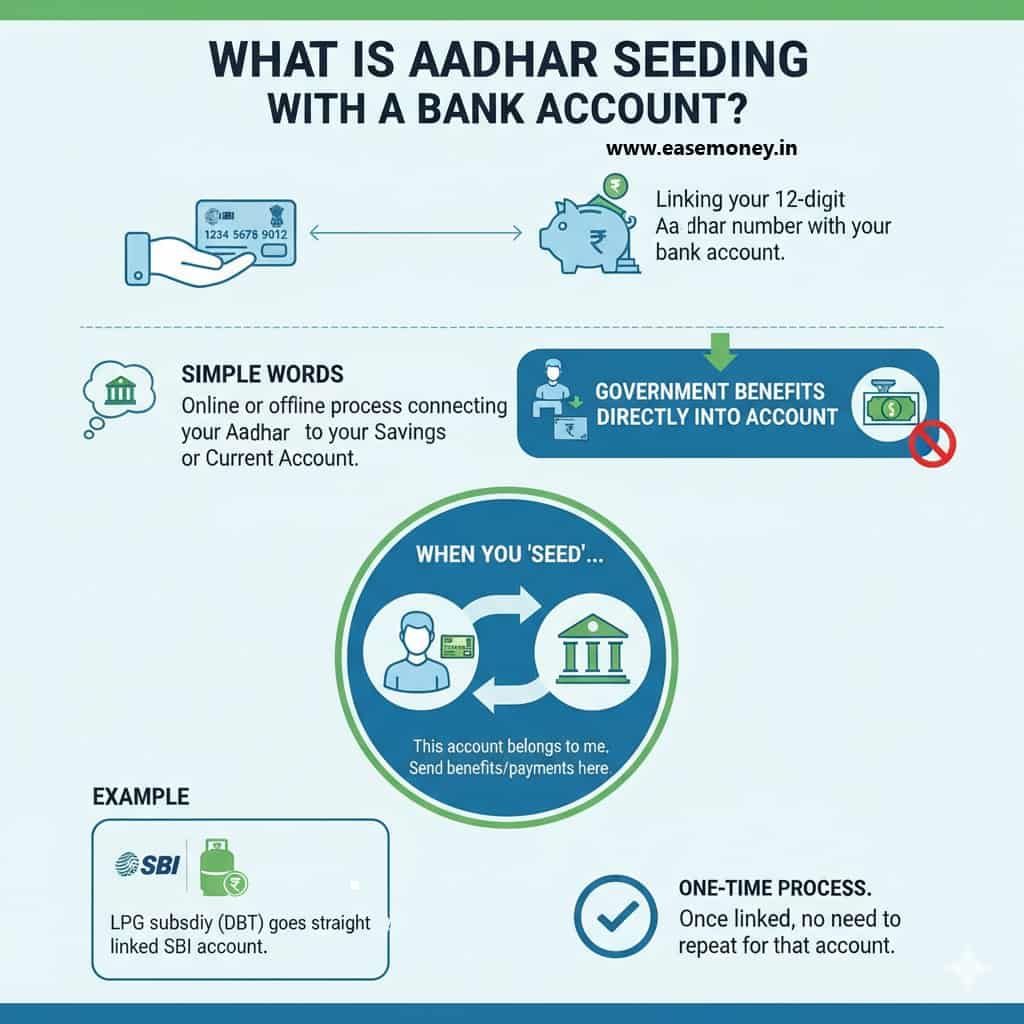

What is Aadhaar Seeding with a Bank account?

Aadhaar Seeding means linking your Aadhaar number with your bank account. In simple words, it is an online or offline process of connecting your 12-digit Aadhaar number to your savings or current account. It allows you to easily receive government benefits directly into your account without a middleman.

When you “seed” your Aadhaar with your bank account, you are essentially telling the bank and the government, “This account belongs to me, and this is where you should send any benefits or payments.”

Simple example for you – If you have a savings account at SBI and you link it with your Aadhaar, the next time the government sends an LPG subsidy under the DBT scheme, the money will go straight to that linked SBI account.

It is a one-time process — once your Aadhaar is linked successfully, you don’t need to repeat it for that account.

