Let’s start with an FD Fact about BOM Bank – Before checking the latest public FD rates, one thing is important, which most people don’t talk about.

Bank of Maharashtra staff, retired staff and the spouse of deceased or retired staff get an extra 1.00% interest on FD. This benefit is available on a deposit of up to ₹5 crore. This extra interest is separate from the senior citizen benefit. Normal customers cannot get this benefit.

- In simple words,

- if the normal FD rate is 6.65%,

- then eligible staff can earn up to 7.65% on the same FD tenure.

This type of staff benefit is not common in PSU banks, and it is officially mentioned in the Bank of Maharashtra deposit rules.

What Are the Latest Bank of Maharashtra FD Rates?

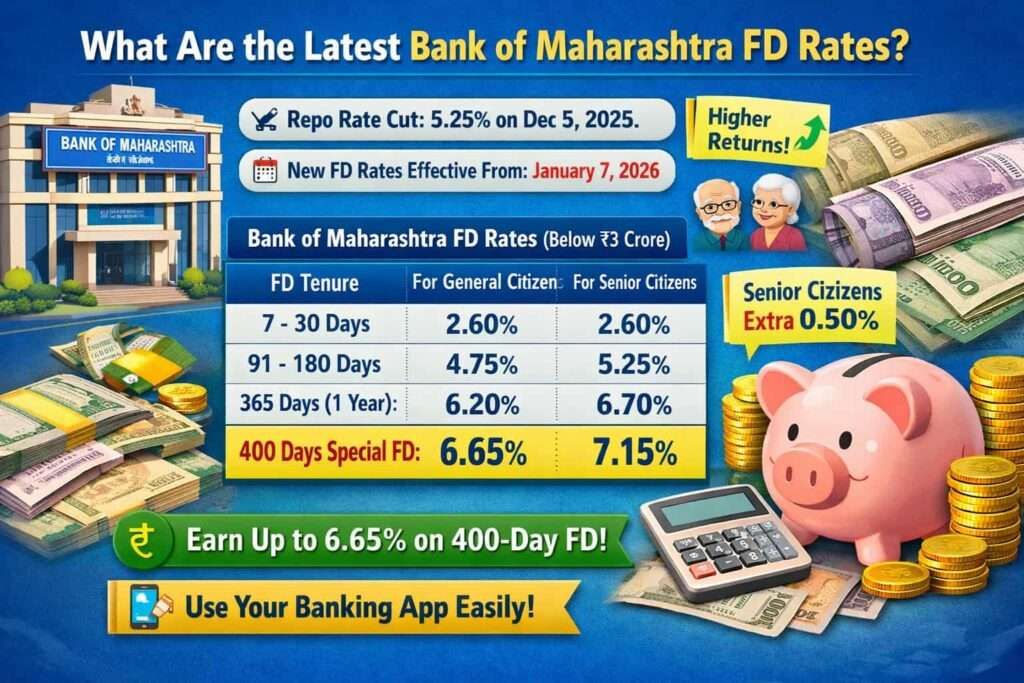

On 5 December 2025, the RBI reduced the repo rate to 5.25% for economic support. After a repo rate cut, banks normally review the deposit interest rate and make changes.

After the RBI rate cut, the Bank of Maharashtra revised its FD rates after a month. But the new rates came into effect from 07 January 2026. If you are looking at special FD schemes, then those are applicable from 08 January 2026.

As per the latest revision, Bank of Maharashtra FD rates now start from 2.60% and go up to 6.65% per year for domestic term deposit any amount below ₹3 crore. But the highest rate is 6.65%, which bank is offering under the 400-day Special FD scheme. If you are a senior citizen, you get an extra 0.50% interest, so the effective rate becomes 7.15%.

Small Example For You (Why This Matters)

If you invest ₹1,00,000 in normal 1-year FD, you earn around 6.20% interest. But if you choose 400-day FD, interest becomes 6.65%. This means return is slightly better, even after RBI repo rate cut. You can find these popular FD offer on your mobile Banking app easily.

