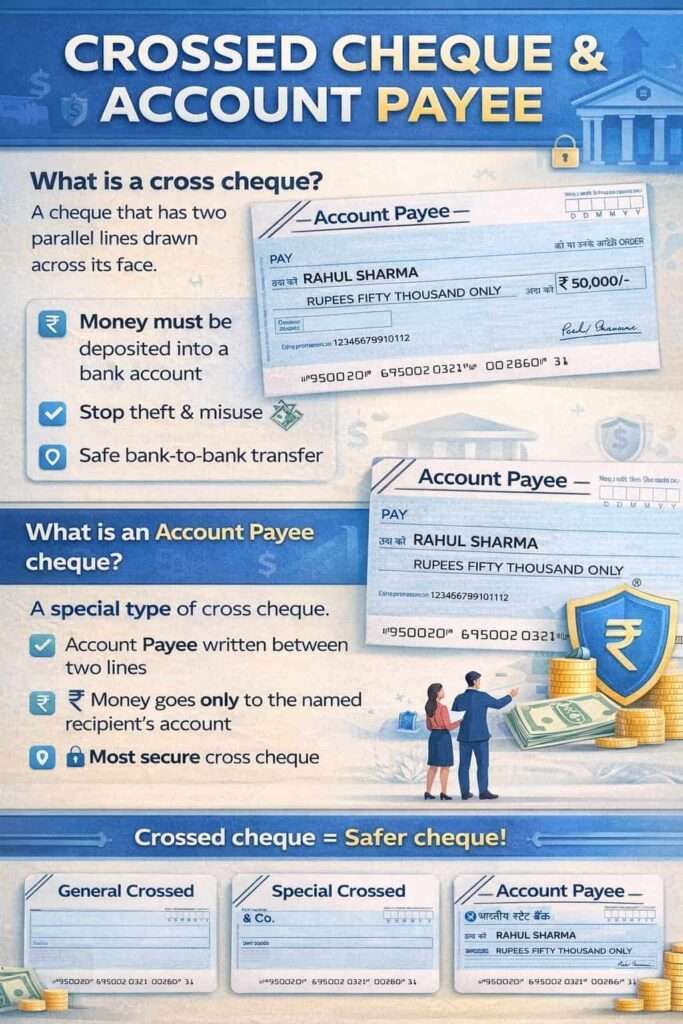

Define: What is a Cross Cheque?

A cross cheque is any cheque that has two parallel lines drawn on the left side of the Top corner of the face. If I say directly, the primary purpose of these lines is to enhance security.

The meaning of that is signalling to the banking system that the cheque must not be paid in cash. The instruction is absolute and direct: the payment must move or credit only the bank account.

Most people get confused with crossed, double-crossed cheque, and crossing a cheque; however, those all terms are the same concept. If we talk about what crossing a cheque means operationally in banks –

It goes directly in 1 sentence: “The drawer or holder has instructed the bank to route payment only through an account. It creates a traceable banking record.”

Also, legally, this instruction is recognised and enforced under the Negotiable Instruments Act, 1881, and operationally enforced through RBI clearing systems and the CTS system.

For example: If someone gives you a cheque with these lines, it means you cannot get cash instantly from the counter, but it will settle only your bank account, the payee account only. If it is crossed “Account Payee Only – Rahul Kumar”, the bank will credit only Rahul Kumar’s account. No cash withdrawal is allowed; you can choose the cheque drop box or the counter, and the instructions are the same.

What actually changes in real life?

In practice, a crossed cheque does three things at once:

- Removes the cash counter completely – Most branches suggest please put this in the cheque drop box with the pinched written deposit slip.

- Forces account-based settlement

- Teller’s discretion disappears

- Creates a permanent audit trail

- liability shifts to account-based verification

Banks do not debate intention here. Crossing is treated as a mandatory instruction to route funds only through accounts.

This rule applies:

- All types of cheque, such as =

- Bearer cheque

- Order cheque

- Bank-issued cheque

- Savings or current account cheque

- Who presents the cheque

- whether the amount is small or large

It is completely the opposite with open cheques. With open cheques, you can walk into the bank named on the cheque, hand it to the teller, and walk out with physical cash. It is high-risk because if you lose it, anyone can find it and encash it.

Why do people or Firms give cross cheques

The direct answer is, it enhances the security and makes the process simple. However, here are, few points for you to understand better –

- Safety against loss or theft – By any chance, if a crossed cheque is lost or stolen, no one can withdraw cash from it. It reduces the misuse and stress of both parties.

- Ensures money reaches the right person – With Account Payee crossing, the amount goes only to the named payee’s account. This prevents someone else from encashing or diverting the cheque.

- Creates a clear record (proof of payment) – Payments through crossed cheques leave a bank trail: who paid, who received and proper date, timing, and amount.

- Legal and compliance reasons – Most big organisations and banks do not allow bearer cheques for payments because they can be a Higher fraud risk and have no tracking. But the double-cross meets internal control and audit requirements.

