RTGS is one of the best options for transferring funds from one bank to another in India. If you are using the Bank of India, you can choose from multiple options, such as online banking or offline, by submitting the RTGS/Star Insta Remit form at any BOI branch. You can find the RTGS-enabled branch on the BOI customer care page.

Steps: BOI RTGS Form PDF Download (Official Links)

The official RTGS form can be downloaded directly from the Bank of India’s official website. You have to print it, or you can collect a copy from the customer care desk or the form counter of any branch as well. Let’s check how you can get it online –

How to Download from the Official Site

- Firstly, go to the official site (NEW URL updated as per RBI) – https://bankofindia.bank.in.

- On the homepage, scroll down to the footer section OR use the top menu header to find “Downloads centre”

- Now, Tap on Certification Format, Digital Transaction, Forex Forms & Tax.

- Under “Digital Transaction”, you will get the RTGS/NEFT Remittance Application Format.

- Tap on it to download it in PDF version. It is the English version only.

Direct Download Links

Here is a complete list of official and alternate BOI RTGS form download options

| Form Type | File Name | Download Link | Tips / Suggestions |

|---|---|---|---|

| 1. Star Insta Remit Application Form (Official) | RTGS_NEFT_Remittance_Application_Format.pdf | 👉 Download Now | This is the official BOI RTGS/NEFT form used across most branches. Ideal for large or business transfers. You need to carry a self-cheque with the same amount. |

| 2. Small BOI RTGS/NEFT Form (Quick Form) | Short_RTGS_Form_BOI.pdf | 👉 Download Now | Most branches offer a small application slip for RTGS; you can also use that, usually accepted at all BOI retail branches. |

| 3. Top-to-Bottom (Private Bank Style) Form | BOI_RTGS_Top_to_Bottom_Format_(Official).pdf | 👉 Download here (Not officially hosted by BOI). | Similar design to ICICI or HDFC RTGS forms — single-column layout, easy to fill. Print and use only if your BOI branch accepts alternate templates. |

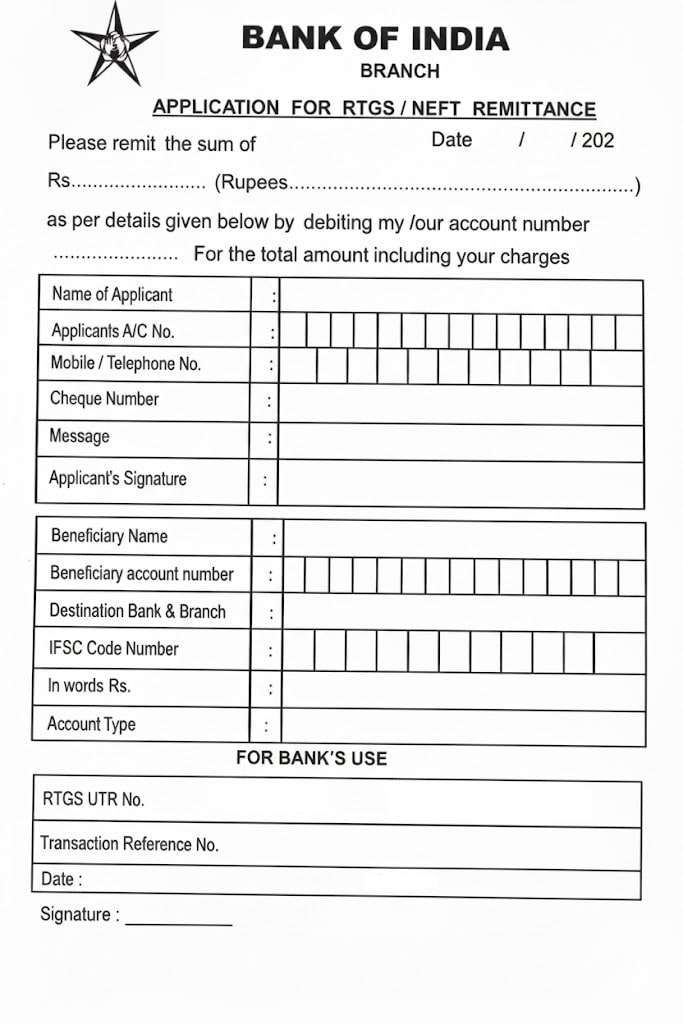

BOI RTGS Form Variants

Bank of India offers three designs of RTGS form; however work is the same, but with slightly different designs and additional details to enter. The Hindi and English versions are provided separately if you request them at the branch. Bilingual options are also available.

