What is Debit Card AMC?

When you open a savings account with a bank. They issue a debit card for you, but the bank does not give it for free forever. Most banks (government banks and private banks) charge something called AMC, which stands for Annual Maintenance Charge.

As per its name, it is simply a yearly fee you pay to keep your debit card active. The amount depends on the bank and card type, and GST gets added on top. Even if the account holder forgets about it, the deduction happens automatically.

When is AMC Deducted?

There are two common methods:

- On the anniversary of the card – Suppose you got your debit card in August. Every year in August, the AMC will be auto-deducted.

- On a fixed cycle – Some banks just deduct all AMCs for customers on a particular month, say April, regardless of when the card was issued.

It’s always automatic. The bank will directly take the money from your linked account. You don’t have to pay it manually.

How Much Do Banks Charge for Debit Card AMC?

Charges vary a lot depending on the bank and the type of card. Government banks usually charge less, while private banks and premium cards can be quite expensive.

| Bank | Debit Card Type | AMC (₹) | With GST (₹) | Link to Details |

|---|---|---|---|---|

| SBI | Classic / Global | 125–300 | 148–354 | |

| Bank of Baroda | Rupay / Visa | 150–600 | 177–708 | BOB Dcardfee |

| PNB | Basic / Intl | 150–300 | 177–354 | |

| Union Bank | Rupay / Visa | ~150–300 | 177–354 | |

| ICICI Bank | Coral / Platinum | 200–700 | 236–826 | ICICI Dcardfee |

| HDFC Bank | Classic / Platinum | 150–850 | 177–1,003 | |

| Axis Bank | Standard / Premium | 200–500 | 236–590 | |

| Kotak 811 | Classis/ VISA Platinum | 399-499 | 450-550 |

Reasons Banks Deduct Debit Card AMC Fees

- Rewards, Cashback & Insurance – Many debit cards offer cashback on shopping from selected apps or stores, travel or accident insurance, and other perks. AMC helps fund these benefits.

- Card Issuance & Maintenance – When issuing a card in your name, it needs to cover the cost of making and sending your card, plus keeping it active.

- Digital & Security Services – It helps to cover your basic digital services, such as online banking, POS Machine, VISA/RuPay/Mastercard security, like fraud protection.

- Transaction Handling – When you swipe anywhere, an ATM withdrawal, or an online payment requires processing, which takes internal charges.

- Customer Support & Perks – Most cards come with 24/7 support for customers, emergency dispute handling, and give zero liability for 24 hours if you block your card. These services need a fee, such as HDFC cards.