Bank of Maharashtra FD Interest Rates Chart (Below ₹3 Crore)

These are domestic or regular Term Deposit rates. You can check this simple view. If you see above 5 years tenure, the rate remains the same. But if you are looking for a Bulk Term Deposit or an NRO Term Deposit for above ₹10 crore and a higher tenure, you should check the official chart on Bank of Maharashtra official site.

| FD Tenure | General Citizen | Senior Citizen |

|---|---|---|

| 7 – 30 days | 2.60% | 2.60% |

| 31 – 45 days | 2.75% | 2.75% |

| 46 – 90 days | 3.75% | 3.75% |

| 91 – 119 days | 4.00% | 4.50% |

| 120 – 180 days | 4.75% | 5.25% |

| 181 – 270 days | 5.00% | 5.50% |

| 271 – 364 days | 5.25% | 5.75% |

| 365 days (1 Year) | 6.20% | 6.70% |

| 1 – 2 years | 6.15% | 6.65% |

| 2 – 3 years | 5.25% | 5.75% |

| 3 – 5 years | 5.00% | 5.50% |

| Above 5 years | 5.00% | 5.50% |

If you are a senior citizen, you get an additional 0.50% interest on the FD. But FD tenure should be a minimum of 91 days, and the benefit is available only up to ₹5 crore for resident Indians.

Special FD Schemes in 2026 (Highest Paying Options For You)

| FD Scheme | Tenure | General | Senior |

|---|---|---|---|

| Maha Dhanvarsha (BOM Special FD) | 400 days | 6.65% | 7.15% |

| Green Deposit | 1777 days | 6.05% | 6.55% |

Key Insight: Unlike normal 1-year or long-term FDs, where interest rates became a little soft after the repo rate cut, Bank of Maharashtra kept its special tenure FD attractive or higher (like 400 days). That is why this option makes more sense for conservative investors in early 2026.

Real Life Example: How Much Will You Earn?

Example 1 – General Citizen

FD Amount: ₹1,00,000

Tenure: 400 days

Rate: 6.65%

Approx maturity: ₹1,07,300

Example 2 – Senior Citizen

FD Amount: ₹1,00,000

Tenure: 400 days

Rate: 7.15%

Approx maturity: ₹1,07,900

Why Bank of Maharashtra Is Able to Offer These FD Rates?

Around the same time when FD rates were revised, Bank of Maharashtra also reported strong deposit growth. This is one reason why bank is comfortable in offering competitive FD rates, even after the RBI repo rate cut.

As per the quarter ended 31 December 2025 (Q3 FY 2025–26), Bank of Maharashtra’s total deposits, including Fixed, Savings and Current accounts, grew by around 15.30% year-on-year and reached close to ₹3.21 lakh crore.

Out of this total deposit, the bank reported a CASA ratio of 49.55%. This means around 50.45% deposits are Term Deposits, like Fixed Deposits and Recurring Deposits.

What This Means in Simple Words –

- Term deposits are roughly around ₹1.62 lakh crore, if we calculate from total deposits, or PSU Connect reports say.

- Because the deposit base is strong and growing, the bank has enough liquidity comfort.

- This helps Bank of Maharashtra to do two things:

- Offer special FD schemes like a 400-day FD

- Avoid cutting FD rates aggressively just after repo rate changes

Banks with stable deposits don’t rush to reduce FD rates. Bank of Maharashtra deposit growth clearly shows confidence, and because of that, FD rates for early 2026 are still attractive.

