A lien is a hold or block placed on your bank funds. You can see the balance, but you can’t use it until the lien balance is lifted by the bank itself. But not all liens lift themselves.

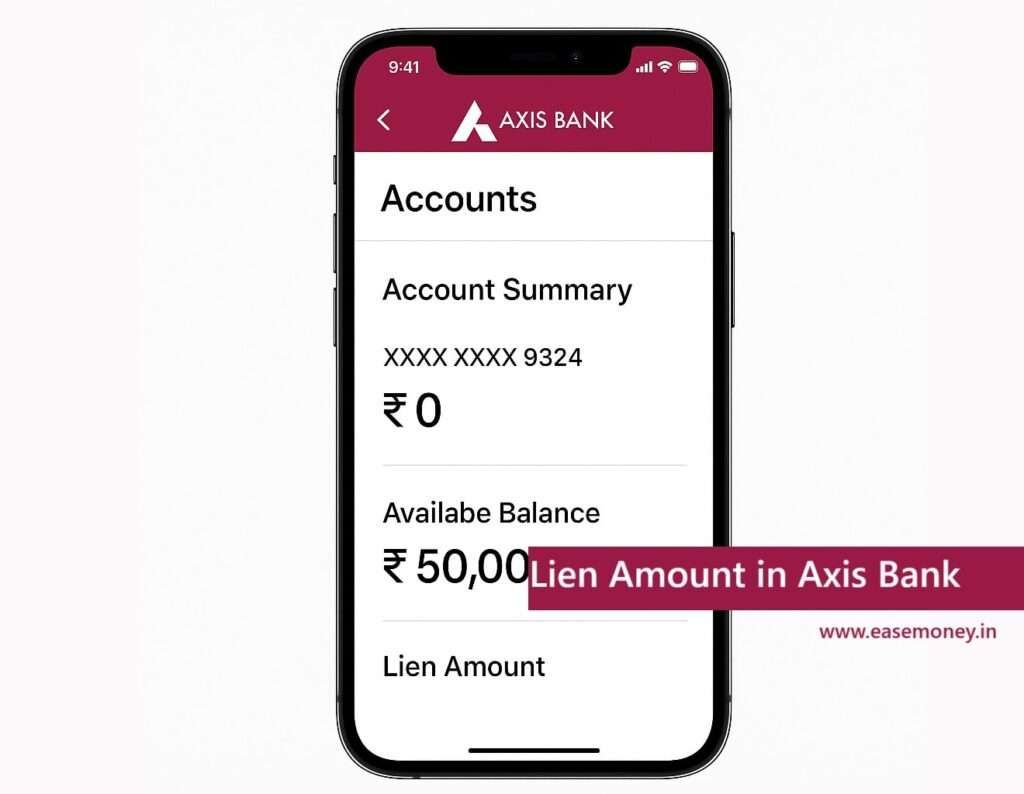

In your Axis mobile app, it looks like this:

- Account Summary → Available Balance ₹0

- Lien Amount ₹50,000

That means ₹50,000 is frozen. The funds are technically yours, but Axis Bank has locked them temporarily — either due to recovery, security, or observation reasons.

Unlike a debit freeze (which blocks all transactions), a lien is selective; it usually blocks a remaining amount; however, it’s not a penalty, but a temporary restriction applied by the bank for a specific reason. Only a certain amount is held, while the rest (if any) remains usable. This exact amount does not withdraw, debit, or credit, does not work on UPI, IMPS, RTGS, and earns no interest.

Is the Lien Amount Refundable?

Yes, but it depends on why it was applied.

- If it’s due to pending dues, it will be adjusted once those charges are recovered.

- In case this is just a temporary or system-generated issue, it will be released automatically within 3 to 7 working days.

- If it’s linked to a dispute, the refund or release happens after case closure.

In all other cases, the money remains safe in your account — just not accessible until the lien is removed.

Why Axis Bank Applies a Lien

Axis Bank does not just block money without reason. Every lien has a trigger, and understanding the cause helps you solve it faster. Here few common reasons found in our case studies of our users, including some banks that rarely talk about publicly.

1. Pending Dues or Recovery of Bank Charges

The simplest and most frequent reason our study found.

If your account has pending service fees, debit card fees, a loan late fee, or penalty charges, Axis can apply a lien for the same amount.

Example — You missed your minimum balance requirement for months. The bank levies a charge but can’t deduct it immediately due to insufficient funds. Once you deposit money, a lien appears for that amount until recovery is complete.

Unlike most fintech wallets that warn you before deduction, Axis Bank usually applies the lien silently and adjusts it automatically later.

2. Credit Card or Loan Payment Delay

If your Axis Bank savings account is linked with your credit card or any active personal loan, the system keeps track of payment timelines.

Even if you pay late by a day or before a day — or your payment updates late in the system, because the Bank takes upto 24 to 48 hours to complete the process— a lien can be triggered.