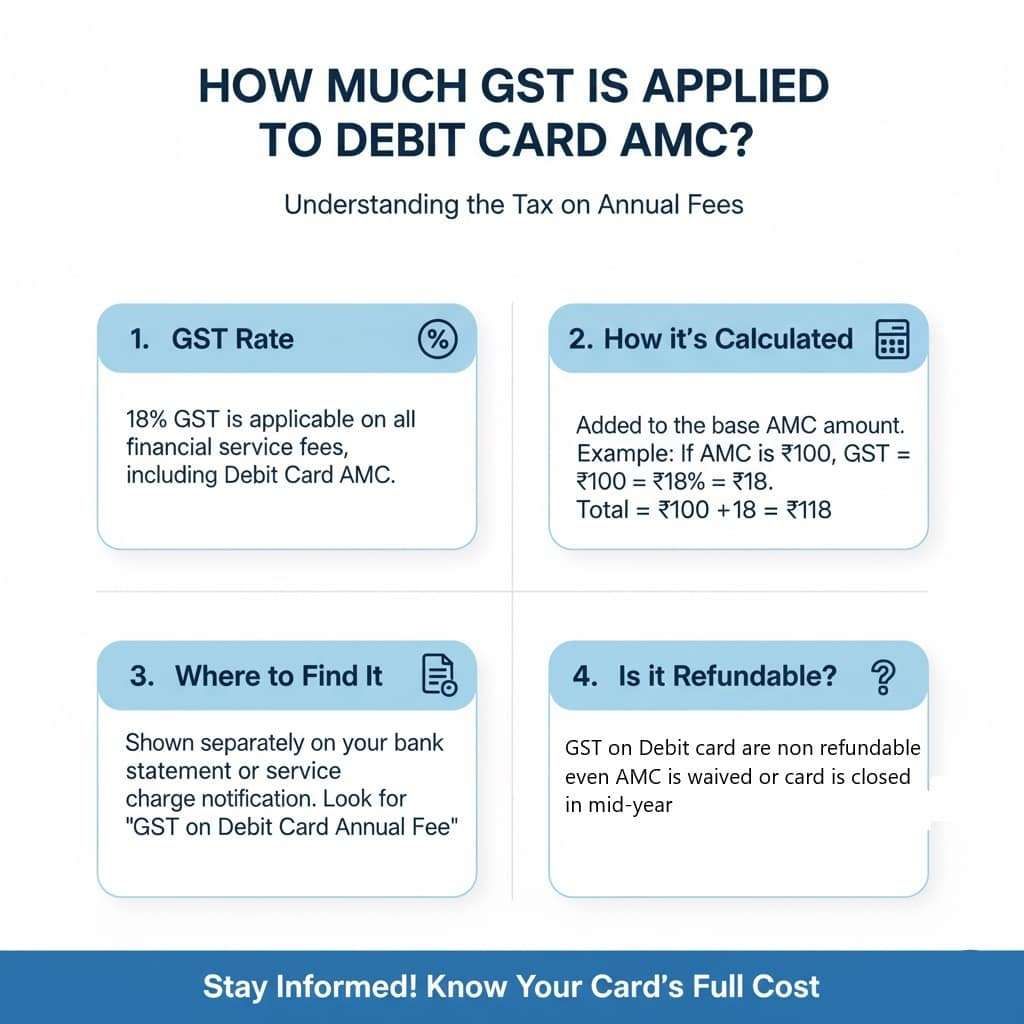

How Much GST is Applied to the Debit Card Annual Fee?

The tricky part with AMC is that the fee itself is not the final amount. On top of AMC, GST is applied. Currently, banks add 18% GST to most service charges, including debit card AMC.

Example:

- If AMC is ₹200, GST = ₹36, total deduction = ₹236.

- If the Debit card annual fee is ₹300, GST = ₹54, you have to pay = ₹354.

That’s why you may see odd amounts deducted instead of round figures. Always remember the advertised AMC is usually without GST.

How to Check Your Debit Card AMC

You can find out your card’s AMC in different ways:

- Look at your bank’s charges page – The easiest option for you, open your bank website, go to products, select your debit card and check the latest prices. Usually, banks revise their charges from time to time.

- Account statement or mini statement – If you see “Dcardfee” or “Annual Fee,” that’s your AMC.

- Use the mobile app – Some banks show AMC details under the “Card Details” section.

- Ask Customer Support – Simply call your bank’s customer care toll-free number to get account-linked debit card details.

What does RBI say about Debit Card AMC?

The RBI doesn’t fix a standard AMC policy for debit cards. In India, banks decide their own charges as per internal programs, but the RBI sets norms on disclosures, fair practices, and customer rights, it means –

- All Banks must clearly share all fees before you order for a card, including how and when they are applied.

- Additional charges such as other-bank ATMs, international transactions, or non-financial ATM usage. Also need ot provide properly on documents and website.

- Banks are required to send periodic statements or alerts so customers know what is being deducted.

- Also, in some cases (e.g. basic savings accounts, small or no-frill accounts), banks may waive off maintenance charges, issuance fees, etc. You can talk with your bank for that, or ask for a virtual Free card instead of a physical card.

What Happens If You Don’t Pay AMC?

- Charges are auto-recovered, so you can’t “skip” them.

- If unpaid for too long, the debit card may get blocked.

- If you put your balance is lower than your debit card, you may find a negative balance.

