Merger Update & Its Impact on Gramin Bank FD Rates

From 1 May 2025, the Government of India completed the “One State – One Regional Rural Bank (RRB)” merger plan. Due to this change, many small Gramin Banks in the same state were joined together and now work as one single and stronger Gramin Bank. As of January 2026, there are only 28 Gramin Banks (RRBs) that are active across India. We can say, state-wise.

What changed for FD investors after the merger?

- Earlier: One state had 2–3 Gramin Banks with different FD rates

- Now: One state = One Gramin Bank = One FD rate structure

- FD rates are now uniform across the entire state

- Banking systems are stronger due to sponsor banks like SBI, PNB, Canara Bank, and Bank of Baroda

- More transparency, less confusion for customers

For people in villages, small towns, and Tier-3 cities, this merger made FD decisions easier and safer.

What is a Gramin Bank Fixed Deposit (FD)?

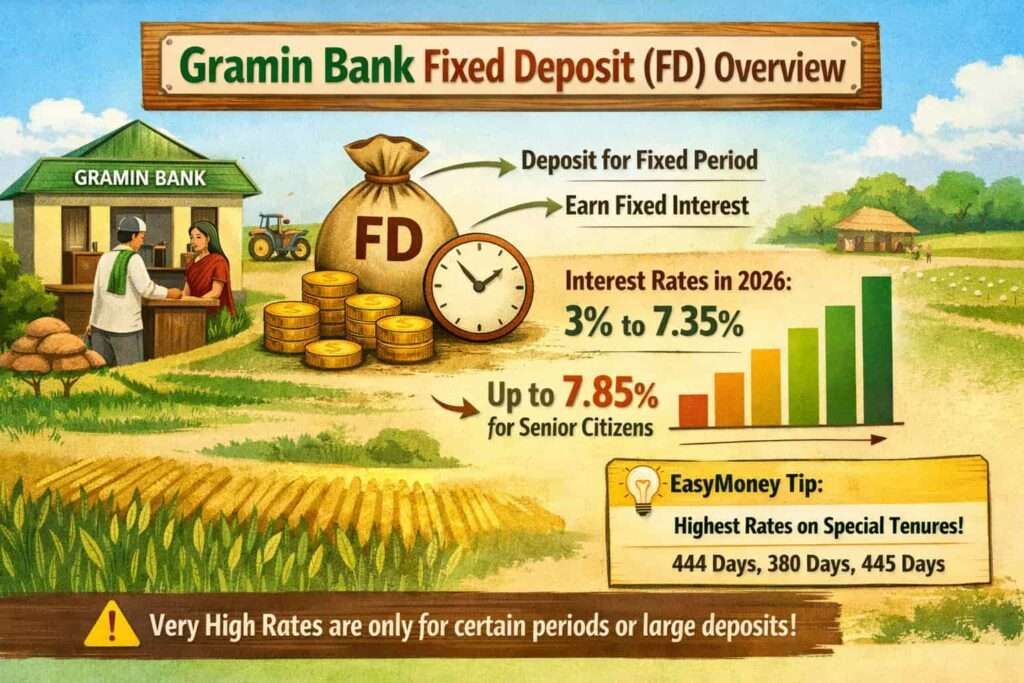

A Gramin Bank FD is a fixed deposit opened in a Regional Rural Bank (RRB). You deposit money for a fixed period, and the bank pays fixed interest. It is an agreement where a customer keeps a lump sum amount in the bank for a fixed time and gets a fixed interest on it. This interest rate is usually higher than a normal savings account.

Gramin Bank Fixed Deposit (FD) interest rates in Jan or Feb 2026 usually start from around 3% and go up to 7.35% per year for normal customers. Senior citizens get an extra benefit, and their FD rates can go up to about 7.85%. The final interest rate depends on which Gramin Bank you choose, how much money you deposit, and for how long you keep the FD.

As of January 2026, based on verified data:

- General public: ~3.00% to 7.35% p.a.

- Senior citizens: up to 7.85% p.a.