Different types of FD options are available in the Bank of Maharashtra

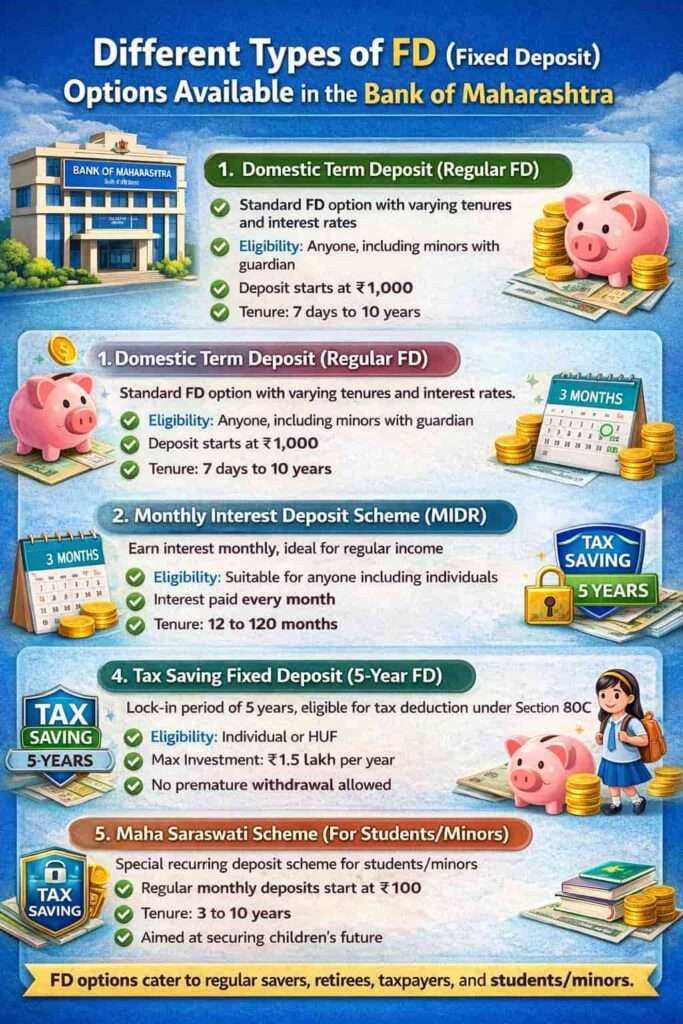

Bank of Maharashtra offers five FD-based deposit options. Each scheme is made for different financial needs, like regular FD, tax-saving FD, and some special options for specific customers.

1. Domestic Term Deposit (Regular FD)

This is the regular Fixed Deposit option of Bank of Maharashtra. If you don’t want to go with special FD schemes like 400-day or 1777-day, then this FD makes sense. Interest rate depends on tenure, but the rate remains the same for normal deposits. You can check the above table. Senior citizens are also the same.

- Who can open: An individual, firm, partner, or company can open this FD. Minor is also allowed with a guardian. That is why this FD suits almost everyone, like salaried people, businessmen, students and homemakers.

- Deposit amount: You can start with ₹1,000 only. This is a one-time lump sum deposit; there is no monthly payment like RD.

- Tenure: You can choose an FD period that starts from 7 days and goes up to 10 years. So you can use it for short-term parking or long-term savings.

- Interest payout: Interest is compounded and paid on maturity in a cumulative FD. But if you want a regular income, you can choose the non-cumulative option where interest is paid monthly or quarterly.

- Extra benefits: A loan against an FD is available up to 90% of the deposit amount. Nomination facility is there, and FD can be transferred from one branch to another without closing it.

Quick Example –

Let’s understand regular domestic FD with one simple example.

Amit is a 38-year-old daily salaried person. He invests ₹2,00,000 in Bank of Maharashtra Regular Fixed Deposit for 1 year (365 days).

- FD amount: ₹2,00,000

- Tenure: 365 days

- Interest rate (Jan 2026): 6.20% per year

- FD type: Regular Domestic Term Deposit

At maturity, Amit will get around ₹2,12,400. This amount includes his original money plus interest earned.

If Amit does not need monthly or quarterly income and goes with the reinvestment option, then interest is added back to the FD and keeps compounding till maturity. This way, the return becomes better compared to keeping the same money in a savings account.

Insight: For short-term safe parking of extra money, a regular 1-year FD gives more predictability. Especially after the RBI repo rate cut, FD feels more stable compared to market-linked options.

2. Monthly Interest Deposit Scheme (MIDR)

This FD scheme is for people who want a monthly income. If you need regular money every month, then this option works well. It feels like one extra income along with your normal earnings, so the monthly budget becomes easy to manage.

- Who can open: Individual, minor with guardian, joint account, firm, company, club — almost anyone can open.

- Deposit amount: You can start with ₹1,000 only. The deposit is one-time, not monthly.

- Tenure: The FD period is from 12 months to 120 months.

- Interest payment: Interest is paid every month. But your principal amount you will get only on maturity.

- Interest rate: The rate is decided by the bank. Monthly interest depends on tenure and the rate at that time.

- Other benefits:

- Monthly interest can come to your SB / CA / RD account.

- Loan against FD is available up to 90%.

- Nomination facility is also there.

Best for: Senior citizens, pensioners, shop owners or anyone who needs a fixed monthly income.

3. Quarterly Interest Deposit Scheme (QIDR)

Bank of Maharashtra Quarterly Interest Deposit Scheme is useful if you want interest every three months. This scheme is ideal for planning tax payments or investments, as quarterly interest helps in managing cash flow easily.

It works similarly to MIDR, but interest is paid quarterly, not monthly.

Good deal for: People who have quarterly expenses or who like to plan cash flow every 3 months.

4. Tax Saving Fixed Deposit (5-Year FD)

This FD is for people who want a tax benefit under Section 80C. If you want to save tax and can lock money for the long term, then this scheme is useful.

- Eligible under: Section 80C of the Income Tax Act

- Maximum investment: ₹1.5 lakh in one financial year

- Lock-in period: 5 years (fixed)

This scheme is officially called the Bank Term Deposit Scheme, 2006, as per Income Tax rules.