It’s an automated protection mechanism, not a penalty. Once your payment reflects, the lien is removed automatically or through a quick verification request.

However, if the update takes longer, you might need to raise a ticket manually.

3. Cybercrime or Fraudulent Activity Flag

This is one of the serious but increasingly common reasons today in india.

If your account gets linked — even unknowingly — to any cybercrime, scam, or fraudulent transfer, Axis Bank can immediately freeze funds under a lien.

For instance, if someone transfers a suspicious ₹10 thousand or ₹1 lakh into your account, or if your UPI ID is tagged in a fraud network, Axis applies a “regulatory lien” to comply with law enforcement.

In this case, you won’t be able to use that money until the cybercrime cell or the investigating authority clears it.

- Most cases came from Online gaming fraud.

- It’s not the bank being unfair — it’s them following compliance law under the Prevention of Money Laundering Act (PMLA) and RBI’s AML rules.

4. Dormant Account or KYC Non-Compliance

If your account hasn’t seen any transactions for a long time, your KYC has expired, or the Bank ask for ReKYC or CKYC registry, Axis may add a lien for compliance.

Once you update your KYC or reactivate your account, the lien goes away immediately.

It’s less about money and more about RBI-mandated identity verification.

5. Piracy, Scams, or Illegitimate Payments

If your account or UPI ID receives funds from grey-market sources, telegram spam, piracy-related websites, or illegal networks, Axis may apply a lien as a preventive measure.

Example — If a streaming or game piracy portal routes money to your account, the system auto-detects and flags it for internal review.

You’ll need to prove that the funds came from a legitimate source before the bank lifts the lien. In this case, you need to visit the branch or RBI office for help.

6. Unknown or Sudden High-Value Credit

This is an interesting one. Let’s say ₹1 Lakh gets credited to your savings account by mistake. Even if you did nothing wrong, the system flags it immediately under AML (Anti-Money Laundering) review.

Axis will apply a lien on that amount to stop any withdrawal until the sender and transaction are verified.

In short, unverified large credits trigger instant liens to protect you and the bank.

7. System or Technical Reconciliation

Sometimes, a lien is not about you — it’s about a data mismatch.

During daily settlements between card networks, UPI, and internal systems, Axis Bank may mark a temporary lien until the records sync.

It usually clears on its own within 24–48 hours.

8. Legal, Court, or SEBI Orders

Sometimes but real and special cases, the bank receives an order from a court, SEBI, or tax authority instructing it to hold certain funds or freeze your complete bank activity.

It could be due to pending legal cases, disputed transactions, or SEBI-triggered investment restrictions.

Axis Bank cannot override this — even if you call or email.

The lien stays until the authority issues a clearance notice. You’ll usually receive an email or physical notice about it.

How to Check Lien Amount in Axis Bank

There are three reliable ways to know if there’s a lien and why it’s there:

1. Axis Mobile App

- Open your Axis Bank app and log in using 6-digit MPIN or fingerprint

- Tap Accounts and open the all activity section – Account Summary

- Scroll down to view the Lien Amount

- If it shows ₹XXXX, that’s the blocked portion of your funds

2. Internet Banking

- Visit AxisBank.com

- Log in using username, password, and mobile OTP → Go to Accounts → select account number and get summary

- You will see “Lien Amount” mentioned below the available balance, or you can get a Digital mini statement simply.

3. Statement or Passbook

Check your latest statement — if there’s a lien, it’ll be marked as: Lien Marked ₹50,000 or Funds Under Hold

How to Remove a Lien in Axis Bank

Here’s how to remove a lien officially — step by step.

Option 1: Contact Axis Customer Care

- Toll-free: 1800 209 5577 or 1800 103 5577 (verify once)

- Chargeable: 1860 419 5555 / 1860 500 5555

Ask them:

- “My account shows a lien. Please share the lien reason code and raise a removal request.”

They will verify your case and raise an internal ticket. In case the issue is bigger, you may have to go home branch; if not, or a negative balance issue, you may have to add an amount and wait for 24 hours to solve the issue.