1. Small RTGS Form

- Short version of the remittance form.

- Suitable for quick transactions (NEFT or RTGS).

- Contains basic and quick required fields: Jus to enter remitter details, Beneficiary details, Amount, IFSC, and Signature.

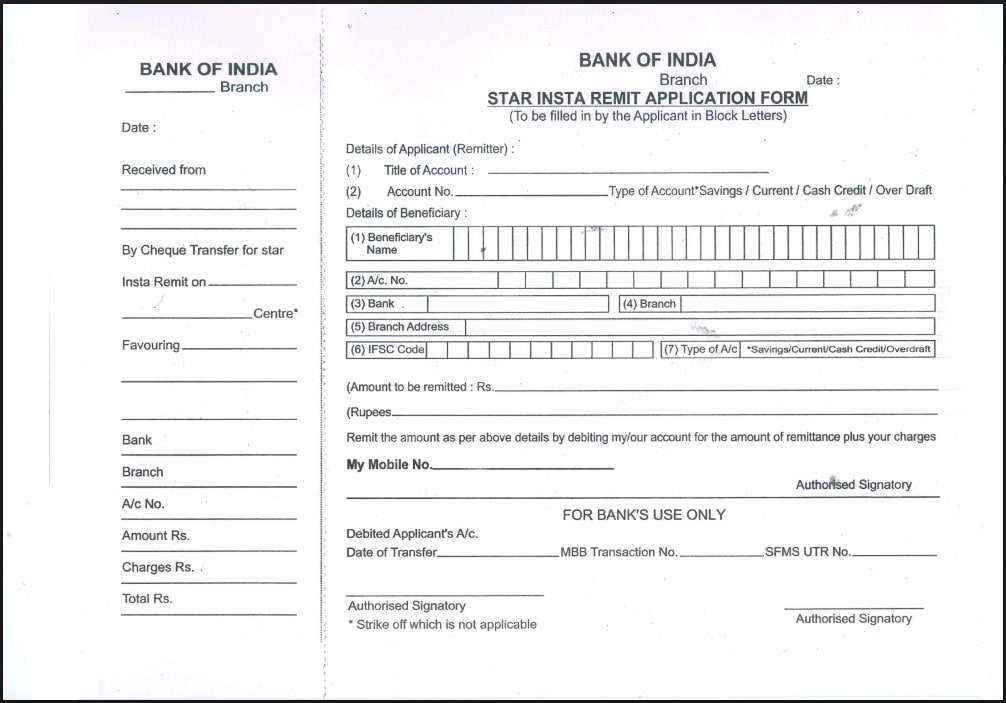

2. Star Insta Remit Application Form

- As per the BOI, this is the original, standard and the most widely used RTGS/NEFT form.

- It is a sided form; the left is the bank copy, and the right is the customer copy.

- Includes complete details such as signatures, charges.

3. Top-to-Bottom (Private Bank Style) Form

- Most branches now offer a modern format similar to forms used by private banks like ICICI or HDFC.

- It is a simple A4 form that starts from top to bottom.

- Often used in metro branches or where digital printing systems are available.

You can use any of the three forms — all are accepted across Bank of India branches as long as the required details are correctly filled.