Important things to know:

- No premature withdrawal allowed

- No loan or overdraft facility

- FD cannot be pledged or traded

Interesting part:

- Interest earned is taxable, even though the principal gets an 80C benefit

- TDS may apply as per the rules

Who can invest:

- Individual or HUF only

Deposit type:

- Can be taken under the MIDR, QIDR, FDR, and CDR options

Other points:

- Minimum investment starts from ₹100

- FD can be transferred between Bank of Maharashtra branches

- Nomination facility is available (not allowed for minor accounts)

One exception:

- If the FD holder passes away, the nominee can withdraw the FD even before 5 years.

Great for: People who want tax savings + safe investment, and can keep money locked for 5 years.

5. Maha Saraswati Scheme (For Students / Minors)

This scheme is mainly for children and students. It works like RD, where you deposit money every month.

- Monthly deposit starts from ₹100 only

- Tenure is from 3 years to 10 years

- Interest rate is the same as a regular FD

This scheme is specially made for girl child education and future needs. If parents want to save slowly in a disciplined way, this option is useful.

One more benefit is that if a later education loan is taken, an interest concession is available.

Best for: Parents who want to plan their children’s education in a safe and regular way.

How to Apply for Bank of Maharashtra FD Using the Mobile App

Using Mahamobile Plus App:

If you are comfortable with mobile, this is the easiest way.

- Log in using MPIN or fingerprint

- Tap on Deposit (FD/RD)

- Select Open FD

- Choose tenure or any special FD

- Select interest payout option (monthly/quarterly/maturity)

- Enter your FD amount

- Select the linked savings account

- Tap on Calculate Maturity to check the final amount

- Enter TPIN and submit

FD amount is auto-debited from the savings account, and the FD usually gets activated within a few hours.

Tip: First, check the maturity amount once before final submission. Many people skip this step.

How to Apply Offline (Branch Method)

If you prefer a bank visit, you can also open an FD from a branch.

- First of all, visit the nearest Bank of Maharashtra branch to your home

- Ask for the FD Account Opening Form

- Fill basic details like:

- Personal details

- FD amount and tenure

- Interest payout option

- Attach required documents

- Submit the form at the counter and collect the FD receipt

Tip: Ask staff about the latest special FD schemes before submitting the form.

Documents Required for FD

For all customers:

- PAN Card

- Aadhaar or your Passport or your Voter ID (anyone)

- Savings account details

Extra for senior citizens:

- Age proof (Aadhaar or PAN usually enough)

- Senior citizen declaration (if bank asks)

Charges, Penalties & Important Rules

Premature Withdrawal Rules

- If FD broken after 1 year → around 1% penalty on applicable rate

- If FD is broken within 1 year → usually no penalty

- Within 7 days, you broke it → no interest paid

Rules can vary slightly by branch, so always confirm once.

TDS on FD Interest

- General citizens: TDS if interest exceeds ₹50,000 per year

- Senior citizens: TDS if interest exceeds ₹1,00,000 per year

- TDS rate:

- 10% with PAN

- 20% without PAN

Forms to avoid TDS (if eligible):

- Form 15G – for non-senior citizens

- Form 15H – for senior citizens

Source: According to Income-tax Act provisions applicable for FY 2025-26 on TDS and interest income

FAQs – Questions For You

What is the Green Deposit FD Scheme in Bank of Maharashtra?

Green Deposit FD is a 1777-day fixed deposit where your money supports eco-friendly projects. Interest is 6.05% (general) and 6.55% (senior), suitable for long-term, purpose-based investors.

Which FD gives the highest interest in Bank of Maharashtra in 2026?

The 400-day Special FD gives the highest return in 2026. General customers get 6.65%, while senior citizens earn 7.15%, which is higher than normal 1-year or 2-year FDs.

After the RBI repo rate cut, is Bank of Maharashtra FD still good?

Yes. Even after RBI cut repo rate to 5.25% on 5 Dec 2025, BoM revised rates on 7 Jan 2026 and kept special FD rates attractive, especially the 400-day FD.

Do senior citizens really get extra benefit in BoM FD?

Yes. Senior citizens get extra 0.50% interest on FDs of 91 days and above, up to ₹5 crore. This benefit is only for resident Indians, not NRE or NRO deposits.

Will TDS be deducted on Bank of Maharashtra FD interest in 2026?

TDS applies if yearly FD interest crosses ₹50,000 (regular) or ₹1 lakh (senior). Submitting Form 15G or 15H on time can legally stop TDS deduction.

Is loan against FD available in Bank of Maharashtra?

Yes. You can get a loan up to 90% of FD amount at lower interest than personal loan. Your FD continues earning interest, so loan option is better than breaking FD.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.