- FD tenure: 7 days to 10 years

- Highest rates are usually on special tenures like 444 days, 380 days, 445 days

Important: Very high FD interest rates are given only for some special time periods or big deposit amounts. For normal 1-year or 5-year FDs, banks usually give medium or average interest, not very high.

How is Gramin Bank FD different from a normal bank FD?

| Point | Gramin Bank FD | Normal PSU / Private Bank FD |

|---|---|---|

| Target customers | Rural & semi-urban people | Urban & metro customers |

| Branch access | Near villages & towns | Mostly city-based |

| FD rates | Often slightly higher | Moderate |

| Process | Simple, branch-friendly | More digital |

| Trust factor | High in local areas | High nationally |

Who usually prefers Gramin Bank FD?

- Farmers

- Senior citizens

- Retired persons

- Small business owners

- Account holder who have same savings account, and wants to save.

- People who want local branch support

Key Features of Gramin Bank Fixed Deposit (FD)

- Suitable for Rural & Small Town People – Gramin Bank FDs are simple, safe, and easy to manage, mainly made for village and semi-urban customers.

- Fixed Return with Full Safety – FD gives guaranteed interest. Your money and return are fixed in advance and not affected by the share market.

- Flexible FD Tenure – You can choose an FD period from 7 days to 10 years, as per your need.

- Extra Interest for Senior Citizens – Senior citizens usually get around 0.50% extra interest.

- Premature Withdrawal Option -FD can be closed early in an emergency. The bank may charge 0.5% to 1% interest penalty.

- Loan Against FD – A loan or overdraft is available up to 90% of the FD amount, without breaking the FD.

- Nomination & Auto-Renew Facility – Nominee and auto-renewal options are available for convenience and safety.

- Low Minimum Investment – Your FD can be started with ₹100 or ₹1,000, affordable for everyone.

Top 5 Best Gramin Bank FD Options in 2026

These are the best FD options among all Gramin Banks in 2026, based on the highest interest and reliability.

| Rank | Gramin Bank | Best FD Rate (General) | Senior Citizen Rate | Best Tenure |

|---|---|---|---|---|

| 1 | Karnataka Gramin Bank | 7.35% | 7.85% | 444 days |

| 2 | Utkal Grameen Bank | 7.15% | 7.65% | Mid-term |

| 3 | Jharkhand Rajya Gramin Bank | 7.00% | 7.25% | 1–2 yrs |

| 4 | Bihar Gramin Bank | 7.00% | 7.00% | 2–3 yrs |

| 5 | Rajasthan Gramin Bank | 6.60% | 7.10% | 1 year |

Note – These are maximum interest rates and not available for all FD periods.

Bank-Wise Gramin Bank FD Rates 2026 (All Banks Covered)

The table below shows the latest confirmed FD interest rates of all 28 Gramin Banks in India for 2026, after the One State–One RRB merger. These rates are taken from bank circulars, branch information, and special FD schemes. The final interest you get depends on the FD time period, the deposit amount, and the senior citizen benefit, so it is always better to confirm once at the bank branch.

| No. | Gramin Bank | General FD Rate Range | Senior Citizen Rate | Special Notes |

|---|---|---|---|---|

| 1 | Andhra Pradesh Grameena Bank | 3.50% – 7.00% | Up to 7.50% | Strong 1–2 yr FD |

| 2 | Arunachal Pradesh Rural Bank | 5.80% – 7.00% | Up to 7.50% | Staff extra +1% |

| 3 | Assam Gramin Vikash Bank | 3.00% – 7.00% | Up to 7.50% | Penalty for premature withdrawal |

| 4 | Bihar Gramin Bank | 4.50% – 7.00% | Up to 7.00% | Best 2–3 yrs |

| 5 | Chhattisgarh Gramin Bank | 3.00% – ~7.75% | Higher for seniors | Final slab varies |

