Latest Update: In December 2025 (End of the year), the Reserve Bank of India (RBI) reduced the repo rate to 5.25%. It goes 25 basis points. Repo rate is the rate at which banks borrow money from the RBI. When the repo rate goes down, banks and firms get cash more cheaply. It affects FDs: FD rates may drop. Seniors and savers, depending on their deposits, might earn less.

Direct effect on Fixed Deposits (FD):

- Your banks are slowly reducing FD interest rates. Recently, HDFC has done that. For example, the rate for general customers on an 18 to <21 month FD dropped from 6.6% to 6.45% after the December 2025 repo rate cut.

- New FDs get lower rates than old FDs

- Old FDs are safe; the rate does not change

Real situation in 2026, for FD at least for 1 Year to 2 Years:

- Big banks’ FD rates: 6% to 6.5%

- Small finance banks’ FD rates: 7.5% to 8.5%

- Senior citizens still getan extra 0.50% in most banks

Insight: People who booked FDs before rate cuts are happy. New investors must compare banks carefully.

Tip: When the repo rate is falling, always try to lock FD for a longer tenure.

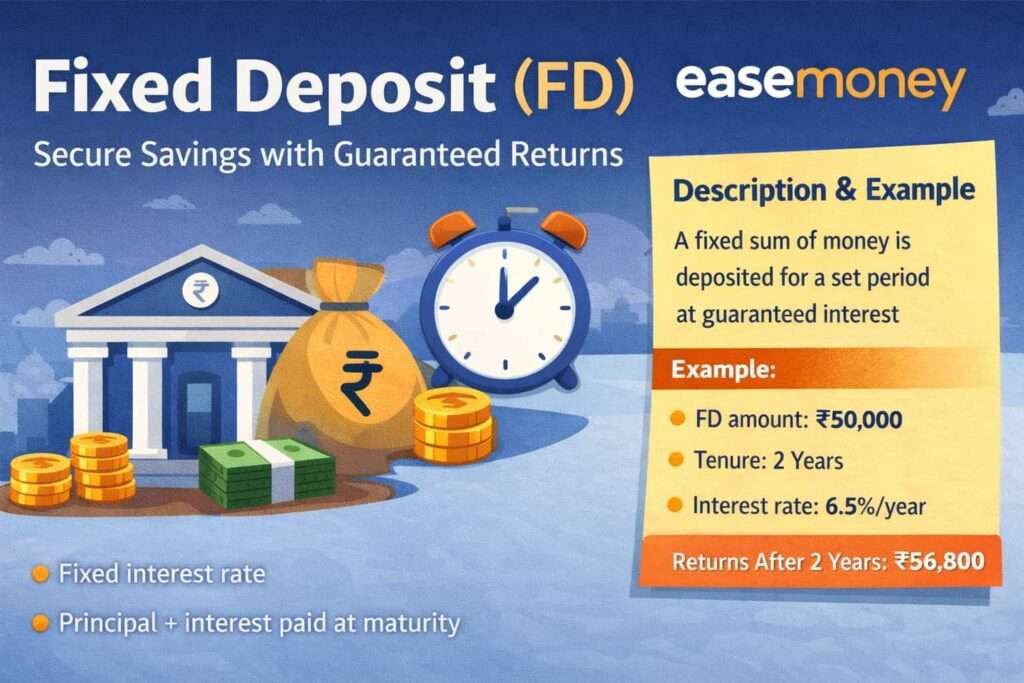

What Is The Fixed Deposit? (FD)

A Fixed Deposit means you give your bank, Post office or NBFC a fixed amount of money for a fixed time. The bank promises a fixed interest rate. After maturity, the bank gives back the principal + interest. It is a financial investment instrument and is backed by the RBI and DICGC. You can choose periods ranging from 7 days to 10 years.

FDs were introduced in India in the British era, with their origins tracing back to the early 1900s. But to build confidence in the banking system. Deposit insurance was introduced in 1962, making FDs a trusted, safe investment option for the public.

An impressive fact about FD in India, as per The Times of India, total deposits in Indian banks have crossed ₹200 lakh crores in 2023/early 2024, with a significant portion, around ₹176 lakh crore, held in term deposits (Fixed Deposits). It tells India is still an FD-loving country, despite market hype.

A simple example of how FD works –

- FD amount: ₹50,000

- Tenure: 2 years

- Interest rate: 6.5% per year

After 2 years, you get approximately ₹56,800.