Stepwise Method to Seed Aadhaar to Bank Account Online

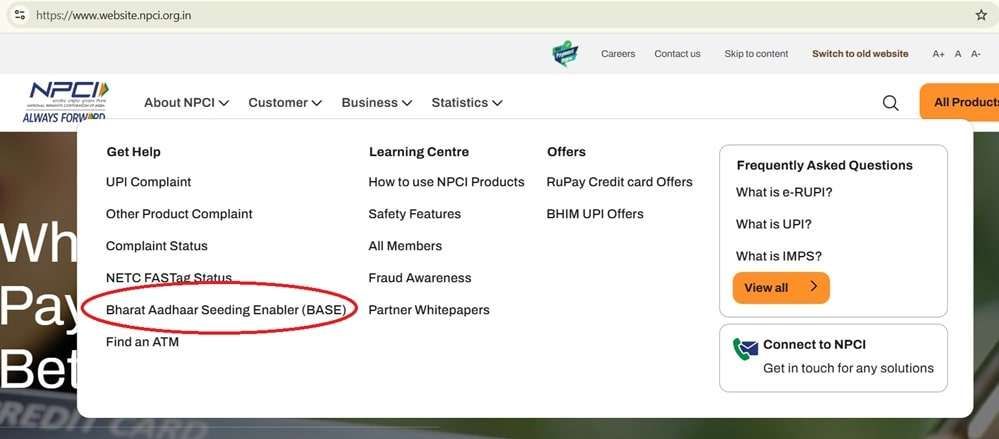

All thanks to NPCI, they offer a direct and quick option – Bharat Aadhaar Seeding Enabler (BASE) platform, you can easily use it on phone or desktop, you don’t need to visit your bank branch for linking. The entire process is online and takes only 5 steps-

Here’s how it works step-by-step:

1 Step: Visit the NPCI Bharat Aadhaar Seeding Enabler

- First of all, you have to visit the NPCI official website using any browser you like.

- Recently, they updated their website URL and design – https://www.website.npci.org.in/

- From the homepage, tap on “Consumer” and then choose the “BASE” option.

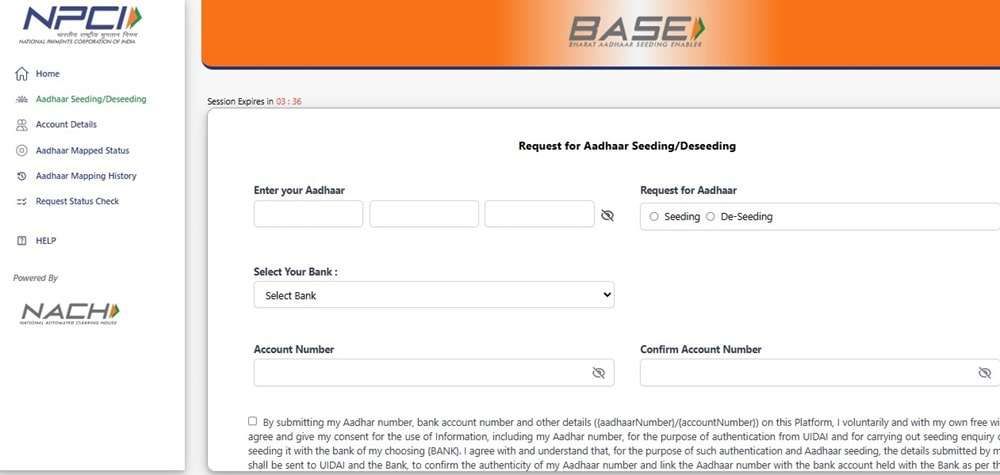

2 Step: Start a Seeding Request

- On the BASE page, tap on the Aadhaar Seeding/Deseeding option.

- Here, you can change your bank account or seed it for the first time.

3 Step: Enter Your Aadhaar and Bank Details

- Here, you have to fill the required fields –

- Aadhaar number: Simply enter your 12-digit Aadhaar.

- Bank name: Now, you have to select your bank you want to connect to.

- Seeding type: Choose the correct option:

- Fresh Seeding: For linking Aadhaar to a bank account for the first time.

- Movement – Same Bank: If you are linking Aadhaar to a different account in the same bank.

- Movement – From One Bank to Another: If you are switching from one bank to another. (It works for changing)

4 Step: Enter Account Number and Verify

- Now, the next option, enter your full account number twice. Then fill in the captcha code and click Submit.

5 Step: Last OTP

- You will get a 6-digit OTP only to your Aadhaar-linked mobile phone. Simply enter it, and the Aadhaar mapping process starts.

Tip: Track Your Request Status

If your seeding is delayed, you can also track using the “Request Initiated Status option on the same BASE portal. It helps you know whether the linking is pending, in process, or completed. If rejected, it also tells the reason why.