| 6 | Gujarat Gramin Bank | 5.75% – 6.65% | Up to 7.15% | Short mid-term |

| 7 | Haryana Gramin Bank | 3.50% – 7.10% | Up to 7.60% | 450-day best |

| 8 | Himachal Pradesh Gramin Bank | 3.50% – 7.10% | +0.50% | Many FD schemes |

| 9 | J&K Grameen Bank | 6.00% – 7.10% | Up to 7.60% | Bulk deposits strong |

| 10 | Jharkhand Rajya Gramin Bank | 3.00% – 7.00% | Up to 7.25% | 445-day scheme |

| 11 | Karnataka Gramin Bank | 3.25% – 7.35% | Up to 7.85% | Highest in India |

| 12 | Kerala Gramin Bank | 4.00% – 6.90% | Up to 7.40% | Long-term good |

| 13 | Madhya Pradesh Gramin Bank | 3.00% – ~7.75% | Higher for seniors | Slab varies |

| 14 | Maharashtra Gramin Bank | 3.25% – 6.65% | +0.50% | 444-day special |

| 15 | Manipur Rural Bank | ~5.75% – 6.50% | Higher for seniors | Limited data |

| 16 | Meghalaya Rural Bank | 5.50% – 7.00% | +0.50% | SBI sponsored |

| 17 | Mizoram Rural Bank | 6.05% – 6.70% | Up to 7.20% | Loan against FD |

| 18 | Nagaland Rural Bank | Market-linked | Varies | Branch check needed |

| 19 | Odisha Grameen Bank | 3.00% – 6.05% | Up to 6.55% | 1-yr best |

| 20 | Puducherry Grama Bank | 4.00% – 5.80% | Higher for seniors | Short-term focus |

| 21 | Punjab Gramin Bank | 3.50% – 6.60% | Up to 7.20% | 1–2 yrs |

| 22 | Rajasthan Gramin Bank | 3.00% – 6.60% | Up to 7.10% | Bulk FD high |

| 23 | Tamil Nadu Grama Bank | 4.75% – 7.00% | Up to 7.50% | No penalty ≤ ₹15L |

| 24 | Telangana Grameena Bank | 3.50% – 7.60% | +0.50% | Strong 1–2 yrs |

| 25 | Tripura Gramin Bank | 3.30% – 6.50% | Up to 7.00% | Tax saver FD |

| 26 | Uttar Pradesh Gramin Bank | 6.25% – 6.50% | Up to 7.00% | Stable slabs |

| 27 | Uttarakhand Gramin Bank | 3.00% – 6.75% | Up to 7.25% | 1-yr best |

| 28 | West Bengal Gramin Bank | 5.50% – 6.70% | Up to 7.20% | 380-day scheme |

How to Apply for Gramin Bank Fixed Deposit (FD)

You can open a Gramin Bank FD in two ways: online, or you can apply directly by visiting your home bank branch.

Online Method (For Existing Customers)

This option is available only if you already have a savings account and net banking or mobile app access.

- Log In to Bank App or Net Banking – Firstly, open your Gramin Bank mobile app or internet banking and log in using your ID and password.

- Go to the FD or Deposit Section – Tap on Deposits or Fixed Deposit option in the menu.

- Enter FD Details – Choose Open Fixed Deposit Account.

- Now – Enter FD amount, time period (7 days to 10 years), and interest payout option (monthly, quarterly, etc.).

- Confirm the FD Booking – You have to check all details carefully, accept the terms, and tap on confirm.

- Money will be directly deducted from your savings or current account.

- Get FD Receipt – After successful booking, you will get a digital FD receipt or confirmation instantly.

Offline Method (Experience-Based)

Step 1: Visit the Nearest Gramin Bank Branch

Go to the branch where you have a savings account. Most Gramin Banks open an FD only for existing customers.

Step 2: Ask for the FD or Term Deposit Form

At the counter, say: “Open an FD Account for me, please” or “Term deposit scheme tell me”.

You will get a single-page form.

Step 3: Decide FD Amount

- Choose how much money to deposit.

- FD usually starts from ₹100 or ₹1,000.

- Tip from me, it is better to split money into 2–3 FDs, not one.

Step 4: Select FD Time Period

- Staff will show the interest rate chart.