Key rules:

- Your interest rate is fixed as you locked in when open an FD account for tenure, even market goes up or down. If bank rates drop, your existing FD continues to earn the higher, originally agreed rate.

- The major benefit here market movements, stock market crashes, or global events do not affect FD returns.

- Early break gives less interest. If your FD is for 2 years, and you break it before, there are penalty charges and less interest.

- Most FDs allow premature withdrawal, but they are typically subject to a small penalty or additional charges (around 0.5% to 1%).

- You can opt for “Cumulative” FDs, where interest is reinvested to provide higher returns at maturity, or “Non-Cumulative” FDs for regular payouts (monthly or quarterly)

- The interest earned from an FD is taxable. Your Bank deduct Tax or TDS if the interest earned exceeds a certain threshold in a year. However, Tax-Saving FDs (with a 5-year lock-in) offer deductions under Section 80C of the Income Tax Act.

Reality check: FD does not make you rich. But your FD protects your money.

Common Types of Fixed Deposits in India

As we already know, India is a mass market for FDs. More money is sitting in FDs than in mutual funds + stocks combined. As per the RBI, up to 46% of total household financial savings in India are in FDs. In that way, India offers several types of fixed deposits (FDs) tailored to meet different financial goals and investor profiles. such as tax savings, regular income and special accounts such as senior citizens and Non-Resident Indians (NRIs). Here is the list –

1. Regular Fixed Deposit

As per its name, it is a standard FD available to most individuals. It goes from 7 days to 10 years, and the interest rates are higher than those of a savings account. It is taxable and simple, but to earn better interest rates, you can choose different banks, such as Small Finance Banks, which give higher FD returns than big banks.

- Who should use: People parking money for short or medium term.

- Example: ₹2 lakh for 18 months in HDFC Bank at ~6.45%.

2. Tax-Saver Fixed Deposits

These FDs come with a focus on tax savings. It gives a mandatory lock-in period of 5 years and offers tax deductions of a maximum of ₹1.5 lakh As per Section 80C of the Income Tax Act. But your premature withdrawal and loans against the deposit are not permitted.

- Common misunderstanding: Interest is NOT tax-free.

3. Senior Citizen Fixed Deposit

Again, as per it names, it is designed for individuals whose age 60 years and above. These FDs offer an additional interest rate, typically 0.25% to 0.75% higher than standard rates. It reaches up to 9.5% p.a. by a few banks. It comes with tax benefits up to ₹50,000 under Section 80TTB. All Basic features are allowed, such as Premature Withdrawal, Joint Accounts, and Nomination.

4. Flexi Fixed Deposits (Auto Fixed Deposits / Sweep-in)

These link your savings account to a fixed deposit, which you can access directly through the mobile banking app. Any extra money in your savings account is automatically moved to an FD so you earn more interest. When you need money, the FD is automatically broken, and the amount comes back to your savings account. So your money stays safe, earns more, and is always available when required.

- Use case: Emergency liquidity with better return than a savings account.

5. Cumulative Fixed Deposit

A Cumulative Fixed Deposit is a type of FD where you do not get monthly or yearly interest. The interest is added to your FD amount again and again. At the end of the FD period, you get the full amount together – your money plus all the interest. Most people use it for child education or marriage planning, mostly long-term.

Tax reality: Interest is taxable every year, even if not received.

6. Non-Cumulative Fixed Deposits

In a Non-Cumulative Fixed Deposit, interest is paid out at regular intervals, such as monthly or quarterly, instead of being reinvested, unlike a Cumulative Fixed Deposit.

This type of FD is usually used by:

- Retired person

- Those planning a regular pension-like income

Example: A fixed deposit of ₹10 lakh at an interest rate of 6.5% provides around ₹5,400 as monthly interest.

7. NRE OR NRO FDs

- NRE = It is designed for Non-Resident Indians (NRIs). The interest earned on NRE FDs is tax-free in India, and both the principal amount and interest are fully repatriable to the NRI’s overseas account.

- NRO = These are meant for managing income earned in India by NRIs, such as rent, pension, or dividends. The interest earned on NRO FDs is taxable in India at 30%, along with applicable surcharge and cess.

8. Corporate/NBFC Fixed Deposit

Corporate or NBFC Fixed Deposits generally offer higher interest rates compared to bank fixed deposits. However, they also carry a higher risk. Most corporate and NBFC FDs are not covered under DICGC insurance, unlike bank FDs. The basic safety formula here is to check all the history about NBFC and find DICGC certificates before applying.

