How Many Digits Are in a Central Bank CIF Number?

For the Central Bank of India, CIF numbers typically consist of 11 digits; however, in some cases, they may be 10 or 12 digits, depending on the individual’s eligibility and the date the account was opened.

Why does the bank offer CIF?

According to the last press release of CBI Bank in 2024, the bank serves over 50 lakh customers. Handling such a vast user base would be impossible without CIF numbers.

The Customer Information File (CIF) number, also known as Customer ID, is a unique and auto-generated code assigned to every customer of the bank. Think of it as your bank identity number. It stores all your account details—savings, loans, KYC documents—under one ID.

Fun Fact: Even if you have multiple accounts in Central Bank (say savings + FD + deposit account + credit card account), they all link to the same CIF number or customer ID.

In the Central bank, your ID is not just for registration, you need it for almost every purpose, such as –

- Opening Central bank PDF account statements (used as a password format)

- Accessing internet banking and creating a login ID.

- Setting up Cent mobile apps

- Updating KYC

- Linking PAN or Aadhaar

- Submitting the Application form to the bank for requests.

So, let’s explore multiple methods to retrieve it –

Where Can You Find the CIF Number Without Logging In?

If you just opened your savings account and the documents are still pending, or you have just lost the login details, these options work without registering and no need to enter lots of banking details.

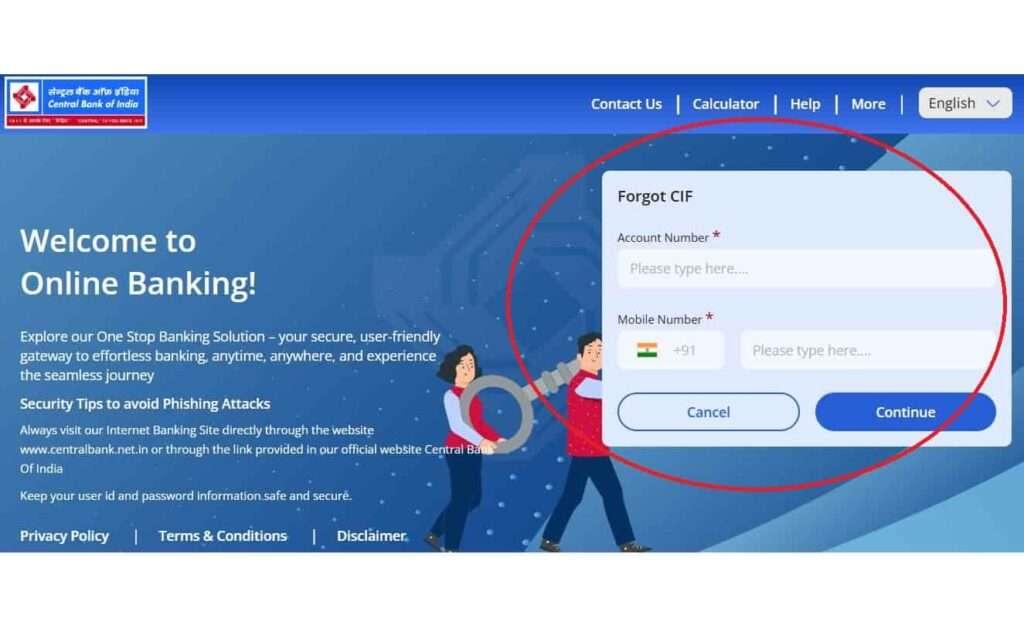

1. Get CIF By Cent Internet Banking

This is a very new and most direct option offered by the Central Bank of India to retrieve your ID. All you need here, your account number and registered mobile number. Follow the process –

This is a very new and most direct option offered by the Central Bank of India to retrieve your ID. All you need here, your account number and registered mobile number. Follow the process –

- First, visit the Official Website of the Central Bank of India, here – www.centralbankofindia.co.in.

- Tap on “Internet Banking”, it’s usually found on the homepage.

- Here, select “Personal Banking”, under this, choose the “Cent Ezee” option.

- Simply, tap on “Proceed” This will open the Cent Ezee Net Banking login portal.

- Under the login form, click on Click on “Trouble Logging In?”

- Choose option “Forgot CIF”.

- Enter the Following Details:

- Full Account Number

- Registered Mobile Number

- Tap on “Continue” An OTP will be sent to your registered mobile number.

- Enter received 6-digit OTP to verify your identity.

- Your CIF Number will be displayed on the screen.

- Optionally, you can also request to receive CIF via SMS or email.

Note: If your account is older and inactive been a while, this option may not work for you. You can visit your nearest Cent branch to activate your deposit account first.

2. Central Bank Mobile Banking App

The older Cent mobile app does not offer the retrieve CIF facility, but recently, as per a Facebook post of the CIB official page, the bank launched its new modern banking app, Cent eeZ Mobile App, on 30th March 2025. Here are the steps to follow –

- Download Cent eeZ from the Google Play Store or iOS App Store

- Select your language

- Tap Login, then select “Forget CIF”

- Enter your registered mobile number and full account number.

