Let’s start with the fact, if you have tried to close your Airtel Payments Bank account using the Airtel Thanks app, you already know the truth — there’s no close-account option anywhere. You can scroll through every menu, tap every setting, but Airtel simply does not provide a “Close Account” button.

That’s because Most payment banks, including Airtel, don’t allow closure through the banking app or SMS directly. It’s a manual process that goes through customer care or email ID. But before you jump into that, it’s better to clean things up inside your account first.

Clean Up Your Savings Account Before You Close

A lot of people rush to close their Airtel Bank account without checking the basics — and then face issues with refunds, autopays, or Aadhaar links later. So here’s the quick pre-closure checklist, so no delay or error you get:

- Remove Autopay & UPI Links: If your Airtel Bank is connected with PhonePe, Paytm, Google Pay, or Amazon Pay, unlink it first. Open each app → Bank accounts → remove Airtel Payments Bank, also remove any active Autopay, UPI-based subscriptions.

- Check Aadhaar Seeding: at the NPCI Aadhaar mapping portal, change your account details if linked with Airtel Bank.

- Handle Refunds or Benefits: If any recent refund is ending, edit your account credit details wherever you used Airtel Bank earlier, such as IRCTC, Amazon, Flipkart, etc.

- Zero Out the Balance: Transfer or withdraw any remaining money from your Airtel Payments Bank wallet or savings account. Even ₹10 or a few 0.5 Paisa left can delay closure.

- Note Down Details: Save your transaction history or last statement before deleting the account, especially if you have made any big transactions recently. (optional)

Once all this is done, your account is ready for closure.

Options: Airtel Payments Bank Closure

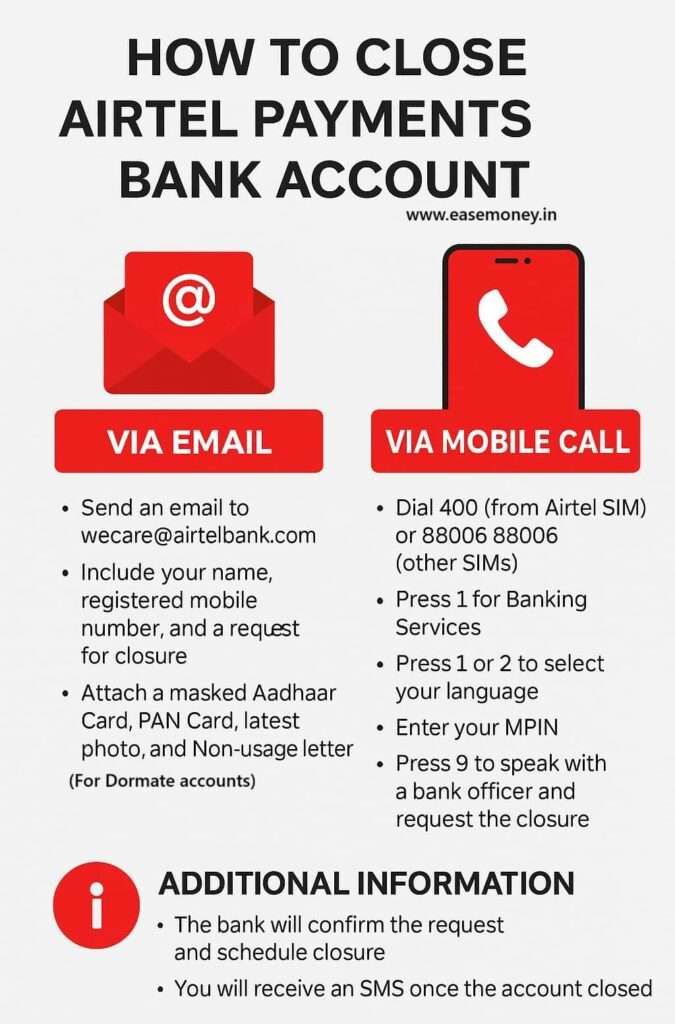

There are two official ways to close your zero-balance account. You can choose to call customer care or send an email request. They generate a ticket for you, and the process starts. Follow these steps –

1 Option: Close via Call Banking (Experts Recommended)

If your SIM is Airtel and your account is linked with the same number, simply call at 400.

But if your SIM is Jio, VI, BSNL, or other, you can call this number – 88006 88006.

Here’s the path once you are on call:

- Firstly, Press 1 for Banking Services

- You have to press 1 or 2 to choose your language – English or Hindi.

- Enter your 4-digit MPIN (the same one that you use for login at Airtel Thanks App)

- Press 9 to talk to a live bank officer

- When connected, just tell them straight — “Hi, I want to close my Savings account permanently.”