- Important Tip: Corporate or NBFC fixed deposits should never be confused with bank fixed deposits, as the risk level and safety protection are different.

- Safety depends on the company’s credit rating

- Only top-rated companies (AAA / Stable by CRISIL, ICRA, etc.) are relatively safer

Types of Banks, Firms in India And FD Rates (2026)

India’s banking system offers different Fixed Deposit interest rates across banks. Currently, Small Finance Banks (SFBs) are providing the highest FD interest rates. It is going up to 8.00% per annum for general citizens as of January 2026.

For investors looking for safety, Post Office Fixed Deposits offer a reliable alternative. Their interest rates are up to 7.5% per annum. It is backed by the Government of India and DICGC Insurance.

1. Public Sector Bank-wise FD Rates

As of 2026, public sector banks in India are offering fixed deposit interest rates between around 3.00% and 6.75% per year for general customers. But as always, the exact rate depends on the bank and the FD tenure you are going with.

Among public sector banks, the Central Bank of India is currently offering the highest FD interest rate of 6.75% per annum on selected tenures.

The table below compares fixed deposit interest rates offered by major public sector banks for general customers, for common FD tenures, on deposits below ₹3 crore.

| Bank Name | Highest FD Rate (% p.a.) | 1-Year FD Rate (% p.a.) | 3-Year FD Rate (% p.a.) | 5-Year FD Rate (% p.a.) |

|---|---|---|---|---|

| Central Bank of India | 6.75% | 6.40% | 6.25% | 6.25% |

| Bank of India | 6.70% | 6.25% | 6.25% | 6.00% |

| Canara Bank | 6.50% | 6.25% | 6.25% | 6.25% |

| State Bank of India (SBI) | 6.45% | 6.25% | 6.30% | 6.05% |

| Bank of Baroda | 6.45% | 6.10% | 6.25% | 6.30% |

| Punjab National Bank (PNB) | 6.40% | 6.10% | 6.30% | 6.10% |

| Union Bank of India | 6.30% | 6.25% | 6.00% | 5.90% |

| Indian Bank | 6.45% (444 Days) | 6.10% | 6.05% | 6.00% |

| UCO Bank | 6.45% | 6.10% – 6.50% | 6.00% – 6.15% | 6.00% |

| Bank of Maharashtra (BOM) | 6.65% (special schemes) | 6.20% | 5.25% | 5.00% |

| Bandhan Bank | 7.20% per year | 7.00% | 7.00% | 5.85% |

2. Private Sector Bank FD Rates

As of 2026, private sector banks give fixed deposit interest rates of up to around 7.20% per annum for general customers. Banks such as RBL Bank, Bandhan Bank, and DCB Bank are currently offering higher FD rates compared to the larger private sector banks.

Here is the table below that compares the fixed deposit interest rates offered by major private sector banks for regular customers’ deposits below ₹3 crore.

| Name | Highest FD Rate (% p.a.) | 1-Year FD Rate (% p.a.) | 3-Year FD Rate (% p.a.) | 5-Year FD Rate (% p.a.) |

|---|---|---|---|---|

| RBL Bank | 7.20% | 7.00% | 7.20% | 6.70% |

| Bandhan Bank | 7.20% | 7.00% | 7.00% | 5.85% |

| DCB Bank | 7.15% | 6.90% | 7.00% | 7.00% |

| IndusInd Bank | 7.00% | 6.75% | 6.90% | 6.65% |

| YES Bank | 7.00% | 6.65% | 7.00% | 6.75% |

| IDFC FIRST Bank | 7.00% | 6.30% | 7.00% | 6.00% |

| Kotak Mahindra Bank | 6.70% | 6.50% | 6.40% | 6.25% |

| ICICI Bank | 6.50% | 6.25% | 6.45% | 6.50% |

| HDFC Bank | 6.45% | 6.25% | 6.45% | 6.40% |

| Axis Bank | 6.45% | 6.25% | 6.45% | 6.45% |

| Federal Bank | 6.75% | 6.25% | 6.50% | 6.50% |

3. Small Finance Banks FD Rates in 2026

As of 2026, small finance banks are giving the highest FD interest rates in India. Some of these banks even give rates up to 8.00% per year, mostly for longer FD periods.