- Enter the OTP sent to your mobile

- Your CIF will be on your display – Write it down for future use.

Where to locate CIF from Cent NetBanking (If Logged In)

If you are already using netbanking and have a login ID And Password, so, it’s just 3 clicks away from your CIF number. Follow the process here –

- Enter your login info, such as your User ID and Password

- Go to Dashboard > Profile Settings

- Select Set Preferred User ID

- Your CIF number will be shown there, note it out.

Alternatively, you can check your banking physical documents –

- Welcome Letter/Kit (from account opening)

- ATM card packet

- Cheque book (first page or slip)

- Passbook (usually the first page)

- Credit Card Kit: If you are looking for CIF for the Central bank credit card, please check the paper you received with the attached card. (Optional)

Ask CIF directly to the Central Bank Customer Support team

If the above methods do not work for you, here are a few direct contact and ask methods that you can try –

1. Central Bank WhatsApp Banking

Here is the direct banking support option, which allows you to get your CIF number via WhatsApp Banking. Let me clear this you first: choose the Central bank WhatsApp number only from their official website, as there are a lot of banking scams happening via WhatsApp.

- For safety, visit the Official Website of the Central Bank.

- On the sidebar (usually bottom-left or floating), you will see the green WhatsApp icon. Tap on it.

- It will automatically open the WhatsApp app and connect you with their official verified number (safer than typing numbers manually).

- Select Your Language and then choose “Existing Customer”.

- A live customer care executive (not a bot) will respond during:

- Usually executive is available from 9:00 AM to 6:00 PM.

- Only Monday to Saturday (excluding bank holidays)

- The executive will:

- Introduce themselves by name

- Ask for limited details like:

- Your Full Name

- The last 4 digits of your account number

- Date of Birth in DDMMYYYY

- Once verified, they may share your CIF number or guide you further.

Important Safety Tip:

The official agent will NEVER ask for OTP, full account number, or passwords. If anyone does, block and report immediately.

2. Central Bank Customer Care Helpline

- You have to dial 1800 3030 (Central bank 24/7 toll-free number) from your registered SIM.

- The IVR will ask you to select the option to talk to a customer care executive. (Press 7 or 8 number, it depends on the menu, listen carefully)

- Once the call is connected with the bank executive, They will ask you basic verification information like:

- Your Full Name

- Your Mother’s Name

- The last 4 digits of your bank account number

- Once they verify that your answers match the account, they will read out your CIF number on the call.

Pro Tip: Keep a pen and paper handy to write it down immediately.

Important Safety

- Always double-check the customer’s care number from the passbook and official website while calling.

- Only call from a registered mobile number

- All calls are recorded for safety and audit.

- Don’t tell your full account number, OTP, ATM PIN, or sensitive information.

3. Visit Your Local Branch

If all fails and you lose documents, then simply walk into your home branch or any nearby Central Bank of India branch with:

- A valid photo ID proof (Aadhaar, PAN)

- Ask for help retrieving your Customer ID (CIF)

- After identity verification, they’ll give it to you instantly

This is the most foolproof method, especially for users who have lost access to digital banking.

Still Have Questions? Read These FAQs

What is the difference between a CIF Number and a Customer ID in the Central Bank of India?

In the central bank case, they are the same thing. “Customer ID” and “CIF” are used interchangeably in the Bank system.

Is my CIF number printed on the CBI Bank monthly statement?

Unfortunately, due to safety, the Cent Bank email statements don’t show CIF numbers. Request a physical statement to get it printed.

Can I get CIF via SMS?

For now, there is no direct SMS method to retrieve your CIF, however, you can use the Cent eeZ app to get your CIF via SMS.

Why does the branch sometimes ask extra questions before sharing the CIF?

At branches, staff verify CIF carefully to prevent misuse. They may cross-check older records, signatures, or dormant status, especially if the account hasn’t been used actively in recent months.

Never. A CIF is permanently unique to one individual. Even identical names, joint accounts, or family members will always have separate CIFs in the Central Bank of India systems.

What’s the safest way to store CIF after retrieving it once?

Write it in your passbook margin or store it in an offline personal notebook. Avoid screenshots or cloud notes, as CIF combined with other data can enable social-engineering fraud.

Can branch staff see my entire financial history using Central Bank CIF?

Branch staff can view linked products like savings, FD, loans, and KYC status. They cannot see unrelated banks or private transactions beyond Central Bank’s internal records.

Why does CIF retrieval fail for inactive or dormant accounts?

For security reasons, digital CIF tools may block dormant accounts. Branch reactivation through KYC is required first, after which CIF retrieval works normally through app, portal, or staff assistance.

Does changing the mobile number affect CIF retrieval later in the Central Bank of India?

Yes, it can. If your registered mobile number isn’t updated, OTP-based CIF retrieval may fail. Branch staff usually update the number first, then help you retrieve the CIF safely.

Why do some old Central Bank passbooks not show CIF clearly?

Older passbooks printed before full CBS upgrades often missed CIF fields. Branches now manually print CIF during passbook updates, which is why updating an old passbook usually reveals the missing number.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.