What Is Flipkart Pay Later?

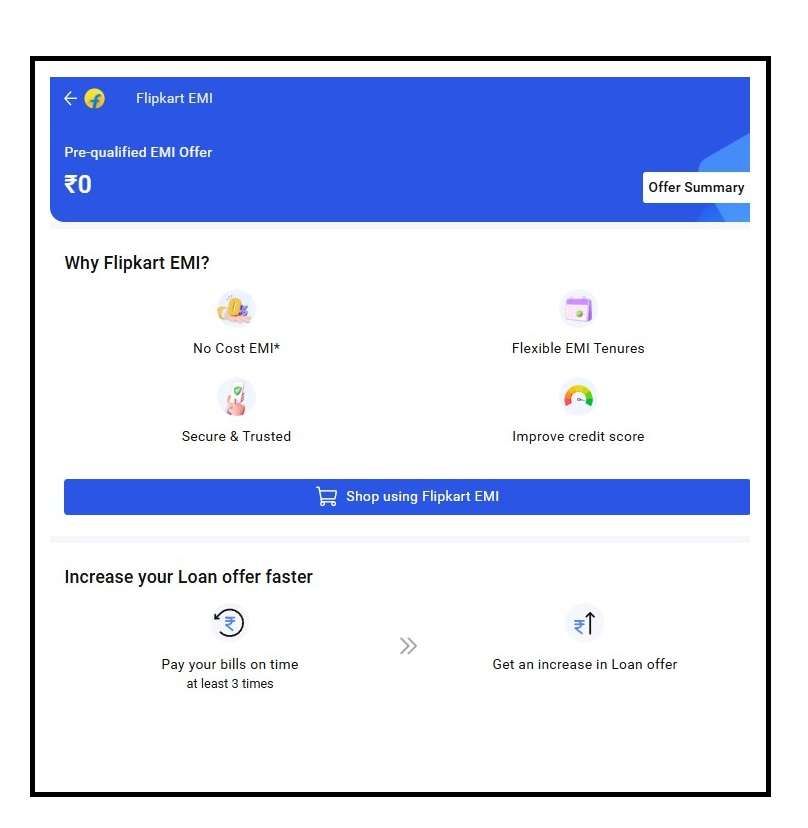

If you are a daily shopper at Flipkart, then this feature is specially for you. Flipkart’s Pay Later is a built-in credit facility. It is a payment option inside the Flipkart app that gives eligible customers a small line of credit to shop now and pay later.

Instead of entering card details or paying upfront, you get a pre-approved spending limit that can range anywhere from ₹5,000 to ₹1,00,000, depending on your credit profile and shopping history.

You place your orders as usual and pay next month’s date 5 without any interest, or you can convert eligible purchases into EMIs. There is no joining fee and no annual maintenance charge if you pay on time.

The Basic Idea behind this service –

Flipkart has a partnership with multiple banks and offers a credit limit that users can use while shopping, so you don’t need a high credit score or premium cards. it works –

- No credit card needed – it works with your normal bank account and UPI.

- Instant approval – if you qualify, the limit shows up as soon as you finish the quick KYC process.

- No Video KYC – Your E-KYC is only required via Aadhaar OTP.

- No joining fee – there is no charge to sign up or keep the account.

- Smart Upgrade Option – It is an add-on plan available for selected products, only for smartphones and electronics. You pay a reduced upfront price, often around 70% of the product cost, and either return the product to upgrade after a fixed period or pay the balance to keep it.

Unlike a credit card, this service has higher interest rates upto 24% and No COST EMI is very limited with products. It has service charges that you need to pay with the first EMI.

Furthermore, there are penalties for late payment upto 6% of the total overdue fee. Plus a negative impact on your credit score.

What are the Eligibility Criteria?

Flipkart Pay Later is not open to everyone. First, you have to use Flipkart for a few months to pre-qualify, then you must have a good to excellent credit score history.

- Age: You must be at least 18 years old.

- Credit Score: A good credit history helps. Customers with a credit score of around 750 or higher usually have better chances.

- KYC: PAN and Aadhaar linked to an active mobile number.

Note: Even if you meet these conditions, Flipkart’s partner banks—IDFC FIRST Bank, Kotak Mahindra Bank and Axis Bank—make the final decision. Some users get high limits, some get modest ones, and a few may be asked for extra verification before activation. In most cases, they offer you different options in 2025, such as SuperPaylater or Supercard.

How to Activate Pay Later by Flipkart

- Open the Flipkart App and go to Account → Flipkart Pay Later.

- Enter your 10-digit PAN and your Aadhaar numbers.

- You have to verify with received 6-digit OTP received at your Aadhaar-linked number only. Your Flipkart account must be with the same number.

- Flipkart checks your CKYCRR Record and other details in the background.

- Add your UPI ID and select a linked bank account.

- A small amount (usually ₹1) is deducted to verify the account.