Below is a table showing FD interest rates of small finance banks for regular customers, for deposits below ₹3 crore.

| Bank | Highest FD Rate (% p.a.) | 1-Year FD Rate (% p.a.) | 3-Year FD Rate (% p.a.) | 5-Year FD Rate (% p.a.) |

|---|---|---|---|---|

| Suryoday Small Finance Bank | 8.00% (For 5 years for Both Senior Or Normal) | 7.25% | 7.25% | 8.00% |

| Jana Small Finance Bank | 7.77% | 7.00% | 7.25% | 7.77% |

| Unity Small Finance Bank | 7.75% | 7.35% | 7.40% | 7.75% |

| Utkarsh Small Finance Bank | 7.50% | 6.00% | 7.50% | 7.00% |

| Equitas Small Finance Bank | 7.30% per year | 7.00% | 7.00% | 7.00% |

| ESAF Small Finance Bank | 7.60% | 4.75% | 5.75% | 5.75% |

| AU Small Finance Bank | 7.25% | 7.00% | 7.00% | 7.25% |

| Ujjivan Small Finance Bank | 7.50% | 6.50% | 7.20% | 7.50% |

| North East Small Finance Bank | 7.00% | 6.00% | 6.50% | 7.00% |

Note: Senior citizens usually get an extra interest of around 0.25% to 0.75% on fixed deposits. Confirm with your bank before opening an FD.

What are the Post Office FD Interest Rates (Jan–March 2026)

Post Office Fixed Deposit is officially called National Savings Time Deposit (TD). In the January to March 2026 quarter, the Government of India has not changed the interest rates of any Post Office small savings schemes. It is 100% government-backed, so safety is very high. The fact here for you is – Interest is compounded quarterly, but paid once a year. For TD, you can start with Rs. 1000, and they allow Premature withdrawal after 6 months, but like banks, interest becomes lower and some penalty may apply.

Unlike banks, senior citizens do not get extra interest on these TD accounts. Here, your interest rate depends only on the tenure you choose.

| Tenure | Interest Rate |

|---|---|

| 1-Year TD | 6.9% |

| 2-Year TD | 7.0% |

| 3-Year TD | 7.1% |

| 5-Year TD | 7.5% |

Other FD-type Post Office Schemes

Apart from normal Time Deposits, the Post Office also has some fixed-style schemes for different needs:

- Senior Citizen Savings Scheme (SCSS)

- For people aged 60 and above

- Interest: 8.2% per year, paid quarterly

- This is the highest rate among Post Office schemes

- National Savings Certificate (NSC)

- 5-year scheme

- Interest: 7.7% per year

- Compounded yearly, money paid only at maturity

- Monthly Income Scheme (MIS)

- Interest: 7.4% per year

- Monthly income for 5 years

- 5-Year Recurring Deposit (RD)

- Interest: 6.7% per year

- Compounded quarterly, good for a monthly savings habit

- Kisan Vikas Patra (KVP)

- Interest: 7.5% per year

- Money doubles in about 115 months (around 9 years, 7 months)

How Tax Works On FD In India

In India, FD interest earned is 100% taxable under the “Income from Other Sources” tag. Tax is payable annually on accrued interest, even if not received until maturity. Your bank can deduct upto 10% TDS on interest for a selected limit –

TDS rules (very simple)

- Below 60 years: TDS is cut if the FD interest is more than ₹40,000 in a year

- Senior citizens (60+): Your TDS is cut if the interest is more than ₹50,000

- TDS rate: 10%

- If PAN is not given → TDS becomes 20%

One important thing: TDS is NOT the final tax. The tax game does not end here.

Actual tax depends on your slab –

Example for you – If your total FD interest in a year is ₹80,000

- 5% slab → tax is ₹4,000

- 20% slab → tax is ₹16,000

- 30% slab → tax is ₹24,000

The bank may cut only 10% TDS, but the final tax depends on your slab when you file ITR.

Simple real-life FD example (easy to understand)

- You open a Fixed Deposit of ₹50,000

- Tenure: 2 years

- Interest rate: 6.5%

After 2 years, the bank shows a maturity amount of around ₹56,800

So total interest earned is ₹6,800

Sounds good, right? But tax comes here

If you fall in 20% tax slab, then Tax on ₹6,800 = ₹1,360

So after paying tax, the real money you actually get = around ₹55,440

As per experience, FD is very safe, no doubt, but tax reduces the final return. The interest rate you see is before tax, not what you take home. That’s why, while taking an FD, always think about post-tax return, not just the rate.

A Fun fact for you – Many FD investors pay MORE tax than needed

Crazy but true: People think tax applies only at maturity, but cumulative FD interest is taxable every year

This mistake causes:

- Wrong ITR filing

- Tax notices

- Unnecessary penalty

FD is simple to invest in, but easy to mess up tax-wise.