The drawback is that crossing cheques sometimes increases the timing of the deposit or withdrawal of funds. First, it goes cheque drop box, then settled, and then it is credited to the bank account. The complete process takes 2 or 3 days at standard. Unless, no Bank holidays in between.

Types of crossing a cheque in India

Cheque crossings in India are best understood by what they restrict, not just by labels. Let’s find out what typical categories of crossing cheques are live in the banking system –

1. General Crossing

- What it does: It restricts Cash Payments and counters instant cash immediately.

- How it appears: It is too simple to do, just put two parallel lines, nothing else is required than.

- Bank Effect:

- A Cheque can be deposited in any bank account in the payee’s name.

- The cash counter or branch will suggest using drop boxes for faster processing.

- Ownership verification is minimal

This is the most common crossing used by individuals.

2. Special Crossing

- What it restricts – It will block the other banks for deposits

- The pattern: It also has two parallel lines, but in between, there is one specific bank’s name written. such as HDFC or Bank of Baroda.

- What Bank got the signal:

- This gives a direct call, the Cheque must pass only through the named bank

- Any other bank must reject it

- Adds an accountability layer by fixing responsibility

This is more Special crossing that is frequently used by institutions and corporations. Most of the time, for salaries or making other payments.

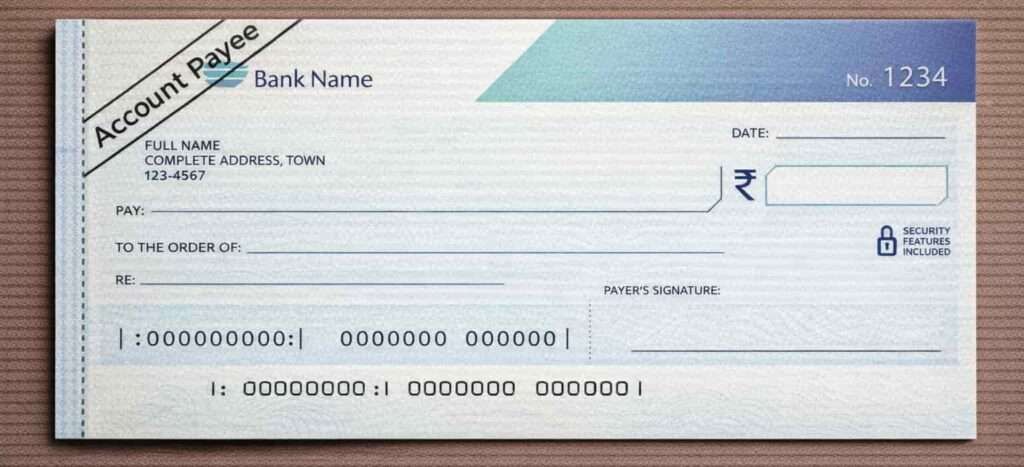

3. Account Payee Crossing

- Meaning: It restricts the beneficiary, or it gives a direct signal, and this is most common in india.

- Look Like: Words like “Account Payee” or “A/C Payee Only” written between crossing lines. only that, not the payee name in between.

- It allows:

- Money must be credited only to the named payee’s account

- Third-party credit is not permitted

- Highest level of misuse prevention

Although not separately defined in statute, banks treat this as a mandatory instruction. This is legal in indian law regulations.

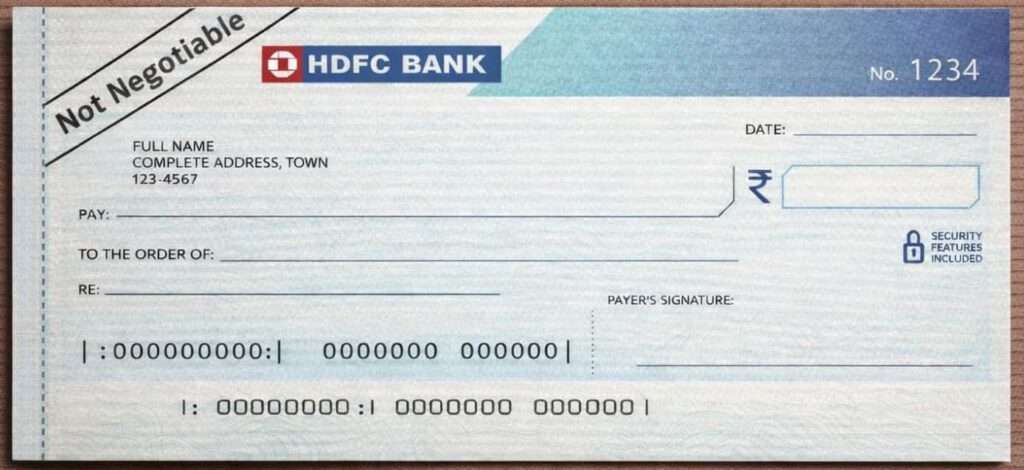

4. Not Negotiable Crossing

- What is it all about: It blocks the title transfer. Not Negotiable Crossing means a cheque can be transferred, but the receiver does not get better legal rights than the giver.