- No effect on credit score, but you lose access to your card.

- Each debit card you own attracts its own AMC.

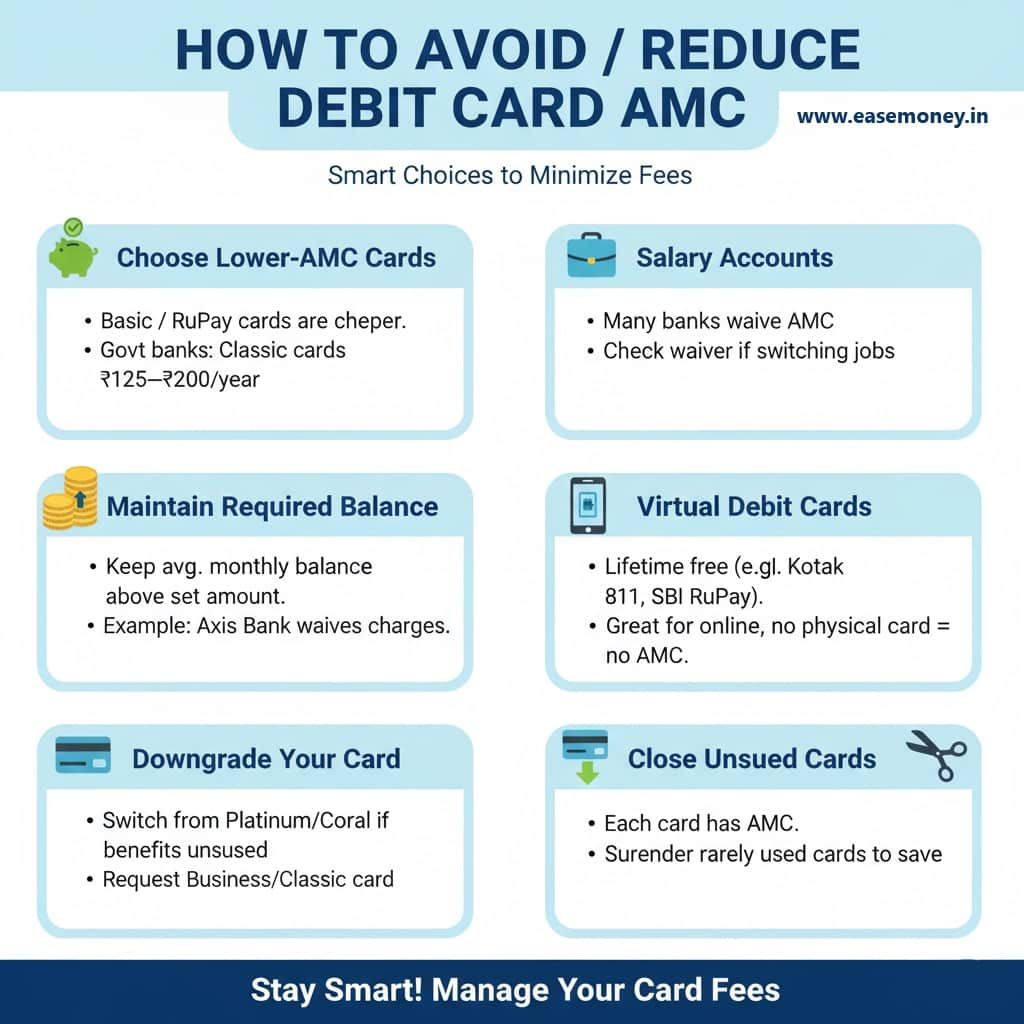

How to Avoid or Reduce Debit Card AMC

You can’t avoid AMC completely in most banks, but you can reduce charges with smart choices:

1. Choose Lower-AMC Cards

- Opt for basic or Rupay cards, which are cheaper.

- Government banks often offer Classic debit cards at ₹125–₹200 per year.

2. Salary Accounts

- Many private banks waive debit card AMC for salary accounts.

- If you switch jobs, check whether the waiver still applies.

