As of January 2026, there are around 1,842 co-operative banks in India. These banks are under the control of the RBI and the State or Central Co-operative Registrar. There are around 1,450–1,500 Urban Co-operative Banks (UCBs) working under the NABARD.

Co-operative banks are very useful in small towns, tier-3 cities, and villages. Local people trust these banks because the staff are familiar and the service is simple. Here, people trust relationships more than big bank names, so many keep their savings in co-operative banks.

Most of the money in co-operative banks comes from fixed deposits (FDs). Many people keep their savings in FDs with these banks. The FD interest rates depend on RBI rates, money needs in the local area, and what other banks are offering at that time. If you are here for the latest rates in 2026, let’s talk basics first –

What Is a Co‑operative Bank Fixed Deposit?

A co-operative bank fixed deposit means you keep one-time money in the bank for a fixed time. The bank tells you the interest rate when you open the FD, and that rate does not change till the FD ends. These fixed deposits are mainly for safe savings.

You know how much interest you will get, and your money is protected. Because of this, many salaried people, senior citizens, traders, and small business owners in smaller cities trust co-operative bank FDs.

As of late 2025, financialexpress.com says term deposits in co-operative banks have increased. In some segments, deposits have reached around ₹4.47 lakh crore.

Many people choose these banks because FD rates are higher, usually between 6.5% to 8.25% in 2026. But compared to big banks, risk is also a little higher, so people should be careful.

Find the Co‑operative Bank FD Interest Rate Range Currently

Co-operative bank FD interest rates are not the same everywhere. In most cases, the rates fall within this range.

- For regular people, interest usually stays between 5.40% to 8.10% per year.

- For senior citizens, banks give extra benefits, and the rate can go up to 8.60% per year, including an additional interest of 0.50% to 0.60%.

The final FD rate depends on a few simple things:

- Which co-operative bank you choose

- For how long do you keep the money

- Whether the bank is running any special FD scheme

- Check any recent Repo-rate up or down by the RBI

- And if the depositor is a senior citizen

Very short-term FDs, like below six months, usually give low interest, sometimes around 3.25%. On the other hand, special periods like 400 days or 16 months often give the highest returns.

RBI Repo Rate and Co‑operative Bank FD Rates

As of January 2026, the RBI repo rate is 5.25%. Repo rate simply means the interest rate at which banks take short-term loans from the RBI.

How the repo rate affects FD rates – When the RBI reduces the repo rate, borrowing becomes cheaper for banks. In such cases, banks usually reduce FD rates to control their cost of funds. When the repo rate increases, banks raise FD rates to attract more deposits.

According to RBI policy actions, several repo rate cuts were made during 2025. Because of this, early 2026 is seeing a relatively low-interest-rate environment. Even in this scenario, many co‑operative banks continue to offer better FD rates than large PSU banks, especially on special tenures.

Top 10 Biggest Co-operative Banks & FD Rates (January-Feb-March 2026)

| No. | Bank Name | Max FD Rate (General) | Max FD Rate (Senior Citizen) | Tenure Giving Highest Rate |

|---|---|---|---|---|

| 1 | Saraswat Bank | 7.15% – 7.50% | 7.65% – 8.00% | 16 months |

| 2 | Cosmos Bank | 7.60% | 8.00% | 13 months |

| 3 | SVC Bank | 6.85% | 7.35% | 12–14 months |

| 4 | TJSB Sahakari Bank | Up to 7.25% | Up to 7.75% | 1–2 years |

| 5 | Abhyudaya Bank | 6.55% | 6.90% | 2–3 years |

| 6 | Bharat Co-operative Bank | 7.00% – 7.30% | 7.50% – 7.80% | 1–18 months |

| 7 | NKGSB Bank | Up to 7.00% | Up to 7.50% | 1–3 years |

| 8 | Janata Sahakari Bank (Pune) | 7.25% | 7.75% | 12–36 months |

| 9 | Kalupur Commercial Bank | Up to 7.10% | Up to 7.60% | 1–2 years |

| 10 | New India Co-operative Bank | 7.60% | 8.10% | 400 days |

Important Note – India has thousands of co-operative banks, and not every bank is listed here. If your local co-operative bank name is not in this list, don’t worry.

Just visit your bank branch, ask for the latest FD brochure, and check the interest rates carefully. This table gives you a basic idea of current FD rates.