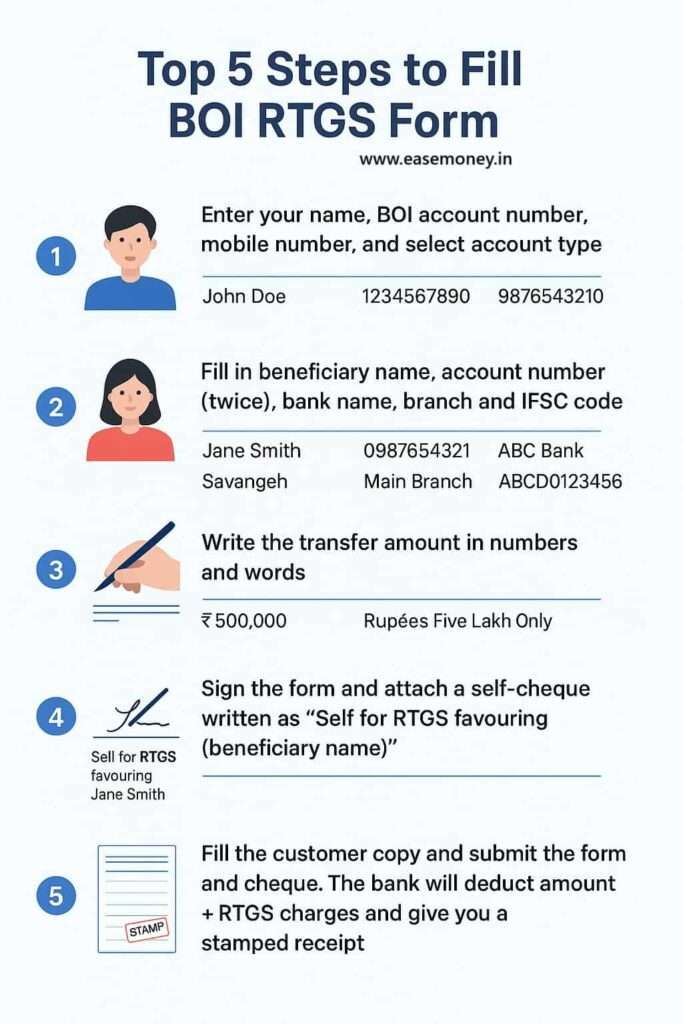

How to Fill the BOI (RTGS/NEFT) Form

BOI says Star Insta is the most used Application form, so let’s check how you can fill it for RTGS. First of all, use Block letters only and use a regular blue or black pen. Block letters mean plain capital words.

1 Step: Fill in Details of the Applicant (Remitter)

This section is about you – the person sending the money.

- Title of Account: Write your account holder’s name (as per bank records).

- Account Number: Enter your BOI account number. (find on your statement or passbook)

- Type of Account: Tick the correct option —

Savings / Current / Cash Credit / Overdraft. - Mobile Number: Enter your active bank-registered mobile number (for transaction alerts).

2 Step: Fill in Details of the Beneficiary (Receiver)

This section’s information must be accurate. Your Beneficiary who is to receive this amount, the account number must be written twice. You can ask for a bank statement or a cheque leaf photo from your client for this –

- Beneficiary Name: Enter your receiver’s full name (as per their bank account).

- Account Number: Enter the receiver’s bank account number carefully — double-check it.

- Bank Name: Example — SBI, HDFC Bank, PNB, etc.

- Branch Name & Address: If you don’t know, ask the beneficiary or check their bank statement.

- Type of Account: Just tick the correct one —

Savings / Current / Overdraft. - IFSC Code: Enter the 11-character IFSC code of your beneficiary’s bank branch.

3 Step: Enter Amount to be Remitted

- Amount in Figures: How much are you sending? Enter here; it must be above ₹2 lakh to be eligible for RTGS transfer. Example — ₹5,00,000/-

- Amount in Words: same amount in words, Example —

Rupees Five Lakh Only

4 Step: Signature

- Sign the form exactly as per your bank account signature or you do on your cheque leaf or PAN.

- For joint accounts, the primary holder or both holders must sign (as required).

5 Step: Bank’s Use Section (Leave Blank)

This section is meant for Bank Staff Only —

They will fill in:

- Debit amount from your account

- UTR Number (Transaction ID)

- Service charges

- Total amount after adding GST

Do not write anything here.

6 Step: Prepare a Self-Cheque

If your branch asks for a self-cheque, here are the steps on how to fill it –

- Write a cheque, put the name section – “Self for RTGS favouring to enter your beneficiary name”.

- Write the same amount as mentioned in the form.

- Sign it exactly as per your account signature or application form.

- The cheque number will be mentioned in the RTGS form.’

7 Step: Fill Customer Copy (Acknowledgement Slip)

This section is for you, the bank will give back to you, but you have to fill it up. This is your proof of submission.