3. Maintain Required Balance

- Some banks cancel AMC if you keep the average monthly balance above a set amount.

- Example: Axis waives charges if a higher balance is maintained.

4. Virtual Debit Cards

- You can ask your bank for a virtual card if you do not need of physical card. such as Kotak 811 digital card or SBI virtual RuPay Card. lifetime free.

- Great for online payments, no physical card = no AMC.

- HDFC used to offer NetSafe virtual cards, but the service is currently suspended.

5. Downgrade Your Card

- Don’t pay for Platinum or Coral debit cards if you don’t use benefits like lounge access.

- Ask your bank to issue a Business or Classic card instead.

6. Close Unused Cards

- Each debit card comes with its own AMC.

- If you rarely use a card, surrender it and save money.

Recently, in August 2025, HDFC offered me an upgrade debit card to my account, it was a Visa Platinum Debit Card with a yearly charge of ₹850 + GST (total = ₹1,003).

- The charges are higher because it has more facilities, but most of the benefits do not fit my daily lifestyle, so I asked for alternatives.

- HDFC then offered a Business Debit Card with a lower AMC of ₹350 plus GST. Choosing that card immediately cut my annual expenses by more than half.

That’s a saving of almost ₹600 every year. However, it always depends on your requirements for services how many benefits you want.

Estimating Your Own AMC Burden Every year

Imagine someone has three bank accounts where he has an active physical card:

- SBI Classic Debit Card – ₹125 + GST = ₹148

- ICICI Coral Debit Card – ₹500 + GST = ₹590

- HDFC Business Debit Card – ₹350 + GST = ₹413

Total yearly spend = ₹1,151

Over 10 years, that’s more than ₹11,000 spent only on the debit card annual fee. That’s why reviewing your cards is worth the effort.

Additional Regular Questions

Is the debit card AMC the same for all customers?

No, your annual charge depends on the account type and card type. If a zero balance account, it has a basic card under Rs. 500, where an HDFC Infiniti premium card annual fee is Rs. 2,500 or higher.

Can I avoid debit card AMC completely?

You can avoid AMC, but limited; you can go with a virtual card or select a basic RuPay Card for normal usage, which reduces your AMC every year.

What happens if I don’t have the balance for the AMC deduction?

You may face a negative balance issue if you do not maintain an annual charge for your debit card in your savings account.

Why do banks deduct debit card AMC even if I rarely use my card?

AMC is charged for keeping the card active, not for usage. Even unused cards stay connected to ATM, POS, and fraud-protection systems, which banks maintain around the year.

Why does the AMC amount deducted never match the advertised fee?

Because banks show AMC without GST. An 18% GST is added at deduction time. Example: ₹300 AMC becomes ₹354, which often confuses customers when checking their statements.

Can banks deduct debit card AMC without sending prior notice?

Yes. AMC is auto-deducted as per account terms. Most banks send SMS or statement alerts, but no explicit permission is required every year once the card is active.

Does closing a bank account automatically stop debit card AMC?

Only if the card is formally surrendered or blocked. Many branches forget to close cards during account closure, causing AMC deductions until you submit a written closure request.

Why are private bank debit card AMCs much higher than those of PSU banks?

Private banks bundle extras like insurance cover, lounge access, zero-liability protection, and premium support. PSU banks keep features basic, so their AMC stays around ₹125–₹300 yearly.

Can maintaining a higher balance really waive debit card AMC?

Yes, in some banks. Certain accounts waive AMC if you maintain a higher average monthly balance, but the waiver applies only to specific card variants, not premium cards.

Are virtual debit cards truly AMC-free in real banking practice?

Mostly yes. Virtual cards have no printing, courier, or ATM linkage, so banks usually keep them lifetime free. They work best for online payments, not ATM withdrawals.

What is the smartest way to reduce long-term debit card AMC cost?

Audit your cards yearly. Downgrade premium cards, close unused accounts, and keep only one physical card. This single habit can save ₹500–₹1,000 every year.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.