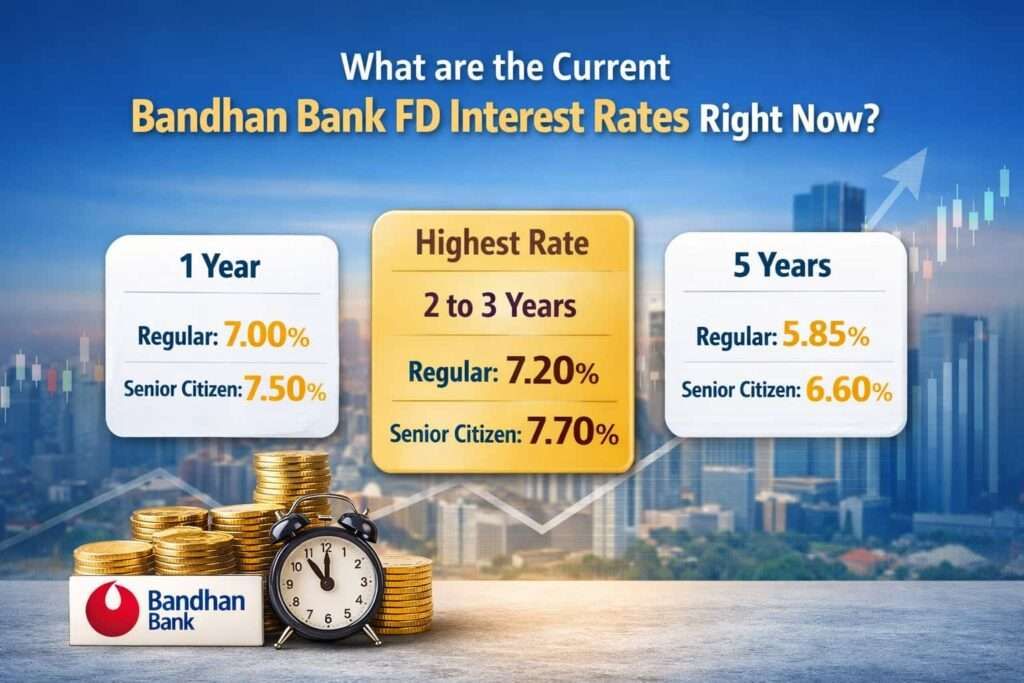

In 2026, Bandhan Bank FD interest starts from around 2.95% and can go up to 7.20% per year for regular customers. Senior citizens get a bit more, and it can go up to 7.70%. Usually, the better interest is for deposits kept for 2 years or less than 3 years, so if someone is thinking of a mid-term Fixed Deposit, this time period generally gives a better return.

Earlier, back in March 2024, Bandhan Bank had come up with a 500-day special FD via a media press release. At that time, interest was 7.85% for general customers and 8.35% for senior citizens, but that scheme was there only for a short period. Now it is not available in the current FD rates. So before putting money, it’s always better to check with the bank once, because FD rates keep changing.

What are the current Bandhan Bank FD Interest Rates right now?

In December 2025, the RBI reduced the repo rate to support the economy and improve cash flow in the system. After that, banks started revising their deposit rates. Bandhan Bank also updated its Retail Domestic and NRO term deposit rates, which are effective from September 1, 2025. These rates match the current situation and offer decent returns across different deposit periods, including for senior citizens.

| Tenure | Regular (% p.a.) | Senior Citizen (% p.a.) |

|---|---|---|

| 7 days – 14 days | 2.95% | 3.70% |

| 15 days – 30 days | 2.95% | 3.70% |

| 31 days – < 2 months | 3.45% | 4.20% |

| 2 months – < 3 months | 4.20% | 4.95% |

| 3 months – < 6 months | 4.20% | 4.95% |

| 6 months – < 1 year | 4.20% | 4.95% |

| 1 year | 7.00% | 7.50% |

| 1 year 1 day – 1 year 9 months | 7.00% | 7.50% |

| 1 year 9 months 1 day – < 2 years | 7.00% | 7.50% |

| 2 years – < 3 years | 7.20% | 7.70% |

| 3 years – < 5 years | 7.00% | 7.50% |

| 5 years – 10 years | 5.85% | 6.60% |

The Key Points here –

- These interest rates are for normal retail deposits, that is, amounts below ₹3 crore.