How to Reduce FD Tax Legally

- Submit Form 15G or 15H – If your total income for the year is below the basic taxable limit, you can prevent the bank from 10% TDS by submitting this form.

- Form 15H is for senior citizens, and Form 15G is for regular.

- Use senior citizen benefits – As of the 2025-26 budget, senior citizens can earn up to ₹1,00,000 in interest per year without TDS, doubled from ₹50,000.

- Split FD among family members – You can split investments among family members with lower or no income, which can lower your total tax liability. You can gift money to a non-earning spouse, parent, or adult child to open an FD. Since their tax slab is lower (or nil), the interest earned will be taxed lightly.

How Safe Are Fixed Deposits (FDs) in India?

In India, Fixed Deposits are considered safe mainly because banks promise fixed returns and also because of insurance cover.

- Most bank FDs are protected by DICGC insurance, which is a government-backed insurance under the RBI.

- Post Office FDs are even safer because they are directly backed by the central government.

- Corporate or NBFC FDs depend on the company’s total financial strength and credit rating, so risk is higher there.

What is DICGC? (Very Important)

DICGC is a Deposit Insurance and Credit Guarantee Corporation. It is a government-backed free insurance under the RBI. This is like a shield. It protects your money if a bank fails.

Coverage Rules

- ₹5 lakh per person per bank

- This ₹5 lakh includes:

- Savings account

- Fixed Deposit (FD)

- Recurring Deposit (RD)

Big rule to remember: ₹5 lakh insurance is per bank, not per FD

Which Banks Are Covered?

- All public banks

- All private banks

- Foreign banks in India

- Co-operative banks

All of them come under DICGC.

FD-Backed Credit Cards

Some banks give credit cards against FD:

- Easy approval

- Good for first-time users

- Helps build a credit score

- Interest is usually lower

It is also safe and covered by DICGC

₹25 Lakh – Real Life Example (Very Important)

Wrong Way

- One FD of ₹25 lakh in one bank

- Insurance cover = only ₹5 lakh

- The remaining ₹20 lakh is not insured

Smart Way as per Easemoney And RBI

- ₹5 lakh FD in 5 different banks

- Total money = ₹25 lakh

- Total insured = ₹25 lakh

That’s why many people still trust FDs, especially for saving money.

FAQs

Why do banks offer higher FD rates sometimes?

Banks increase FD rates when they need money or competition is high. After RBI repo cuts in 2025, some banks still paid 7–8% to attract deposits quickly.

Should I put ₹25 lakh in one FD?

No. Real branch advice is to split. Put ₹5 lakh in five different banks. This way, full ₹25 lakh stays insured under DICGC instead of only ₹5 lakh.

Do I lose money if I break the FD early?

You don’t lose principal, but interest reduces. Bank recalculates interest for the actual period and applies a 0.5–1% penalty. Tip: break FD only for real emergency.

Why do seniors prefer FD more than others?

Senior citizens get an extra 0.5% interest and ₹50,000 yearly interest tax-free under Section 80TTB. which was increased to ₹1 lakh for FY 2025-26.

This makes FD a stable income tool after retirement.Are small finance bank FDs risky?

Risk is slightly higher, but DICGC insurance is the same as that of big banks. For amounts under ₹5 lakh, small finance banks giving 7.5–8.5% are practical.

When is an FD better than a mutual fund?

FD is better for short-term needs, emergency funds, or low-risk money. Mutual funds suit long-term growth. Real idea: never mix safety money with growth money.

What happens if I keep more than ₹5 lakh in one bank?

Anything above ₹5 lakh in a single bank is not insured. If the bank fails, recovery of the excess amount depends on liquidation, which can take years or may not fully happen.

Are Post Office FDs safer than bank FDs?

Post Office FDs are backed directly by the Government of India, so there is no ₹5 lakh limit. That’s why many people park long-term or retirement money in Post Office schemes.

Do savings account and FD insurance limits add separately?

No. Savings, FD, and RD balances in the same bank are added together. The total insurance limit remains ₹5 lakh per person per bank, not account-wise.

Why do banks suggest FD-backed credit cards?

FD-backed cards are easy to get because the FD acts as security. They help first-time users build credit score, usually give 75–90% limit of FD value.

- READ THIS –

- What Are LIC Fixed Deposit Schemes & How Do They Work?

- What Are Gramin Bank FD Interest Rates in 2026? Top Best Banks for Rates

- What Are Latest Co-operative Bank FD Interest Rates?

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.