Why More HDFC Credit Card Users Are Choosing PDF Statements in 2026

According to the report of the Indiatimes website, HDFC is one of the leading credit card providers in India with a credit card market share of 22 % as of February 2025. As of FY2024, it has over 21 million active cards

But what’s the trend in 2026? A shift towards digital efficiency. Most users today prefer HDFC’s e-statement service — a password-protected, secure PDF of your monthly credit card details delivered straight to your inbox.

These statements not only save time but also help track spending, manage payments, and reduce paper waste.

The HDFC Bank offer two digital statement options, E-statement in a PDF file and Web Statement.

What really is an HDFC e-statement in a PDF File?

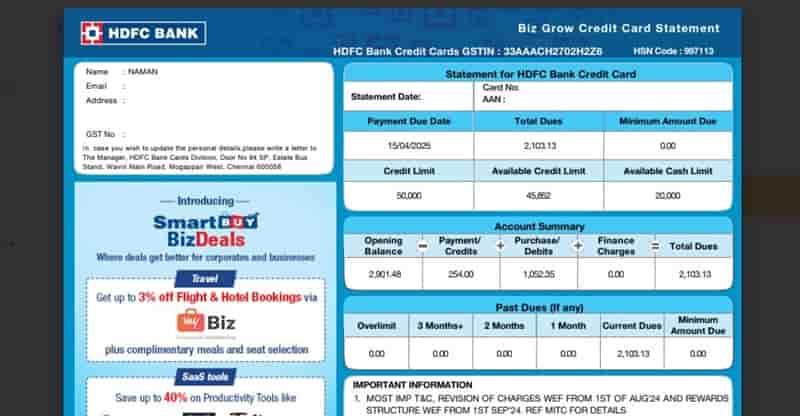

An E-statement is a digital version of your monthly credit card statement, with all transaction records directly sent to your email address. But it’s not just a list of transactions. It’s a payment due date reminder, credit card bill, available credit overview, and more.

HDFC Web Statement

HDFC Web Statements is also the same, but it also includes personalised offers and benefits available online without even downloading a PDF. Just enter the password and explore. For this, you don’t need a PDF reader, just your web browser.

However, both follow the same password-protected protocol and unlock using the same password format set by HDFC.

What’s the Password for the HDFC Credit Card Statement PDF?

So, the statement lands in your inbox – what now?

- Step 1: Download the Statement: Open your email inbox. Search for “HDFC (Card Name) Credit Card Statement PDF (Month)”, and open the email > Scroll down > Click Save PDF.

- Step 2: Open the PDF: Use any PDF reader app. HDFC recommends Adobe PDF Reader, but you can also try: Foxit Reader, Google PDF Viewer, and Built-in PDF viewers on Windows/Mac.

- Step 3: Enter the Correct Password:

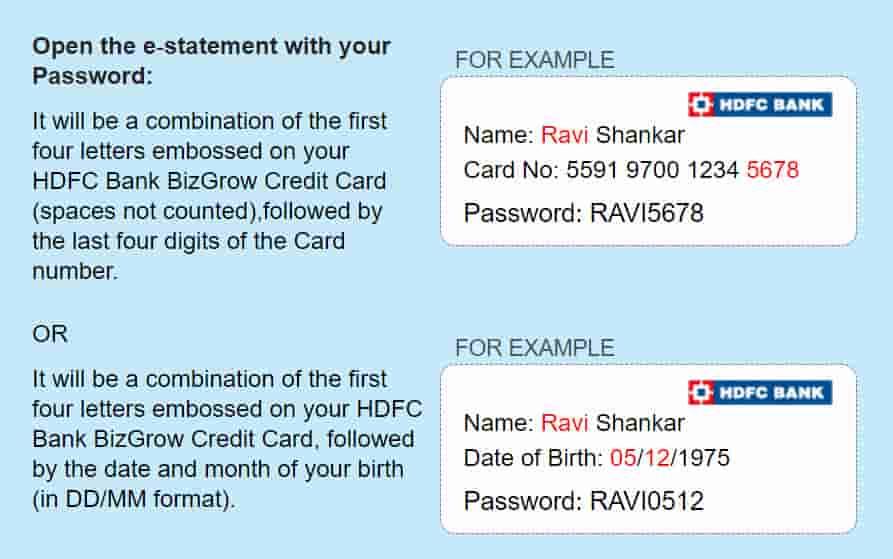

To unlock the credit card PDF, HDFC sets a password format as the First 4 letters of your name in CAPITAL LETTERS (as printed on the card) + the Last 4 digits of the card number.