How Much Time Does Aadhaar Seeding Take?

Generally, the seeding process is quick and takes a few hours after being requested by BASE.

- Online Requests: It takes upto 48 hours to reflect in the NPCI portal.

- Bank branch submissions: May take 3 to 5 working days, depending on your bank’s internal process and request timings.

Note: Sometimes, you may find a delay due to an old linked account and mismatched details for verifications.

What If My Aadhaar Seeding Fails?

If your Aadhaar seeding request fails, it happens due to a system mapping issue.

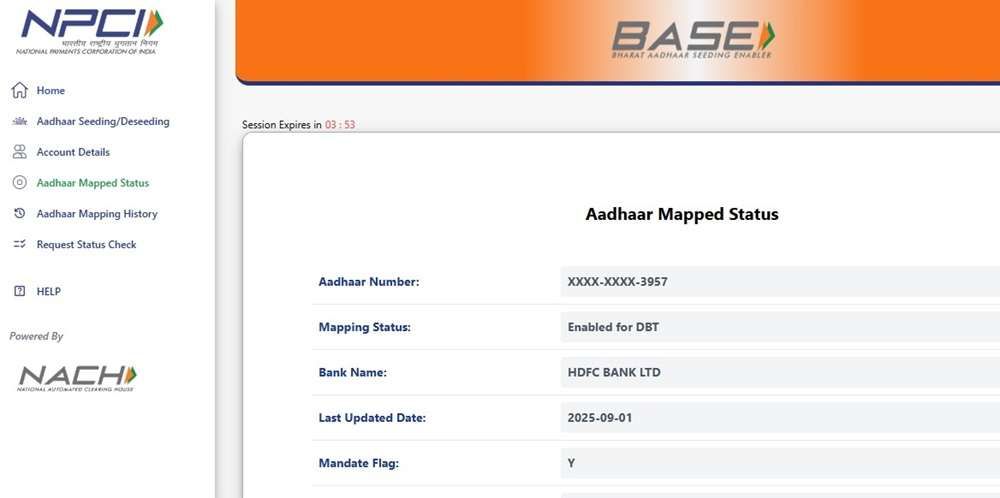

1 Step – Firstly, check and Confirm Seeding Status.

- Go to the NPCI BASE portal.

- Tap on NPCI Consumer section (top-menu)→ BASE → Aadhaar Mapped Status.

- Enter your Aadhaar number, captcha, and Linked-OTP.

- Tap Check Status.

The page will tell whether your Aadhaar is mapped to any bank and which bank it is, even your account number digits.

2 Step – Visit Your Bank Branch

- Bring Documents: Carry your original Aadhaar card and bank passbook or account statement, the basic documents.

- Fill Consent Form: Ask a bank for a Consent form, or you can download the application from the NPCI official website in PDF. Submit a duly filled Aadhaar consent form (Annexure I) to the bank.

- Request Seeding: Ask the bank to link your Aadhaar to your account and upload it to the NPCI mapper.

If you receive an error code, you can find the answer on the UIDAI error codes list to find out why it is happening to you. Usually, your bank is responsible for uploading your Aadhaar after your request. However, you can contact NPCI here – npci.dbtl@npci.org.in

Tip: The bank-stamped Aadhaar consent form can also be uploaded to the email.

What Documents Are Required

In most cases, no physical documents are needed if you’re seeding Aadhaar online. You need your registered mobile number and basic PAN, and aadhaar number. Both place the BASE portal or Bank NetBanking.

However, if you are visiting your home branch for seeding, you may be asked to provide:

- Your Aadhaar card or a scanned copy of Aadhaar

- Aadhaar seeding form can be downloaded, or banks also offer that printed.

- A copy of your bank passbook

- Your signature on the form, done.

Why Is Aadhaar Bank Seeding Important?

You must be thinking why linking my Aadhaar is important nowadays, and looking list of benefits, whether you do that or not.

The answer lies in the way government money flows today. Let’s look at how it works –

1. To Receive Government Benefits (DBT)

As per the PIB (DBT) Press release on 2022, in 2013, the government launched DBT for seven schemes, but in 2017, the government added upto 140 schemes and later in 2020, 420 schemes under 56 ministries.

This is most important reason is to receive money from government schemes directly into your bank account. This system, known as Direct Benefit Transfer. The major focus is to eliminate middlemen and reduce corruption so people get benefits without delay.

For example:

- LPG and electricity subsidies are credited directly to your bank account.

- PM-Kisan instalments go straight to your account.