If your bank is offering much lower interest, you can choose any one:

- Ignore that FD offer, or

- Compare with another nearby co-operative bank before investing.

Key Takeaways (Simple Points)

- Special or limited-period FDs like 400 days or 16 months are giving the best interest. Senior citizens can even get more than 8% in some banks.

- Co-operative banks are giving good FD rates, but some Small Finance Banks (like Suryoday SFB) are offering even 8.00% to 8.40% during the same period.

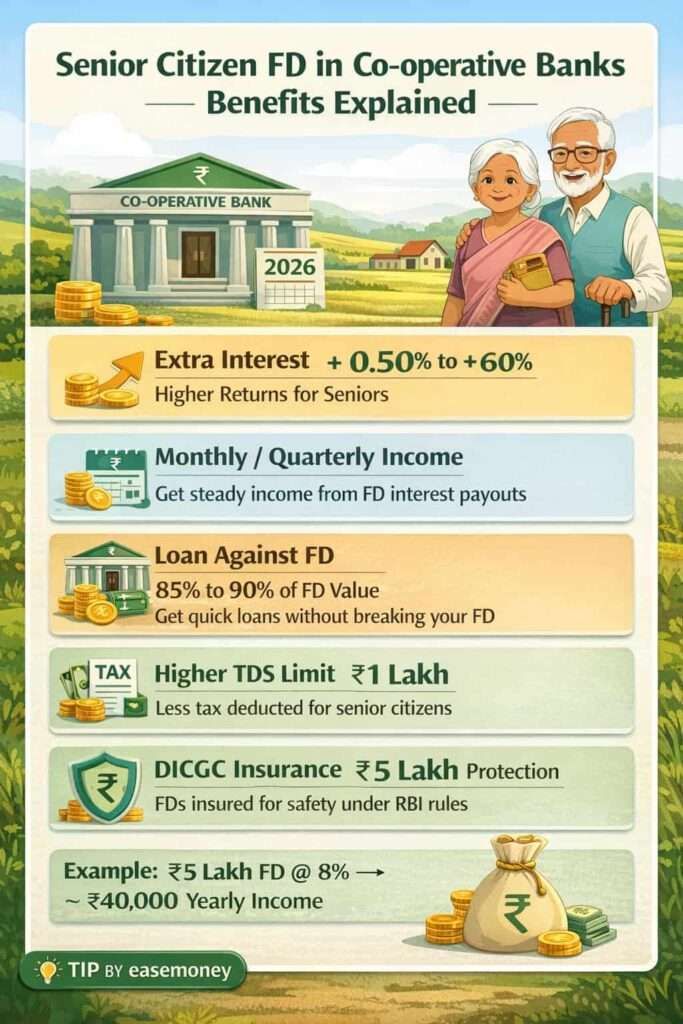

Senior Citizens and Co‑operative Bank FDs

Many senior citizens in small towns prefer co-operative bank FDs because the service is personal and returns are stable. Bank staff usually know the customers, which gives more comfort.

- Senior citizens get an extra interest of around 0.50% to 0.60%, so FD rates can go up to 8.60% per year in some banks.

- Interest can be taken monthly or quarterly, which helps in managing daily expenses like medicines and bills.

- Risk is low compared to the share market or market-linked products, so money remains safe.

- In case of an emergency, seniors can take a loan against an FD without breaking the deposit.

- Senior citizens have a higher TDS limit of ₹1 lakh per year.

- By submitting Form 15H, eligible seniors can avoid TDS deduction on FD interest.

Example: FD Investment in a Tier-3 City (Senior Citizen)

- Suppose a senior citizen deposits ₹5 lakh in a co-operative bank FD for 16 months.

- For a normal customer, the FD interest rate may be around 7.00% per year.

- Senior citizens usually get an extra interest of around 0.50% to 0.60%, so the final rate becomes around 7.50% to 7.60%.

- If the bank is offering a special scheme at 8.00%, the yearly interest comes to around ₹40,000 on ₹5 lakh.

- If the senior citizen chooses a quarterly interest payout, they will receive regular income every three months.

- The FD amount of ₹5 lakh remains safe and protected under DICGC insurance.

- After the FD period is over, the full deposit amount is returned without any market risk.

Main Features of Co-operative Bank FDs

- Fixed return, no tension – Once the FD is opened, the interest rate is fixed. Even if rates change outside, your FD return will not change.

- FD for a short or long time – You can keep FD for a few days or many years. Most co-operative banks give options from 7 days to 10 years.