- Fill few information –

- The Date – same date when you are making the transfer

- Received from – your account number

- Favouring – (beneficiary name) Bank, Branch, A/c No., Amount,

- Total with charges. RTGS have minimal charges, check below.

- The bank will stamp and return this part to you.

Note: If You Get the BOI Short RTGS/NEFT Form or the Modern form, you have to fill in the same information; however, it has a few additional sections, such as the Message to Customer and, cheque number section.

8 Step: How to Put BOI RTGS Charges in the Form?

When filling the Bank of India RTGS/Star Insta Remit form, there’s a small section labelled “Charges Rs.” near the bottom. You can confirm with the branch about the latest charges. However, the current charges are across Bank of India branches –

| Transaction Amount | RTGS Outward Charges | GST (18%) | Total Deduction |

|---|---|---|---|

| ₹2 lakh – ₹5 lakh | ₹25 | ₹4.50 | ₹29.50 |

| Above ₹5 lakh (any amount such as ₹50 Lakh or ₹1 Cr) | ₹49 | ₹8.82 | ₹57.82 |

How Are BOI RTGS Charges Deducted?

The total amount is automatically debited from your account in two parts:

- Transfer Amount – The exact sum you are sending to the beneficiary.

- RTGS Charges + GST – The service fee charged by BOI for branch-based RTGS.

Example:

If you want to transfer an amount such as ₹5,00,000 through a branch RTGS.

- BOI charges ₹25 for transfers between ₹2 lakh and ₹5 lakh.

- GST is 18% of ₹25 = ₹4.50.

- Your deduction = ₹5,00,000 + ₹29.50 = ₹5,00,029.50.

So, your beneficiary will get ₹5,00,000, and your account is debited for ₹5,00,029.50.

Free RTGS (Special Accounts)

RTGS outward transactions through the branch are free of cost for:

- BOI Salary Plus Account (Para-Military Personnel)

- Jai Jawan Salary Plus Account Scheme

BOI RTGS Transfer Limits

- Minimum RTGS Limit: ₹2,00,000

- Maximum Limit: Technically, RTGS has no upper limit, but the Bank of India may set limits depending on:

- Account category (salary, current, premium, etc.)

- Branch policy (for security reasons)

Example: Many BOI branches allow up to ₹25 lakh to ₹50 Lakh per day via branch RTGS. For higher transfers, prior authorisation or talk to the branch manager for approval.

Furthermore Questions

Can RTGS be reversed if sent to the wrong account?

No, your any amount transfer via RTGS is instant and final. You have to contact the branch immediately; reversal depends on the beneficiary bank.

Do I need a passbook to fill out the RTGS form?

Not mandatory at the branch counter, but having the passbook helps confirm account number, IFSC, and account type.

How long does an RTGS transfer take to reflect?

Payment by RTGS is received immediately within a 30 to 40-minute cycle if all details are accurate. In the afternoon, it may take a few minutes. But if you give your application by the end of the day, it may be processed the next day due to cut-off timings.

Why does BOI allow multiple RTGS form formats in branches?

BOI follows a CBS-based validation, not format-based. As long as beneficiary details, signatures, and cheque authorisation match records, different RTGS form layouts are accepted across branches.

Is the BOI branch RTGS still reliable compared to online RTGS?

Yes, especially for property or business payments. Branch RTGS includes manual verification, cheque validation, and officer approval, making it safer for one-time, high-value transfers.

What happens if BOI RTGS is submitted near closing hours?

Forms submitted after the cut-off (usually 3:30–4 PM) are queued. The debit may happen next working day, even if the form was accepted before closing.

How does BOI handle very large RTGS requests above ₹25 lakh?

Large RTGS transfers often need branch manager approval. Some branches split verification into two levels for security, especially for amounts above ₹50 lakh.

Why does BOI debit RTGS charges separately from the amount?

RTGS charges and GST are treated as service fees, not part of the transfer. This ensures the beneficiary receives the exact intended amount, with fees debited transparently.

What is the safest way to avoid RTGS errors at BOI?

Always collect a cancelled cheque or account proof from the beneficiary. Most RTGS mistakes at BOI happen due to wrong IFSC or missing digits in account numbers.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.