- The senior citizen get extra 0.50% interest on each tenure. Your age must be above 60, and proper documents.

- Extra interest for senior citizens is only for residents in India; it does not apply to NRIs.

- Under a tax saver fixed deposit, you can claim a tax benefit up to ₹1.5 lakh.

- In a 5-year tax saver FD, money cannot be withdrawn before maturity.

- TDS will be deducted if interest crosses the limit:

- ₹40,000 for regular customers

- ₹50,000 for senior citizens

- If a fixed deposit is closed before the time, the bank cuts 1% interest from the applicable rate.

FD interest rates can change anytime, so it’s always better to check once before booking.

How to Get the Highest FD Interest Rate (Real Example)

Example: Shri Mati Suman (Age 65)

Shri Mati Suman is 65 years old, so she is treated as a senior citizen by the bank. Because of this, she gets a higher interest on fixed deposits compared to normal customers.

Step 1: Pick the FD period that gives the most interest

As per Bandhan Bank’s current FD rates (starting from September 1, 2025), the highest interest is given for deposits kept between 2 years and less than 3 years.

- Senior citizen interest for this period: 7.70% per year

So, if someone wants a better return without locking money for very long, this period usually works best.

Step 2: Choose the right type of FD

Instead of keeping money in a savings account or short-term FD, Suman chooses a regular cumulative fixed deposit.

In this type of FD, interest is added every quarter, so the return becomes better over time.

Step 3: Simple return example from real life

If Suman invests ₹5,00,000 for 2 years and 6 months at 7.70% interest, her final amount will be clearly higher compared to:

- putting the money in a 1-year FD at 7.50%, or

- leaving the money in a savings account, where interest is much lower.

Why does this option suit her better

- Senior citizens get extra interest

- A 2 to 3-year FD gives the best rate

- Money is not locked for too many years

- Returns are better without taking any risk

Small but important note

If Suman were below 65 years, she would be treated as a regular customer.

In that case, for the same 2 to less than 3 years FD, the interest would be 7.20% per year, which is 0.50% less than the senior citizen rate.

How to Open a Bandhan Bank FD Online

Suman does not need to visit the branch. She can open the FD online.

Simple steps:

- Go to Bandhan Bank’s Fixed Deposit section on the official website

- Click on “Open Fixed Deposit”

- Enter basic details like date of birth and mobile number

- You can verify with OTP, then select the FD amount and time period

- Finish the process online

This online FD option is available for both Bandhan Bank account holders and non-account holders.

Types of Fixed Deposits Offered by Bandhan Bank

Bandhan Bank has different fixed deposit options. Some are for people who like to do everything online, some are for regular saving, some are for tax saving, and some are for long-term goals. There are also FD options for customers who want to deposit a bigger amount.

1. Neo+ Digital Fixed Deposit

This is a fully online fixed deposit, mainly for new customers who don’t want paperwork or branch visits.

How it works:

- FD can be opened online

- Video KYC is done, no need to visit any branch

- Everything is paperless

- You can start with ₹1,000

- The maximum amount is ₹2 lakh

- FD period can be from 7 days to 10 years

- Both tax saver FD and normal FD options are available

- You don’t need any earlier account with Bandhan Bank

Who can open it:

- Indian residents, 18 years and above

- Should not already be a Bandhan Bank customer

- Must have Aadhaar and PAN

- Aadhaar should be linked with mobile number

- PAN and Aadhaar should be linked with each other

What you need for Video KYC:

- Mobile or laptop with a camera and a mic

- Location access should be turned on

During Video KYC, keep ready:

- Original PAN card

- Signature on a blank white paper

2. Bandhan Standard Fixed Deposit

This is a normal fixed deposit, suitable if someone wants to invest for a short time or a long time, both.