- If you meet the criteria, your spending limit is displayed instantly.

Is Flipkart Pay Later closed?

Recently, in 2024 to 2025, Flipkart Pay Later was discontinued for Many Users; they just started closing most Pay Later accounts with a single notification. This closure was not universal—some accounts remained active.

- In 2025, some customers still retain active Pay Later accounts—especially those with a long credit history or strong repayment record.

- Lending partners remain the same:

- IDFC FIRST Bank

- Kotak Mahindra Bank

- Axis Bank

Also, Flipkart now offer different tiers of Pay Later based on risk and customer profile, such as –

| Customer Type | Typical Limit | Current Status |

|---|---|---|

| High-credit users | Up to ₹1,00,000 | Some still active |

| Moderate users | ₹5,000 – ₹20,000 | Frozen usage until mandate or additional verification |

| Basic Credit score 720 or above | ₹40,000 | Migrated to SuperPayLater |

If you have queries or are asking about Re-KYC issues, you can call:

- 1800 208 9898 or grievance.officer@flipkart.com (Flipkart Pay Later helpline customer care)

- Or use the in-app Help Centre → Pay Later section for chat/call options.

- Read – Why Flipkart Pay Later Is Not Working

Flipkart Current Variations for Credit

In 2025, Flipkart runs several credit formats side by side:

| Product | Typical Limit | Key Details |

|---|---|---|

| Classic Pay Later | ₹5,000 – ₹1,00,000 | Standard pay-next-month or EMI plan, still active for high-score customers |

| Frozen-Limit Pay Later | Same as approved | The Limit may be temporarily locked until the mandate or extra verification |

| SuperPayLater | Up to ₹15,000 (depending on the credit profile) | Split each purchase into three interest-free EMIs (1/3 upfront, next 1/3 in 60 days, final 1/3 in 90 days) |

Which version you will be eligible, is completely based on Flipkart and its partners, and your credit score ratings.

What is SuperPay Later By Flipkart?

As per The Livemint report, Flipkart introduced the Super Money app in July 2024. The focus to giving credit facilities and UPI benefits to users. They also launched SuperPay (also called SuperPayLater) as a new BNPL (Buy Now, Pay Later) alternative.

If your older pay-later account is closed, you can apply for that –

| Feature | Details |

|---|---|

| Credit Limit | starts from Rs. 5000 (may vary by user) |

| EMI Structure | Split into 3 interest-free EMIs |

| Payment Timeline | – 1/3rd upfront (at checkout) – 2nd part in 60 days – 3rd part in 90 days |

| Fees/Interest | No interest & no additional fee if paid on time |

| Where to Use | Only on Flipkart purchases |

How to Apply Flipkart SuperPay Facility

- Open your Flipkart App and go to Account (bottom footer).

- Tap Pay Later → then SuperPay.

- If you don’t see “SuperPay”, it means you are not eligible right now for that.

- Tap Activate → It will show your pre-approved limit.

- Set Up Autopay Mandate:

- Mandate is typically set for ₹4,000 (for the full limit).

- Flipkart will deduct ₹1 to verify your account.

- Bank Verification:

- Select your bank → Send SMS → Enter UPI PIN to confirm.

- Once verified, your SuperPay account activates instantly.

Note: No need for PAN and Aadhaar if already used any credit services of Flipkart.