- More benefits, such as Scholarships, pensions, and maternity gifts, are transferred directly.

Without Aadhaar seeding, your payment may fail or never reach you at all.

2. To Access Subsidies, Scholarships, Pensions, and Salaries

Most popular schemes, such as LPG subsidy to students’ scholarships, farmer support, pension schemes, and even employee salaries, now use Aadhaar-based payment systems and the PFMS method to transfer directly from the government. Seeding is the first key that unlocks these services.

Some examples of payments that require Aadhaar linking:

- PM-Kisan Samman Nidhi Yojana

- LPG Subsidy (PAHAL)

- Scholarships for students (via NSP and state portals)

- Social security pensions

- Bank Scholarships

- Anganwadi workers’ salaries (via PFMS Samman Pranali)

- Refunds Schemes –

3. To Simplify KYC and Verification

Your aadhaar now works as a universal identity and address proof for accounts. It gives power when you link it to your bank account. It simplifies your KYC (Know Your Customer) process and CKYCRR process. In simple words, it proves that you are the rightful owner of the account and reduces the chances of any fraud, duplication, or misuse.

4. To Enable Aadhaar-Based Banking Services

Once you have seeded it completely, your account becomes eligible for Aadhaar-based financial payments and other services –

- AEPS (Aadhaar Enabled Payment System): You can easily use your aadhaar OTP or fingerprint to withdraw cash, check balances, or transfer money.

- Subsidy portals and government apps: Many portals ask for your Aadhaar-linked accounts to process transactions.

How Aadhaar Bank Seeding Sends Money to You-

There are three main components involved:

- Aadhaar Bank Seeding – The link between your Aadhaar and your account.

- PFMS (Public Financial Management System) – The government’s payment platform. It is used for tracking and executing all payments under hundreds of government schemes.

- APBS (Aadhaar Payment Bridge System) – The payment highway that delivers money. It is a route which used for transfer.

Here’s the flow in simple terms:

- You link your Aadhaar to your bank account (Aadhaar Bank Seeding) using the bank or NCPI site.

- If you enrol on any government schemes and if you are eligible for benefits.

- The government decides to send you money under a scheme (like PM-Kisan or LPG subsidy).

- The payment is processed through PFMS, which manages and approves all payments.

- PFMS uses APBS, which uses your Aadhaar number to identify your bank account.

- You will get SMS such as APBS Credit via PFMS or APB Subsidy.

- The money is credited directly into your Aadhaar-linked bank account.

Other FAQs

How can I link my Aadhaar to my bank account using Netbanking?

You can simply seed it using the app or NetBanking portal. First, log in and go to the service OR Insta services, tap on Aadhar Seed. Enter your Aadhaar and bank details, confirm with OTP, done. Banks take approximately 48 hours to complete your request.

Can I change my Aadhaar-linked bank account?

Yes, you just have to choose “Movement” in BASE, select the same or a different bank, enter the new account number, verify with OTP, and submit to update the link.

Is Aadhaar seeding mandatory for all bank accounts?

Not really, it’s not legally mandatory for all accounts, but it is fully required to get any DBT benefits, such as salaries, subsidies, pensions, and scholarships.

What Is the Last Date for Bank Seeding?

There is no fixed universal deadline for Aadhaar seeding across all schemes; however, it depends on the scheme’s approval and close timing. Such as farmer benefit programs may announce a cut-off date. Before enrolling on any DBT-based schemes, check the basic requirements and timings.

Is Aadhaar seeding the same as Aadhaar linking shown in bank apps?

Not always. App linking confirms Aadhaar with the bank, but DBT seeding requires NPCI mapping. Tip: Always verify status on the NPCI BASE portal, not just your bank app.

Why did my subsidy fail even after Aadhaar was linked?

Because Aadhaar may be linked but not mapped as the default DBT account. Only one bank can receive APBS credits. Check and move Aadhaar mapping using BASE if needed.

Can Aadhaar be seeded to multiple bank accounts?

Yes, Aadhaar can be linked to many accounts, but DBT payments go to only one NPCI-mapped account. Tip: Choose your primary savings account with active SMS alerts.

How do I know which bank is currently mapped for DBT?

Use NPCI BASE → Aadhaar Mapped Status. It shows the bank name and last four digits. This check takes less than one minute with Aadhaar OTP.

What’s the safest way to avoid Aadhaar–bank seeding issues?

Use only NPCI BASE or your bank’s official channel, never third-party sites. After seeding, wait 24–48 hours and recheck mapping before enrolling in any DBT scheme.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.