Simple points to understand:

- FD can be opened through internet banking, phone banking, or by visiting the branch

- FD can be kept from 7 days to 10 years

- Interest can be taken monthly or quarterly, as you prefer

- If needed, a partial withdrawal is allowed, but there are charges.

- FD can be closed before time, but some interest cut may apply

- You can take a loan or overdraft against the FD

- Auto-renewal option is there, so FD continues after maturity

- Nominee can be added

- Minimum deposit is ₹1,000, and after that in ₹1 multiples

3. Tax Saver Fixed Deposit

This FD is mainly for people who want to save tax under Section 80C.

Tax Saver Fixed Deposit Rates (w.e.f. Aug 9, 2025)

| FD Type | Regular (% p.a.) | Senior Citizen (% p.a.) |

|---|---|---|

| 5-Year Tax Saver FD | 6.25% | 7.25% |

- You can open it through internet banking, the mBandhan app, or by visiting the branch

- You can claim a tax benefit up to ₹1.5 lakh in a financial year

- FD period is 5 years, and the money is locked for the full 5 years

- You can deposit from ₹1,000 up to ₹1.5 lakh in one year

- Interest can be taken monthly, quarterly, or at maturity, as you prefer

- Returns are fixed and safe, not linked to the market

- No early withdrawal is allowed in this FD

- This FD is available for Resident Indians, HUFs, and NROs

4. Advantage Fixed Deposit

This FD is for people who want better growth, as interest gets added back to the deposit.

- Minimum amount to start is ₹1,000

- Interest is compounded, so money grows over time

- FD period can be from 6 months to 10 years

- Partial withdrawal is allowed if needed

- FD can be closed before time, with applicable charges

- You can take a loan or an overdraft against this FD

- Auto-renewal option is available

- Nominee facility is there

5. Dhan Samriddhi Fixed Deposit

This FD is for people who want to save money for a specific goal in the near or medium term.

It is good for things like marriage, children’s education, travel plans, festivals, or housework.

Simple points to know:

- Minimum amount to start is ₹5,000

- Interest is added back to the FD, so money grows over time

- FD period can be from 6 months to 10 years

- You can take a loan or overdraft against this FD if needed

- Auto-renewal option is there

- Nominee can be added

6. Premium Fixed Deposit (For Large Amounts)

This fixed deposit is for customers who want to deposit a very large amount.

- Nominee facility is available

- Minimum deposit starts from ₹3 crore and above

- Interest rates are better for high-value deposits

- FD period can be from 7 days to 10 years

- Interest can be taken monthly or quarterly

- Partial withdrawal is allowed if required

- FD can be closed before time, as per the rules

Bandhan Bank also offers Domestic, NRO, and NRE Bulk Deposits, classified as:

- Callable Deposits (with premature withdrawal facility)

- Non-Callable Deposits (higher rates, no premature withdrawal)

Bandhan Bank Bulk FD Interest Rates (Domestic / NRO)

Callable Bulk Fixed Deposits (Deposits ₹3 crore & above). This is updated on January 07, 2026

| Tenure | Interest Rate (p.a.) |

|---|---|

| 7 days – 15 days | 3.00% |

| 16 days – 1 month | 3.25% |

| 1 month – 2 months | 5.00% |

| 2 months – 3 months | 5.35% |

| 3 months – 6 months | 6.15% – 6.40% |

| 6 months – 9 months | 6.50% – 6.55% |

| 9 months – 11 months | 6.65% |

| 12 months – 13 months | 7.00% |

| 13 months – 18 months | 5.50% – 6.55% |

| 18 months – 2 years | 7.00% |

| 2 years – < 3 years | 6.80% |

| 3 years – < 5 years | 5.55% |

| 5 years – 10 years | 4.40% |

Same interest rates apply across all bulk slabs (₹3 cr to ₹50 cr+)