Let me give you an example: if your card’s printed name is LAXMAN SINGH and your card’s last 4 digits are XXXX 7777, then your correct password will be = LAXM7777.

Alternatively, you can use another password format:

- First 4 letters of your name + Date & Month of Birth (DDMM)

- Example: LAXMAN SINGH + 20 AUGUST 1990

- The password will be: LAXM2008

Note: The passwords also work with HDFC Web statements.

Tips For You:

- Use UPPERCASE for the name letters

- Do not put any extra dots, spaces, symbols, or special characters

Changed Your HDFC Credit Card Recently? Do This

If you got a new card, you can use the new card’s last 4 digits in the password. Old ones won’t work anymore. Also, ensure the statement email is for the updated card. You can verify this by checking the masked card number in the email body.

How to Enable HDFC e-Statement in Under 3 Minutes

If you are not receiving statements in your inbox from HDFC. Here are the steps to follow to start receiving e-statements every month-

- Go to Google and search instaservices.hdfcbank.com

- Choose the option Change of Email ID (Paperless)

- Enter your mobile number and PAN number

- Enter the OTP sent to your phone

- Input your new email ID and tap on submit.

You’re now registered. You will start receiving monthly password-protected e-statement PDFS in your inbox. Easy, right?

Want a Physical Copy of your statement? Here’s How to Request It

If you prefer a printed statement, HDFC allows you to request one.

- Use the MyCards App or NetBanking → Select ‘Services’ → Request ‘Physical Statement.’

- Delivery can take up to 5-7 working days.

But note: ₹10 is charged per duplicate statement.

Tip for you – you can also print out your Digital statement as physical copy just using a printer, the digital copy also works in all important offices.

Common Errors While Opening HDFC PDF Statements

| Issue | Fix |

|---|---|

| Statement not received | Check Spam/Junk folder or update email via InstaServices |

| Password not working | Double-check name/card format or use alternate password format |

| File corrupted | Re-download or request again |

| Doesn’t open on mobile | Use Adobe Acrobat or forward to PC |

| Name too short | Use surname letters or try DOB method |

Explore FAQs

How do I open an HDFC credit card statement without a password?

It’s simple; you can use the HDFC Mobile Banking App. Log in, go to ‘Cards’, select your card, tap ‘Statement’, choose the month, and download or view it without needing any password.

How do I request an e-statement by using the HDFC MyCards App?

Open the HDFC MyCards app, log in using your mobile number, select your credit card, go to ‘Services’, tap on ‘Request e-Statement’ in the manage section — your PDF will be sent to your email OR you can directly get to your smartphone.

How long are old HDFC statements available?

HDFC usually keeps the last 24 months of statements online via mobile banking and net banking. For older ones, you might need to request them manually through HDFC customer service.

Is there one password format for all banks?

Nope — each bank uses its own password format, like name + DOB or customer ID. You can check our full list of password formats for all banks at EaseMoney’s password guide.

Why does my HDFC credit card PDF open on my laptop but not on my phone?

Many mobile PDF viewers can’t handle encrypted files properly. Use Adobe Acrobat mobile or forward the PDF to a laptop. This fixes over 90% of “won’t open” issues.

What if my name on the card is shorter than four letters?

Use available letters plus surname letters. Example: “RAJ K” becomes RAJK. If it still fails, switch to the DOB-based password format, which almost always works.

Can I open my HDFC statement if my credit card is blocked or closed?

Yes. Statements remain accessible even after blocking or closure. Use the last valid password format or download statements via NetBanking, where password protection isn’t applied.

What’s the fastest way to access statements without dealing with passwords?

Use the HDFC Mobile Banking app. Statements open directly after login—no PDF password needed. This is the quickest method for checking dues or downloading copies instantly.

Does HDFC change the PDF password every month?

No. The password format stays constant. Only the card number or name change affects it. Monthly statement cycle does not alter the password logic at all.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.