- If there’s any balance in your account, during on-call, you will be given two options:

- Withdraw the remaining money, then call back or

- Agree that Airtel Bank can deduct (forfeit) the balance before closure.

- Once you confirm, your request will be registered immediately.

You will receive an SMS text, and the account will be closed within 7 to 10 working days. In most cases, it happens within 3 days.

2 Option: Generate a ticket to delete your account via Email

If you can’t call or are looking for any digital option, this is a semi-online option for you. You can send an email to wecare@airtelbank.com.

- First of all, make sure you have a linked and active email ID with Airtel Bank.

- Write down in the email, add your name, mobile and account number, and add direct text – please, close my account permanently.

- You can add a small note, why you are closing.

- Add an Aadhaar or PAN photograph, and send it directly.

- They generate a token for you and close your account within 5 to 7 working days if no errors are found.

3 Option: If the Account is Not Closed Even After 10 or 15 Days

If you don’t receive any SMS or your app still shows your account active after 10 to 15 working days, or fails due to any unknown reasons, you can escalate the issue to the Grievance Officer of Airtel Bank:

- The contact details: You can email grievance.officer@airtelbank.com OR 0124-4247797. Remember, contact on working days from 10 to 5 PM.

- Level 2, Principal Nodal Officer: pno@airtelbank.com

- Official portal for level 2 Grievance: airtelpayments.bank/static/contact-us

- They will respond and confirm your closure within a few days once you mention the pending request.

Where to go for closing Dormant or Old Account:

If Y Airtel Bank account has not been used for 6 months or 1- 2 years, it will be marked as dormant. In simple words, as per Airtel’s recent notice, Airtel Payments Bank automatically closes your zero-balance account without any action required.

But if your dormant account has a balance or you want to close it manually, you’ll have to complete a small verification.

Here’s what to do:

- Visit any nearest Airtel Payments Bank Banking Point (find one here: https://www.airtelpayments.bank.in/banking-points).

- You will need a scanned copy of your Aadhaar and PAN card.

- Your closed or active mobile number or email ID may be required.

- Tell them you want to close a dormant account.

- Fill out a small form and verify your identity.

If you don’t want to visit, you can email wecare@airtelbank.com, just add your Masked Aadhaar (first 8 digits hidden), your old or linked mobile number, and PAN card.

How to Track and Confirm Your Account Is Closed

After requesting closure:

- You will get an SMS once the account is successfully closed.

- Inside the Airtel Thanks App, the Banking section will stop working, no balance, no MPIN access.

- If you try to log in again, your MPIN will be invalid.

- You can also call 400 or 88006 88006 to confirm the closure status after 5 to 6 working days.

- These are the only real ways to confirm — Airtel doesn’t show any online “closure complete” status inside the app.

Additionally Section

How to write an application to close an Airtel Payment Bank account?

You can use this format,

Dear Sir/Madam,

I request to close my Airtel Payments Bank account permanently linked with my mobile number [Your Mobile Number] and account number [Your Account Number].

Please proceed with the closure process. I’m closing this account because [write your short reason, optional].

Thank you,

[Your Full Name]

[Registered Mobile Number]Can I reopen my account after closing my Airtel Payments Bank account?

No. Once closed, Airtel Payments Bank does not reopen the same account. You must create a fresh account with full KYC again, and your old account number, MPIN, and history are permanently deleted.

What happens if I forget to unlink UPI autopay before account closure?

Some autopays may fail silently or retry for 1–2 days. Best practice is unlink first. If already closed, update bank details inside the merchant app to avoid future payment failures.

Is there any closure charge or penalty by Airtel Payments Bank?

No. Airtel Payments Bank does not charge any account closure fee. However, if you allow balance forfeiture during the call, even ₹1 left will not be refunded later.

Can I close the account if my registered mobile number is inactive?

Yes, but it takes longer. You’ll need email closure with PAN or Aadhaar and identity verification. Expect 7–12 working days instead of the usual 3–7 days for active numbers.

Will my Aadhaar still stay linked after closing the account?

No. Once the account is closed, Aadhaar seeding with Airtel Payments Bank is removed. Still, check the NPCI mapper after 48 hours and update your new bank to avoid subsidy misrouting.

What’s the fastest real-world method to close the account without delays?

Calling from the registered Airtel number via 400, choosing banking → MPIN → executive, is the fastest. Most verified cases close within 72 hours, much quicker than email-based requests.

How do I confirm Airtel Payments Bank account closure for legal or record use?

Save the closure confirmation SMS and take a screenshot of the disabled banking section in the Airtel Thanks app. These two together are accepted proof in most refund or dispute cases.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.