- Best options in 2026 are usually around 1 year or special tenures like 444 or 380 days.

- Ask clearly: “Highest interest, best tenure?”

Step 5: Tell Senior Citizen Status (If Any)

- If the age is 60 years or more, inform the staff.

- Extra 0.50% interest will be added.

- Age proof is needed if the account is new.

Step 6: Choose Interest Payment Option

- You can select monthly, quarterly, or at maturity.

- Most village customers choose interest at maturity.

Step 7: Add Nominee Name

- Always add a nominee. (Nowadays, it is mandatory in all schemes)

- This avoids problems for the family later.

- Step 8: Submit Documents

- Usually required: Aadhaar, PAN, and passbook.

- No extra documents in most cases.

Step 9: Deposit the Money

Payment can be made by cash (limit applies, confirm first), cheque, or from a savings account.

Step 10: Collect FD Receipt

- Before leaving, check the FD amount, tenure, and interest rate.

- Keep the FD receipt safely.

Real Facts About Gramin Bank FDs (Pros & Cons)

Pros – Why People Trust Gramin Bank FDs

- RBI Regulated Banks – All Gramin Banks work under RBI rules, so they are safe and reliable.

- Strong Government Support – Gramin Banks are owned by:

- Strong Ownership:

- Sponsor Bank – 35%

- Central Government – 50%

- State Government – 15%

- Deposit Insurance Available – Your FD money is insured up to ₹5 lakh per bank under DICGC.

- No Market Risk – FD returns are fixed, so they are good for people who don’t want share market risk.

Cons – Things You Should Know Clearly

- FD Interest Is Fully Taxable – You can Interest earned on FD is added to your income and taxed as per your slab.

- TDS Is Deducted by the bank –

- Above ₹50,000 interest (normal customer)

- Above ₹1 lakh interest (senior citizen)

- Inflation Can Reduce Real Return – Sometimes FD return may not beat inflation, especially in the long term.

- Interest Rate Gets Locked – If the bank increases FD rates later, your old FD rate will not change.

Smart Tip to Reduce Risk

Instead of choosing a big FD, you have to use short-term FDs or FD laddering. This means splitting money into different FD periods, so you can get better rates later.

FAQs

Which Gramin Bank gives the highest FD interest in 2026?

As of January or February 2026, Karnataka Gramin Bank offers the highest FD rate — 7.35% for general and 7.85% for senior citizens — mainly on a 444-day special FD, confirmed at the branch level.

Will I lose money if I break the FD before maturity?

You won’t lose principal, but you may lose 0.5%–1% interest as a penalty. Tip: Keep emergency money in a short-term FD, not in your long-term high-rate FD.

Are Kerala Gramin Bank FD rates good for long-term deposits?

Yes. Kerala Gramin Bank is better for long-term FDs above 1 year, where rates reach around 6.9% (7.4% for seniors). Short-term FDs give lower returns, as seen at branches.

Which FD tenure works best in Tripura Gramin Bank?

In Tripura Gramin Bank, the 2 to 3-year FD usually gives the highest interest — around 6.5% for general and 7% for senior citizens. Branch staff often recommend this slab.

Are Gramin Bank FD rates the same in every branch of a state?

Yes, after the merger. FD rates are uniform across all branches in a state, whether village or town. Only difference may be special schemes or bulk deposits, which the branch staff will explain.

Does Assam Gramin Vikash Bank give stable FD returns?

Yes. Assam Gramin Vikash Bank offers stable FD rates, especially between 1 to 3 years, where interest can go up to 7% (7.5% for seniors). Premature closure carries a small penalty.

Can I take a loan against my Gramin Bank FD easily?

Yes. Most Gramin Banks allow loans or overdrafts up to 85–90% of the FD value. Interest is usually 1% above the FD rate, and money is credited faster than personal loans.

What is the most common mistake people make while booking FD?

Most people choose 5-year FD blindly. In reality, 1–2 year or special tenures like 444 days often give better interest. Always ask the branch for “highest rate tenure”.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.