- Deposit Amount – In co-operative banks, FD can start with ₹1,000 or ₹5,000. You can keep money for a few days or many years. There is no upper limit, but it depends on bank to Banks. Nomination and auto-renewal options are usually available.

- More interest than a savings account – A savings account gives very little interest. FD gives a much better return, so money grows faster.

- Interest as per your need – You can take interest every month for expenses, every three months, or add it back to the FD till the end.

Loan Facility Against FD (When Money Is Urgently Needed)

- If you need money suddenly, you don’t have to break the FD.

- The bank can give a loan or overdraft against your FD.

- You can get 85% to 90% of the FD amount as a loan.

- Loan interest is slightly higher than FD interest, usually 1% to 2% extra.

- Very useful during medical treatment, marriage expenses, or small business cash problems.

Deposit Insurance and Safety (Money Protection)

- Most co-operative banks are covered under DICGC insurance.

- Your money is safe up to ₹5 lakh per person per bank.

- This cover includes the FD amount plus interest.

- This safety is given under RBI rules, so there is no difference between small and big customers.

Premature Withdrawal Rules (If FD Is Closed Early)

- If needed, FD can be closed before time in most banks.

- The bank will charge a small penalty, usually 0.50% to 1% less interest.

- A 5-year tax-saving FD cannot be broken before maturity.

Simple Tip – You always ask the bank staff for the FD receipt, interest rate, and insurance details. Never hurry. First understand, then invest.

Who Can Open a Co-operative Bank FD?

- Any resident individual can open an FD, alone or with a family member.

- Senior citizens can also open an FD and get extra interest.

- Children’s FD can be opened through a parent or guardian.

- HUFs can open an FD in the family name.

- Partnership firms can keep business money in an FD.

- Trusts and registered societies are also allowed.

Documents Required (You will need)

- Aadhaar card, Voter ID or Passport for identity.

- Address proof like an electricity bill or a bank passbook.

- A PAN card is required for tax and TDS purposes.

- Passport-size photo of the depositor.

Taxation of Co‑operative Bank FD Interest (Source: FY 2025–26)

- FD interest is taxable under Income from Other Sources

- TDS at 10% is deducted if interest exceeds:

- ₹50,000 for general citizens

- ₹1 lakh for senior citizens

Form 15G or 15H can be submitted if the total income is below the taxable limit.

How to Open a Co-operative Bank FD

Offline Method (Most Common)

- First of all, you have to visit your nearest co-operative bank branch.

- Ask for the FD account open application form and fill in the simple details.

- Submit documents and deposit cash or cheque.

- FD receipt will be given by the bank.

Online Method (In Big Co-operative Banks)

- Some large co-operative banks allow FD booking online.

- FD can be opened using the bank website or mobile app.

- A few platforms also help in FD booking, depending on the bank.

FAQs

What is the 444-day FD scheme people talk about?

The 444-day FD is a special scheme by banks like SBI and Indian Bank. It gives higher interest than normal FDs, suits short-term savers, and allows loan or premature withdrawal with a small penalty.

Is the 444-day FD better than a normal one-year FD?

In most cases, yes. Branch staff explain that 444-day schemes pay 0.20%–0.40% more than one-year FDs, without locking money for two or three years.

What is the current FD rate in RGB (Regional Gramin Bank)?

RGB FDs give around 6.05% for 6–12 months, 6.60% for one year, and 6.50% for up to three years. Senior citizens generally get 0.50% extra interest.

Should senior citizens choose co-operative banks or Gramin banks for FD?

From real experience, seniors choose co-operative banks for higher interest and Gramin banks for safety and comfort. Many smart investors split money—₹3–4 lakh in each—to balance return and protection.

Are very high FD rates like 9% or more always safe?

Not always. Branch staff advise checking DICGC insurance, bank size, and tenure. Keeping deposits within ₹5 lakh per bank reduces risk, even when interest rates look attractive.

Is it okay to invest more than ₹5 lakh in one co-operative bank FD?

Staff usually suggest splitting deposits across two banks. Keeping more than ₹5 lakh in one bank reduces insurance protection. Many smart investors open two FDs of ₹4–₹5 lakh separately.

Why do co-operative banks give higher FD interest than PSU banks?

Co-operative banks depend more on local deposits. To attract money, they offer 0.50%–1% higher rates, especially on special tenures like 400 days or 16 months, which PSU banks usually avoid.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.