- How it appears: The words “Not Negotiable” are added to a crossed cheque.

- Bank effect:

- A cheque can be transferred

- But the transferee cannot obtain a better legal title than the transferor

- Protects the true owner if the cheque is stolen or misused

Quick Example For You: Rahul gives a “Not Negotiable” cheque to Amit. If it is stolen and deposited by Rohit, the bank can recover the money and return it to Amit. Normally, a person who receives a cheque in good faith may get legal protection. Not Negotiable removes that protection.

5. Restrictive Crossing

Restrictive crossing is not a separate statutory class. It is a functional term used by banks to describe any crossing that restricts payment to a specific account.

In practice:

- Account Payee crossing is the most common restrictive crossing

- Banks follow restrictive instructions strictly

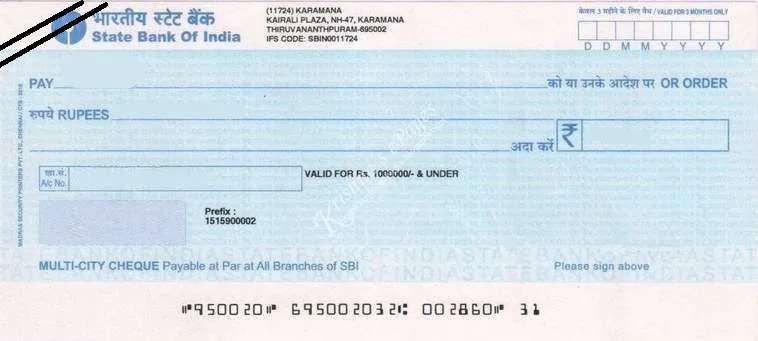

How to cross a cheque (Mostly used in India)

Crossing a cheque does not require bank approval. It is a manual act. You can do when writing a cheque for someone, use the same blue or black ink, not another, to create lines. Check what the quick steps are –

1. Draw the crossing

First of all, draw two parallel lines across the top-left portion of the cheque (anywhere on the face is legally valid, but this position is standard and suggested by the Negotiable Instruments Act and RBI).

2. Add instruction (optional but recommended)

Between the two lines, write:

- “Account Payee” (for maximum safety), or

- “Not Negotiable” (if transfer risk exists)

- Or Bank Name (if required)

This step changes the category of your crossed cheque.

Step 3: Fill cheque details normally

- Date (It also works on post-dated cheques)

- Payee name

- Amount (figures and words)

- Signature or thumb impression

- Back side cheque double sign, for additional security layer as per indian PSU Banks.

No extra stamp or format is required.

Who can cross a cheque

A cheque can be crossed by:

- Drawer (person issuing the cheque – the account owner)

- Holder (person legally in possession of cheque)

- Banker, in limited circumstances while collecting

This flexibility exists to allow safety enhancement even after issuance.

How banks process crossed cheques today

Under the Cheque Truncation System (CTS) implemented nationwide by RBI:

- Physical cheques are scanned

- Crossing instructions are captured digitally

- Clearing is image-based

- Legal effect of crossing remains unchanged

CTS modernised logistics, not a legal character.

Additional Questions

How can I withdraw a crossed cheque easily in India?

You can’t withdraw a crossed cheque directly in cash. The easiest way is to deposit it into your bank account, wait for credit, and then withdraw cash using ATM, branch, or UPI transfer.

How do I give a crossed cheque to someone correctly?

Just draw two clear parallel lines on the cheque, preferably at the top-left corner, write “Account Payee” for safety, then fill date, name, amount, sign it, and hand it over.

I received a crossed cheque but don’t have a bank account, what should I do?

You’ll need a bank account to receive the money. Crossed cheques are strictly account-credit only. Many people open a basic savings account just to deposit such cheques.

Can the bank manager allow cash on a crossed cheque if I request?

No, even a branch manager cannot override cheque crossing rules. Once crossed, cash payment is legally blocked. Banks don’t have discretion here, only compliance responsibility.

What happens if someone writes Account Payee but forgets to draw crossing lines?

Banks usually ignore “Account Payee” if crossing lines are missing. For full protection, both crossing lines and Account Payee wording should be present on the cheque.

Can I deposit a crossed cheque at any branch of my bank or only home branch?

You can deposit it at any branch of your bank, not necessarily your home branch. CTS has removed branch dependency, but you must still use your own bank.

Why do banks still issue cheques marked “or bearer” if crossing blocks cash?

Banks print standard cheque formats. The real control comes from crossing. Once crossed, “bearer” becomes irrelevant, and the cheque behaves strictly as account-credit only.

How to Deposit a crossing cheque via a branch?

If you have an HDFC Bank account and receive a crossed SBI cheque, visit any HDFC branch, fill out a cheque deposit slip with your account and cheque details, endorse the back if required, and drop it in the cheque box or submit it at the counter for account credit.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.