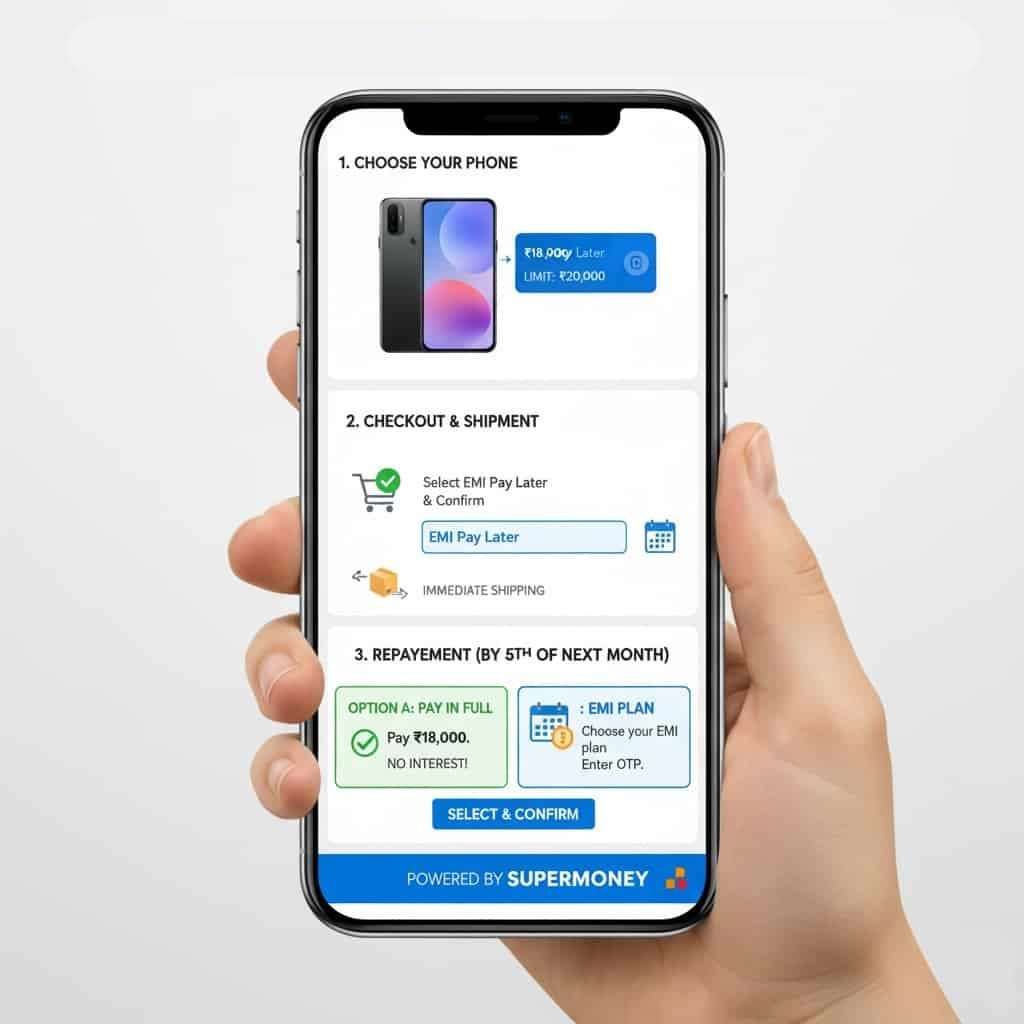

How to use Flipkart EMI option for shopping – Example

Here’s how a real purchase might look:

- You find a smartphone worth ₹18,000.

- Your Flipkart Pay Later limit is ₹20,000.

- At checkout, you select EMI Pay Later and confirm.

- Flipkart ships the phone immediately.

- By the 5th of next month, you either:

- Pay the full ₹18,000 at once, or

- Choose an EMI plan if available.

- Select as per your need, and enter the mobile OTP to order it.

If you pay in full before the due date, there is no interest.

How to Pay Flipkart Pay Later EMI or Monthly Bill

- Open Flipkart App → Go to My Account → Pay Later.

- Tap Pay Bill / Pay EMI.

- You can pay using Flipkart UPI, or you can choose Net Banking, or Debit Card.

- Confirm payment before the due date (usually the 5th of every month).

- You will get a Text SMS once the payment is accepted.

Pro Tip: Enable AutoPay mandate to avoid late fees.

Still Q/A

Is Flipkart Pay Later good for a CIBIL score?

Yes, it is a good starting point, or if your credit score is lower, your timely repayments improve your CIBIL score. But delayed payments can drop your credit ratings as well.

Is the Super Money app required for SuperPayLater?

Not mandatory, but the Super Money app provides easy management of SuperPayLater, Super Card, and future Flipkart credit products.

How to increase Flipkart Pay Later or SuperPay limit?

The basic formula is to maintain a strong CIBIL, shop regularly, and wait for automatic credit reviews—manual limit requests aren’t available. Usually, credit offers came in Flipkart sales such as Big Billion Days.

Is Flipkart Pay Later safer than using a credit card?

For small purchases, yes. But Pay Later usually charges higher interest (up to 24%) and late fees. Tip: Use it only for short-term credit under 30 days.

Why do some users still have active Flipkart Pay Later in 2025-2026?

Because eligibility depends on lender risk assessment, not Flipkart alone. Users with long repayment histories and stable CIBIL profiles are sometimes retained, while others are migrated or closed.

Does Flipkart Pay Later show as a loan in credit reports?

Yes. It appears as a short-term unsecured loan. Even a ₹5,000 limit counts as an active credit line, which banks review during home or personal loan approvals.

Can SuperPayLater improve my credit score?

Yes, if paid on time. Three interest-free EMIs with zero delay can help thin-file users build credit. One missed payment, however, can negate multiple months of positive history.

Why does Flipkart ask for an AutoPay mandate?

AutoPay reduces default risk. Mandates are usually set below your full limit (₹3,000–₹4,000). Tip: Ensure your bank balance stays above mandate amount to avoid penalties.

Should I close inactive Pay Later accounts manually?

Absolutely. Dormant BNPL accounts inflate your credit exposure count. Closing unused Pay Later lines improves approval chances for credit cards, especially when applying within the next 6–12 months.

What happens if I miss the 5th due date once?

A single delay can attract 6% late fee, interest, and a negative CIBIL remark. Tip: Even partial payment before the due date reduces damage compared to total non-payment.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.