Non-Callable Bulk Fixed Deposits

(No premature withdrawal | Slightly higher rates)

| Tenure | Interest Rate (p.a.) |

|---|---|

| 7 days – 15 days | 3.00% |

| 16 days – 1 month | 3.50% |

| 1 month – 2 months | 5.15% |

| 2 months – 3 months | 5.50% |

| 3 months – 6 months | 6.25% – 6.50% |

| 6 months – 9 months | 6.65% |

| 9 months – 11 months | 6.75% |

| 12 months – 13 months | 7.10% – 7.20% |

| 13 months – 18 months | 6.50% – 6.85% |

| 18 months – 2 years | 7.10% |

| 2 years – < 3 years | 7.00% |

| 3 years – < 5 years | 6.15% |

| 5 years – 10 years | 4.90% |

NRE Bulk Fixed Deposit Rates (Summary)

| Tenure | Callable | Non-Callable |

|---|---|---|

| 12 months – 13 months | 7.00% | 7.10% – 7.20% |

| 18 months – 2 years | 7.00% | 7.10% |

| 2 years – < 3 years | 6.80% | 7.00% |

| 3 years – < 5 years | 5.55% | 6.15% |

| 5 years – 10 years | 4.40% | 4.90% |

Simple takeaway (very important for readers)

- Best bulk FD rates are around 12–13 months

- Non-callable FDs pay slightly higher interest

- Callable FDs allow early exit but attract 1% penalty

- Deposits of ₹10 crore and above need treasury approval

FAQs

What is the FD interest rate in Bandhan Bank?

Bandhan Bank FD interest rates currently go up to 7.20% for regular customers and 7.70% for senior citizens, mainly on 2 to 3-year fixed deposit tenures.

Is Bandhan Bank good for FD?

Yes, Bandhan Bank is good for FD if you want higher interest than savings accounts, flexible tenures, and extra benefits for senior citizens, especially for mid-term investments.

Which is better, HDFC Bank or Bandhan Bank for an FD?

HDFC Bank offers stability and brand trust, while Bandhan Bank usually gives higher FD interest rates. If return matters more than brand, Bandhan Bank can be better.

What is Bandhan Bank’s monthly income scheme interest rate?

Bandhan Bank does not have a separate MIS, but monthly interest payout FDs offer up to 7.70% for senior citizens, depending on tenure and deposit amount.

What is the monthly interest for ₹1 lakh in Bandhan Bank FD?

On a ₹1 lakh FD at 7.70%, senior citizens can earn around ₹640 per month before tax, depending on tenure and monthly payout option selected.

Can I open a Bandhan Bank FD without an account?

Yes, through Neo+ Digital Fixed Deposit, even non-customers can open an FD online using Aadhaar, PAN, mobile number, and video KYC, without visiting a branch.

Which Bandhan Bank FD gives the highest return?

The 2 years to less than 3 years FD currently offers the highest return, giving 7.20% for regular customers and 7.70% for senior citizens.

How does the Bandhan Bank FD rate calculator work?

The FD calculator shows interest earned and maturity amount based on deposit amount, tenure, and interest payout type, helping customers easily plan their savings and returns.

What FD interest rate do senior citizens get in Bandhan Bank?

Senior citizens in Bandhan Bank can earn up to 7.70% interest per year, which is 0.50% higher than regular customers, mainly on 2 to 3-year fixed deposits.

Is Bandhan Bank FD safe for senior citizens?

Yes, Bandhan Bank FD is safe for senior citizens as it is RBI-regulated and offers guaranteed returns, making it suitable for retirees seeking steady and predictable income.

Can senior citizens get a monthly income from Bandhan Bank FD?

Yes, senior citizens can choose monthly interest payout FDs, which help cover regular expenses like medicines and household bills, while keeping the main deposit amount safe.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.