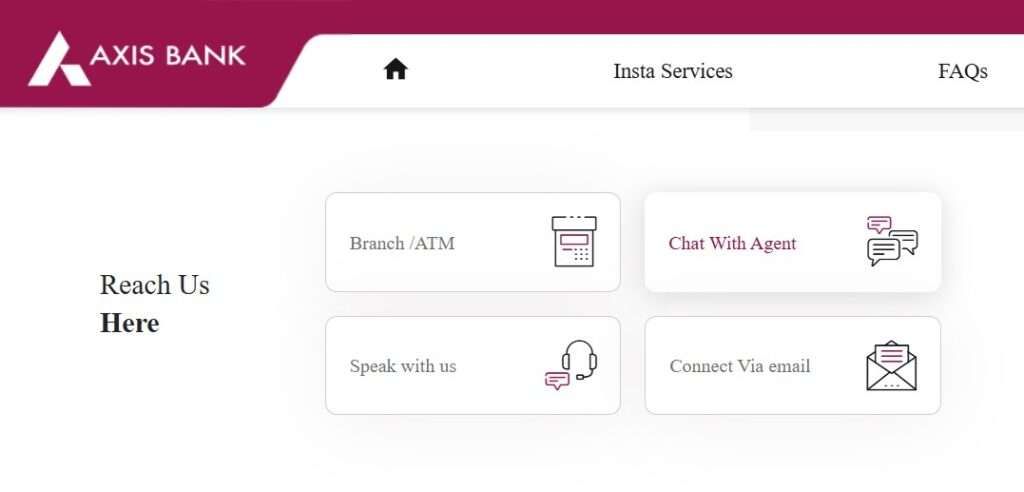

Option 2: Raise a Support Ticket via Axis Help Centre (No customer care or visit required)

Go to: https://application.axis.bank.in/webforms/axis-support/index.aspx

Follow these steps carefully:

- Scroll to Connect via Email

- Select Product: Bank Accounts

- Select Account Type: All Savings Accounts

- From “Reason to Connect,” choose Dormant Account / Lien / Debit Freeze

- Under the sub-issue, select the appropriate lien-related option

- Tap Email and fill in the details:

- Registered email ID

- Account or card number (last 4 digits)

- Registered mobile (with country code)

- Name on the account

- Subject: “Request for Lien Removal from Savings Account”

- Message: Briefly explain your situation, amount, and basic details.

Attach relevant documents, if any — such as payment proof, EMI confirmation, or dispute closure email.

Then hit Send.

Usually, Axis resolves lien-related requests within 3 working days.

Option 3: Axis Chat Support

For faster turnaround, use the Chat Support available on Axis Bank’s site or mobile app.

You can type directly:

“I want to know why my account shows lien amount.”

Chat support operates between:

- Anywhere between 9:00 a.m. – 6:00 p.m. (Retail Customers)

- 7:00 a.m. – 11:00 p.m. (Premium Customers)

- 24×7 (for NRI Accounts)

They will respond instantly or escalate your case for resolution, or generate a ticket for you.

Note: if everything has not worked, go to your home branch with valid documents, or the Axis Bank Nodal officer, and last but not least, the RBI Sachet portal.

FAQs

When does Lien appear even after a Payment happens in Axis Bank?

This happens often when a loan or credit card payment is made slightly late or has not yet synced.

The lien triggers automatically based on system flags.

Once your payment reflects (within 24–48 hours), the lien disappears. If not, raise a request with your payment proof attached.Can Axis Bank apply a lien on a joint account if one holder has dues?

Yes. Axis Bank can place a lien even on joint accounts if one holder has pending dues, loan defaults, or legal issues. The lien stays until full verification or settlement.

Does a lien in Axis Bank affect my CIBIL score or loan eligibility?

A lien itself doesn’t reduce your CIBIL score, but if it’s applied due to delayed payments or unpaid EMIs, those underlying issues can affect your credit report and future loan eligibility.

What happens if the lien stays for months and Axis Bank doesn’t remove it?

If the lien remains beyond ten working days without any dispute, contact customer care, raise a written support ticket, and escalate to the Axis Nodal Officer or the RBI CMS portal.

Can Axis Bank place a lien without informing the account holder?

Yes. In most cases, Axis applies liens system-driven, without prior SMS or call. Customers usually notice only after checking their balance. Tip: always review “Lien Amount” after large credits or repayments.

Does a lien amount earn interest while blocked?

No. Lien-blocked funds do not earn savings interest during the hold period. Even though money stays in your account, it’s treated as non-operational until release.

Can Axis debit EMIs or charges from lien-marked funds?

Yes. If the lien exists for recovery or dues, Axis can adjust charges directly from the lien amount. That’s why lien balances sometimes reduce automatically without manual confirmation.

Why does a lien appear even when my account shows a positive balance?

Available balance excludes lien. Example: ₹80,000 balance minus ₹50,000 lien means only ₹30,000 usable. Many customers misread this and think money is missing.

How long can Axis Bank legally keep a lien active?

There’s no fixed RBI timeline. Operational liens usually clear in 3–7 working days. Regulatory, fraud, or legal liens stay until clearance from the authority or internal compliance approval.

Is a branch visit mandatory for lien removal?

Not always. About 60–70% cases resolve online via customer care or email ticket. A branch visit is required mainly for fraud, legal, or KYC-related liens needing documents.

What’s the biggest mistake customers make during lien removal?

Waiting silently. Many liens auto-clear, but unresolved ones don’t. Pro tip: raise a ticket within 48 hours with proof to prevent long-term holds and escalations.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.